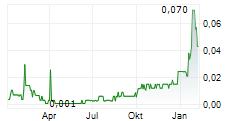

MONTREAL, April 12, 2024 (GLOBE NEWSWIRE) -- TOMAGOLD CORPORATION (TSXV: LOT) (OTCQB: TOGOF) ("TomaGold" or the "Corporation") announces the following corporate update.

East Block acquisition term extended

The Corporation has extended the "Option to Purchase" with Chibougamau Independent Mines Inc. (TSXV: CBG) ("Chibougamau") until April 30, 2024, to finalize the financing to acquire Chibougamau's East Block copper-gold properties. In addition, the purchase price for the East Block has been adjusted upward by $500,000 since the original agreement with Chibougamau. The initial transaction was announced in the press releases dated August 14, 2023, September 13, 2023 and September 18, 2023.

Clarification of share pricing for the acquisition of the Chibougamau Mining Camp properties

The breakdown of the amount in dollars to be satisfied by share issuance for the acquisition of the properties from SOQUEM Inc. ("SOQUEM"), Chibougamau and Globex Mining Enterprises Inc. ("Globex"), as disclosed in the August 14, 2023 press release, will be determined using the 10-day VWAP for SOQUEM and 20-day VWAP for Chibougamau and Globex, all subject to a minimum price of $0.05 per share.

Prior investor relations consulting agreements

The Corporation announces prior investor relations consulting agreements with Mezzo Consulting Services S.A. ("Mezzo") and MI3 Communications Financières Inc. ("MI3"), which have been terminated.

On November 24, 2022, TomaGold retained Mezzo to act as a marketing consultant for a six-month term. Mezzo is a Germany-based investor and capital markets and investment advisory with a focus on mining stocks. Services provided by Mezzo consisted mainly in advising the Corporation on capital markets environment; introducing the Corporation to its network of media representatives; advising the Corporation in regard to disseminating content throughout the European investor community and engaging newsletter writers; and providing advice on developing a strategic marketing plan specifically tailored for the investment community in Europe. The agreement with Mezzo included a one-time retainer fee of $60,000 and 500,000 stock options at an exercise price of $0.05 per share exercisable for a period of 5 years. The agreement was terminated on April 30, 2023 and the options were cancelled. Mezzo and the Corporation were unrelated entities and at the time of the agreement, Mezzo had an interest in the securities of the Corporation by holding 2,400,000 common shares.

On December 5, 2022, the Corporation signed a one-year agreement with MI3 to act as financial public relations advisor. MI3 is a Montreal-based financial communications company that provide public relations, market-making activities and investor relations to Canadian public companies. Services provided by MI3 included mainly the organization of roadshows and the distribution of press releases to its network to help increase visibility and interest within the financial community. The agreement with MI3 included a monthly retainer of $3,000 and 400,000 stock options at an exercise price of $0.05 per share exercisable for a period of 5 years. The agreement was terminated on December 5, 2023 and the options were cancelled. MI3 and the Corporation were unrelated entities and at the time of the agreement, MI3 had an interest in the securities of the Corporation by holding 122,000 common shares.

These agreements were subject to the TSX Venture Exchange approval.

Board member resignation

The Corporation also announces that Albert Contardi has resigned from the board of directors of TomaGold, effective March 13, 2024. The Corporation wishes Mr. Contardi all the best in his future endeavours.

About TomaGold

TomaGold Corporation (TSXV: LOT) (OTCQB: TOGOF) is a Canadian mineral exploration company engaged in the acquisition, assessment, exploration and development of gold, copper, rare earth elements and lithium projects. Its primary goal is to consolidate the Chibougamau Mining Camp in northern Quebec. In addition to the recent agreements to acquire 20 properties in the camp, the Corporation holds interests in five gold properties in the vicinity of the camp: Obalski, Monster Lake East, Monster Lake West, Hazeur and Doda Lake.

TomaGold also owns a 100% interest in a lithium property and in the Star Lake rare earth elements property, located in the James Bay region of Quebec, as well as a 24.5% interest in the Baird property, located near the Red Lake mining camp in Ontario through a joint venture with Evolution Mining Ltd. and New Gold Inc.

Contact:

David Grondin

President and Chief Executive Officer

(514) 583-3490

www.tomagoldcorp.com

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.