NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES

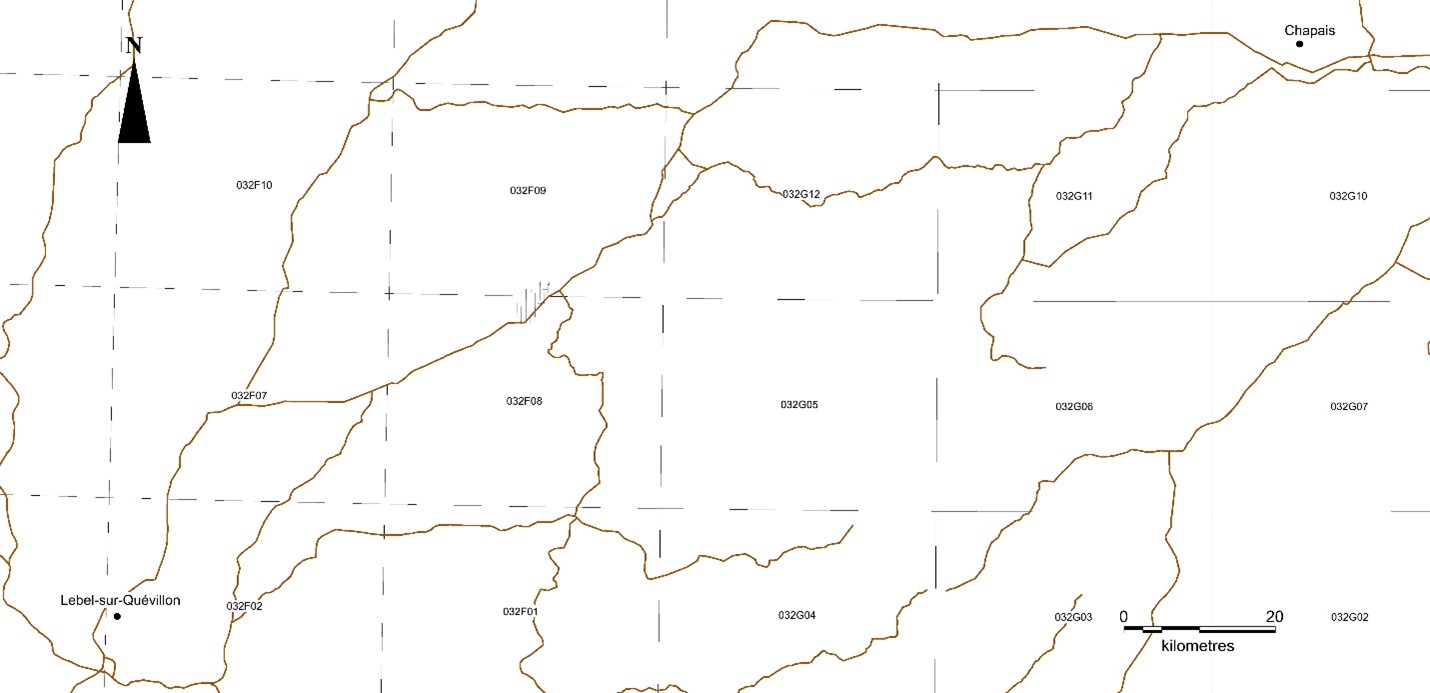

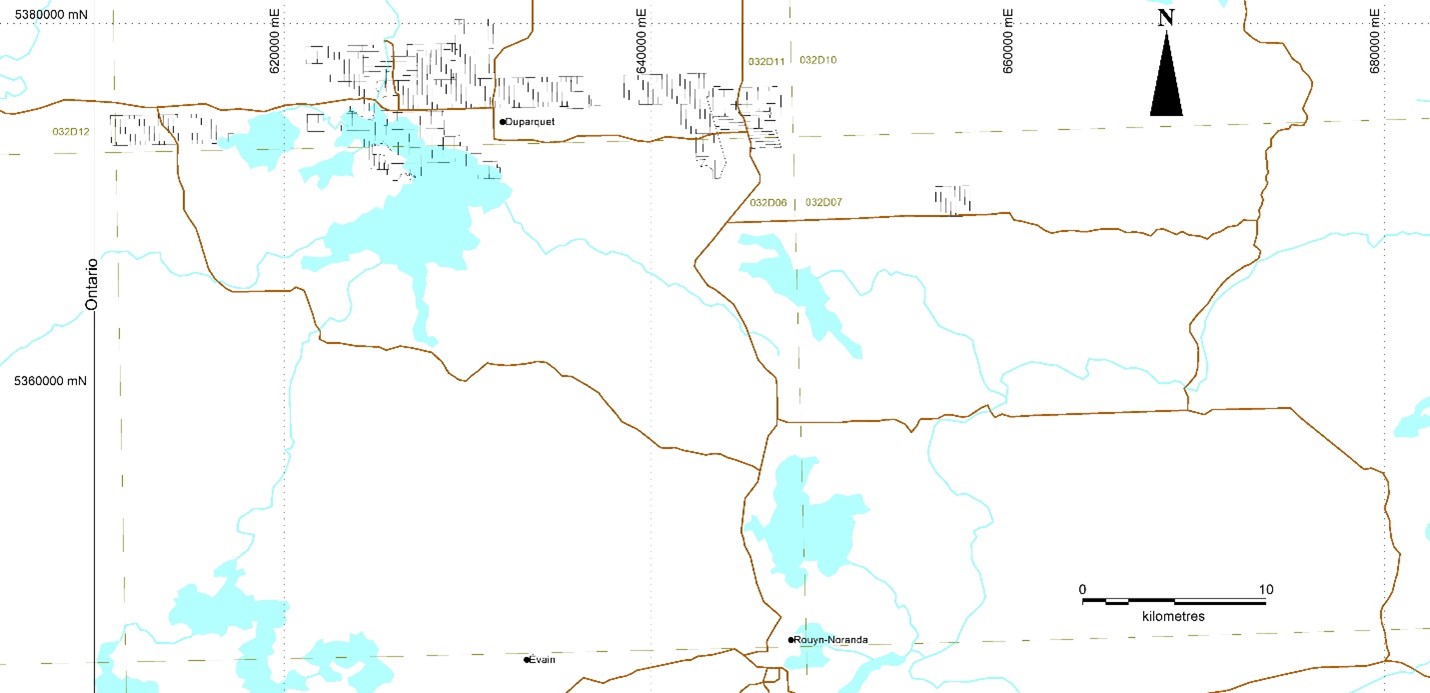

TORONTO, April 15, 2024 (GLOBE NEWSWIRE) -- O2Gold Inc. (NEX: OTGO.H) ("O2Gold" or the "Company") is pleased to announce that it has entered into a share exchange agreement dated March 21, 2024 (the "Agreement") with Quebec Aur Ltd., a private Ontario corporation, (the "Target") and its shareholders, (the "Shareholders") respecting the purchase of a gold mining exploration property in Quebec through the acquisition of all of the issued and outstanding shares of the Target from the Shareholders (the "Acquisition"). The property consists of 288 mining exploration claims in Quebec (collectively, the "Assets"). A map with further details of the Assets is provided below.

Pursuant to the Agreement, O2Gold has agreed to issue 5 million of its common shares to the Shareholders in exchange for all of the issued and outstanding shares of the Target, at a deemed price per share of $0.05, representing an aggregate amount of $250,000. The Target does not have any material liabilities, other than a loan outstanding in the amount of C$337,369.86 (the "Loan") owing to a third party. Interest is payable on the principal sum of the Loan, as well as on interest accrued and unpaid, at a rate of 12% per annum.

Peter Michel is the chief financial officer of both the Company and one of the Shareholders, Sulliden Mining Capital Inc. ("Sulliden"). Notwithstanding the shared officers, the Acquisition does not constitute a Related Party Transaction under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101") because Sulliden and the Target are not Related Parties of O2Gold (as such terms are defined in MI 61-101). However, the Acquisition may constitute a Related Party Transaction under TSX Venture Exchange ("TSXV") Policies 1.1, 5.3, and 5.9 as a result of the shared officers. The Acquisition is intended to be characterized as a Fundamental Acquisition that will result in the Company satisfying the TSX Venture Tier 2 Minimum Listing Requirements, enabling it to qualify to graduate from the NEX board of the TSXV to Tier 2 of the TSXV (as such terms are defined in the policies of the TSXV). Trading of the Company's common shares ("Common Shares") will remain halted pending receipt and review by the TSXV of acceptable documentation pursuant to section 5.6(d) of TSXV Policy 5.3 regarding Fundamental Acquisitions. O2Gold is not paying any finder's fees in connection with the Acquisition. The closing of the Acquisition is subject to the satisfaction of customary conditions precedent, including, inter alia, the approval of the TSXV, the provision of applicable legal opinions concerning the titles to the Assets and other closing conditions customarily found in transactions similar to the Acquisition.

Please see below for a map showing the location of the Assets:

In addition, the Company announces a non-brokered private placement financing of up to 5,000,000 Common Shares at a price of $0.05 per Common Share for gross proceeds to the Company of up to $250,000 (the "Offering"). All securities issued in connection with the Offering will be subject to a statutory hold period of four-months and one day. Completion of the Offering is subject to a number of conditions, including approval from the TSXV. The Company intends to use the net proceeds of the Offering to finance activities on the Assets and for general working capital purposes. The Offering and Acquisition are expected to close on or about May 31, 2024.

Finder's fees may be paid to eligible finders in accordance with the policies of the TSXV consisting of a cash commission equal to up to 7% of the gross proceeds raised under the Offering and finder warrants ("Finder Warrants") in an amount equal to up to 7% of the number of Common Shares sold pursuant to the Offering. Each Finder Warrant will entitle the holder thereof to purchase one Common Share at a price of $0.05 per share for a period of 12 months following the closing date of the Offering.

About O2Gold

O2Gold is a mineral exploration company.

For additional information, please contact:

Scott Moore, Chief Executive Officer

Phone: (416) 861-1685

Cautionary Note Regarding Forward-looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to the Assets, the Company's ability to complete the Acquisition and the Offering and to develop the Assets, the expected timing of completion of the Offering and Acquisition, the receipt of approval of the TSXV in connection with the Offering and the Acquisition, the satisfaction by the Company of TSX Venture Tier 2 Listing Requirements following completion of the Acquisition and the graduation to Tier 2 of the TSXV, the resumption of trading of the Common Shares on the TSXV, and other matters related thereto. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to: receipt of necessary approvals; general business, economic, competitive, political and social uncertainties; future mineral prices and market demand; accidents, labour disputes and shortages and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/24252c53-30ea-42df-b62e-3663d0eb0b78

https://www.globenewswire.com/NewsRoom/AttachmentNg/91943bf4-3719-434e-a956-e43885237d5f