NEW YORK, April 16, 2024 (GLOBE NEWSWIRE) -- SuRo Capital Corp. ("SuRo Capital", the "Company", "we", "us", and "our") (Nasdaq: SSSS) today provided the following preliminary update on its investment portfolio for the first quarter ended March 31, 2024.

"We remain incredibly enthusiastic about both our investment pipeline and our current portfolio as the IPO market strengthens and new opportunities at compelling valuations continue to come to light. We are now executing on these opportunities. As such, we are excited to announce that during the first quarter, we added one new portfolio company through a $10.0 million primary investment in Supplying Demand, Inc. (d/b/a Liquid Death), a CPG brand focused on still water, sparkling water, and teas, and are in final documentation on another compelling new investment," said Mark Klein, Chairman and Chief Executive Officer of SuRo Capital.

"With these exciting new additions to our portfolio, and over $60.0 million in investable capital, we remain steadfast in our belief that there continue to be high-quality opportunities available at attractive prices that allow us to be both opportunistic and judicious with the deployment of capital," Mr. Klein continued.

"As we have consistently demonstrated, SuRo Capital is committed to initiatives that enhance shareholder value, and we believe the market is currently undervaluing our portfolio. Given the discount our stock has traded at compared to net asset value per share, we believe our recent Modified Dutch Auction Tender Offer was an efficient and accretive deployment of capital. As announced in the first quarter and executed subsequent to quarter-end, the Modified Dutch Auction Tender Offer resulted in the purchase of 2.0 million shares of common stock for $4.70 per share. Further, we continue to monitor leveraging the remaining $20.7 million authorized under our active Share Repurchase Program," concluded Mr. Klein.

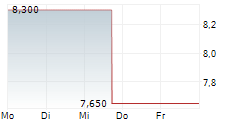

As previously reported, SuRo Capital's net assets totaled approximately $203.4 million, or $7.99 per share, at December 31, 2023, and approximately $215.0 million, or $7.59 per share at March 31, 2023. As of March 31, 2024, SuRo Capital's net asset value is estimated to be between $6.90 to $7.40 per share.

Investment Portfolio Update

As of March 31, 2024, SuRo Capital held positions in 38 portfolio companies - 35 privately held and 3 publicly held, some of which may be subject to certain lock-up provisions.

During the three months ended March 31, 2024, SuRo Capital made the following investments, excluding short-term US treasuries:

| Portfolio Company | Investment | Transaction Date | Amount |

| Supplying Demand, Inc. (d/b/a Liquid Death) | Series F-1 Preferred Shares | 1/18/2024 | $10.0 million |

During the three months ended March 31, 2024, SuRo Capital exited or received proceeds from the following investments, excluding short-term US treasuries:

| Portfolio Company | Transaction Date | Quantity | Average Net Share Price(1) | Net Proceeds | Realized Gain/(Loss) | |

| Nextdoor Holdings, Inc.(2) | Various | 112,420 | $1.92 | $0.2 million | $(0.4 million) | |

| PSQ Holdings, Inc. (d/b/a PublicSquare) - Public Warrants(3) | Various | 100,000 | $1.03 | $0.1 million | $0.1 million | |

__________________

(1) The average net share price is the net share price realized after deducting all commissions and fees on the sale(s), if applicable.

(2) As of February 23, 2024, SuRo Capital had sold its remaining Nextdoor Holdings, Inc. public common shares.

(3) As of March 31, 2024, SuRo Capital held 2,296,037 remaining PSQ Holdings, Inc. (d/b/a PublicSquare) public warrants.

SuRo Capital's liquid assets were approximately $84.6 million as of March 31, 2024, consisting of cash, short-term US treasuries, and securities of publicly traded portfolio companies not subject to lock-up restrictions at quarter-end.

As of March 31, 2024, there were 25,353,284 shares of the Company's common stock outstanding.

Modified Dutch Auction Tender Offer

On February 14, 2024, our Board of Directors authorized a Modified Dutch Auction Tender Offer ("Tender Offer") to purchase up to 2.0 million shares of our common stock at a price per share between $4.00 and $5.00, using available cash. In accordance with the Tender Offer, following the expiration of the Tender Offer at 5:00 P.M. Eastern Time on April 1, 2024, the Company repurchased 2,000,000 shares at a price of $4.70 per share, representing 7.9% of its outstanding shares. The per share purchase price of properly tendered shares represents 58.8% of net asset value per share as of December 31, 2023.

Share Repurchase Program

Under the Share Repurchase Program, the Company may repurchase its outstanding common stock in the open market, provided it complies with the prohibitions under its insider trading policies and procedures and the applicable provisions of the Investment Company Act of 1940, as amended, and the Securities Exchange Act of 1934, as amended.

Since inception of the Share Repurchase Program in August 2017, SuRo Capital has repurchased over 6.0 million shares of its common stock for an aggregate purchase price of approximately $39.3 million. This does not include repurchases under various tender offers during this time period. The dollar value of shares that may yet be purchased by SuRo Capital under the Share Repurchase Program is approximately $20.7 million. The Share Repurchase Program is authorized through October 31, 2024.

Preliminary Estimates and Guidance

The preliminary financial estimates provided herein are unaudited and have been prepared by, and are the responsibility of, the management of SuRo Capital. Neither our independent registered public accounting firm, nor any other independent accountants, have audited, reviewed, compiled, or performed any procedures with respect to the preliminary financial data included herein. Actual results may differ materially.

The Company expects to announce its first quarter ended March 31, 2024 results in May 2024.

Forward-Looking Statements

Statements included herein, including statements regarding SuRo Capital's beliefs, expectations, intentions, or strategies for the future, may constitute "forward-looking statements". SuRo Capital cautions you that forward-looking statements are not guarantees of future performance and that actual results or developments may differ materially from those projected or implied in these statements. All forward-looking statements involve a number of risks and uncertainties, including the impact of any market volatility that may be detrimental to our business, our portfolio companies, our industry, and the global economy, that could cause actual results to differ materially from the plans, intentions, and expectations reflected in or suggested by the forward-looking statements. Risk factors, cautionary statements, and other conditions which could cause SuRo Capital's actual results to differ from management's current expectations are contained in SuRo Capital's filings with the Securities and Exchange Commission. SuRo Capital undertakes no obligation to update any forward-looking statement to reflect events or circumstances that may arise after the date of this press release.

About SuRo Capital Corp.

SuRo Capital Corp. (Nasdaq: SSSS) is a publicly traded investment fund that seeks to invest in high-growth, venture-backed private companies. The fund seeks to create a portfolio of high-growth, emerging private companies via a repeatable and disciplined investment approach, as well as to provide investors with access to such companies through its publicly traded common stock. SuRo Capital is headquartered in New York, NY and has offices in San Francisco, CA. Connect with the company on X, LinkedIn, and at www.surocap.com.

Contact

SuRo Capital Corp.

(212) 931-6331

IR@surocap.com