KING OF PRUSSIA, Pa., April 22, 2024 (GLOBE NEWSWIRE) -- Vertex, Inc. (NASDAQ:VERX), a leading global technology provider of indirect tax solutions, today announced preliminary financial results for the period ended March 31, 2024.

"Vertex's first quarter financial results were strong across our business," noted David DeStefano, President, Chief Executive Officer, and Chairperson of the Board. "We look forward to providing investors with full details when we announce our full first quarter financial results in early May."

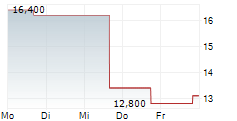

Revenues for the three months ended March 31, 2024 are expected to be between $155.5 million and $157.5 million, compared to $132.8 million for the three months ended March 31, 2023, representing an increase of approximately 17% to 19%.

Annual Recurring Revenue at March 31, 2024 is expected to be between $523.5 million to $525.5 million, compared to $446.5 million for the three months ended March 31, 2023, representing an increase of approximately 17% to 18%.

Net revenue retention at March 31, 2024 is expected to be between 111% and 113%, as compared to 110% at March 31, 2023.

Gross Revenue Retention at March 31, 2024 is expected to be between 94% and 96%, as compared to 96% at March 31, 2023.

Net Income for the three months ended March 31, 2024 is expected to be between $2.4 million and $3.1 million, compared to a net loss of $18.1 million for the three months ended March 31, 2023.

Adjusted EBITDA for the three months ended March 31, 2024 is expected to be between $35.5 million and $37.5 million, compared to $20.2 million for the three months ended March 31, 2023, representing an increase of approximately 76% to 86%.

Approximately $2 million of the expected Adjusted EBITDA outperformance was driven by expenses that were delayed from the first quarter to future quarters in 2024; and another $2 million was driven by a higher percentage of capitalized R&D costs compared to expensed R&D costs in the first quarter.

First Quarter Earnings Announcement and Conference Call

Vertex will release full first quarter 2024 financial results before the market opens on Wednesday, May 8, 2024. A conference call to discuss the results will be held at 8:30 a.m. Eastern Time that same day.

Those wishing to participate may do so by dialing 1-412-317-6026 approximately ten minutes prior to start time. A listen-only webcast of the call will also be available through the Company's Investor Relations website at https://ir.vertexinc.com.

A conference call replay will be available approximately one hour after the call by dialing 1-412-317-6671 and referencing passcode 10187911, or via the Company's Investor Relations website. The replay will expire on May 22, 2024 at 11:59 p.m. Eastern Time.

About Vertex

Vertex, Inc. is a leading global provider of indirect tax solutions. The Company's mission is to deliver the most trusted tax technology enabling global businesses to transact, comply and grow with confidence. Vertex provides solutions that can be tailored to specific industries for major lines of indirect tax, including sales and consumer use, value added and payroll. Headquartered in North America, and with offices in South America and Europe, Vertex employs over 1,400 professionals and serves companies across the globe.

Forward Looking Statements

Any statements made in this press release that are not statements of historical fact, including statements about our beliefs and expectations, are forward-looking statements and should be evaluated as such. Forward-looking statements include, among other statements, information concerning our preliminary results of operations. Forward-looking statements are based on Vertex management's beliefs, as well as assumptions made by, and information currently available to, them. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected. Factors which may cause actual results to differ materially from current expectations include, but are not limited to: our ability to attract new customers on a cost-effective basis and the extent to which existing customers renew and upgrade their subscriptions; our ability to sustain and expand revenues, maintain profitability, and to effectively manage our anticipated growth; our ability to identify acquisition targets and to successfully integrate and operate acquired businesses; our ability to maintain and expand our strategic relationships with third parties; the potential effects on our business from the existence of a global endemic or pandemic; and the other factors described under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for the year ended December 31, 2023 filed with the Securities Exchange Commission ("SEC"), as may be subsequently updated by our other SEC filings. Copies of such filings may be obtained from the Company or the SEC.

Our unaudited financial information for the three months ended March 31, 2024 presented above are preliminary, based upon our good faith estimates and subject to completion of our financial closing procedures. This summary is not a comprehensive statement of our financial results for the quarterly period. We have provided ranges for our expectations described above because our fiscal quarter closing procedures are not yet complete. While we expect that our final financial results for the quarterly period ended March 31, 2024, following the completion of our financial closing procedures, will be within the ranges described above, our actual results may differ materially from these estimates as a result of the completion of our financial closing procedures as well as final adjustments and other developments that may arise between now and the time that our financial results for this quarterly period are finalized. All of the data presented above has been prepared by and is the responsibility of management. No independent registered public accounting firm has audited, reviewed or compiled, examined or performed any procedures with respect to these preliminary results, nor have they expressed any opinion or any other form of assurance on these preliminary estimated results.

All forward-looking statements reflect our beliefs and assumptions only as of the date of this press release. We undertake no obligation to update forward-looking statements to reflect future events or circumstances, except as required by applicable law.

Definitions of Certain Key Business Metrics

Annual Recurring Revenue ("ARR")

We derive the vast majority of our revenues from recurring software subscriptions. We believe ARR provides us with visibility to our projected software subscription revenues in order to evaluate the health of our business. Because we recognize subscription revenues ratably, we believe investors can use ARR to measure our expansion of existing customer revenues, new customer activity, and as an indicator of future software subscription revenues. ARR is based on monthly recurring revenues ("MRR") from software subscriptions for the most recent month at period end, multiplied by twelve. MRR is calculated by dividing the software subscription price, inclusive of discounts, by the number of subscription covered months. MRR only includes direct customers with MRR at the end of the last month of the measurement period. AARPC represents average annual revenue per direct customer and is calculated by dividing ARR by the number of software subscription direct customers at the end of the respective period.

Net Revenue Retention Rate ("NRR")

We believe that our NRR provides insight into our ability to retain and grow revenues from our direct customers, as well as their potential long-term value to us. We also believe it demonstrates to investors our ability to expand existing customer revenues, which is one of our key growth strategies. Our NRR refers to the ARR expansion during the 12 months of a reporting period for all direct customers who were part of our customer base at the beginning of the reporting period. Our NRR calculation takes into account any revenues lost from departing direct customers or those who have downgraded or reduced usage, as well as any revenue expansion from migrations, new licenses for additional products or contractual and usage-based price changes.

Gross Revenue Retention Rate ("GRR")

We believe our GRR provides insight into and demonstrates to investors our ability to retain revenues from our existing direct customers. Our GRR refers to how much of our MRR we retain each month after reduction for the effects of revenues lost from departing direct customers or those who have downgraded or reduced usage. GRR does not take into account revenue expansion from migrations, new licenses for additional products or contractual and usage-based price changes. GRR does not include revenue reductions resulting from cancellations of customer subscriptions that are replaced by new subscriptions associated with customer migrations to a newer version of the related software solution.

Use and Reconciliation of Non-GAAP Financial Measures

In addition to our results determined in accordance with accounting principles generally accepted in the U.S. ("GAAP") and key business metrics described above, we have calculated Adjusted EBITDA, which is a non-GAAP financial measures. We have provided tabular reconciliations of this non-GAAP financial measure to its most directly comparable GAAP financial measure.

Management uses non-GAAP financial measures to understand and compare operating results across accounting periods, for internal budgeting and forecasting purposes, and to evaluate financial performance and liquidity. Our non-GAAP financial measures are presented as supplemental disclosure as we believe they provide useful information to investors and others in understanding and evaluating our results, prospects, and liquidity period-over-period without the impact of certain items that do not directly correlate to our operating performance and that may vary significantly from period to period for reasons unrelated to our operating performance, as well as comparing our financial results to those of other companies. Our definitions of these non-GAAP financial measures may differ from similarly titled measures presented by other companies and therefore comparability may be limited. In addition, other companies may not publish these or similar metrics. Thus, our non-GAAP financial measures should be considered in addition to, not as a substitute for, or in isolation from, the financial information prepared in accordance with GAAP, and should be read in conjunction with the consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 29, 2024.

We calculate this non-GAAP financial measure as follows:

- Adjusted EBITDA is determined by adding back to GAAP net income or loss the net interest income or expense (including adjustments to the settlement value of deferred purchase commitment liabilities), income taxes, depreciation and amortization of property and equipment, depreciation and amortization of capitalized software and acquired intangible assets included in cost of subscription revenues, amortization of acquired intangible assets included in selling and marketing expense, amortization of cloud computing implementation costs in general and administrative expense, asset impairments, stock-based compensation expense, severance expense, acquisition contingent consideration, changes in the settlement value of deferred purchase commitment liabilities recorded as interest expense, litigation settlements, and transaction costs, included in GAAP net income or loss for the respective periods.

The table below provides a reconciliation of preliminary Adjusted EBITDA to the closest comparable U.S. GAAP financial measure, net income, for the three months ended March 31, 2024.

| Dollars in thousands | ||||||||||||

| (Unaudited) | ||||||||||||

| Three Months Ended March 31, 2024 | Three Months Ended March 31, 2023 | |||||||||||

| Low | High | Actual | ||||||||||

| Net income (loss) | $ | 2,400 | $ | 3,050 | $ | (18,132 | ) | |||||

| Interest expense (income), net | 250 | 300 | (350 | ) | ||||||||

| Income tax expense (benefit) | (4,650 | ) | (4,350 | ) | 9,553 | |||||||

| Depreciation and amortization | 21,500 | 22,000 | 16,942 | |||||||||

| Stock-based compensation expense | 16,000 | 16,500 | 11,434 | |||||||||

| Severance expense | 500 | 1,000 | 555 | |||||||||

| Acquisition contingent consideration | (500 | ) | (1,000 | ) | 200 | |||||||

| Adjusted EBITDA | $ | 35,500 | $ | 37,500 | $ | 20,202 | ||||||

We encourage investors and others to review our financial information in its entirety, not to rely on any single financial measure and to view these non-GAAP financial measures in conjunction with the related GAAP financial measures.

Investor Relations contact:

Joe Crivelli

Vertex, Inc.

investors@vertexinc.com

Media Relations contact:

Rachel Litcofsky

Vertex, Inc.

mediainquiries@vertexinc.com