FINANCIAL INFORMATION OF THE FIRST QUARTER 2024

Consolidated Revenue of the first quarter 2024

The consolidated revenue of PAREF Group stands at €6.8 Mn for the first quarter 2024, down by 24% compared to the same period of 2023.

The revenue consists of:

- Gross rental income of €2.2 Mn, up by 4%, mainly resulted from rent indexation across all owned assets;

- Gross management commissions of €3.8 Mn, increasing by 14% thanks to new investments realised in SCPI funds in 2023, particularly in SCPI Novapierre Allemagne 2 and Interpierre France;

- Gross subscription commissions of €0.9 Mn, -75% compared to the same period of last year while increasing by 15% compared to the 4th quarter of 2023. The evolution is in line with adjustments in the commercialization of SCPI products impacted by rising interest rates.

| Revenues (in €Mn)1 | Q1 2023 | Q1 2024 | Variation in % |

| Gross rental income[1] | 2.1 | 2.2 | +4% |

| Commissions | 6.9 | 4.7 | -32% |

| -o.w. management commissions | 3.4 | 3.8 | 14% |

| -o.w. subscription commissions | 3.6 | 0.9 | -75% |

| Total | 9.0 | 6.8 | -24% |

Main events of the first quarter of 2024

- The restructuring project of The Medelan asset, located in Milan's historical city center, managed by the Italian subsidiary, continues the progress in leasing activities. While 100% of the office spaces are already leased, a lease for retail spaces has been secured in the first quarter. Thus 96% of retail spaces are now leased or under binding offer;

- PAREF Group has secured a new property management mandate from a leading client in the real estate sector, for a prime office and retail asset in the downtown of Paris. This mandate reflects PAREF Group's commitment to expand its services for third parties and attests its recognized expertise in property management;

- SCPI Novapierre Résidentiel strengthens its Parisian real estate portfolio with the delivery of a new building, acquired in bare ownership with Régie Immobilière de la Ville de Paris (RIVP) as the usufructuary. This innovative real estate complex is part of the rehabilitation project of the former Grand Garage Clignancourt, ideally located in the center of 18th district. This project has been certified Bâtiment Énergie Environnement (BEE) Logement Neuf for the overall performance of its buildings in terms of eco-design, integration into its environment, energy efficiency and quality of life for future tenants, illustrating the Group's strategy in responsible investment;

- SCPI Interpierre Europe Centrale won the 2nd prize in Office SCPI category at the First Sustainable SCPI rankings[2]. This prize recognizes the sustainable performance of this SCPI labelled ISR since January 2023 and demonstrates PAREF Group's commitment to implementing its ESG strategy "Create More". This fund also won the award for the performance in the open-ended Office SCPI category[3], showing the Group's capacity and expertise in management for third parties.

"In a context of paradigm shift, the strength of the PAREF's model relies on the diversity of its activities. We are continuing to diversify our revenues by increasing the recurring revenues from management fees on existing funds, on the new mandates and on other opportunities for which PAREF Group is well positioned."

Antoine Castro

Chairman & CEO PAREF Group

" We disclosed in the 1st quarter the good performance of our funds, confirming once again their progress. Our range of funds stands out positively in a challenging market environment, as a result of the management and the choices made in recent years. In 2024, we will continue the development of our activities on behalf of third parties, always with the same ambitions to propose diversified strategies including our ESG politics "Create More" at each step."

Anne SCHWARTZ

Deputy CEO PAREF Group and CEO of PAREF Gestion

Financial agenda

May 23rd, 2024: Annual General Meeting of shareholder

July 30th, 2024: Half-Year 2024 results

About PAREF Group

PAREF is a leading European player in real estate management, with over 30 years of experience and the aim of being one of the market leaders in real estate management based on its proven expertise.

Today, the Group operates in France, Germany, Italy, and Switzerland and provides services across the entire value chain of real estate investment: investment, fund management, renovation and development project management, asset management, and property management. This 360° approach enables it to offer integrated and tailor-made services to institutional and retail investors.

The Group is committed to creating more value and sustainable growth and has put CSR concerns at the heart of its strategy.

As of December 31, 2023, PAREF Group manages about €3bn assets under management.

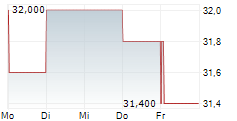

PAREF is a company listed on Euronext Paris, Compartment C, under ISIN FR0010263202 - Ticker PAR.

More information on www.paref.com

Press contacts

| PAREF Samira Kadhi +33 (7) 60 00 59 52 samira.kadhi@paref.com | Citigate Dewe Rogerson Yoann Besse / Marlène Brisset +33 (6) 63 03 84 91 / +33 (6) 59 42 29 35 Paref@citigatedewerogerson.com |

[1] Excluding recovered rental charges

[2] Organized by l'Association des Acteurs de la Finance Responsable, L'Info Durable and Deeptinvest, a company specialized in sustainable financial analysis

[3] Selected by the magazine "Investissement Conseils"

- SECURITY MASTER Key: x5qdaMmXk2jInZudl8pqa2OZb2tkm5WYbWfInGNolMyaaGmSmmtkZ8WYZnFmmGlq

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-85344-paref-financial-information-q1-2024.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free