- Showroomprivé records 3% growth in GMV and a 2% decline in revenues in Q1 2024

- Continuation of trends observed at the end of fiscal year 2023: the dynamism of growth drivers (the Marketplace and the segment Travel & Ticketing) as well as the International segment, that recorded a 12% growth, partially offset the decline in the historical businesses in France, still held back by sluggish consumption

- The Bradery continues to grow, increasing its revenues by 82% y-o-y

- Another quarter of strong growth for the Marketplace (+84%), in line with the Group's strategy

- Good growth in Travel & Leisure segment, up 11% over the period

- Strengthening the Group's RSE positioning with the acquisition of a stake in Paradigme, a start-up specialized in the second-hand

La Plaine Saint Denis, April 25, 2024 - Showroomprivé (SRP Groupe), a European group specialized in smart shopping, announces its revenue for the first quarter ended March 31, 2024.

CONFIRMATION OF DYNAMIC GROWTH DRIVERS IN Q1 2024

Showroomprivé reported Growth Merchandise Volume (GMV) of €247.2 million for Q1 2024, up +3% compared with Q1 2023, when GMV rose sharply (+17%). Revenues were down slightly by €3.0 million (-1.9%). Performance over the first three months of 2024 was in line with that at the end of 2023. Household consumption remains under pressure and is weighing on the historical flash sales activities, but these are being partially offset by growth drivers that are confirming their full potential. The Bradery, posted another quarter of strong growth, with revenues up by over 80%, demonstrating its ability to maintain a high growth rate, quarter after quarter, despite a gloomy environment and increasingly demanding base effects.

David Dayan, Chairman and CEO of Showroomprivé, comments on the start of the year: "The first months of our 2024 financial year are in line with the trend observed at the end of 2023. The market remains difficult in our core businesses, with reduced customer consumption continuing to weigh on e-commerce. Against this backdrop, the decision, largely reinforced by the ACE roadmap, to focus on a diversified offering with a variety of product families, has proved to be the right one. Indeed, investments made in recent years have enabled us to broaden our scope, extend our geographical presence and launch new, more premium offerings. Thanks to this strategy, we are now more resilient and have rejuvenated our customer base. These successes encourage us to continue adapting to a rapidly changing market, guided by our ACE roadmap. This has two objectives: reprofiling our core businesses to capitalize fully on the return to growth; and developing new sources of revenue and new levers of profitability. To achieve this, over the coming months we will continue to optimize our logistics infrastructure, deploy the latest technological tools for e-commerce, and launch our Marketplace in our international market. Implementing these new measures will be our operational priority for 2024."

Revenue breakdown

| (in € millions) | Q1 2023 | Q1 2024 | Change 24/23 % |

| Gross Merchandise Volume[1] | 240.0 | 247.3 | +3.0% |

| Internet Revenue | |||

| France | 124.3 | 119.1 | -4.2% |

| International | 27.9 | 31.3 | 12.4% |

| Total Internet Revenue | 152.1 | 150.4 | -1.1% |

| Other revenue | 3.6 | 2.2 | -37.6% |

| Net Revenue | 155.6 | 152.6 | -1.9% |

Over the period, Showroomprivé was able to capitalize on the good performance of its growth drivers:

- The Bradery once again recorded a very strong growth of 82% over Q1 2023, confirming the potential of its business model;

- The Marketplace recorded a very strong 84% increase in GMV compared with Q1 of the previous year. Its development was fuelled by the signing of new flagship partners, as well as by the strategic switch of certain brands, traditionally promoted through flash sales to the Marketplace;

- SRP Services was confronted with a more difficult situation, due to a still delicate context for media agencies and a decline in audience related to the market, but also as a short-term consequence of the search for more qualified traffic;

- The Travel & Leisure segment continued to perform well over the year, with its GMV up 11%, in line with Group expectations;

- International revenues continue to outperform France, with growth of 12%, thanks to the acceleration and penetration of certain international markets initiated under the ACE plan.

Showroomprivé's performance in its historic flash sales business was mixed, depending on the market, thus illustrating the resilience enabled by its diversified offering. Sport & Lifestyle sales rose by 65%, partially offsetting the decline in the Apparel & Accessories segment. The Home & Deco segment continues to suffer from a lack of offering. The Group is currently finalizing a precise action plan to turn around this segment's performance. Beauté Privée is seeing the very first effects of its efforts to turn its business around, and has managed to stabilize its performance, recording commercial successes thanks in particular to the contribution of new brands.

Key Performance Indicators

| Q1 2023 | Q1 2024 | Change 24/23 % | |

| Cumulative buyers* (in millions) | 14.9 | 16.0 | +7.3% |

| Buyers** (in millions ) | 1.5 | 1.4 | -2.3% |

| Of which repeated buyers*** | 1.1 | 1.2 | +5.1% |

| As % of total number of buyers | 78% | 84% | +5.9pt |

| Number of orders (in millions) | 3.1 | 3.0 | -2.0% |

| Revenue per buyer (IFRS) | 104.2 | 105.4 | +1.2% |

| Average number of orders per buyer | 2.1 | 2.1 | +0.3% |

| Average basket size | 49.6 | 50.0 | +0.9% |

* All buyers who have made at least one purchase on the Group's platform since its launch

** Member having placed at least one order during the year

*** Member who has placed at least one order during the year and at least one order in previous years

In an unfavorable environment, Showroomprivé succeeded in attracting many new buyers over the quarter, with the number of cumulative buyers now reaching 16 million, up 7.3% year-on-year. In line with its strategy of re-engagement of the member base, the number of loyal buyers also rose by +5.1% to 1.2 million. The number of orders fell slightly (-2.0%), but this was partially offset by a slight increase in the average basket (+0.9%).

ACQUISITION OF A STAKE IN PARADIGME, A START-UP SPECIALIZING IN SECOND-HAND GOODS

Showroomprivé has acquired a minority stake in the start-up Paradigme, as part of their first fund raising of €1.2 million, bringing together several investors including venture capital funds and leading fashion entrepreneurs, as well as Bpifrance as part of a seed financing/loan.

Founded in 2022 by two brothers, Vincent and Fabien Huché-Deniset, Paradigme is a premium fashion buy-resell platform for brands and individuals. The company is positioned on the second-hand market, which could reach $260 billion by 2025 thanks to annual growth of 30%. More specifically, it targets the accessible luxury segment, which is still under addressed by second-hand players.

Paradigme's model is based on an immediate buy-back offer in exchange for vouchers, creating an economically virtuous circle in which sellers become buyers without any cash outflow for the company, while providing an attractive offer for other users of the platform. To be able to capitalize on this model, the company can rely on efficient management of the logistics of the items on sale and real know-how in displaying them, with the aim of reproducing, for the second-hand, the same experience as when purchasing a new item. Paradigme now resells around a hundred high-end second-hand brands, including Sézane, ba&sh and Maje. Among them, some fifteen players have launched their second-hand offer with Paradigme's help, including Petite Mendigote and Ines de la Fressange Paris.

This stake acquisition is associated with the implementation of an operational partnership launched on April 3, under which Showroomprivé members will now be able to offer Paradigme the opportunity to take back their used parts from premium brands. These items will be eligible for gift cards to be spent in the fashion, home decoration and accessories segments, as well as in the home, travel, and sports segments of the showroomprive.com website.

David Dayan comments: "We are delighted to support Fabien and Vincent in such a relevant entrepreneurial project. This is Showroomprivé's first investment in the second-hand sector, and it fits in perfectly with our vision of the subject. Paradigme places sustainability at the heart of its model, associating second-hand with premium and offering a genuine partnership to the brands it integrates into its BtoC universe."

PROGRESS REPORT ON ACE AND OUTLOOK FOR 2024

Showroomprivé has begun to implement the acceleration measures of its ACE plan, notably the continued rationalization of the logistics network, the implementation of targeted and ROI-strong marketing levers, and the deployment of Artificial Intelligence solutions. The Group will also initiate the deployment of the Marketplace in its international market where it is now well established.

Showroomprivé confirms that 2024 will be a year of transformation, with operating expenses that may impact profitability. In addition, as part of the rationalization of its logistics network, investments will be made and will impact cash flow. However, the Group will remain vigilant in controlling its cost structure and will optimize the allocation of its resources to its high-potential activities.

UPCOMING NEWS

Combined Annual General Meeting 2024: June 19, 2024

fORWARD LOOKING STATEMENTS

This press release contains only summary information and is not intended to be comprehensive.

This press release may contain forward-looking information and statements about the Group and its subsidiaries. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements may be identified by the words "believe," "expect," "anticipate," "goal" or similar expressions. Although the Group believes that the expectations reflected in such forward-looking statements are reasonable, investors and the Group's shareholders are advised that forward-looking information and statements are subject to numerous risks and uncertainties, many of which are difficult to predict and are generally beyond the control of the Group, which could cause actual results and developments to differ materially and adversely from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in filings with the Autorité des Marchés Financiers (France's financial markets authority) made or to be made by the Group (particularly those detailed in Chapter 4 of the Company's registration document). The Group makes no commitment to publicly update its forward-looking statements, whether as a result of new information, future events or otherwise.

about showroomprivÉ

Showroomprivé is an innovative European player in the online private sales industry, specialized in fashion. Showroomprivé offers a daily selection of more than 3,000 brand partners via its mobile apps or website in France and six other countries. Since its launch in 2006, the company has enjoyed quick growth.

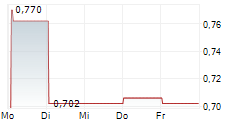

Showroomprivé is listed on Euronext Paris (code: SRP) and reported GMV of €1 billion incl. VAT in 2023, and net revenue of €677 million. The Group is headed by David Dayan, the co-founder, and employs over 1,100 people.

For more information: http://showroomprivegroup.com

Contacts

| Showroomprivé | NewCap |

| Sylvie Chan Diaz, Investor Relations investor.relations@showroomprive.net | Financial Communication Théo Martin, Louis-Victor Delouvrier |

| Anne Charlotte Neau-Julliard Relations.presse@showroomprive.net | Financial Media Relations Gaelle Fromaigeat, Nicolas Merigeau showroomprive@newcap.eu |

[1] The Gross Merchandise Volume ("GMV") represents, inclusive of all taxes, the total amount of the transaction billed and therefore includes gross Internet sales, including sales on the Marketplace, other services, and additional revenues

- SECURITY MASTER Key: lZtqk52alZmbnp2baptom2WVbGeSxmeXmWbIlGJsZ8eYmnJhx5mTaMWVZnFmmGln

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-85341-2024.04.25-en-pr-q1-2024_vfinal.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free