Company Reports Record Annual Revenue While Reducing Net Loss By 14%

FY Q1 2024 Expected to Deliver All Time Record Quarterly Revenue

TORONTO, MUMBAI and LOS ANGELES, April 29, 2024 /PRNewswire/ - QYOU Media Inc., (TSXV: QYOU) (OTCQB: QYOUF) a company operating in India and the United States producing and distributing content created by social media stars and digital content creators, is reporting financial results for the quarter and year ended December 31, 2023. Highlights include as follows:

- The company recorded annual revenue of $27,562,899 representing the highest annual revenue mark in corporate history. This was achieved despite the US WGA writers and SAG actors strike combined with a soft global ad market, resulting in a material adverse effect on overall FY 2023 revenues. The company is now experiencing a material improvement in the results for FY Q1 and FY Q2 2024 due to the strike having concluded and anticipates reporting all time record revenue for Q1 2024.

- Improved Net Loss: For the year ended December 31, 2023, net loss improved by $1,604,223 or 14% compared to prior year, most significantly driven by stable revenue growth offset by an increase in workforce and other operating expenses associated with building relationships in the social media and direct-to-consumer space.

- Adjusted EBITDA*: For the three months ended December 31, 2023 compared to same period prior year, Adjusted EBITDA decreased by $2,042,010 most significantly driven by strategic investment in the direct-to-consumer gaming segment, digital channels, digital contents, workforce and relationships in the social media space.

- Cash Balance: Cash used in operating activities for the three months ended December 31, 2023 was $1,897,153 compared to $1,871,858 in same period prior year. The decrease in cash used in operating activities is primarily due to the increase in collection of trade receivables. The Company concluded the year ended December 31, 2023 with cash of $736,713.

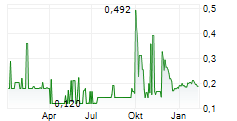

QYOU Media CEO and Co-Founder, Curt Marvis commented, "There is no question that in the second half of 2023 our business faced some real challenges. The soft ad market combined with the actors and writers strike in the US had a material adverse effect on our growth. Despite that, we were able to record our highest annual revenue to date and we are rebounding strongly in 2024. The weakness in our share price, while frustrating to all management and shareholders, is something we believe will be temporary as we continue to push ahead with new strategies and initiatives that will ultimately reward all stakeholders. For those of you that have remained patient, management is determined to have that value returned going forward."

*Note on Adjusted EBITDA:

To supplement our consolidated financial statements, which are prepared and presented in accordance with International Financial Reporting Standards ("IFRS"), we present Earnings Before Interest Tax Depreciation and Amortization ("Adjusted EBITDA") which is a non-IFRS financial measure. The presentation of non-IFRS financial measurement are not intended to be considered in isolation from, or as a substitute for, or superior to, operating loss or net income (loss) or any other performance measures derived in accordance with IFRS or as an alternative to net

cash provided by operating activities or any other measures of cash flows or liquidity.

We define earnings before interest, taxes, depreciation and amortization ("Adjusted EBITDA") as revenue minus operating expenses excluding non-cash and or non-recurring operating expenses of stock-based compensation, marketing credits, depreciation and amortization (interest and taxes are not included in the Company's operating expenses). Adjusted EBITDA is used as an internal measure to evaluate the performance of our operating segments. We believe that information about this non-IFRS financial measure assists investors by allowing them to evaluate changes in operating results of our business separate from non-operational factors that affect operating income (loss) and net income (loss), thus providing insights into both operations and other factors that affect reported results. A limitation of the use of Adjusted EBITDA as a performance measure is that it does not reflect the periodic costs of certain amortizing assets used in generating revenue in our business. Furthermore, this measure may vary among companies; thus Adjusted EBITDA as presented herein may not be comparable to similarly titled measures of other companies.

In connection with the closing of the Company's private placement of units for aggregate gross proceeds of $2,100,000, as announced on October 20, 2023, the Company paid an aggregate of approximately $156,576 and issued finder's warrants to acquire up to an aggregate of 1,695,561 common shares at a price of $0.10 per share for twenty-four months as finder's fees to certain persons who assisted the Company in connection with the offering.

Forward-Looking StatementsThis press release contains certain forward-looking statements within the meaning of applicable securities laws. Words such as "expects', "anticipates" and "intends" or similar expressions are intended to identify forward-looking statements. The forward-looking statements contained herein may include, but are not limited to, information concerning the completion of future investments, the approval of the Exchange of the investments, the approval of the Reserve Bank of India of future investments, the expected use of proceeds from the investment, and statements relating to the business and future activities of QYOU. These forward-looking statements are based on QYOU's current projections and expectations about future events and other factors management believes are appropriate. Although QYOU believes that the assumptions underlying these forward-looking statements are reasonable, they may prove to be incorrect, and readers cannot be assured that the offering and the closing thereof will be consistent with these forward-looking statements. Actual results could differ materially from those projected in the forward-looking statements as a result of numerous factors, including certain risk factors, many of which are beyond QYOU's control. Additional risks and uncertainties regarding QYOU are described in its publicly-available disclosure documents, filed by QYOU on SEDAR (www.sedar.com) except as updated herein. The forward-looking statements contained in this news release represent QYOU's expectations as of the date of this news release, or as of the date they are otherwise stated to be made, and subsequent events may cause these expectations to change. QYOU undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

About QYOU MediaOne of the fastest growing creator-media companies, QYOU Media operates in India and the United States producing, distributing and monetizing content created by social media influencers and digital content stars. In India, under our flagship brand, The Q and on connected TV, via channels Q Kahaniyan, Q GameX, Q Comedistaan & Sadhguru TV, QToonz and RDCMovies we curate, produce and distribute premium content across television networks, VOD and OTT platforms, mobile phones, smart TV's and app-based platforms. In addition, QYOU has numerous additional content destinations, apps and gaming platforms engaging over 125 million Indian households weekly. Our influencer marketing company, Chtrbox, has been a pioneer in India's creator economy, leveraging data to connect brands to the right social media influencers. QGamesMela is a recently launched casual gaming business leveraging access to the large audience enjoyed by Q India products. In the United States, we power major film studios, game publishers and brands to create content and market via creators and influencers. Founded and created by industry veterans from Lionsgate, MTV, Disney and Sony, QYOU Media's millennial and Gen Z-focused content reaches more than one billion consumers around the world every month. Experience our work at www.qyoumedia.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE QYOU Media Inc.