VANCOUVER, BC / ACCESSWIRE / April 30, 2024 / Sitka Gold Corp. ("Sitka" or the "Company") (TSXV:SIG)(FSE:1RF)(OTCQB:SITKF) is pleased to announce that it has entered into amending agreements (the "Amendments") dated April 22, 2024 to acquire a 100% ownership in the RC and BeeBop properties (the "Properties"), two of the underlying properties that comprise the Company's road accessible, 386 square kilometre RC Gold Project ("RC Gold" or the "Project") located in Yukon's Tombstone Gold Belt. The amendments to the RC and BeeBop option agreements in addition to the previously announced Barney Ridge property amendment (see news release dated April 23, 2024) and Clear Creek property amendment (see news release dated (December 19, 2023) will complete Sitka's acquisition of 100% ownership of all the underlying properties that comprise the district-scale and road accessible RC Gold Project.

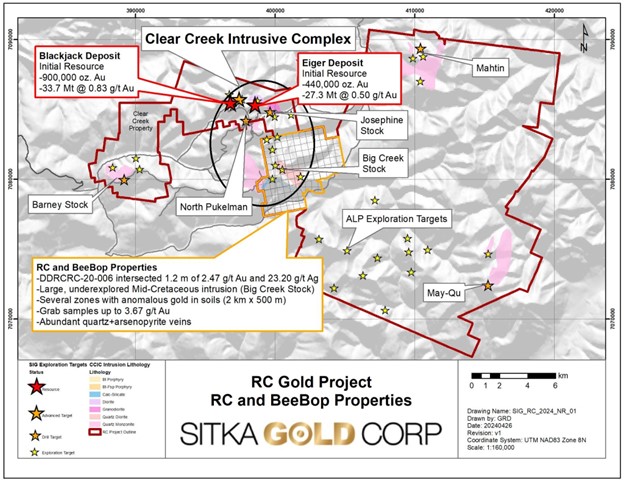

The RC and BeeBop properties are adjacent to the east of the Clear Creek property which hosts the Blackjack and Eiger gold deposits (see Figure 1). To date, the Company has completed all the exploration requirements and has made all property cash and share payments pursuant to the RC and BeeBop option agreements (see news release dated July 30, 2019) subject to the Amendments whereby the balance of future exploration expenditures will be waived and the Company will make a final payment of $60,000 cash and issue 375,000 shares (the "RC Consideration Shares") to acquire a 100% interest in the RC Property and a final payment of $20,000 cash and issue 125,000 shares (the "BeeBop Consideration Shares, together with the RC Consideration Shares, the "Consideration Shares") to acquire a 100% interest in the BeeBop Property. Payments will be made on or before May 15, 2024. The Amendments and the issuance of the Consideration Shares remain subject to the approval of the TSX Venture Exchange.

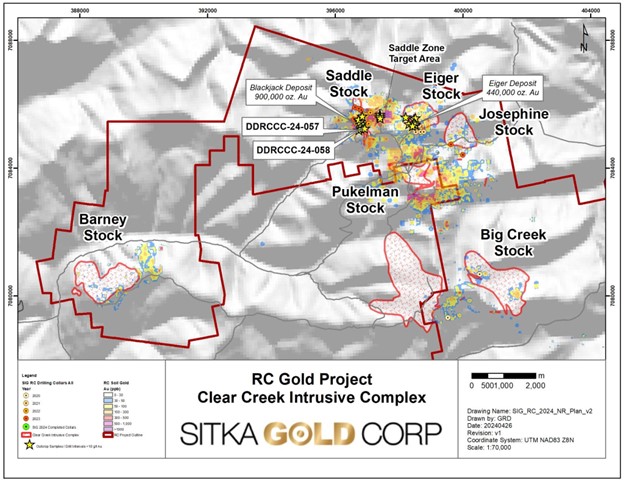

The 100 mineral claims of the RC property and the 24 mineral claims of the BeeBop property form a contiguous block of claims covering approximately 2,760 hectares and contain the Big Creek Stock. The Big Creek Stock is a 2 km by 3 km body of dioritic intrusive that forms part of the Clear Creek Intrusive Complex, where the Company has recently defined a mineral resource estimate (the "MRE" ) of 1.34 million ounces of gold(1) within and around the Saddle and Eiger intrusive stocks (see Figure 2). The Saddle and Eiger stocks are associated with the Blackjack and Eiger intrusion related gold deposits which comprise the MRE, remain open in all directions and contain 900,000 ounces of gold at a grade of 0.83 g/t and 440,000 ounces of gold at a grade of 0.50 g/t respectively(1). The intrusion related gold deposit targets at RC and BeeBop have seen limited exploration, and exhibit gold mineralization that is analogous to the gold mineralization present at the nearby Blackjack and Eiger gold deposits. The western and southern areas of the RC and BeeBop claim group are road accessible.

"Upon completion of these amendments, the Company will have secured a 100% ownership in all the underlying properties that comprise our flagship RC Gold Project," stated Cor Coe, Sitka Gold's CEO and Director. "The RC and BeeBop claims contain the 2 km by 3 km Big Creek stock, one of nine known intrusions with associated gold mineralization that are present across our 386 square kilometre RC Gold Project. While exploration on the RC and BeeBop claims has been limited, these road accessible properties have multiple intrusion related gold deposit targets that have mineral characteristics similar to the mineralization present at our expanding Blackjack and Eiger gold deposits, which remain open in all directions (see Figure 1). While our primary focus remains on expanding the current resource contained within the Blackjack and Eiger gold deposit area, we look forward to following up on the promising targets at the RC and BeeBop claims as well as elsewhere across Project.

"With assays currently pending from our recently completed winter phase of diamond drilling and a fully funded 2024 exploration program with up to 15,000 metres of diamond drilling planned, Sitka is very well positioned to continue growing the existing resource and pursuing additional new discoveries across our district-scale, 100% owned RC Gold Project."

Figure 1: Map of the RC Gold Project showing the RC and BeeBop Property location. Nine known intrusions (shown in pink) with associated gold mineralization have been discovered on the district-scale project to date. While the Company's recent focus has primarily been on the Blackjack and Eiger gold deposit areas, several promising targets (yellow and orange stars) with the potential to host additional intrusion related gold deposits remain untested or underexplored.

Figure 2: Plan map of the Northern Extent of the Clear Creek Intrusive Complex where several drill intervals and surface samples have demonstrated the high-grade nature of the Reduced Intrusion Related Gold System present. Yellow stars indicate where outcrop rock samples or drill hole intervals have returned >10 g/t gold. Several additional targets with the potential to host intrusion related gold deposits of significant size and grade have yet to be drilled within this approximately 3 km x 5 km area. The Saddle Zone target area remains largely untested by drilling and contains the largest and strongest gold-in-soil anomaly on the property. Results for drill holes DDRCCC-24-057 and DDRCCC-24-058 are pending.

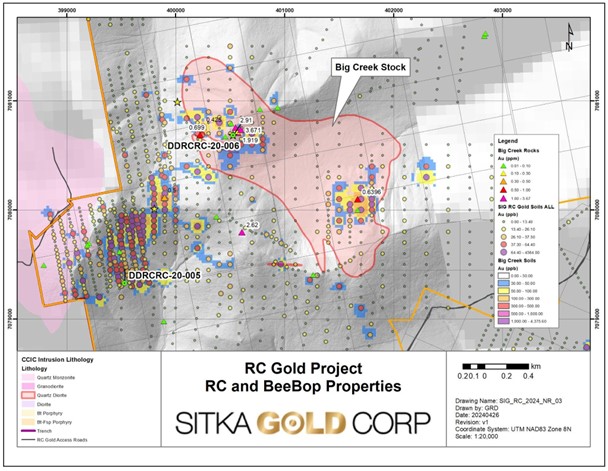

Exploration on the Properties to date has consisted of soil geochemical sampling, LiDAR surveying, IP geophysical surveying, rock sampling and two reconnaissance drill holes. The soil sampling has defined 3 areas of significantly anomalous gold and associated pathfinder elements that demonstrate the possible presence of a large intrusive related gold mineralized system (Figure 3). Limited rock sampling within these anomalies has returned gold values ranging from detection up to 3.6 g/t in a quartz breccia. Only two reconnaissance diamond drill holes have been completed on the Properties. The one drill hole within the Big Creek stock intersected numerous zones of sheeted-style quartz veins with anomalous gold values, and a significant quartz-arsenopyrite-tourmaline returned 2.47 g/t gold and 23.2 g/t silver over the 1.2 meters.

Figure 3: Work map highlighting rock and soil sample results with significant gold values at the RC and BeeBop Properties where the 2 km by 3 km Big Creek Stock is located. Limited exploration work in this area has returned significant gold values analogous to the gold mineralization present at the nearby Blackjack and Eiger gold deposits.

About the flagship RC Gold Project

The RC Gold Project consists of a 386 square kilometre contiguous district-scale land package located in the heart of Yukon's Tombstone Gold Belt. The project is located approximately 100 kilometres east of Dawson City, which has a 5,000 foot paved runway, and is accessed via a secondary gravel road from the Klondike Highway which is usable year-round and is an approximate 2 hour drive from Dawson. It is the largest consolidated land package strategically positioned mid-way between Victoria Gold's Eagle Gold Mine - Yukon's newest gold mine which reached commercial production in the summer of 2020 - and Victoria Gold's former producing Brewery Creek Gold Mine.

On January 19, 2023 Sitka Gold announced an Initial Mineral Resource Estimate prepared in accordance with National Instrument 43-101 ("NI 43-101") guidelines for the RC Gold Property of 1,340,000 ounces of gold(1). The road accessible, pit constrained Mineral Resource is classified as inferred and is contained in two zones: The Blackjack and Eiger deposits. Both of these deposits are at/near surface, are potentially open pit minable and amenable to heap leaching, with initial bottle roll tests indicating that the gold is not refractory and has high gold recoveries of up to 94% with minimal NaCN consumption (see News Release July 13, 2022). The Mineral Resource estimate is presented in the following table at a base case cut-off grade of 0.25 g/t Au:

RC Gold Inferred Mineral Resource Estimate

COG g/t Au | Blackjack Zone | Eiger Zone | Combined | ||||||||

Tonnes 000's | Au g/t | 0z Au 000's | Tonnes 000's | Au g/t | 0z Au 000's | Tonnes 000's | Au g/t | 0z Au 000's | |||

0.20 | 35,798 | 0.80 | 921 | 32,523 | 0.45 | 471 | 68,321 | 0.63 | 1,391 | ||

0.25 | 33,743 | 0.83 | 900 | 27,362 | 0.50 | 440 | 61,105 | 0.68 | 1,340 | ||

0.30 | 31,282 | 0.88 | 885 | 22,253 | 0.55 | 393 | 53,535 | 0.74 | 1,279 | ||

0.35 | 29,065 | 0.92 | 860 | 17,817 | 0.60 | 344 | 46,882 | 0.80 | 1,203 | ||

0.40 | 26,975 | 0.96 | 833 | 14,506 | 0.66 | 308 | 41,481 | 0.86 | 1,140 | ||

Notes

- Mineral resource estimate prepared by Ronald G. Simpson of GeoSim Services Inc. with an effective date of January 19, 2023. Mineral Resources are classified using the 2014 CIM Definition Standards.

- The cut-off grade of 0.25 g/t Au is believed to provide a reasonable margin over operating and sustaining costs for open-pitmining and processing

- Mineral resources are constrained by an optimised pit shell using the following assumptions: US$1800/oz Au price; a 45° pit slope; assumed metallurgical recovery of 85%; mining costs of US$2.00 per tonne; processing costs of US$8.00 per tonne; G&A of US$1.50/t.

- Mineral resources are not mineral reserves and do not have demonstrated economic viability.

- Totals may not sum due to rounding.

To date, 56 diamond drill holes have been drilled into this system for a total of approximately 19,962 metres including 16 drill holes totalling 6,515 metres completed in 2023 focused on expanding the initial resource. The drilling in 2023 produced results of up to 219.0 m of 1.34 g/t gold including 124.8 m of 2.01 g/t gold and 55.0 m of 3.11 g/t gold in drill hole DDRCCC-23-047 at Blackjack (see news release dated September 26, 2023). The Company recently completed two drill holes totalling 1,085 metres during the winter phase of a planned 15,000 metre diamond drilling program at the RC Gold Project for 2024. All core samples for these drill holes have been delivered to the lab and assays are currently pending.

*For more detailed information on the underlying properties please visit our website at www.sitkagoldcorp.com

RC Gold Deposit Model

Exploration on the Property has mainly focused on identifying an intrusion-related gold system ("IRGS"). The property is within the Tombstone Gold Belt which is the prominent host to IRGS deposits within the Tintina Gold Province in Yukon and Alaska. Notable deposits from the belt include: Fort Knox Mine in Alaska with current Proven and Probable Reserves of 230 million tonnes at 0.3 g/t Au (2.471 million ounces; Sims 2018)(1); Eagle Gold Mine with current Measured and Indicated Resources of 233 million tonnes at a grade of 0.57 g/t Au at the Eagle Main Zone (4.303 million ounces; Harvey et al, 2022)(2); the Brewery Creek deposit with current Indicated Mineral Resource of 22.2 million tonnes at a gold grade of 1.11 g/t (0.789 million ounces; Hulse et al. 2020)(3); the Florin Gold deposit, located adjacent to Sitka's RC Gold project, with a current Inferred Mineral Resource of 170.99 million tonnes grading 0.45 g/t (2.47 million ounces; Simpson 2021)(4) and the AurMac Project with an Inferred Mineral Resource of 347.49 million tonnes grading 0.63 gram per tonne gold (7.00 million ounces)(5).

(1) Sims J. Fort Knox Mine Fairbanks North Star Borough, Alaska, USA National Instrument 43-101 Technical Report. June 11, 2018. https://s2.q4cdn.com/496390694/files/doc_downloads/2018/Fort-Knox-June-2018-Technical-Report.pdf

(2) Harvey N., Gray P., Winterton J., Jutras M., Levy M.,Technical Report for the Eagle Gold Mine, Yukon Territory, Canada. Victoria Gold Corp. December 31, 2022. https://vgcx.com/site/assets/files/6534/vgcx_-_2023_eagle_mine_technical_report_final.pdf

(3) Hulse D, Emanuel C, Cook C. NI 43-101 Technical Report on Mineral Resources. Gustavson Associates. May 31, 2020. https://minedocs.com/22/Brewery-Creek-PEA-01182022.pdf

(4) Simpson R. Florin Gold Project NI 43-101 Technical Report. Geosim Services Inc. April 21, 2021. https://www.sedarplus.ca/csa-party/viewInstance/resource.html?node=W7420&drmKey=c048532e51949de5&drr=ssf4ac499f55978d75766200a3765eeaf7c5dd96a0d64b652cf1e36dd8ed30ecf9d95ca788ef0d57c4ad8a267a6ad1485aux&id=0c11f8b7998bcd96d602db37aafa5cc12e7834d151aa29b3

(5) Banyan Gold News Release Dated February 7, 2023 (Technical Report to be filed within 45 days of news release) https://banyangold.com/news-releases/2024/banyan-announces-7-million-ounce-gold-updated-mineral-resource-estimate-aurmac-project-yukon-canada/

Upcoming Events

Sitka Gold will be attending and/or presenting at the following events*:

- 121 Mining Investment Conference, London, England: May 15 - 16, 2024

- Yukon Mining Alliance Property Tours, Dawson City, Yukon: June 20 - 26, 2024

- Takestock Investor Forum, Stampede Event, Calgary, Alberta: July 3, 2024

- Precious Metals Summit, Beaver Creek, Colorado: September 10 - 13, 2-024

*All events are subject to change.

About Sitka Gold Corp.

Sitka Gold Corp. is a well-funded mineral exploration company headquartered in Canada. The Company is managed by a team of experienced industry professionals and is focused on exploring for economically viable mineral deposits with its primary emphasis on gold, silver and copper mineral properties of merit. Sitka currently has an option to acquire a 100% interest in the RC, Barney Ridge, Clear Creek and OGI properties in the Yukon and the Burro Creek Gold property in Arizona. Sitka owns a 100% interest in its Alpha Gold property in Nevada, its Mahtin Gold property in the Yukon and its Coppermine River project in Nunavut.

The Company recently announced an NI 43-101 compliant initial inferred Mineral Resource Estimate of 1,340,000 ounces of gold(1) beginning at surface and grading 0.68 g/t at its RC Gold Project in Yukon (see news release dated January 19, 2023). A total of approximately 7,585 metres of additional diamond drilling within 18 drill holes has been completed at RC Gold since the announcement of the Mineral Resource Estimate.

(1) Simpson, R. January 19, 2023. Clear Creek Property, RC Gold Project, NI 43-101 Technical Report, Dawson Mining District, Yukon Territory

The scientific and technical content of this news release has been reviewed and approved by Cor Coe, P.Geo., Director and CEO of the Company, and a Qualified Person (QP) as defined by National Instrument 43-101.

ON BEHALF OF THE BOARD OF DIRECTORS OF

SITKA GOLD CORP.

"Donald Penner"

President and Director

For more information contact:

Donald Penner

President & Director

778-212-1950

dpenner@sitkagoldcorp.com

or

Cor Coe

CEO & Director

604-817-4753

ccoe@sitkagoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements

This news release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation. The forward-looking statements herein are made as of the date of this news release only, and the Company does not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. These forward-looking statements include, among other things, statements relating to the TSX Venture Exchange's approval of the Amendment and the issuance of the Consideration Shares.

Such forward-looking statements are based on a number of assumptions of management, including, without limitation, that the TSX Venture Exchange will approve of the Amendment and the issuance of the Consideration Shares. Additionally, forward-looking information involve a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of the Company to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) the failure of the Company to obtain approval of the TSX Venture Exchange to the Amendment and the issuance of the Consideration Shares, and (b) unanticipated costs.

Such forward-looking information represents management's best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information. Neither the Company nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this news release. Neither the Company nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this news release by you or any of your representatives or for omissions from the information in this news release.

SOURCE: Sitka Gold Corp

View the original press release on accesswire.com