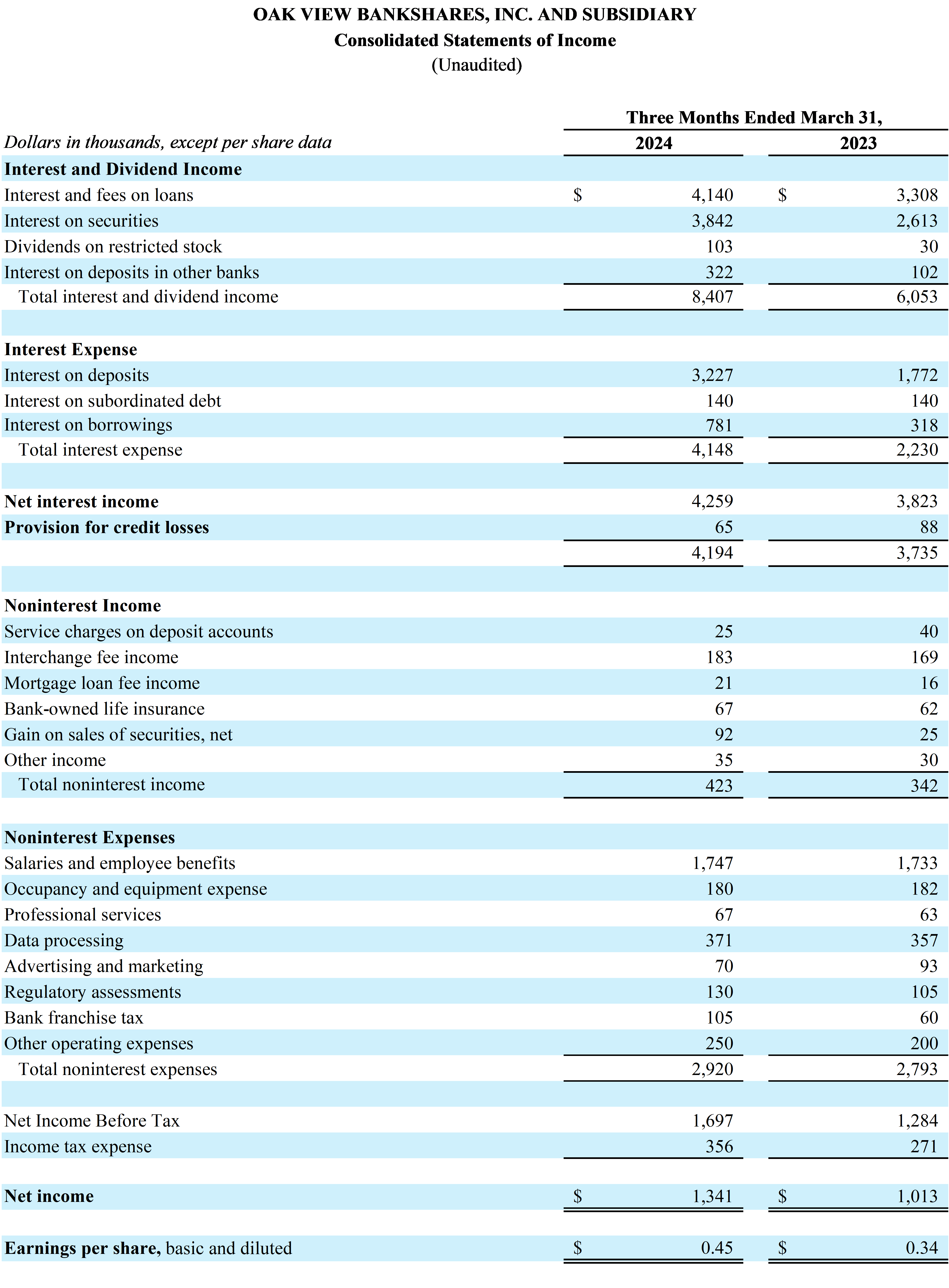

WARRENTON, VA / ACCESSWIRE / April 30, 2024 / Oak View Bankshares, Inc. (the "Company") (OTC Pink:OAKV), parent company of Oak View National Bank (the "Bank"), reported net income of $1.3 million for the quarter ended March 31, 2024, compared to net income of $1.0 million for the quarter ended March 31, 2023, an increase of 32.4%.

Basic and diluted earnings per share were $0.45 per share for the quarter ended March 31, 2024, compared to $0.34 for the quarter ended March 31, 2023.

Michael Ewing, CEO and Chairman of the Board said, "Our strong first quarter performance continues to reflect our disciplined approach in managing our balance sheet. We remain nimble and opportunistic as the banking needs of our community change in real-time, reflecting a challenging economic landscape and interest rate environment. We recognize that robust risk management practices are central to our continued financial performance. We remain dedicated to sound management practices as we strive to find the optimal balance among safety and soundness, profitability, and growth in this dynamic operating environment. We look forward to building on the foundation we built fifteen years ago and are privileged to be your trusted community bank."

Selected Highlights:

- Return on average assets was 0.88% and return on average equity was 16.45% for the quarter ended March 31, 2024, compared to 0.76% and 14.03%, respectively, for the quarter ended March 31, 2023.

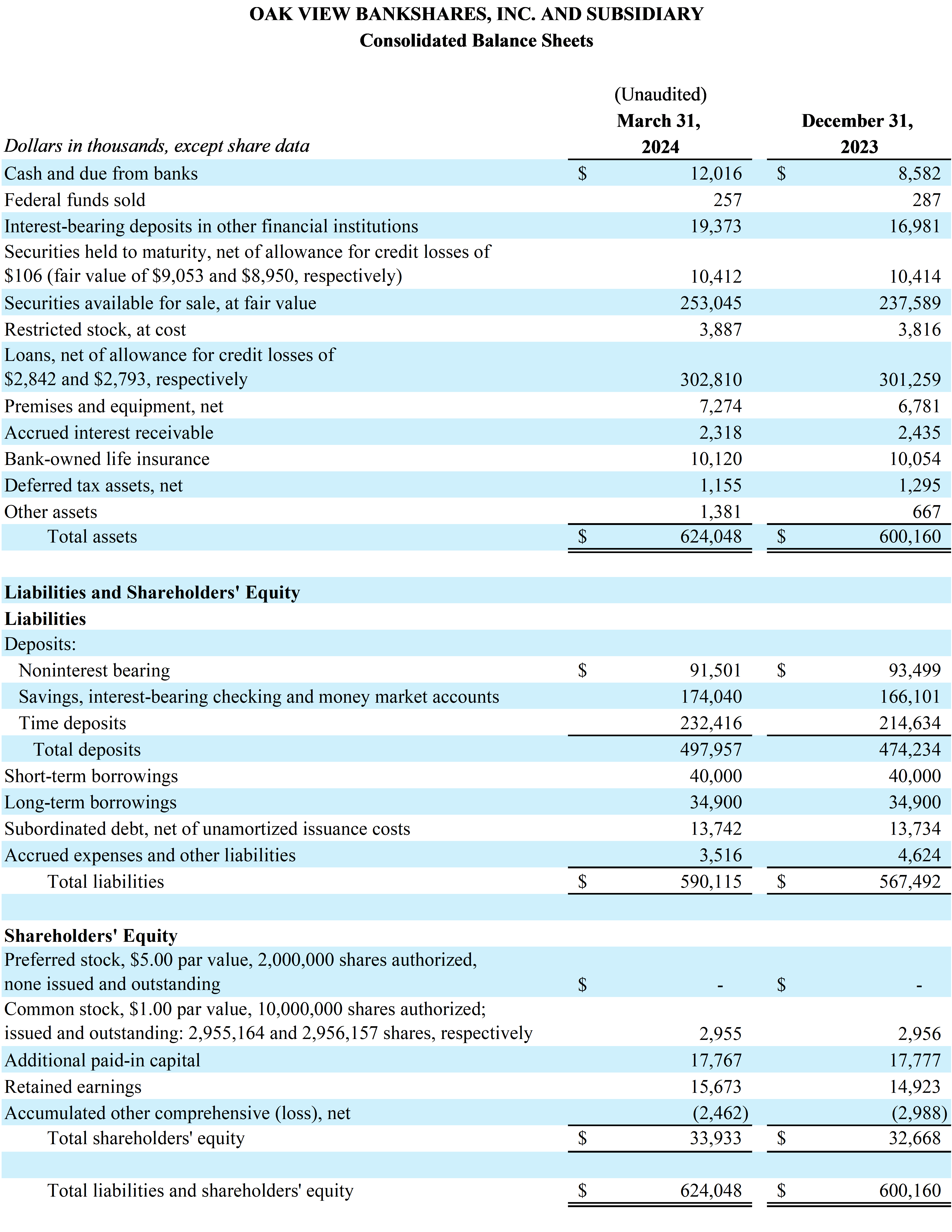

- Total assets were $624.0 million on March 31, 2024, compared to $600.2 million on December 31, 2023.

- Total loans were $305.7 million on March 31, 2024, compared to $304.1 million on December 31, 2023.

- Total securities were $263.6 million on March 31, 2024, compared to $248.1 million on December 31, 2023.

- Total deposits were $498.0 million on March 31, 2024, compared to $474.2 million on December 31, 2023.

- Regulatory capital remains strong with ratios exceeding the "well capitalized" thresholds in all categories.

- Credit quality continues to be outstanding. There were no nonperforming loans as of March 31, 2024.

- On-balance sheet liquidity remains strong with $479.7 million as of March 31, 2024, compared to $453.9 million as of December 31, 2023. Liquidity includes cash, unencumbered securities available for sale, and available secured and unsecured borrowing capacity.

Net Interest Income

The net interest margin was 2.92% for the quarter ended March 31, 2024, compared to 3.01% for the quarter ended March 31, 2023. Net interest income was $4.3 million for the quarter ended March 31, 2024, compared to $3.8 million for the quarter ended March 31, 2023. Average earning assets and the related yield increased to $592.0 million and 5.76%, respectively, for the quarter ended March 31, 2024, compared to $570.9 million and 5.66%, respectively, for the quarter ended March 31, 2023. Interest bearing liabilities and the related cost of funds increased to $478.6 million and 2.92%, respectively, for the quarter ended March 31, 2024, compared to $463.5 million and 1.85%, respectively, for the quarter ended March 31, 2023.

Noninterest Income

Noninterest income was $0.4 million for the quarter ended March 31, 2024, compared to $0.3 million for the quarter ended March 31, 2023. For the quarter ended March 31, 2024, the largest contributors of the increase in noninterest income compared to March 31, 2023, were gains on the sales of available for sale securities of $0.09 million. The sales of these investment securities were redeployed into assets with more attractive risk and return characteristics.

Noninterest Expense

Noninterest expense was $2.9 million for the quarter ended March 31, 2024, compared to $2.8 million for the quarter ended March 31, 2023, an increase of $0.1 million or 4.6%.

Salaries and employee benefits were the largest category of noninterest expense, which totaled $1.7 million for the quarter, relatively unchanged compared to the quarter ended March 31, 2023. Regulatory assessments and bank franchise tax contributed to the largest increase in noninterest expenses due to our growth.

Liquidity

The Company's liquidity position remains exceptionally strong with $479.7 million of liquid assets available which included cash, unencumbered securities available for sale, and secured and unsecured borrowing capacity as of March 31, 2024, compared to $453.9 million as of December 31, 2023.

The Company's deposits proved to be stable with core deposits, which are defined as total deposits excluding brokered deposits, of $457.1 million as of March 31, 2024, compared to $443.6 million as of December 31, 2023. Uninsured deposits, those deposits that exceed FDIC insurance limits, were $84.0 million as of March 31, 2024, or 16.9% of total deposits, well within industry averages.

Asset Quality

As of March 31, 2024, the allowance for credit losses related to the loan portfolio was $2.8 million or 0.93% of outstanding loans,net of unearned income, relatively unchanged compared to December 31, 2023. The slight increase in the allowance for credit losses was primarily due to the growth in the loan portfolio as well as adjustments to other qualitative factors by loan type. There were no nonperforming loans, nonaccrual loans or loans 90 days or more past due as of March 31, 2024.

The provision for credit losses was $0.07 million for the quarter ended March 31, 2024, compared to $0.09 million for the quarter ended December 31, 2023. As of March 31, 2024, $0.03 million of the provision was allocated to the loan portfolio and $0.01 million was allocated to unfunded commitments.

Shareholders' Equity & Regulatory Capital

Shareholders' equity was $33.9 million on March 31, 2024, compared to $32.7 million on December 31, 2023. Accumulated Other Comprehensive Loss improved $0.5 million to $2.5 million as of March 31, 2024, compared to $3.0 million as of December 31, 2023. These unrealized losses are primarily related to mark-to-market adjustments on U.S. Treasury bonds within the available-for-sale securities portfolio related to changes in interest rates.

As of March 31, 2024, the Bank's regulatory capital ratios were 14.81% in Common Equity Tier 1 and Tier 1 Capital, 15.75% in Total Capital and 8.07% in Leverage Ratio. These ratios exceeded the "well capitalized" thresholds for the period.

About Oak View Bankshares, Inc. and Oak View National Bank

Oak View Bankshares, Inc. is the parent bank holding company for Oak View National Bank, a locally owned and managed community bank serving Fauquier, Culpeper, Rappahannock, and surrounding Counties. For more information about Oak View Bankshares, Inc. and Oak View National Bank, please visit our website at www.oakviewbank.com. Member FDIC.

For additional information, contact Tammy Frazier, Executive Vice President & Chief Financial Officer, Oak View Bankshares, Inc., at 540-359-7155.

SOURCE: Oak View Bankshares, Inc. VA

View the original press release on accesswire.com