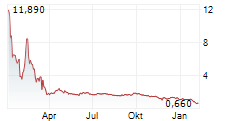

XIAMEN, China, April 30, 2024 (GLOBE NEWSWIRE) -- Blue Hat Interactive Entertainment Technology ("Blue Hat" or the "Company") (NASDAQ: BHAT), primarily a company of commodity trading in China, today announced its audited financial results for the fiscal year ended December 31, 2023 ("Fiscal Year 2023"), reflecting a remarkable surge in the revenue.

Fiscal Year 2023 Financial Highlights

Blue Hat achieved a revenue of $73.68 million in 2023, increasing 33 times than the previous year. This extraordinary achievement is credited to the company's robust expansion of its commodity trading business, particularly in the realms of jewelry and gold trading, since the fourth quarter of 2022. However, despite the substantial revenue growth, the company incurred a net loss of $21.72 million for the Fiscal Year 2023. The primary reasons for the loss include bad debts and asset impairment resulting from divested businesses. Notably, the Company's new business line, commodity trading, contributed a profit of nearly $1.2 million to the company for the Fiscal Year 2023.

Management Commentary

Mr. Chen Xiaodong, CEO of Blue Hat, stated at the Company's annual summary meeting: "Our achievements in 2023 represent not only a breakthrough in financial data, but also a resounding affirmation of Blue Hat's business strategy transition. In 2024, we will continue leveraging on the technology and experience we have accumulated in past few years. We will deepen our commodity trading in jewelry, especially the diamond and gold trading, and meanwhile expanding online gold derivatives trading, which aim to deliver excellent performance and reward our investors. Furthermore, we are committed to embracing the era of artificial intelligence and inspired to set a new benchmark as a 'smart' gold trader."

Fiscal Year 2023 Financial Results

Please refer to Blue Hat's annual report on Form 20-F for the fiscal year ended December 31, 2023 filed with the Securities and Exchange Commission on April 30, 2024 for a detailed analysis of Blue Hat's financial results.

About Blue Hat

Blue Hat was formerly a provider of communication services and IDC business, as well as a producer, developer, and operator of AR interactive entertainment games, toys, and educational materials in China. Leveraging years of technological accumulation and unique patented technology, Blue Hat is expanding its business to commodity trading, aiming to become a leading intelligent commodity trader worldwide. For more information, please visit the Company's investor relations website at http://ir.bluehatgroup.com. The Company routinely provides important information on its website.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All forward-looking statements are inherently uncertain as they are based on current expectations and assumptions concerning future events or future performance of the Company. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. In evaluating such statements, prospective investors should review carefully various risks and uncertainties identified in this release and matters set in the Company's SEC filings. These risks and uncertainties could cause the Company's actual results to differ materially from those indicated in its forward-looking statements.

Contacts:

Blue Hat Interactive Entertainment Technology

Phone: +86 (592) 228-0010

Email: ir@bluehatgroup.net

| CONSOLIDATED BALANCE SHEETS | ||||||||

| December 31, | December 31, | |||||||

| 2023 | 2022 | |||||||

| (Restated) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 407,588 | $ | 69,273 | ||||

| Restricted cash | 1,587 | 1,129 | ||||||

| Inventories | 17,545,153 | - | ||||||

| Accounts receivable, net | 15,157,384 | 9,170,996 | ||||||

| Accounts receivable, related party | 9,571 | - | ||||||

| Other receivables, net | 4,182,706 | 4,704,455 | ||||||

| Other receivables, related party | 1,941,723 | 1,427,829 | ||||||

| Prepayments, net | 36,588 | 80,834 | ||||||

| Assets related to discontinued operation | - | 6,077,554 | ||||||

| Total current assets | 39,282,300 | 21,532,070 | ||||||

| Non-current assets: | ||||||||

| Operating lease, right-of-use asset | 2,353,083 | 40,596 | ||||||

| Prepayments | 2,388,435 | 2,495,570 | ||||||

| Property, plant and equipment, net | 3,544,751 | 3,817,015 | ||||||

| Intangible assets, net | - | 1,368,424 | ||||||

| Long-term investments | 1,694,269 | 1,722,999 | ||||||

| Assets related to discontinued operation | - | 3,300,184 | ||||||

| Total non-current assets | 9,980,538 | 12,744,788 | ||||||

| Total assets | $ | 49,262,838 | $ | 34,276,858 | ||||

| LIABILITIES AND EQUITY | ||||||||

| Current liabilities: | ||||||||

| Short-term loans - banks | $ | 273,713 | $ | 473,825 | ||||

| Taxes payable | 805,577 | 841,334 | ||||||

| Accounts payable | 318,729 | 324,991 | ||||||

| Other payables and accrued liabilities | 4,027,883 | 9,014,057 | ||||||

| Other payables - related party | - | 22,643 | ||||||

| Operating lease liabilities - current | 235,470 | 11,261 | ||||||

| Customer deposits | 3,020 | 19,629 | ||||||

| Liability related to discontinued operation | - | 6,700,468 | ||||||

| Total current liabilities | 5,664,392 | 17,408,208 | ||||||

| Non-current liabilities: | ||||||||

| Operating lease liability | 2,141,421 | 31,041 | ||||||

| Long-term loans banks | - | - | ||||||

| Long-term loans - related party | 834,950 | 914,771 | ||||||

| Convertible notes payable | - | 1,393,499 | ||||||

| Total other liabilities | 2,976,371 | 2,339,311 | ||||||

| Total liabilities | 8,640,763 | 19,747,519 | ||||||

| Shareholder's equity | ||||||||

| Ordinary shares, $0.01 par value, 500,000,000 shares authorized, 58,398,281 shares issued and outstanding as of December 31, 2023, 9,894,734 shares issued and outstanding as of December 31, 2022 | 583,982 | 98,947 | ||||||

| Additional paid-in capital | 93,828,090 | 44,145,826 | ||||||

| Statutory reserves | 2,143,252 | 2,143,252 | ||||||

| Retained earnings | (56,832,015 | ) | (35,113,598 | ) | ||||

| Accumulated other comprehensive loss | 898,766 | 834,513 | ||||||

| Total Blue Hat Interactive Entertainment Technology shareholders' equity | 40,622,075 | 12,108,940 | ||||||

| Non-controlling interests | - | 2,420,399 | ||||||

| Total Equity | 40,622,075 | 14,529,339 | ||||||

| Total liabilities and shareholders' equity | $ | 49,262,838 | $ | 34,276,858 | ||||

| CONSOLIDATED STATEMENTS OF INCOME (LOSS) AND COMPREHENSIVE INCOME (LOSS) | ||||||||||||

| Year ended | Year ended | Year ended | ||||||||||

| December 31, | December 31, | December 31, | ||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| (Restated) | (Restated) | |||||||||||

| Revenues | $ | 73,686,733 | $ | 2,195,954 | $ | 12,139,500 | ||||||

| Cost of revenue | (72,532,882 | ) | (958,438 | ) | (5,782,664 | ) | ||||||

| Gross profit | 1,153,851 | 1,237,516 | 6,356,836 | |||||||||

| Operating expenses: | ||||||||||||

| Selling | (7,677 | ) | (159,937 | ) | (315,600 | ) | ||||||

| Research and development | (2,570,158 | ) | (2,734,982 | ) | (11,233,806 | ) | ||||||

| General and administrative expenses | (13,766,487 | ) | (6,224,674 | ) | (31,335,421 | ) | ||||||

| Impairment loss | (13,693,305 | ) | (33,397 | ) | (14,632,931 | ) | ||||||

| Total operating expenses | (30,037,627 | ) | (9,152,990 | ) | (57,517,758 | ) | ||||||

| (Loss)/Income from operations | (28,883,776 | ) | (7,915,474 | ) | (51,160,922 | ) | ||||||

| Other income (expense) | ||||||||||||

| Interest income | 7 | 374 | 156,038 | |||||||||

| Interest expense | (222,057 | ) | (133,882 | ) | (229,985 | ) | ||||||

| Other finance expenses | (62,025 | ) | (15,264 | ) | (65,344 | ) | ||||||

| Other income (expense), net | 66,205 | 39,080 | (191,499 | ) | ||||||||

| Total other expense, net | (217,870 | ) | (109,692 | ) | (330,790 | ) | ||||||

| (Loss)/ income from Continuing Operations before income taxes | (29,101,646 | ) | (8,025,166 | ) | (51,491,712 | ) | ||||||

| Provision for income taxes | (6,081 | ) | (1,097,888 | ) | (1,104 | ) | ||||||

| (Loss)/ income from continuing operations | (29,107,727 | ) | (9,123,054 | ) | (51,492,816 | ) | ||||||

| Discontinued Operations (Note 19) | ||||||||||||

| Gain on disposal of discontinued operations | 7,389,310 | - | 1,493,945 | |||||||||

| (Loss) from discontinued operations | - | (282,027 | ) | (10,055,749 | ) | |||||||

| Net Income (Loss) | (21,718,417 | ) | (9,405,081 | ) | (60,054,620 | ) | ||||||

| Less: Net (loss) income attributable to non-controlling interest | (2,420,399 | ) | (40,025 | ) | (2,918,680 | ) | ||||||

| Net (Loss) Income attributable to Blue Hat Interactive Entertainment Technology | (19,298,018 | ) | (9,365,056 | ) | (57,135,940 | ) | ||||||

| Other comprehensive (loss) income | ||||||||||||

| Net (loss)/ Income from continued operations | (29,107,727 | ) | (9,123,054 | ) | (51,492,816 | ) | ||||||

| Foreign currency translation adjustment continued operation | (199,032 | ) | (1,883,571 | ) | 651,272 | |||||||

| Comprehensive (loss) income - continued operation | $ | (29,306,759 | ) | $ | (11,006,625 | ) | $ | (50,841,544 | ) | |||

| Income (loss) from discontinued operation | 7,389,310 | (282,027 | ) | (8,561,804 | ) | |||||||

| Foreign currency translation adjustment - discontinued operation | 263,285 | 258,828 | 66,288 | |||||||||

| Comprehensive income (Loss) - discontinued operation | $ | 7,652,595 | $ | (23,199 | ) | $ | (8,495,516 | ) | ||||

| Comprehensive (loss) income | $ | (21,654,164 | ) | $ | (11,029,824 | ) | $ | (59,337,060 | ) | |||

| Less: Net (loss) income attributable to non-controlling interest | (2,420,399 | ) | (40,025 | ) | (2,918,680 | ) | ||||||

| Comprehensive income (loss) attributable to Blue Hat Interactive Entertainment shareholders | (19,233,765 | ) | (10,989,799 | ) | (56,418,380 | ) | ||||||

| Weighted average number of ordinary shares | ||||||||||||

| Basic | 29,722,950 | 7,639,482 | 5,053,727 | |||||||||

| Diluted | 30,975,275 | 8,565,163 | 5,800,048 | |||||||||

| Earnings per share | ||||||||||||

| Basic (loss) earnings per share from continued operation | $ | (0.98 | ) | $ | (1.19 | ) | $ | (10.19 | ) | |||

| Basic earnings per share from discontinued operation | 0.33 | (0.04 | ) | (1.12 | ) | |||||||

| Diluted Earnings per share: | ||||||||||||

| Diluted (loss) earnings per share from continued operation | $ | (0.98 | ) | $ | (1.19 | ) | $ | (10.19 | ) | |||

| Diluted earnings per share from discontinued operation | 0.33 | (0.04 | ) | (1.12 | ) | |||||||

| CONSOLIDATED STATEMENTS OF CASH FLOW | ||||||||||||

| Year ended | Year ended | Year ended | ||||||||||

| December 31, | December 31, | December 31, | ||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| (Restated) | (Restated) | |||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||||||

| Net (loss) income | $ | (21,718,417 | ) | $ | (9,405,081 | ) | $ | (60,054,620 | ) | |||

| Net income (loss) from discontinued operation | 7,389,310 | (282,027 | ) | (8,561,804 | ) | |||||||

| Net (loss) from continuing operation | (29,107,727 | ) | (9,123,054 | ) | (51,492,816 | ) | ||||||

| Adjustments to reconcile net income to net cash used in operating activities: | ||||||||||||

| Depreciation of property, plant and equipment | 260,883 | 185,083 | 241,265 | |||||||||

| Amortization of intangible assets | 159,579 | 169,149 | 1,557,016 | |||||||||

| Impairment of goodwill | - | 3,681 | 14,537 | |||||||||

| Impairment of intangible assets | 1,075,997 | - | 14,632,931 | |||||||||

| Impairment of Property, plant and equipment | 17,308 | 29,716 | - | |||||||||

| Impairment of inventory | 12,600,000 | |||||||||||

| Interest expenses related to convertible note | 146,322 | 100,314 | - | |||||||||

| Share-based payments | 3,659,080 | 4,043,550 | - | |||||||||

| Issuance of common stock to pay for goods | 42,420,000 | - | - | |||||||||

| Provision for doubtful accounts | 10,246,270 | (1,060,782 | ) | (29,661,273 | ) | |||||||

| Deferred income taxes | - | - | 119,127 | |||||||||

| Changes in operating assets and liabilities: | ||||||||||||

| Accounts receivable | (14,915,499 | ) | 4,762,503 | 9,091,390 | ||||||||

| Accounts receivables related party | - | - | 1,906,101 | |||||||||

| Other receivables | (1,208,861 | ) | 385,779 | 24,850,497 | ||||||||

| Inventories | (17,545,153 | ) | 116,115 | (41,460 | ) | |||||||

| Prepayments | 41,367 | (773,671 | ) | 14,189,940 | ||||||||

| Operating lease assets | 22,102 | 276 | (13,025 | ) | ||||||||

| Accounts payable | (6,260 | ) | (21,891 | ) | 134,526 | |||||||

| Other payables and accrued liabilities | (4,986,175 | ) | 92,607 | 5,179,130 | ||||||||

| Customer deposits | (16,609 | ) | 12,549 | 5,532 | ||||||||

| Taxes payable | (35,756 | ) | (395,191 | ) | (5,337,785 | ) | ||||||

| Net cash (used in) generated from operating activities - continued operation | (9,773,132 | ) | (1,473,267 | ) | (14,624,367 | ) | ||||||

| Net cash (used in) generated from operating activities - discontinued operation | 7,661,561 | 281,780 | (5,488,297 | ) | ||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||||||

| Purchases of property and equipment | - | (3,429 | ) | (140,962 | ) | |||||||

| Proceeds from disposal of equipment | - | 9,760 | 52,799 | |||||||||

| Purchase of intangible assets | - | - | (16,385,451 | ) | ||||||||

| Proceeds from disposal of intangible assets | - | - | 12,985,106 | |||||||||

| Disposal of a subsidiary | (15,380 | ) | - | (866,075 | ) | |||||||

| Acquisition of subsidiaries, net of cash received | - | 5 | (162,326 | ) | ||||||||

| Net cash from investing activities - continued operation | (15,380 | ) | 6,336 | (4,516,909 | ) | |||||||

| Net cash from investing activities - discontinued operation | - | - | (1,952 | ) | ||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||||||

| Proceeds from issuance of new shares | 2,998,397 | 88,592 | 12,830,780 | |||||||||

| Gross proceeds from issuance of convertible note | - | 1,550,000 | - | |||||||||

| Repayment of convertible note | (449,999 | ) | - | (739,189 | ) | |||||||

| Proceeds (Repayment) from other payables - related party | - | 905,171 | 6,406 | |||||||||

| (Repayment) from loan payables - related party | (102,464 | ) | - | (14,117 | ) | |||||||

| Change in restricted cash | (1,587 | ) | (1,129 | ) | - | |||||||

| Repayments of short-term loans - banks | (138,393 | ) | - | (4,663,292 | ) | |||||||

| Net cash generated from financing activities - continued operation | 2,305,954 | 2,542,634 | 7,420,588 | |||||||||

| Net cash generated from financing activities - discontinued operation | (52,322 | ) | (11,960 | ) | 154,260 | |||||||

| EFFECT OF EXCHANGE RATES ON CASH | 210,505 | (1,319,437 | ) | 1,439,535 | ||||||||

| NET CHANGES IN CASH AND CASH EQUIVALENTS | 337,186 | 26,086 | (15,617,142 | ) | ||||||||

| CASH AND CASH EQUIVALENTS, beginning of year | 70,402 | 50,449 | 15,752,704 | |||||||||

| CASH AND CASH EQUIVALENTS, end of year | $ | 407,588 | $ | 76,535 | $ | 135,562 | ||||||

| Less: cash and cash equivalents from the discontinued operations, end of year | - | (7,262 | ) | (85,113 | ) | |||||||

| CASH AND CASH EQUIVALENT, FROM THE CONTINUING OPERATIONS, end of year | $ | 407,588 | $ | 69,273 | $ | 50,449 | ||||||

| SUPPLEMENTAL CASH FLOW INFORMATION: | ||||||||||||

| Cash and cash equivalents | $ | 407,588 | $ | 76,535 | $ | 135,562 | ||||||

| CASH AND CASH EQUIVALENTS, end of year | $ | 407,588 | $ | 76,535 | $ | 135,562 | ||||||

| Provision for doubtful trade receivables | $ | (8,929,110 | ) | $ | (1,035,345 | ) | $ | (6,037,274 | ) | |||

| Provision for doubtful other receivables | (1,207,145 | ) | (22,869 | ) | (13,484,319 | ) | ||||||

| Reversal for doubtful prepayments | (110,014 | ) | 4,925 | (10,166,240 | ) | |||||||

| Allowance for inventory | - | (7,492 | ) | 26,561 | ||||||||

| (Reversal)/Provision for doubtful accounts | $ | (10,246,269 | ) | $ | (1,060,781 | ) | $ | (29,661,272 | ) | |||

| Cash paid for income tax | $ | 6,081 | $ | 1,097,888 | $ | 1,529,850 | ||||||

| Cash paid for interest | $ | 222,057 | $ | 133,882 | $ | 229,985 | ||||||

| SUPPLEMENTAL NON-CASH INVESTING INFORMATION: | ||||||||||||

| Additional of operating lease, right-of-use asset | $ | 2,353,083 | $ | 40,596 | $ | 118,272 | ||||||

| SUPPLEMENTAL NON-CASH FINANCING INFORMATION: | ||||||||||||

| Operating lease liabilities | $ | 235,470 | $ | 11,261 | $ | 57,645 | ||||||