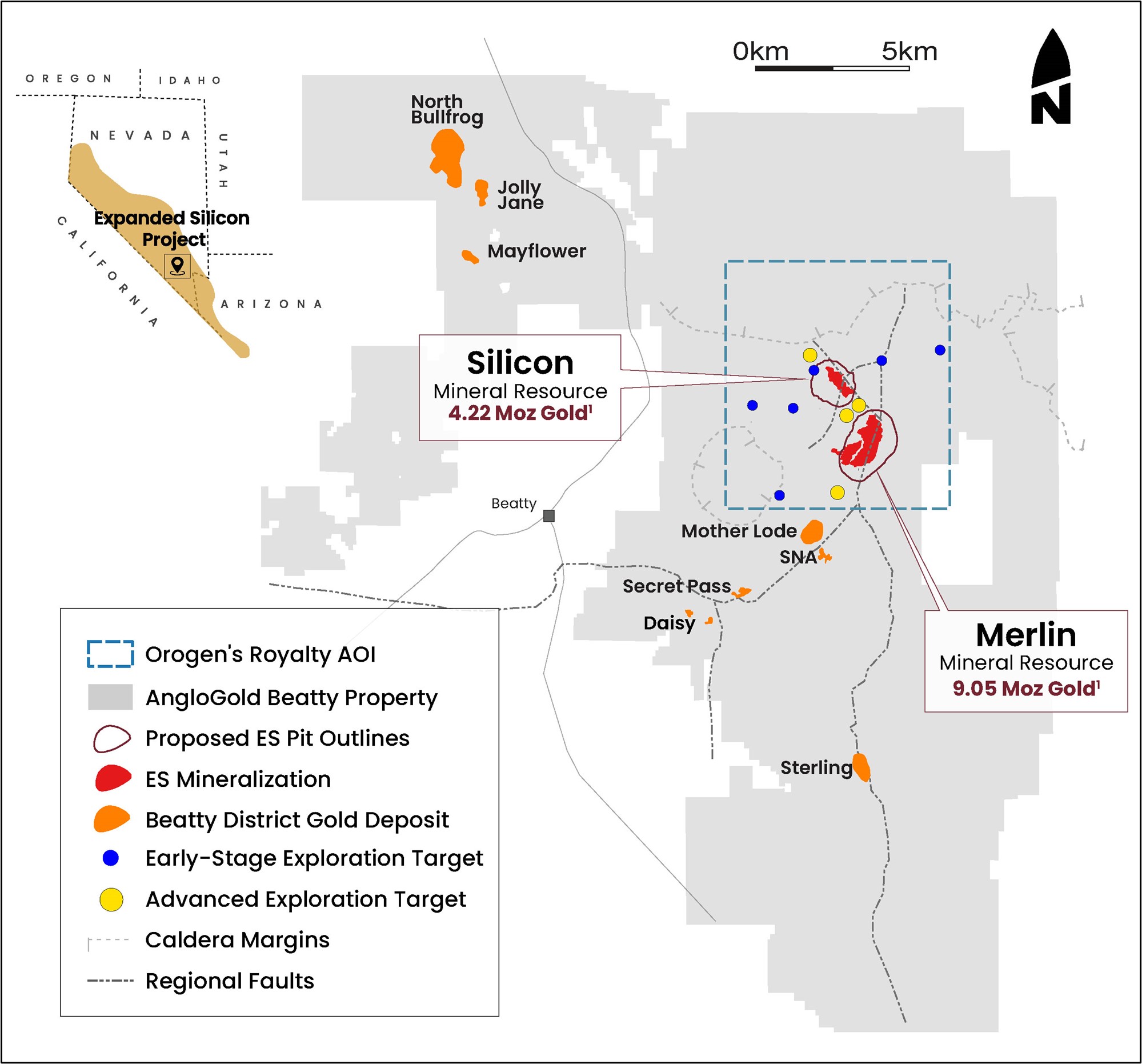

VANCOUVER, BC / ACCESSWIRE / May 1, 2024 / (TSXV:OGN)(OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce a technical update and preliminary mine production schedule for the Merlin gold deposit near Beatty, Nevada, USA. The Merlin and Silicon deposits together comprise the Expanded Silicon project, where Orogen holds a 1% net smelter return ("NSR") royalty.

On April 25, 2024, project owner AngloGold Ashanti NA ("AngloGold") released a Regulation S-K 1300 Technical Report Summary entitled "Merlin deposit, Expanded Silicon project. An Initial Assessment Report" with an effective date of December 31, 2023. The report is available on EDGAR at

https://www.sec.gov/Archives/edgar/data/1973832/000162828024017820/exhibit191510merlintrsexhi.htm.

Merlin Update Highlights

- Inferred mineral resources at Merlin of 9.05 million ounces of gold and 15.22 million ounces of silver consisting of 284 million tonnes grading 0.99 grams per tonne ("g/t") gold and 1.67 g/t silver.

- The Merlin deposit remains open to the north and west with significant potential for expansion.

- The pit-constrained Merlin mineral resource is based on large-scale open pit mining with estimated gold recoveries of 94% for mill material and 70% for heap leach material.

- The estimated mine life at Merlin is 14 years with two years of pre-stripping followed by twelve years of ore production averaging over 750,000 ounces of contained gold per year, including production of 1.1 million ounces gold in Year 3 and 1.8 million ounces gold in Year 4.

- The production schedule contemplated at Merlin excludes the nearby Silicon deposit (Indicated Resources of 3.4 million ounces gold and Inferred Resources of 800,000 ounces gold).

- AngloGold has initiated a pre-feasibility study for the Expanded Silicon project that incorporates both the Merlin and Silicon deposits.

About the Expanded Silicon Project

Orogen holds a 74 square-kilometre 1% NSR royalty area of interest covering the Expanded Silicon project, which includes the Silicon and Merlin deposits (Figure 1). By the end of 2023, AngloGold had completed over 300 kilometres of drilling and announced resource updates in late February1 (Table 1).

Table 1:Reported Mineral Resources at the Expanded Silicon Project1

| Deposit | Category | Tonnes (million) | Grade | Contained Gold |

| Silicon | Indicated | 121 | 0.87 | 3.40 |

Inferred | 36 | 0.70 | 0.81 | |

| Total Silicon | 158 | 0.83 | 4.22* | |

| Total Merlin | Inferred | 284 | 0.99 | 9.05 |

*Rounding of numbers may result in computational discrepancies in the Mineral Resource tabulations and are reported directly from AngloGold disclosure

Merlin Production Summary

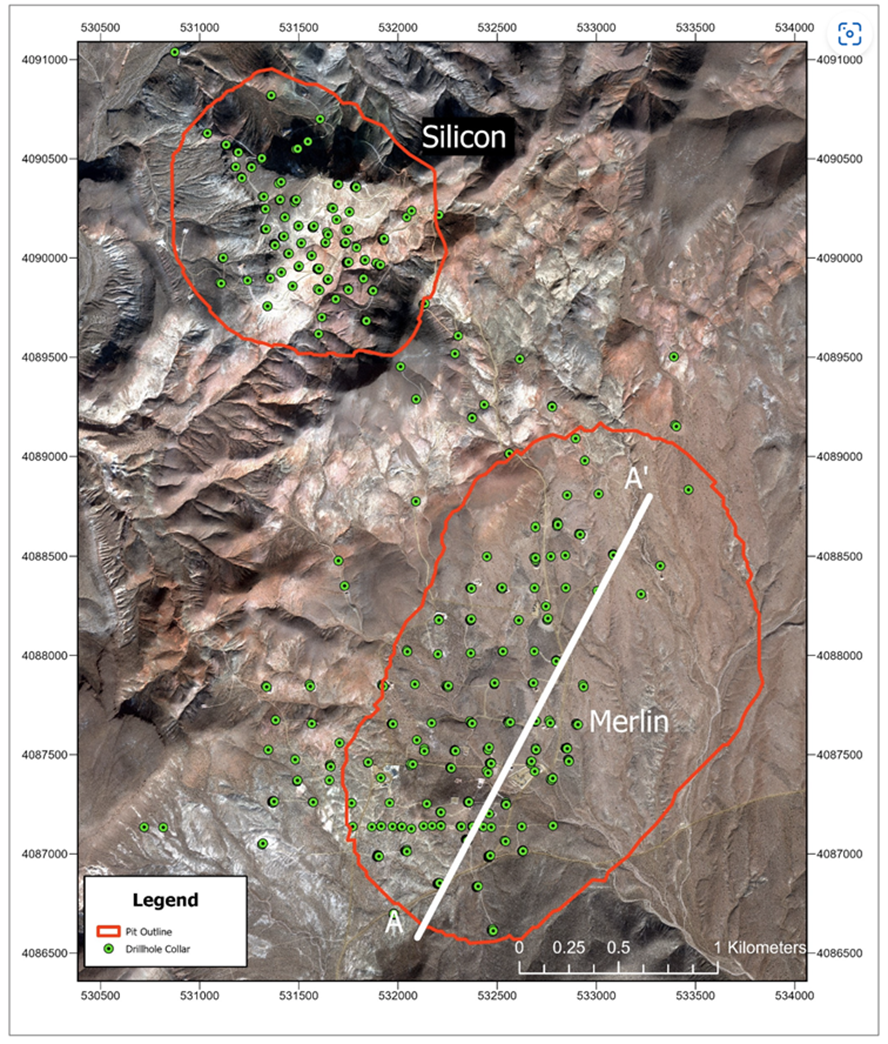

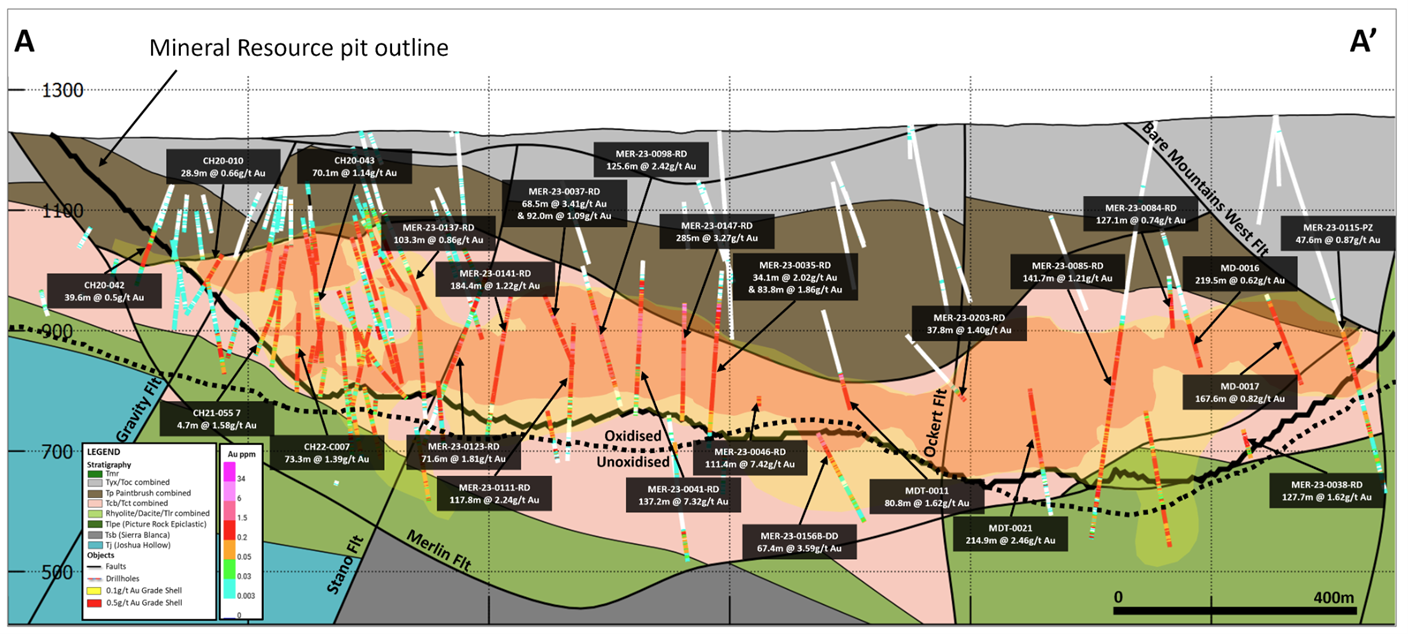

The Merlin inferred mineral resource has been reported inside a US$1,750 per ounce optimized pit with additional optimization based on geotechnical and economic parameters (Figure 2 and 3)2. The resulting pit contains 1,929 million tonnes ("Mt") of material including 283 Mt of ore. The Merlin pit is scheduled to be mined over 14 years with target ore production of 27Mt per year.

The first two years of the production schedule consists of waste stripping, with years three and four targeting an apparent cohesive high-grade region of the deposit, with average grades greater than 3.0 g/t gold (Table 2). Estimated contained gold mined, for years three and four are 1.1 and 1.8 million ounces, respectively. Ore production averages over 750,000 ounces of contained gold across the twelve years of scheduled production.

Table 2: Mine Production Schedule by year for the Merlin pit adapted from Merlin Assessment Report2

Ore Mined | Gold Grade | Contained Gold Moz | Grade Silver | Contained Silver | Waste Mined | Total Mined | |

Year 1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 55.2 | 55.2 |

Year 2 | 0.0 | 0.3 | 0.0 | 1.9 | 0.0 | 143.7 | 143.8 |

Year 3 | 10.6 | 3.1 | 1.1 | 4.2 | 1.4 | 193.2 | 203.8 |

Year 4 | 17.0 | 3.3 | 1.8 | 3.4 | 1.8 | 186.5 | 203.5 |

Year 5 | 28.2 | 0.9 | 0.8 | 1.3 | 1.2 | 165.7 | 193.9 |

Year 6 | 30.9 | 0.9 | 0.9 | 1.4 | 1.4 | 168.9 | 199.7 |

Year 7 | 29.7 | 0.7 | 0.7 | 1.1 | 1.1 | 170.2 | 199.9 |

Year 8 | 18.0 | 1.2 | 0.7 | 2.0 | 1.2 | 182.7 | 200.7 |

Year 9 | 19.8 | 1.2 | 0.7 | 2.0 | 1.3 | 180.9 | 200.7 |

Year 10 | 23.7 | 0.7 | 0.5 | 1.9 | 1.4 | 133.5 | 157.2 |

Year 11 | 34.5 | 0.5 | 0.5 | 1.4 | 1.6 | 41.7 | 76.2 |

Year 12 | 35.7 | 0.5 | 0.6 | 1.1 | 1.2 | 17.1 | 52.9 |

Year 13 | 26.2 | 0.6 | 0.5 | 1.4 | 1.2 | 4.0 | 30.2 |

Year 14 | 9.5 | 0.6 | 0.2 | 1.2 | 0.4 | 1.6 | 11.1 |

Total | 283.88 | 0.99 | 9.05 | 1.67 | 15.22 | 1,645 | 1,929 |

* Rounding of numbers may result in computational discrepancies in the production schedule tabulations and are reported directly from AngloGold disclosure.

Merlin Geology, Mineralization and Exploration Potential

The Merlin deposit is interpreted as a low sulphidation epithermal gold system developed in an extensional setting between two strike slip faults. Mineralization is hosted within a stack of rhyolitic ignimbrite sheets cut by multiple normal faults a subset of which appear to control the emplacement of the mineralization. Mineralization occurs as high-gold grade epithermal veins and stockworks and a low to moderate gold grade broad disseminated zone within silica-adularia altered tuffs. The deposit is oxidized to depths exceeding five hundred metres (Figure 3).

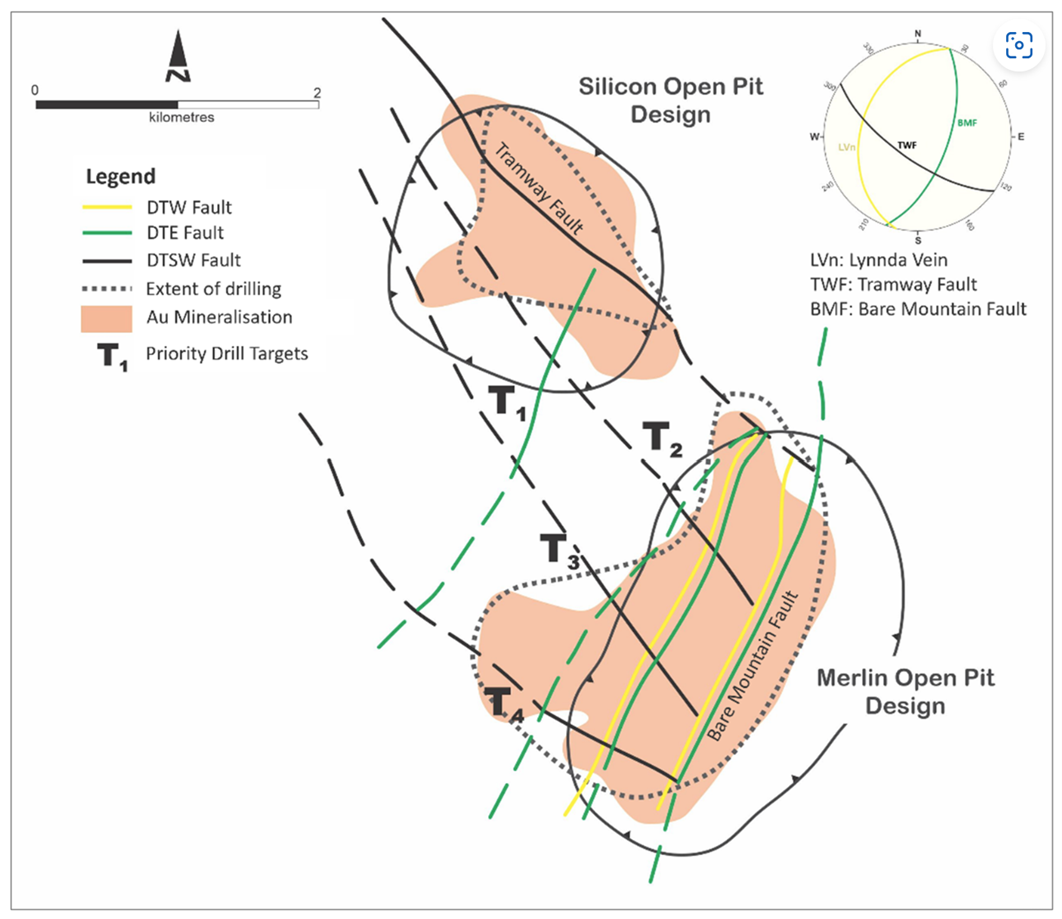

The Merlin deposit remains open in multiple directions with drilling planned to define the limits of mineralization to the west of the current ore body and to better understand the mineralization and fault systems between Merlin and Silicon to the north (Figure 4). There is significant potential for deep, high-grade feeder structures within the sulphide zone at both deposits, which have been intersected by exploration drilling but not included in the current resource calculations.

Figure 1: Overview of AngloGold's Beatty Project, the Expanded Silicon Project

and Orogen's royalty area of interest.

Figure 2: Plan view map of the drill hole collars within the Merlin and Silicon projects with outlines of the Mineral Resource pit design2.

Figure 3: Long section of the Merlin deposit with section line shown in Figure 2.2

Figure 4: Simplified plan view of the three main structural groups at Merlin and Silicon displaying priority drill targets.2

Qualified Person Statement

All new technical data, as disclosed in this press release, has been reviewed by Laurence Pryer, Ph.D., P.Geo., VP. Exploration for Orogen. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

All technical disclosure in this release is a summary of previously released information and the Company is relying on the interpretation provided by the relevant referenced partner. Additional information can be found on the links in the footnotes or on SEDAR+ (www.sedarplus.ca) or EDGAR (www.sec.gov).

About Orogen Royalties Inc.

Orogen Royalties is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver Mine in Sonora, Mexico (2.0% NSR royalty) operated by First Majestic Silver Corp. and the Expanded Silicon gold project (1.0% NSR royalty) in Nevada, U.S.A, being advanced by AngloGold Ashanti NA. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President of Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1015 - 789 West Pender Street

Vancouver, BC

Canada V6C 1H2

1.https://www.sec.gov/Archives/edgar/data/1973832/000162828024017820/exhibit191510merlintrsexhi.htm.

2.https://thevault.exchange/?get_group_doc=143/1708694171-PreliminaryFinancialUpdate2023-Presentation.pdf

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward looking statements. Forward looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Except where otherwise stated, the disclosure in this news release relating to properties and operations in which Orogen holds a royalty are based on information publicly disclosed by the owners or operators of these properties and information/data available in the public domain as at the date hereof, and none of this information has been independently verified by Orogen. Specifically, as a royalty holder and prospect generator, the Company has limited, if any, access to properties on which it holds royalty or other interests in its asset portfolio. The Company may from time to time receive operating information from the owners and operators of the mining properties, which it is not permitted to disclose to the public. Orogen is dependent on, (i) the operators of the mining properties and their qualified persons to provide information to Orogen, or (ii) on publicly available information to prepare disclosure pertaining to properties and operations on the properties on which the Company holds royalty or other interests, and generally has limited or no ability to independently verify such information. Although the Company does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some reported public information in respect of a mining property may relate to a larger property area than the area covered by Orogen's royalty or other interest. Orogen's royalty or other interests may cover less than 100% of a specific mining property and may only apply to a portion of the publicly reported mineral reserves, mineral resources and or production from a mining property.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Orogen Royalties Inc.

View the original press release on accesswire.com