Highlights

Results of the 2023 soil sampling program, taken together with previous geochemical and geophysical results1, are interpreted to support the Trojan-Condor Corridor as a high priority, drill ready exploration target.

VANCOUVER, British Columbia, May 02, 2024 (GLOBE NEWSWIRE) -- COLLECTIVE METALS INC. (CSE: COMT | OTC: CLLMF | FSE: TO1) (the "Company" or "Collective") is pleased to provide a review of results from Ah and B horizon soil samples taken from the Trojan-Condor target areas in its flagship Princeton Project in south-central B.C. (the "Project" or the "Property"). The Property hosts several alkalic Cu-Au porphyry targets associated with Triassic diorite intrusions analogous to those associated with the currently producing Copper Mountain Mine, which lies approximately 10 km to the east. Results from two soil geochemical surveys completed in 2023 are interpreted to confirm the mineral potential of the Trojan-Condor target area as one of five (5) promising prospects with favourable geology, geophysical signatures, and/or historic geochemistry (please see the Company's News Release dated January 8, 2024). The Trojan-Condor Corridor, which hosts significant chargeability anomalies identified in a previous Induced Polarization ("IP") survey1, is considered a drill-ready target.

Chris Huggins, Chief Executive Officer of Collective, commented, "Integration of 2023 geochemical results and reprocessed geophysical data with historic geochemical and geological work on the Property has helped us identify and prioritize our current exploration targets. The well documented mineral endowment and large size of the Property provides significant opportunity for discovery. We look forward to advancing exploration on several secondary targets, including the Lamont Ridge and Fourteen Mile Creek areas, using 3D IP in 2024, in tandem with drilling our primary Trojan-Condor target area."

A total of 483 Ah horizon soil samples and 166 B horizon soils were collected as part of Phase I (Trojan-Condor Corridor) and Phase II (infill sampling on Trojan-Condor Corridor and multiple grids elsewhere on the Property) (the "Programs"). Samples were analyzed using predominantly analytical package AuME-TL43, with a subordinate proportion using ME-MS41. Both use an Aqua Regia digestion, differing only by the inclusion of a gold analysis in AuME-TL43 and a slightly wider range of detection for select elements in AuME-TL43. Analytical results from Phase I soil samples taken in the Trojan-Condor Corridor were previously discussed in a very limited manner (please see the Company's News Release dated September 21, 2023).

Analytical data for soil samples in the Trojan-Condor Corridor were collected from two different horizons, namely the Ah and B horizons. Strictly speaking, the data comprise two separate and distinct datasets for the same area, representing results from two different locations in the variably developed soil profile. In order to fully utilize these data, the two sets of data were leveled with respect to one another, using a module in the Python programming language, resulting in a single dataset for the high priority survey grid. Despite representing samples from two different levels in the soil profile, levelled data for a given station location, where both Ah and B horizon samples were taken for comparative purposes, tend to agree well with one another (see inset to left in the following figures).

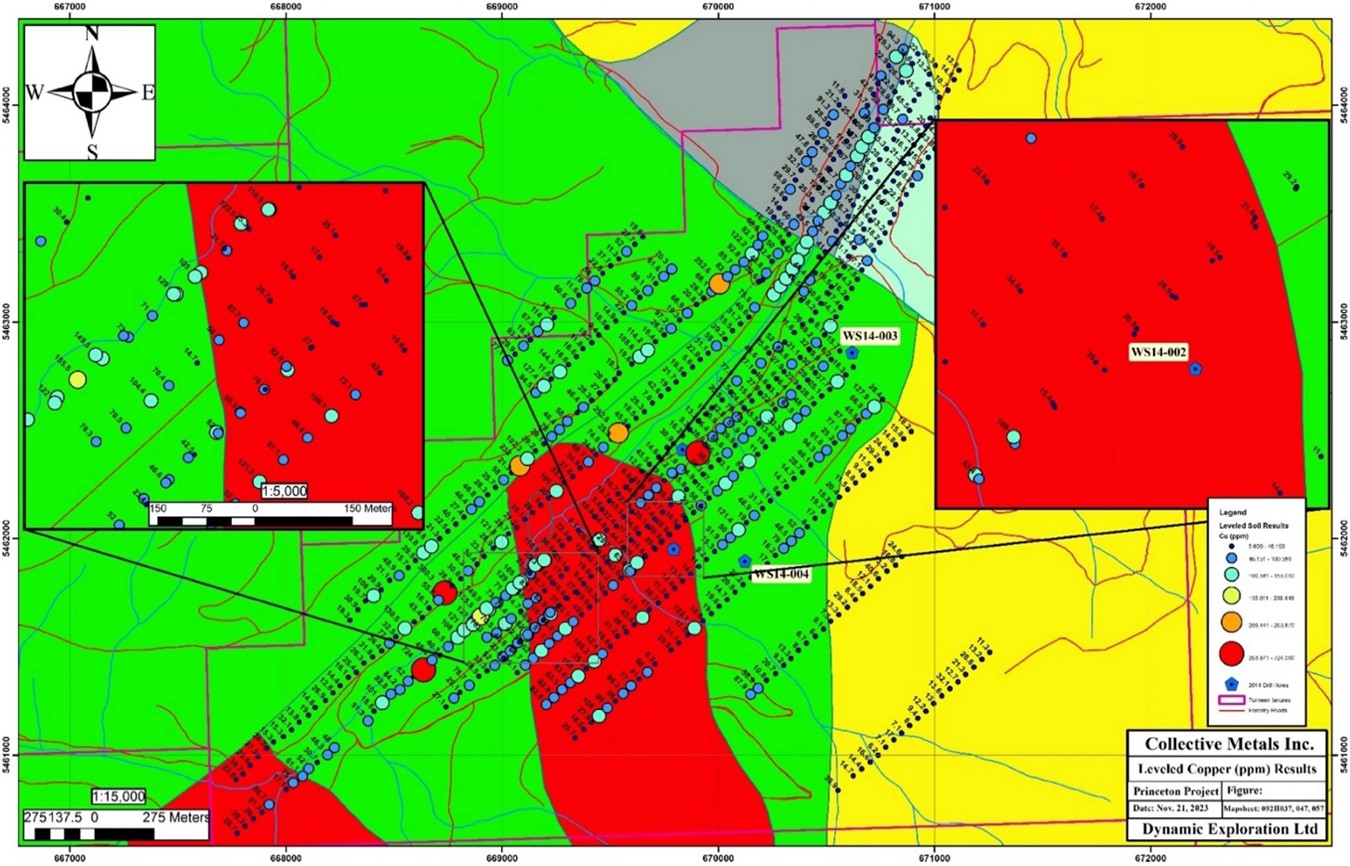

Leveled Copper Results

Leveled copper results for the Trojan-Condor Corridor grid document the majority of results are predominantly background (5.6 - 46.15 ppm; please see Figure 1). However, there are elevated values strongly localized immediately adjacent to the surface trace of the Whipsaw Fault (PA1 anomaly as defined by Phase I soils; please see the Company's News Release dated September 21, 2023) and on the eastern margin of one of the Whipsaw Stocks (PA2 anomaly).

A comparatively large number of weakly anomalous (46.151 to 100.58 ppm) and weakly moderate (100.561 to 155.010 ppm) values are underlain by Late Triassic Nicola Group sediments (unit uTNs; shaded in grey) associated with anomaly PA1, whereas across the Whipsaw Fault to the east (sub-parallel to Whipsaw Creek) results returned have predominantly background values (Nicola Group volcanic sediments; uTNvs; shaded in light green).

There are a relatively large number of elevated copper values underlain by Nicola Group Volcanics (uTNv), with a greater proportion evident on the eastern side of the Whipsaw Fault relative to the west. Copper values documented are dominantly weakly anomalous (46.151 to 100.58 ppm) to weakly moderate (100.561 to 155.010 ppm) values. Interestingly, there is only a single moderately anomalous value (155.5 ppm) located within the PA2 anomaly. In addition, there is a single moderately high value of 252.6 ppm west of the Whipsaw Fault and two moderately high values (232 and 252.6 ppm) and two highly anomalous values (380.3 and 724 ppm) within an interpreted halo around the Whipsaw Stock. Note: The value of 724 ppm is the highest obtained from the 2023 soil program.

Finally, there is a comparatively high proportion of elevated results within, or immediately adjacent to, the PA2 anomaly as defined by Phase I soil results. These elevated results are spatially associated with a Late Triassic ultramafic (Tru) mapped in the northwest margin of the dioritic Whipsaw Stock (note the oval outline which partially straddles Whipsaw Creek). This may indicate the Whipsaw Stock is a multi-phase intrusion, with the ultramafic stock potentially being the causative source of anomalous copper.

Anomalous copper values are evident on the southernmost soil lines within the Whipsaw Stock, interpreted to indicate anomalous copper remains open to the south and southwest.

Copper values returned from within the Princeton Group are all at background levels.

Figure 1 - Leveled copper results for the Trojan-Condor Corridor. Late Triassic Whipsaw Stock (red) hosted by Late Triassic Nicola Group host rocks (green) unconformably overlain by Eocene Princeton Group (yellow). (Note: Inset (left) Ah and B horizon soils samples taken immediately adjacent to one another, have leveled values that strongly agree with one another.)

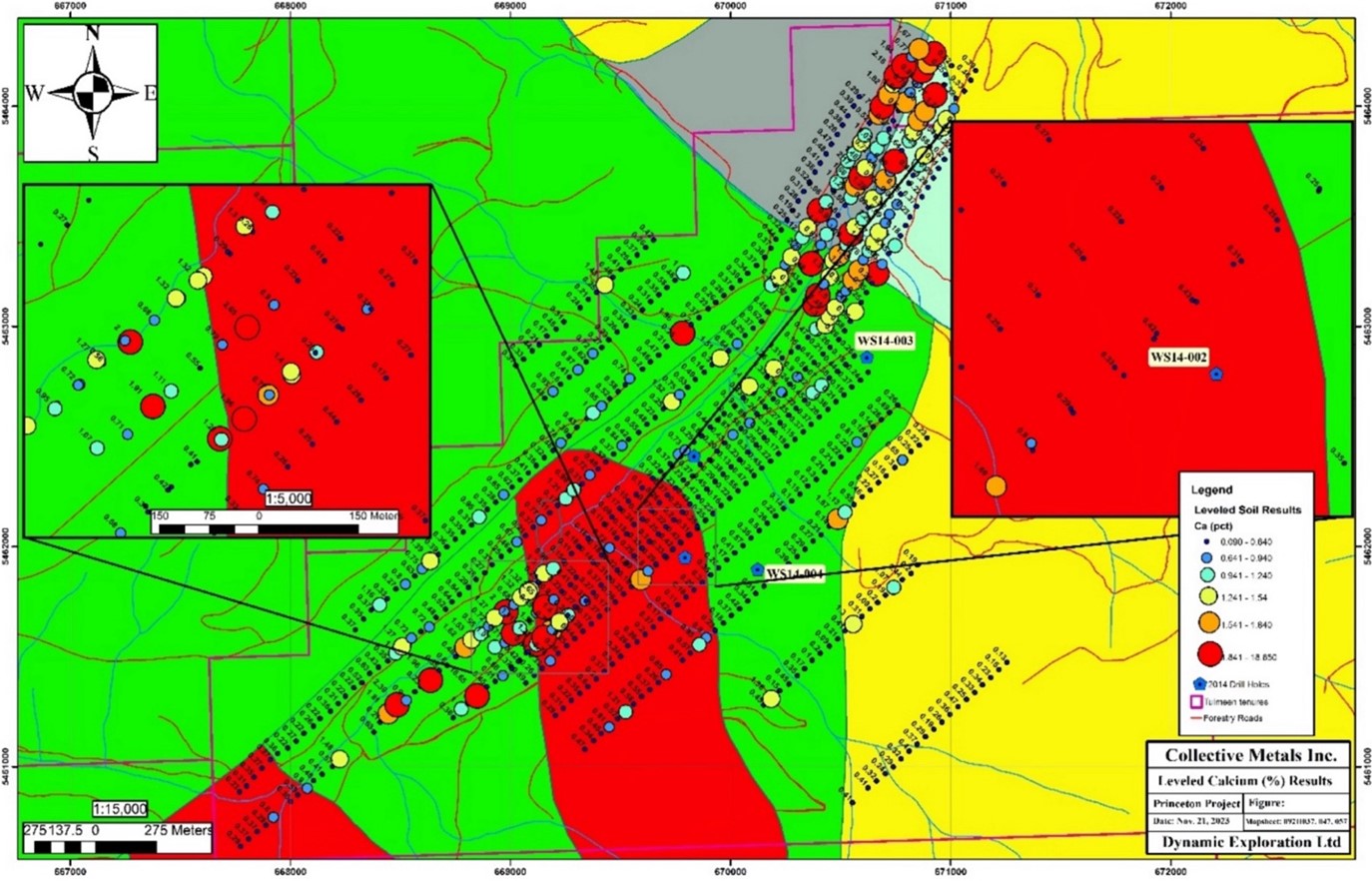

Leveled Calcium Results

Leveled calcium results (please see Figure 2) document a strong spatial association of elevated to anomalous results with both the PA1 and PA2 anomalies. The PA1 anomaly to the northeast, spatially associated with the Condor Chargeability anomaly1, is characterized by anomalous values on the central four soil lines, with generally background to weakly anomalous values on the peripheral lines on either side.

There is a high proportion of anomalous values, ranging from weakly anomalous (0.641 to 0.940%) through weakly moderate (0.941 to 1.24%) and moderately anomalous (1.241 to 1.54%) to moderately highly (1.541 to 1.84%) and highly (1.841 to 18.65%) anomalous. Anomalous values are present on either side of the surface trace of the Whipsaw Fault and an unnamed northwest - southeast fault juxtaposing units uTNs (shaded in grey) and uTNvs (shaded light green) to the northeast against unit uTNv (shaded medium green) to the southwest. These anomalous soil results are spatially associated with the intersection of two faults and are interpreted to indicate geochemical leakage from below, within, and adjacent to, the resulting damage zone (i.e, structural control to anomalous geochemiostry). They are also spatially associated with the Condor Chargeability anomaly.

The other concentration of anomalous results is spatially associated with the PA2 anomaly. There is a comparatively small number of elevated results within the Whipsaw Stock, with a higher proportion in the immediately adjacent Nicola Group volcanic host rocks to the west-southwest. Notably, there are very few anomalous results spatially associated with the Whipsaw Fault in this area, nor are there many elevated results elsewhere throughout the Whipsaw Stock. Again, the highest proportion of anomalous results are localized within the PA2 anomaly on the west side of the Whipsaw Stock and immediately adjacent Nicola Group host rocks. The highest proportion / largest concentration of anomalous results is localized at the mapped contact between the Whipsaw Stock and the host Nicola Group volcanic rocks.

This highly anomalous area is very interesting with respect to the PA1 anomaly and is tentatively interpreted as support for the interpretation of another, near subsurface (blind) Whipsaw Stock underlying the anomaly. The relative lack of elevated to anomalous values along most of the surface trace of the Whipsaw Fault, except in association with the PA1 anomaly, is interpreted to indicate there has not been widespread geochemical leakage along the Whipsaw Fault, so localized concentrations of anomalous values may be a valuable exploration signature.

Again, there are very few anomalous results evident with the mapped exposure of the Princeton Group and, in general, throughout the remainder of the Nicola Group volcanic unit.

Figure 2 - Leveled calcium results for the Trojan-Condor Corridor. Geochemical units as per Figure 1.

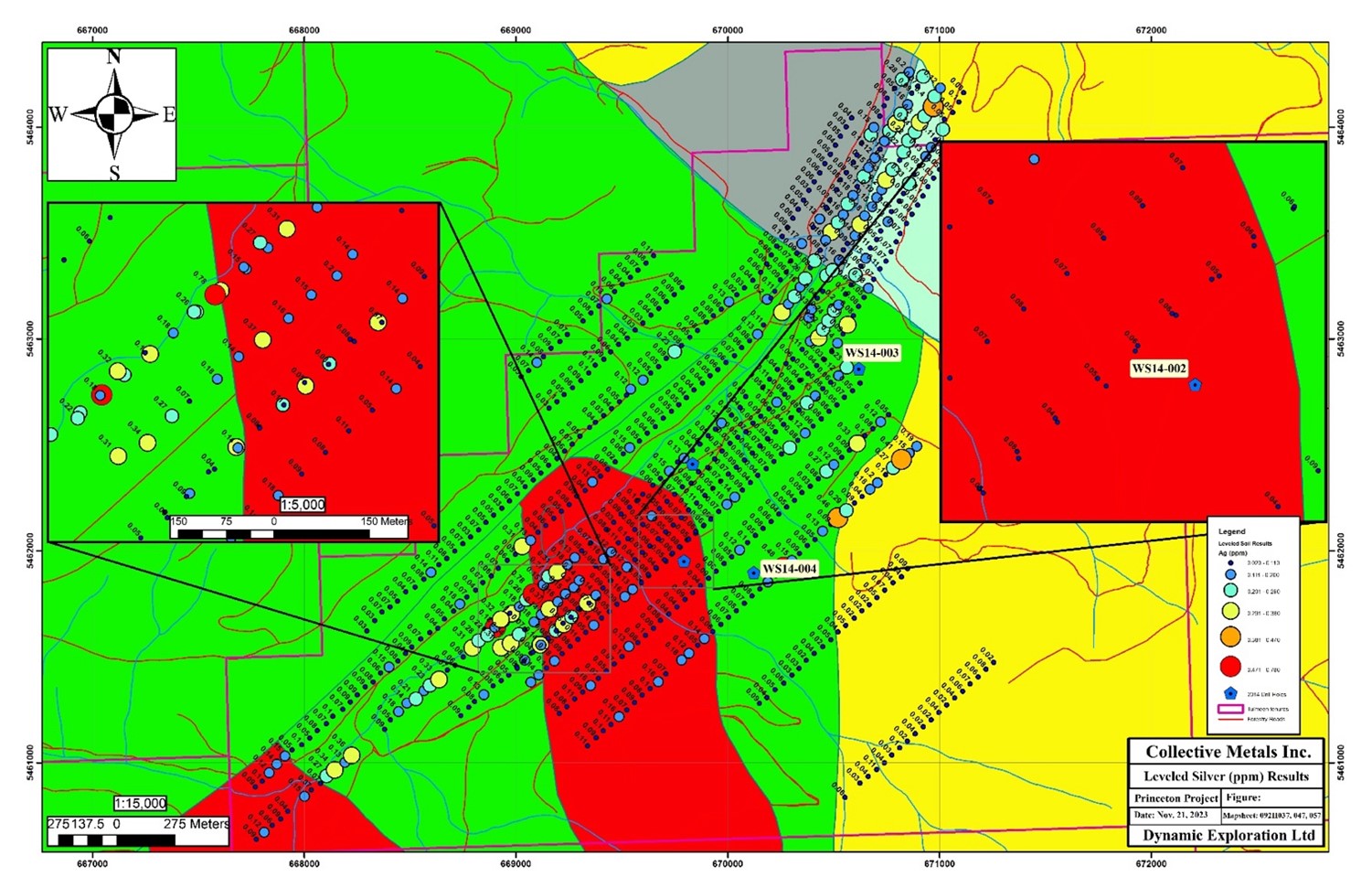

Leveled Silver Results

Leveled silver results (please see Figure 3) are similar to gold results (not shown), supporting identification of the PA1 and PA2 anomalies. The majority of results documented throughout the grid have background values, however, three areas stand out with multiple elevated to anomalous values.

The first is, once again, the PA1 anomaly. The single line of anomalous results which defined the anomaly in Phase I (please see the Company's News Release dated September 21, 2023) has been bracketed by five additional lines, one (immediately west) of which similarly returned multiple anomalous results and a second (immediately east) returned a subordinate proportion of anomalous results. The results are predominantly weakly (0.111 to 0.200 ppm) to weakly moderate (0.201 to 0.290 ppm) anomalous, with subordinate moderately (0.291 to 0.380 ppm) and a single moderately high (0.400 ppm) value.

There is an increase in the proportion of weakly moderate to moderately anomalous values at the northern and southern ends of the lines in the PA1 anomaly. Furthermore, the southern end of the PA1 anomaly becomes slightly better defined southwest of the unnamed fault juxtaposing units uTNs and uTNvs to the northeast against unit uTNv to the southwest and immediately east of the Whipsaw Fault.

The second area of interest is, again, the PA2 anomaly. A high proportion of anomalous values, ranging from weakly anomalous to highly anomalous are associated with both the PA2 anomaly, as initially defined by Phase I soils, and the contact between the Whipsaw Stock and Nicola Group volcanic host rocks. Anomalous silver values extend farther southwest along one of the Phase II lines to a second Whipsaw Stock, where, again, there are multiple anomalous silver values, ranging from weakly to moderately anomalous, localized at the contact between the Whipsaw Stock and Nicola Group volcanic host rocks.

The third area of interest comprises a number of elevated to moderately highly anomalous silver values returned from two soil lines straddling the unconformable contact between the Nicola Group volcanics and the overlying Eocene Princeton Group south of the PA1 anomaly. Anomalous values include a moderate value (0.33 ppm) and two moderately high values (0.41 and 0.45 ppm).

The remainder of the grid is characterized predominantly by background values with highly subordinate weakly anomalous values.

Figure 3 - Leveled silver results for the Trojan-Condor Corridor. Geochemical units as per Figure 1.

Summary

Results from the 2023 soil sampling program support results from both historical and recent rock sampling in the Trojan-Condor Corridor (please see the Company's News Release dated October 24, 2023). The comparative footprint of alkalic Cu - Au porphyries relative to calc-alkalic Cu- Mo porphyries (i.e. the Highland Valley Camp at Logan Lake, BC) is much more subtle and smaller. The results of the 2023 program, taken together with previous geochemical and geophysical results1, are interpreted to support the Trojan-Condor Corridor as a high priority, drill ready exploration target.

Extension of Marketing Agreement

The Company is also pleased to announce, further to its news release on March 15, 2024, that it has increased its engagement of marketing services with RMK Marketing Inc. ("RMK") (address: 41 Lana Terrace, Mississauga, Ontario, Canada, L5A 3B2; email: Roberto@rmkmarketing.ca). RMK was originally retained by the Company on March 14, 2024 to provide marketing services (the "Services") for a term of 6 months, commencing March 22, 2024 (the "RMK Agreement"). Pursuant to the terms of the RMK Agreement, the Company has decided to execute its option to increase the advertising budget by compensating RMK an additional $100,000.

The Company will not issue any securities to RMK as compensation for its marketing services. As of the date hereof, to the Company's knowledge, RMK (including its directors and officers) does not own any securities of the Company and has an arm's length relationship with the Company.

Qualified Person

This news release has been reviewed and approved by Rick Walker, P. Geo., who is acting as the Company's Qualified Person for the Project, in accordance with regulations under NI 43-101.

The information disclosed is not necessarily indicative of mineralization on the Project.

References

1 - Saleken, L.W., 2013. Compilation Assessment Report on the Tulameen Project Mineral Property, Similkameen Mining Division, BC Geological Survey Assessment Report 33626a

About Collective Metals:

Collective Metals Inc. (CSE: COMT | OTC: CLLMF | FSE: TO1) is a resource exploration company specializing in precious metals exploration in North America. The Company's flagship property is the Princeton Project, located in south-central British Columbia, Canada, approximately 10 km west of the currently producing Copper Mountain Mine. The Princeton Project consists of 29 mineral tenures totaling approximately 28,560 ha (70,570 acres) in a well-documented and prolific copper-gold porphyry belt and is easily accessible by road, located immediately west of Highway 3.

The Company's Landings Lake Lithium Project is located in northwestern Ontario where numerous lithium deposits have been delineated to host significant reserves of Li2O. The Landings Lake Lithium Project is located 53 km east of Ear Falls, Ontario and covers 3,146 hectares. The Whitemud Project, with several identified pegmatite outcrops, neighbours the Landings Lake Project and consists of 381 single cell mining claims totaling 7,775 hectares.

Social Media

| X | @COMT_metals |

| Collective Metals Inc | |

| Collective Metals Inc |

ON BEHALF OF COLLECTIVE METALS INC.

Christopher Huggins

Chief Executive Officer

T: 604-968-4844

E: chris@collectivemetalsinc.com

Forward Looking Information

Certain statements in this news release are forward-looking statements, including with respect to future plans, and other matters. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Such information can generally be identified by the use of forwarding-looking wording such as "may", "expect", "estimate", "anticipate", "intend", "believe" and "continue" or the negative thereof or similar variations. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company, including but not limited to, business, economic and capital market conditions, the ability to manage operating expenses, and dependence on key personnel. Forward looking statements in this news release include, but are not limited to, statements respecting: results of the Programs; the Project and its mineralization potential; the provision of the Services by RMK; the Company's objectives, goals or future plans with respect to the Project; the commencement of drilling or exploration programs in the future; further exploration work on the Property in the future. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, anticipated costs, and the ability to achieve goals. Factors that could cause the actual results to differ materially from those in forward-looking statements include, the continued availability of capital and financing, litigation, failure of counterparties to perform their contractual obligations, loss of key employees and consultants, and general economic, market or business conditions. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The reader is cautioned not to place undue reliance on any forward-looking information.

The forward-looking statements contained in this news release are made as of the date of this news release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

The Canadian Securities Exchange has not reviewed this press release and does not accept responsibility for the adequacy or accuracy of this news release.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/a99a52f8-a8d5-4003-a82b-5de512b8fc96

https://www.globenewswire.com/NewsRoom/AttachmentNg/8a968ff6-0fa6-43c5-9175-e7b54e4cccf8

https://www.globenewswire.com/NewsRoom/AttachmentNg/59defd56-3463-4a7c-aeae-a8a3dfa4dbea