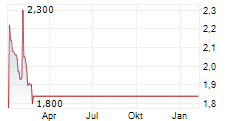

SAN FRANCISCO--(BUSINESS WIRE)--Marin Software Incorporated (NASDAQ: MRIN) ("Marin", "Marin Software" or the "Company"), a leading provider of digital marketing software for performance-driven advertisers and agencies, today announced financial results for the first quarter ended March 31, 2024.

"Empowering performance marketers to excel demands more than just innovation; it requires a relentless commitment to evolving technologies," said Chris Lien, Marin Software's CEO. "At Marin Software, we're laser-focused on creating the most powerful and adaptable platform, driven by a diverse array of AI capabilities, enabling marketers to work smarter, achieve more, and thrive in an ever-changing landscape."

First Quarter 2024 Product Highlights:

- Automated Anomaly Detection: We debuted ChatGPT-powered anomaly detection reports, a part of Marin's Advanced Analytics, designed to identify and summarize performance outliers. These reports are delivered in a concise, easy-to-understand format via email, enabling marketers to quickly review and address significant deviations in campaign performance.

- Innovative Marketing Calendar: Our newly launched Marketing Calendar allows users to effectively track and analyze the impact of various events-such as holidays, promotions, and competitor actions-on campaign outcomes. This tool is essential for strategic planning and optimizing marketing efforts to capitalize on these events.

- Enhanced Marin Scripts Integration: We've expanded the capabilities of Marin Scripts by integrating them with Google Sheets and custom reports. This enhancement allows performance marketers to harness the collaborative features of Google's cloud-based spreadsheets along with Marin's comprehensive analytics to measure, optimize, and automate campaigns with the latest data available.

- Scalable Script Upgrades: Marin Scripts now feature upgraded functionalities that enable reports to run across multiple accounts and automatically filter results tailored to specific users. This upgrade is particularly beneficial for agencies and teams managing large-scale operations, simplifying report management and enhancing efficiency.

- Advanced Budget and Target Automation: Our optimization tools now allow fine-grained control of the posting of budgets and/or targets to ad platforms with Ascend. This feature ensures that budgets are dynamically adjusted to maximize campaign performance without manual intervention.

- Upgraded Paid Search Capabilities: We have enhanced our core paid search functionality to include support for managing Microsoft Advertising's new automated bidding strategies, providing a more robust toolset for managing search campaigns budgets and performance.

- Expanded Advertising Options on Amazon: Marin now supports Amazon Store Spotlight, Sponsored Brand Video, and non-endemic ads, allowing all users to engage with Amazon's highly active customer base-even those who do not sell directly on the platform.

- Enhanced Features for Meta Campaigns: We have bolstered our support for Meta's advanced advertising features, including Outcome-Driven Ad Experiences (ODAX) and dynamic creatives. This enhancement allows marketers to more effectively manage and optimize their social media campaigns through Marin's cross-channel platform.

- Automated Data Posting with FTP: Our Auto-post functionality has been expanded to include an FTP option, improving the automation process and making data handling more efficient.

- Data Sonification in Charts: We have upgraded our data visualization tools to include sonification, enabling users to not only view but also hear data trends in applicable charts, enhancing the data analysis experience.

First Quarter 2024 Notable Client Achievements:

- Operational Efficiency: Rainmaker Ad Ventures saved over 26 hours of manual work weekly by leveraging Marin's powerful automation tools.

- Revenue Growth: A leading Amazon retailer saw a revenue increase of more than 155% through optimized campaign management.

First Quarter 2024 Financial Updates:

- Net revenues totaled $4.0 million, a year-over-year decrease of 12% when compared to $4.6 million for the first quarter of 2023.

- GAAP loss from operations was ($2.5) million, resulting in a GAAP operating margin of (63%), as compared to a GAAP loss from operations of ($6.0) million and a GAAP operating margin of (130%) for the first quarter of 2023.

- Non-GAAP loss from operations was ($2.1) million, resulting in a non-GAAP operating margin of (51%), as compared to a non-GAAP loss from operations of ($5.0) million and a non-GAAP operating margin of (109%) for the first quarter of 2023.

- Cash and cash equivalents were $9.6 million as of March 31, 2024.

Reconciliations of GAAP to non-GAAP financial measures have been provided in the financial statement tables included in this press release. An explanation of these measures is also included below, under the heading "Non-GAAP Financial Measures."

Financial Outlook:

Marin is providing guidance for its second quarter of 2024 as follows:

Forward-Looking Guidance | |||||||||

In millions | |||||||||

Range of Estimate | |||||||||

From | To | ||||||||

Three Months Ending June 30, 2024 | |||||||||

Revenues, net | $ | 3.9 | $ | 4.2 | |||||

Non-GAAP loss from operations | (2.1 | ) | (1.8 | ) | |||||

Non-GAAP loss from operations excludes the effects of stock-based compensation expense, amortization of internally developed software, impairment of long-lived assets, capitalization of internally developed software, non-recurring costs associated with restructurings, and certain professional fees that the Company has incurred in responding to third-party subpoenas that the Company has received related to governmental investigations of Google and Meta.

Additionally, the Company does not reconcile its forward-looking non-GAAP loss from operations, due to variability between revenues and non-cash items such as stock-based compensation. The GAAP loss from operations includes stock-based compensation expense, which is affected by hiring and retention needs, as well as the future price of Marin's stock. As a result, a reconciliation of the forward-looking non-GAAP financial measures to the corresponding GAAP measures cannot be made without unreasonable effort.

Quarterly Results Conference Call

Marin Software will host a conference call today at 2:00 PM Pacific Time (5:00 PM Eastern Time) to review the Company's financial results for the quarter ended March 31, 2024, and its outlook for the future. To access the call, please dial (800) 954-0684 in the United States or (212) 231-2929 internationally with reference to conference ID 13742152. A live webcast of the conference call will be accessible at https://viavid.webcasts.com/starthere.jsp?ei=1639600&tp_key=84848adece. Following the completion of the call through 11:59 p.m. Eastern Time on May 9, 2024, a recorded replay will be available on the Company's website at http://investor.marinsoftware.com/ and a telephone replay will be available by dialing (844) 512-2921 in the United States or (412) 317-6671 internationally with the recording access code 13742152.

About Marin Software

Marin Software Incorporated's (NASDAQ: MRIN) mission is to give advertisers the power to drive higher efficiency and transparency in their paid marketing programs that run on the world's largest publishers. Marin Software provides enterprise marketing software for advertisers and agencies to integrate, align, and amplify their digital advertising spend across the web and mobile devices. Marin Software offers a unified SaaS advertising management platform for search, social, and eCommerce advertising. The Company helps digital marketers convert precise audiences, improve financial performance, and make better decisions. Headquartered in San Francisco with offices worldwide, Marin Software's technology powers marketing campaigns around the globe. For more information about Marin Software, please visit www.marinsoftware.com.

Non-GAAP Financial Measures

Marin uses certain non-GAAP financial measures in this release. Marin uses these non-GAAP financial measures internally in analyzing its financial results and believes they are useful to investors, as a supplement to GAAP measures, in evaluating its ongoing operational performance. Marin believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing our financial results with other companies in our industry, many of which present similar non-GAAP financial measures to investors. Non-GAAP financial measures that Marin uses may differ from measures that other companies may use.

Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. A reconciliation of the non-GAAP financial measures to their most directly comparable GAAP measures has been provided in the financial statement tables included below in this press release. Investors are encouraged to review the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures.

Non-GAAP expenses, measures and net loss per share. Marin defines non-GAAP sales and marketing, non-GAAP research and development, non-GAAP general and administrative, non-GAAP gross profit, non-GAAP operating loss and non-GAAP net loss as the respective GAAP balances, adjusted for stock-based compensation expense, amortization of internally developed software and intangible assets, capitalization of internally developed software, non-recurring costs associated with restructurings, and certain professional fees that the Company has incurred in responding to third-party subpoenas that the Company has received related to governmental investigations of Google and Meta. Non-GAAP net loss per share is calculated as non-GAAP net loss divided by the weighted average shares outstanding.

Adjusted EBITDA. Marin defines Adjusted EBITDA as net loss, adjusted for stock-based compensation expense, depreciation, amortization of internally developed software and intangible assets, capitalization of internally developed software, benefit from or provision for income taxes, other income, net, non-recurring costs associated with restructurings, and certain professional fees that the Company has incurred in responding to third-party subpoenas that the Company has received related to governmental investigations of Google and Meta. These amounts are often excluded by other companies to help investors understand the operational performance of their business. The Company uses Adjusted EBITDA as a measurement of its operating performance because it assists in comparing the operating performance on a consistent basis by removing the impact of certain non-cash and non-operating items. Adjusted EBITDA reflects an additional way of viewing aspects of the operations that Marin believes, when viewed with the GAAP results and the accompanying reconciliations to corresponding GAAP financial measures, provide a more complete understanding of factors and trends affecting its business.

Forward-Looking Statements

This press release contains forward-looking statements including, among other things, statements regarding Marin's business, impact of investments in product and technology on future operating results, the increasing complexity in marketing, progress on product development efforts, product capabilities, advertiser and customer behavior, and future financial results, including its outlook for the second quarter of 2024. These forward-looking statements are subject to the safe harbor provisions created by the Private Securities Litigation Reform Act of 1995. Actual results could differ materially from those projected in the forward-looking statements as a result of certain risk factors, including but not limited to, our ability to reduce our expenses or raise additional capital to meet our obligations as a going concern; our ability to successfully implement a restructuring plan that we commenced in July 2023 and the expected costs and savings from the restructuring plan; the amount of digital advertising spend managed by our customers using our products; the extent of customer acceptance, adoption and usage of our MarinOne platform; the productivity of our personnel and other aspects of our business; our ability to maintain or grow sales to new and existing customers; any adverse changes in our relationships with and access to publishers and advertising agencies and strategic business partners, including any adverse changes in our revenue sharing agreement with Google; our ability to retain and attract qualified management, technical and sales and marketing personnel; any delays in the release of updates to our product platform or new features or delays in customer deployment of any such updates or features; competitive factors, including but not limited to pricing pressures, entry of new competitors and new applications; quarterly fluctuations in our operating results due to a number of factors; inability to adequately forecast our future revenues, expenses, Adjusted EBITDA, cash flows or other financial metrics; delays, reductions or slower growth in the amount spent on online and mobile advertising and the development of the market for cloud-based software; progress in our efforts to update our software platform; our ability to maintain or expand sales of our solutions in channels other than search advertising; any slow-down in the search advertising market generally; any shift in customer digital advertising budgets from search to segments in which we are not as deeply penetrated; the development of the market for digital advertising; our ability to provide high-quality technical support to our customers; material defects in our platform including those resulting from any updates we introduce to our platform, service interruptions at our single third-party data center or breaches in our security measures; our ability to develop enhancements to our platform; our ability to protect our intellectual property; our ability to manage risks associated with international operations; the impact of fluctuations in currency exchange rates, particularly an increase in the value of the dollar; near term changes in sales of our software services or spend under management may not be immediately reflected in our results due to our subscription business model; our ability to maintain the listing of our common stock on the Nasdaq; and adverse changes in general economic or market conditions. These forward-looking statements are based on current expectations and are subject to uncertainties and changes in condition, significance, value and effect as well as other risks detailed in documents filed with the Securities and Exchange Commission, including our most recent report on Form 10-K, recent reports on Form 10-Q and current reports on Form 8-K, which we may file from time to time, and all of which are available free of charge at the SEC's website at www.sec.gov. Any of these risks could cause actual results to differ materially from expectations set forth in the forward-looking statements. All forward-looking statements in this press release reflect Marin's expectations as of May 2, 2024. Marin assumes no obligation to, and expressly disclaims any obligation to update any such forward-looking statements after the date of this release.

Marin Software Incorporated | ||||||||

Condensed Consolidated Balance Sheets | ||||||||

(On a GAAP basis) | ||||||||

March 31, | December 31, | |||||||

(Unaudited; in thousands, except par value) | 2024 | 2023 | ||||||

Assets: | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 9,563 | $ | 11,363 | ||||

Accounts receivable, net | 3,422 | 3,864 | ||||||

Prepaid expenses and other current assets | 1,386 | 1,548 | ||||||

Total current assets | 14,371 | 16,775 | ||||||

Property and equipment, net | 118 | 120 | ||||||

Right-of-use assets, operating leases | 1,613 | 1,912 | ||||||

Other non-current assets | 504 | 508 | ||||||

Total assets | $ | 16,606 | $ | 19,315 | ||||

Liabilities and Stockholders' Equity: | ||||||||

Current liabilities: | ||||||||

Accounts payable | $ | 609 | $ | 664 | ||||

Accrued expenses and other current liabilities | 1,820 | 2,099 | ||||||

Operating lease liabilities | 1,613 | 1,518 | ||||||

Total current liabilities | 4,042 | 4,281 | ||||||

Operating lease liabilities, non-current | - | 394 | ||||||

Other long-term liabilities | 980 | 1,001 | ||||||

Total liabilities | 5,022 | 5,676 | ||||||

Stockholders' equity: | ||||||||

Convertible preferred stock, $0.001 par value | - | - | ||||||

Common stock, $0.001 par value | 3 | 3 | ||||||

Additional paid-in capital | 359,234 | 358,884 | ||||||

Accumulated deficit | (346,662 | ) | (344,251 | ) | ||||

Accumulated other comprehensive loss | (991 | ) | (997 | ) | ||||

Total stockholders' equity | 11,584 | 13,639 | ||||||

Total liabilities and stockholders' equity | $ | 16,606 | $ | 19,315 | ||||

Marin Software Incorporated | ||||||||

Condensed Consolidated Statements of Operations | ||||||||

(On a GAAP basis) | ||||||||

Three Months Ended March 31, | ||||||||

(Unaudited; in thousands, except per share data) | 2024 | 2023 | ||||||

Revenues, net | $ | 4,031 | $ | 4,583 | ||||

Cost of revenues | 1,743 | 3,240 | ||||||

Gross profit | 2,288 | 1,343 | ||||||

Operating expenses: | ||||||||

Sales and marketing | 1,250 | 2,025 | ||||||

Research and development | 1,881 | 2,942 | ||||||

General and administrative | 1,684 | 2,336 | ||||||

Total operating expenses | 4,815 | 7,303 | ||||||

Loss from operations | (2,527 | ) | (5,960 | ) | ||||

Other income, net | 104 | 225 | ||||||

Loss before income taxes | (2,423 | ) | (5,735 | ) | ||||

Provision for (benefit from) income taxes | (12 | ) | 48 | |||||

Net loss | $ | (2,411 | ) | $ | (5,783 | ) | ||

Net loss per common share, basic and diluted | $ | (0.80 | ) | $ | (2.01 | ) | ||

Weighted-average shares outstanding, basic and diluted | 3,024 | 2,873 | ||||||

Marin Software Incorporated | ||||||||

Condensed Consolidated Statements of Cash Flows | ||||||||

(On a GAAP basis) | ||||||||

Three Months Ended March 31, | ||||||||

(Unaudited; in thousands) | 2024 | 2023 | ||||||

Operating activities: | ||||||||

Net loss | $ | (2,411 | ) | $ | (5,783 | ) | ||

Adjustments to reconcile net loss to net cash used in operating activities | ||||||||

Depreciation | 2 | 11 | ||||||

Amortization of internally developed software | - | 419 | ||||||

Amortization of right-of-use assets | 371 | 399 | ||||||

Amortization of deferred costs to obtain and fulfill contracts | 87 | 94 | ||||||

Unrealized foreign currency losses | (1 | ) | 4 | |||||

Stock-based compensation related to equity awards | 413 | 1,032 | ||||||

Provision for credit losses | (10 | ) | (279 | ) | ||||

Deferred income tax benefits | 3 | - | ||||||

Changes in operating assets and liabilities | ||||||||

Accounts receivable | 459 | 734 | ||||||

Prepaid expenses and other assets | 81 | 232 | ||||||

Accounts payable | (55 | ) | 194 | |||||

Accrued expenses and other liabilities | (297 | ) | (350 | ) | ||||

Operating lease liabilities | (371 | ) | (399 | ) | ||||

Net cash used in operating activities | (1,729 | ) | (3,692 | ) | ||||

Investing activities: | ||||||||

Capitalization of internally developed software | - | (579 | ) | |||||

Net cash used in investing activities | - | (579 | ) | |||||

Financing activities: | ||||||||

Employee taxes paid for withheld shares upon equity award settlement | (60 | ) | (10 | ) | ||||

Proceeds from employee stock purchase plan, net | - | 18 | ||||||

Net cash provided by (used in) financing activities | (60 | ) | 8 | |||||

Effect of foreign exchange rate changes on cash and cash equivalents | (11 | ) | 22 | |||||

Net decrease in cash and cash equivalents | (1,800 | ) | (4,241 | ) | ||||

Cash and cash equivalents: | ||||||||

Beginning of period | 11,363 | 27,957 | ||||||

End of the period | $ | 9,563 | $ | 23,716 | ||||

Marin Software Incorporated | |||||||||||||||||||||||||||

Reconciliation of GAAP to Non-GAAP Expenses | |||||||||||||||||||||||||||

Three Months Ended | Year Ended | Three Months

| |||||||||||||||||||||||||

Mar 31, | Jun 30, | Sep 30 | Dec 31, | Dec 31, | Mar 31, | ||||||||||||||||||||||

(Unaudited; in thousands) | 2023 | 2023 | 2023 | 2023 | 2023 | 2024 | |||||||||||||||||||||

Sales and Marketing (GAAP) | $ | 2,025 | $ | 1,935 | $ | 1,482 | $ | 1,078 | $ | 6,520 | $ | 1,250 | |||||||||||||||

Less Stock-based compensation | (165 | ) | (184 | ) | (88 | ) | (65 | ) | (502 | ) | (64 | ) | |||||||||||||||

Less Restructuring related expenses | - | - | (122 | ) | - | (122 | ) | - | |||||||||||||||||||

Sales and Marketing (Non-GAAP) | $ | 1,860 | $ | 1,751 | $ | 1,272 | $ | 1,013 | $ | 5,896 | $ | 1,186 | |||||||||||||||

Research and Development (GAAP) | $ | 2,942 | $ | 2,797 | $ | 2,860 | $ | 1,636 | $ | 10,235 | $ | 1,881 | |||||||||||||||

Less Stock-based compensation | (270 | ) | (305 | ) | (131 | ) | (119 | ) | (825 | ) | (127 | ) | |||||||||||||||

Less Restructuring related expenses | - | - | (815 | ) | (22 | ) | (837 | ) | - | ||||||||||||||||||

Plus Capitalization of internally developed software | 579 | 578 | 354 | 296 | 1,807 | - | |||||||||||||||||||||

Research and Development (Non-GAAP) | $ | 3,251 | $ | 3,070 | $ | 2,268 | $ | 1,791 | $ | 10,380 | $ | 1,754 | |||||||||||||||

General and Administrative (GAAP) | $ | 2,336 | $ | 2,442 | $ | 2,119 | $ | 1,974 | $ | 8,871 | $ | 1,684 | |||||||||||||||

Less Stock-based compensation | (473 | ) | (627 | ) | (85 | ) | (187 | ) | (1,372 | ) | (183 | ) | |||||||||||||||

Less Restructuring related expenses | - | - | (189 | ) | - | (189 | ) | - | |||||||||||||||||||

Less Third-party subpoena-related expenses | (84 | ) | (45 | ) | (36 | ) | (30 | ) | (195 | ) | (60 | ) | |||||||||||||||

General and Administrative (Non-GAAP) | $ | 1,779 | $ | 1,770 | $ | 1,809 | $ | 1,757 | $ | 7,115 | $ | 1,441 | |||||||||||||||

Marin Software Incorporated | |||||||||||||||||||||||||||

Reconciliation of GAAP to Non-GAAP Measures | |||||||||||||||||||||||||||

Three Months Ended | Year Ended | Three Months

| |||||||||||||||||||||||||

Mar 31, | Jun 30, | Sep 30, | Dec 31, | Dec 31, | Mar 31, | ||||||||||||||||||||||

(Unaudited; in thousands) | 2023 | 2023 | 2023 | 2023 | 2023 | 2024 | |||||||||||||||||||||

Gross Profit (GAAP) | $ | 1,343 | $ | 1,186 | $ | 1,351 | $ | 2,216 | $ | 6,096 | $ | 2,288 | |||||||||||||||

Plus Stock-based compensation | 124 | 137 | 5 | 41 | 307 | 39 | |||||||||||||||||||||

Plus Amortization of internally developed software | 419 | 426 | 433 | 423 | 1,701 | - | |||||||||||||||||||||

Plus Restructuring related expenses | - | - | 671 | 2 | 673 | - | |||||||||||||||||||||

Gross Profit (Non-GAAP) | $ | 1,886 | $ | 1,749 | $ | 2,460 | $ | 2,682 | $ | 8,777 | $ | 2,327 | |||||||||||||||

Operating Loss (GAAP) | $ | (5,960 | ) | $ | (5,988 | ) | $ | (5,110 | ) | $ | (5,748 | ) | $ | (22,806 | ) | $ | (2,527 | ) | |||||||||

Plus Stock-based compensation | 1,032 | 1,253 | 309 | 412 | 3,006 | 413 | |||||||||||||||||||||

Plus Amortization of internally developed software | 419 | 426 | 433 | 423 | 1,701 | - | |||||||||||||||||||||

Plus Restructuring related expenses | - | - | 1,797 | 24 | 1,821 | - | |||||||||||||||||||||

Less Capitalization of internally developed software | (579 | ) | (578 | ) | (354 | ) | (296 | ) | (1,807 | ) | - | ||||||||||||||||

Plus Third-party subpoena-related expenses | 84 | 45 | 36 | 30 | 195 | 60 | |||||||||||||||||||||

Plus Impairment loss on long-lived assets | - | - | - | 3,276 | 3,276 | - | |||||||||||||||||||||

Operating Loss (Non-GAAP) | $ | (5,004 | ) | $ | (4,842 | ) | $ | (2,889 | ) | $ | (1,879 | ) | $ | (14,614 | ) | $ | (2,054 | ) | |||||||||

Net Loss (GAAP) | $ | (5,783 | ) | $ | (5,917 | ) | $ | (4,954 | ) | $ | (5,263 | ) | $ | (21,917 | ) | $ | (2,411 | ) | |||||||||

Plus Stock-based compensation | 1,032 | 1,253 | 309 | 412 | 3,006 | 413 | |||||||||||||||||||||

Plus Amortization of internally developed software | 419 | 426 | 433 | 423 | 1,701 | - | |||||||||||||||||||||

Plus Restructuring related expenses | - | - | 1,797 | 24 | 1,821 | - | |||||||||||||||||||||

Less Capitalization of internally developed software | (579 | ) | (578 | ) | (354 | ) | (296 | ) | (1,807 | ) | - | ||||||||||||||||

Plus Third-party subpoena-related expenses | 84 | 45 | 36 | 30 | 195 | 60 | |||||||||||||||||||||

Plus Impairment loss on long-lived assets | - | - | - | 3,276 | 3,276 | - | |||||||||||||||||||||

Net Loss (Non-GAAP) | $ | (4,827 | ) | $ | (4,771 | ) | $ | (2,733 | ) | $ | (1,394 | ) | $ | (13,725 | ) | $ | (1,938 | ) | |||||||||

Marin Software Incorporated | |||||||||||||||||||||||||||

Calculation of Non-GAAP Earnings Per Share | |||||||||||||||||||||||||||

Three Months Ended | Year Ended | Three Months Ended | |||||||||||||||||||||||||

(Unaudited; in thousands, except per share data) | Mar 31, | Jun 30, | Sep 30, | Dec 31, | Dec 31, | Mar 31, | |||||||||||||||||||||

2023 | 2023 | 2023 | 2023 | 2023 | 2024 | ||||||||||||||||||||||

Net Loss (Non-GAAP) | $ | (4,827 | ) | $ | (4,771 | ) | $ | (2,733 | ) | $ | (1,394 | ) | $ | (13,725 | ) | $ | (1,938 | ) | |||||||||

Weighted-average shares outstanding, basic and diluted | 2,873 | 2,902 | 2,985 | 3,009 | 2,943 | 3,024 | |||||||||||||||||||||

Non-GAAP net loss per common share, basic and diluted | $ | (1.68 | ) | $ | (1.64 | ) | $ | (0.92 | ) | $ | (0.46 | ) | $ | (4.66 | ) | $ | (0.64 | ) | |||||||||

Marin Software Incorporated | |||||||||||||||||||||||||||

Reconciliation of Net Loss to Adjusted EBITDA | |||||||||||||||||||||||||||

Three Months Ended | Year Ended | Three Months Ended | |||||||||||||||||||||||||

Mar 31, | Jun 30, | Sep 30, | Dec 31, | Dec 31, | Mar 31, | ||||||||||||||||||||||

(Unaudited; in thousands) | 2023 | 2023 | 2023 | 2023 | 2023 | 2024 | |||||||||||||||||||||

Net Loss | $ | (5,783 | ) | $ | (5,917 | ) | $ | (4,954 | ) | $ | (5,263 | ) | $ | (21,917 | ) | $ | (2,411 | ) | |||||||||

Depreciation | 11 | 3 | 3 | 2 | 19 | 2 | |||||||||||||||||||||

Amortization of internally developed software | 419 | 426 | 433 | 423 | 1,701 | - | |||||||||||||||||||||

Provision for (benefit from) income taxes | 48 | 144 | 2 | (344 | ) | (150 | ) | (12 | ) | ||||||||||||||||||

Stock-based compensation | 1,032 | 1,253 | 309 | 412 | 3,006 | 413 | |||||||||||||||||||||

Capitalization of internally developed software | (579 | ) | (578 | ) | (354 | ) | (296 | ) | (1,807 | ) | - | ||||||||||||||||

Restructuring related expenses | - | - | 1,797 | 24 | 1,821 | - | |||||||||||||||||||||

Impairment loss on long-lived assets | - | - | - | 3,276 | 3,276 | - | |||||||||||||||||||||

Other income, net | (225 | ) | (215 | ) | (158 | ) | (141 | ) | (739 | ) | (104 | ) | |||||||||||||||

Third-party subpoena-related expenses | 84 | 45 | 36 | 30 | 195 | 60 | |||||||||||||||||||||

Adjusted EBITDA | $ | (4,993 | ) | $ | (4,839 | ) | $ | (2,886 | ) | $ | (1,877 | ) | $ | (14,595 | ) | $ | (2,052 | ) | |||||||||

Contacts

Investor Relations, Marin Software

ir@marinsoftware.com

Media Contact

Wesley MacLaggan

Marketing, Marin Software

(415) 399-2580

press@marinsoftware.com