TORONTO, ON / ACCESSWIRE / May 6, 2024 / Grid Metals Corp. (TSXV:GRDM)(OTCQB:MSMGF) ("Grid" or the "Company") is pleased to announce an updated Mineral Resource Estimate ("MRE") for its copper/nickel MM (previously "Makwa Mayville") Project in southeastern Manitoba, prepared in accordance with CIM (2019) Best Practice Guidelines. The resource estimate contains two separate deposits located 35 km apart and approximately 145 kilometres from Winnipeg the capital of Manitoba. Grid has consolidated the majority of the prospective copper-nickel mineral tenure of the highly prospective Bird River Greenstone Belt including several other deposits near the Makwa and Mayville resources. Concurrently with the new resource estimate the Company has completed a Project wide geophysical review which has identified a number of new high potential targets for drilling. An initial drill program is in planning and expected to commence later in 2024. The Company is seeking financing and/or strategic partnerships to actively develop the Project.

Mineral Resource and Project Highlights:

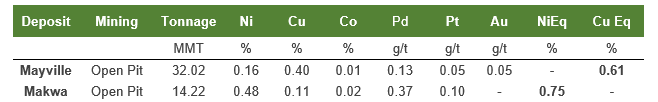

The Indicated mineral resource amenable to open pit mining and constrained within pit-shells is tabulated below:

*See details of the Mineral Resource Estimate including calculation methods used to determine the copper equivalent (CuEq) and nickel equivalent (NiEq) grades presented in Tables 1A and 1B.

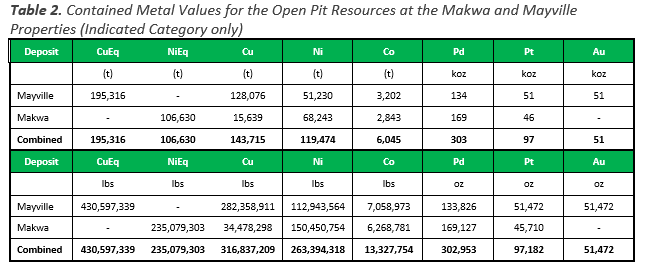

- Contained metal content in the indicated open pit category includes 317 million pounds of copper, 263 million pounds of nickel and 452,000 ounces of combined palladium, platinum and gold.

- Both deposits remain partly open along strike and at depth, and the Company holds the mineral rights to three other near-surface mineral deposits in the belt that could augment the mineral resource inventory in the future.

- Both deposits have had extensive metallurgical test work completed over multiple campaigns with results indicating that saleable sulfide concentrates can be produced (nickel at Makwa; separate copper and nickel concentrates at Mayville).

- The main factors contributing to the increased resources from previous estimates are improvements in modelled metallurgical recoveries, changes in metal prices and forex used in the resource calculation and additional drilling.

- The Mayville Deposit has no royalty; the Makwa Deposit has a 1% NSR royalty of which one half of a percent can be re-purchased for CAD$500,000.

- There are no offtake obligations on either of the deposits. The Company is currently seeking expressions of interest to fund resource expansion and project development through marketing of nickel and copper offtake rights for the project.

- The target/model for the project is +80 million tonnes of open pit resources augmented by the delineation of high-grade massive sulfide deposits throughout the belt.

- The Company has the mineral rights to the majority of the prospective Bird River Greenstone belt which has a geologic analogue to the McFaulds Lake Greenstone Belt which hosts the Ring of Fire deposits (see reference 2 at end of the press release)

- Among the economic parameters used in the mineral resource estimate, metal prices for the key metals are US$3.75 lb for copper and $9 lb for nickel.

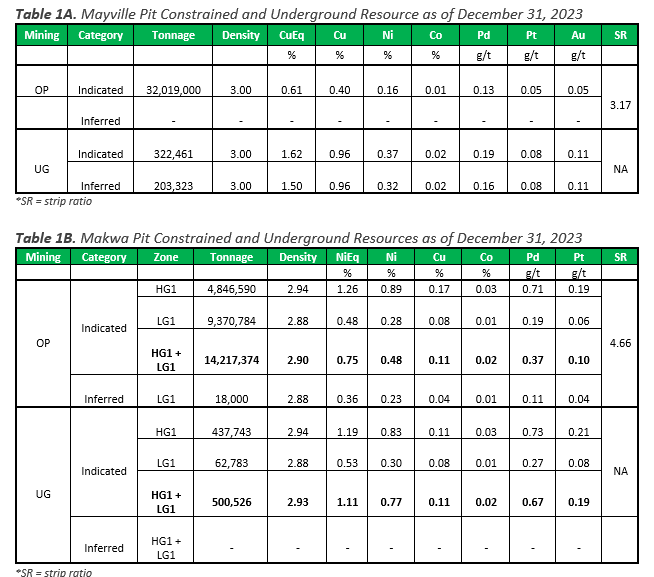

- Strip ratios for the resource shells were 3.2 for Mayville and 4.7 for Makwa and are provided in the resource Tables 1A and 1B.

- Company plans to commence an initial phase of exploration drilling later in 2024 to test high priority nearby targets including possible massive sulphide targets identified from the recent geophysical review.

Robin Dunbar, CEO of Grid Metals, commented, "The resource estimate announced today provides impetus for further exploration and continued expansion of the MM copper/nickel Project. The MM Project resource is a conventional and near surface copper-nickel sulfide resource with readily apparent upside. The Project is ideally located to service critical metals demand in North America. The Mayville deposit is located directly adjacent to the Company's advanced exploration stage Donner Lithium Project which is currently progressing through the mine permitting process. We see tremendous synergies between our copper/nickel and lithium project development plans as we continue to build the mineral resources necessary to develop an important critical metals production and processing hub in a Tier 1 mining jurisdiction."

Project Overview

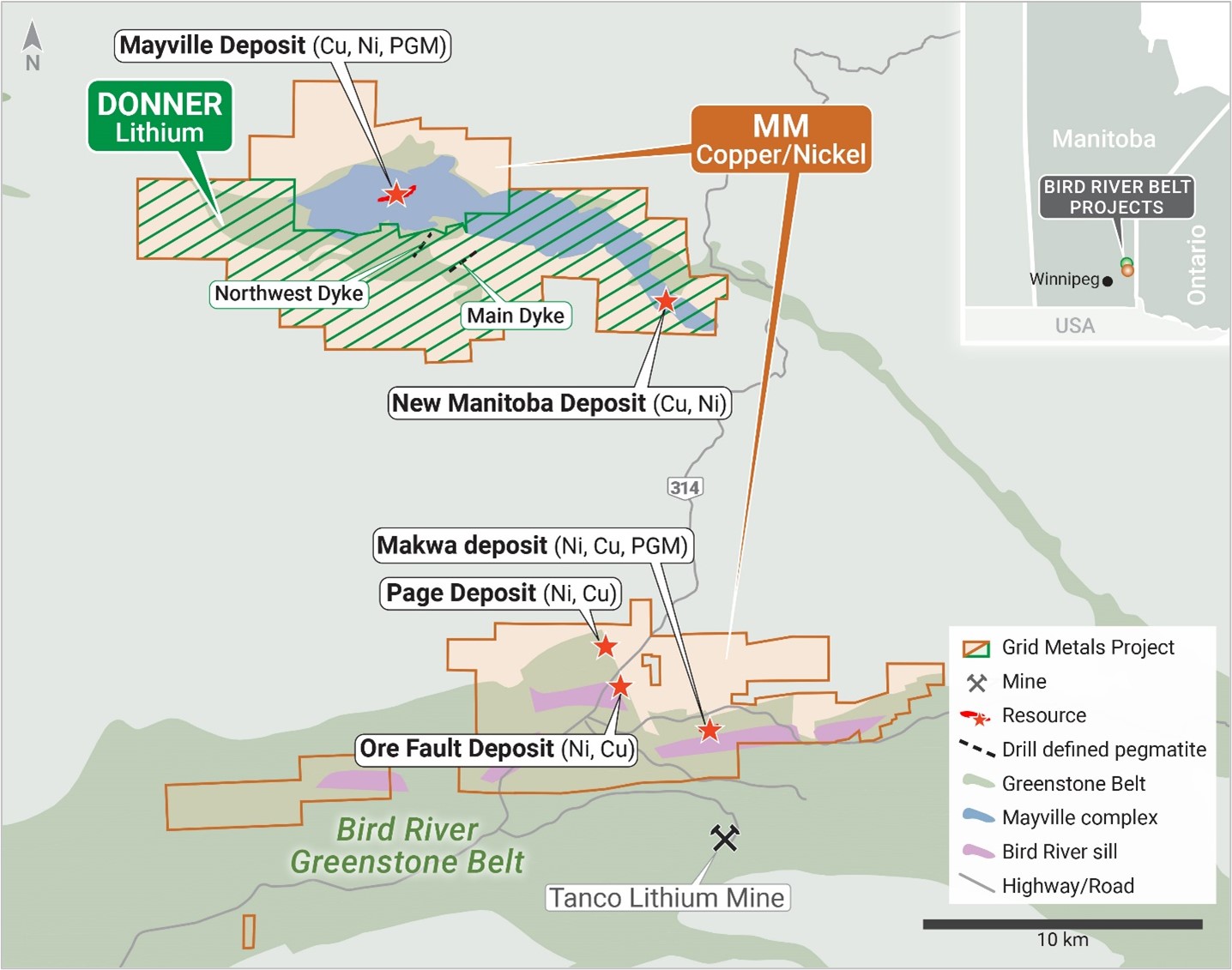

The MM Project includes a copper-rich (Mayville) and a nickel-rich (Makwa) disseminated magmatic sulfide deposit along with three additional near-surface deposits (Page, Ore Fault, and New Manitoba) which were acquired by Grid in April 2023. The Mayville and Makwa deposits are located in the northern and southern parts of the Bird River Greenstone Belt, respectively, in southeastern Manitoba (see Figure 1). The Bird River Greenstone Belt and its mineral occurrences have been the subject of multiple research projects including research work completed under the Targeted Geoscience Initiative by the Canadian Geological Survey. The Project area has been identified as being a direct analogue to the Ring of Fire belt in northwestern Ontario (Houlé et al., 2020) which hosts several significant mineral deposits.

The Project consists of a mining lease and mineral claims held by the Company and its subsidiaries. It is readily accessible year-round, by provincial highways from the capital city of Winnipeg located ~145 km to the southwest. The Mayville deposit is situated two km north of the Company's Donner Lithium Project where the Company has published a NI 43-101 Resource Estimate Technical Report. Both the Donner and MM Projects will benefit from efficiencies in exploration, government and First Nations relations, permitting and infrastructure.

In total, 99 mineral claims and one mineral lease (Makwa) are held for base metal exploration by the Company and its subsidiaries. A further 51 mining claims are under option from Gossan Resources with a $300,000 option payment remaining under the option and due in April 2025. The Makwa Deposit is held under a Mineral Lease granted by the Province of Manitoba that expires in 2040 and is subject to annual payments of approximately $10,000 per year. Under the mineral tenure system in Manitoba, assessment credits are "banked" to enable the claims to be held without annual payments provided sufficient exploration credits are expended on the Property. Currently, the Company has sufficient exploration credits to keep the Project in good standing for over 10 years.

Figure 1: Location of the MM Copper/Nickel Project and the Donner Lithium Project in southeastern Manitoba

Exploration Potential

The Company views the updated MM resource estimate as an important base upon which it can expand. The Company notes that by far the majority of the exploration completed to date has focused on near surface disseminated mineralization. The higher-grade cores of the deposits and higher-grade values associated with massive sulfides in multiple drill holes give clear indication that the potential for higher-grade massive sulfide is evident throughout the belt as well as proximal to the known deposits.

The Project has several walk-up targets that could provide immediate upside to the current mineral resource. These include the newly acquired New Manitoba Cu-Ni historical occurrence and the untested EM conductors between New Manitoba and the Mayville Cu-Ni Deposit approximately 10 km to the west. As well, the newly acquired Page and Ore Fault deposits and their potential extensions are also priority targets. The Company plans to complete an initial drill program to test these priority targets later this year and will provide further details on the targets and timing as soon as possible.

The other deposits and mineral occurrence in the MM Project area are:

- The New Manitoba deposit, which has a historical mineral resource estimate of 1.8Mt at 0.75% Cu and 0.33% Ni (Manitoba Mineral Inventory Card #217) (Note: The Company has not been able to verify the historical estimate as relevant and the historical estimate should not be relied on);

- The Ore Fault deposit, containing a previously NI 43-101 reported indicated resource of 0.9Mt at 0.32% Ni and 0.24% Cu and an inferred resource of 2.5Mt 0.35% Ni and 0.19% (Ewert et al., 2009; see reference 1, below); and,

- The Page deposit, containing a previously NI 43-101 reported indicated resource of 1.5Mt at 0.32% Ni and 0.13% Cu (Ewert et al., 2009).

(Note that all previous mineral resource estimates mentioned above need to be updated following the CIM 2019 Best Practice Guidelines to make them current)

The Ore Fault and Page deposit MREs were prepared in accordance with National Instrument 43-101. The Company considers these estimates to be reasonable but has not independently verified them and will be required to take additional steps including drilling to complete the verification process.

Mineral Resource Estimate

The updated mineral resource estimate for the MM Project is provided in Tables 1 and 2, below. The new estimate was prepared by Micon International Ltd. ('Micon') following the CIM 2019 Best Practice Guidelines and is reported in accordance with National Instrument 43-101 ("NI 43-101") - Standards of Disclosure for Mineral Projects and its Companion Policy 43-101CP. The current mineral resource was estimated by Micon using an updated drill hole database and new mineralization wireframes that capture all verified historical drill hole data sets. Block grade interpolation was performed using the Kriging technique). The resource modeling was completed by Micon in accordance with both CIM Guidelines and the relevant parts of the JORC 2012 Code, and in keeping with regulatory requirements for the filing of technical reports for mineral resource estimates at both the TSX Venture Exchange and the Australian Stock Exchange (ASX).

The Technical Report incorporating the new resource estimate will be accessible on SEDAR (www.sedar.com) within 45 days of this news release.

Notes to Accompany the Makwa and Mayville Resource Estimate:

- The effective date of this Mineral Resource Estimate is December 31, 2023.

- The MRE presented above uses economic assumptions for both surface mining and underground mining.

- The MRE has been classified in the Indicated and Inferred categories following spatial grade continuity analysis and geological confidence.

- The calculated cut-off grades to report the MRE are dynamic in nature following metallurgical recovery curves, the average COG for Makwa is 0.30 % Ni in surface mining and 0.84 % Ni in underground mining; for Mayville is 0.30 % Cu in surface mining and 1.37 % Cu in underground mining.

- The economic parameters used metal prices of US$9.0/lb Ni, US$3.75/lb Cu, US$23.0/lb Co, US$900/oz Pt, US$1,400/oz Pd and US$1,750/Au with specific metallurgical recovery curves summarized as follow: copper recoveries of 87% to high grade copper concentrate of 28%; and nickel recoveries in the range from 50% to 68% to 10% nickel concentrate at Mayville and 50-68% nickel recovery to 10% nickel concentrate based on average grades and over 70% recovery for highest grade (+1% Ni) blocks at Makwa); a mining cost of US$3.5/t in surface and US$80.0/t in underground; Processing cost of US$15/t and a General & Administration cost of US$3.2/t.

- For surface mining the open pits at Makwa and Mayville use a slope angle of 53°.

- The block models for Makwa and Mayville are rotated and use a block size of 10 m x 5 m x 5 m with the narrow sides across strike (North-South) and vertically (z direction).

- The open pit optimization uses a re-blocked size of 10 m x 10 m x 10 m and for the underground the optimization uses stopes 20 m long by 20 m high and a minimum mining width of 3 m.

- Messrs. Alan J. San Martin, MAusIMM(CP) and Charley Murahwi, P.Geo., FAusIMM, from Micon International Limited are the Qualified Persons (QPs) for this Mineral Resource Estimate (MRE).

- Mineral resources unlike mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The mineral resources have been estimated in accordance with the CIM Best Practice Guidelines (2019) and the CIM Definition Standards (2014).

- Totals may not add correctly due to rounding.

- Equivalent (Eq) Grade Calculations: (a) Makwa NiEq = Ni% + ((Cu% x CuR x CuP) + (Co% x CoR x CoP) + (Pt g/t x PtR x PtP) + (Pd g/t x PdR x PdP))/(NiR x NiP); (b) Mayville CuEq* = Cu% + ((Ni% x NiR x NiP) + (Co% x CoR x CoP) + (Pt g/t x PtR x PtP) + (Pd g/t x PdR x PdP) + (Au g/t x AuR x AuP))/(CuR x CuP). NiEQ = nickel equivalent grade. R = metal recovery. P = metal price.

- The Mayville CuEq calculation assumes the production of separate Cu and Ni concentrates.

- Metallurgical recovery ranges using input grades at the cutoff grade (low end) and 2 times the average open pit resource grade (high end) are as follow: Makwa: Ni: 36 to 86%; Cu: 85.6% (invariant); Co: fixed to nickel recoveries; Pd: 59 to 90% (capped); Pt: 39 to 90% (capped); Mayville: For the copper concentrate model :Cu: 86.5 to 86.9%; Ni: 5% (fixed); Co: (5% - fixed to nickel recovery); Pd: 42% (fixed); Pt: 35% (fixed); Co: 30% (fixed); For the nickel concentrate model: Cu: 5% (fixed); Ni: 42 to 69%;Co: matches nickel recoveries; Pd: 33%; Pt: 21%; Au: 10%.

In summary, the updated open-pit resource estimate for the Mayville deposit includes 32.0 million tonnes in the indicated category with 0.40% Cu and 0.16% Ni and byproduct concentrations of cobalt, palladium, platinum and gold (0.61% copper equivalent grade). The open pit resources at Makwa include 14.2 million tonnes in the indicated category with 0.48% Ni, 0.11% Cu, 0.02% Co, 0.37 g/t Pd and 0.10 g/t Pt (0.75% nickel equivalent grade). The Makwa deposit is subdivided into a central, higher-grade zone ('HG1') and a flanking (both hanging-wall and footwall) lower-grade ('LG1') zone. The new resource estimate includes 4.8 million tonnes of the HG1 zone grading 0.89% Ni (1.26% nickel equivalent grade).

The previous resource estimate for the MM Project was published by RPA Inc. (2014) and supported a Preliminary Economic Assessment based on two open pit mines feeding a central concentrator to be located at the Mayville property. Low base metal prices during the period of 2014 to 2020 precluded any significant new development activity and drilling at the Project. However, with an improved outlook for copper prices and the increasing strategic importance of nickel as a critical metal, the Project ranks favourably for future exploration and development.

Compared to the previous published resource estimate for the MM project (RPA Inc., 2014), the combined open pit resources (indicated category) increased by 12.4 million tonnes or 36.8%. This increase is largely attributable to the inclusion of recent infill drilling (Makwa - 2022), improved metallurgical recoveries from testwork completed after the previous resource estimate was published, and a more favourable US dollar to Canadian dollar exchange rate.

Mayville Deposit

The Mayville magmatic sulfide deposit is a copper-rich disseminated sulfide deposit hosted by the western part of the ~17 km long late Archean Mayville mafic-ultramafic complex. The Mayville deposit is approximately 1.5 km long, up to 200 metres wide, and has been delineated to maximum depth of ~500 metres. It dips steeply to the south. The deposit includes the Main Zone (Figure 2, below) and two satellite zones (not shown here) located at the eastern end of the deposit. The two satellite zones have not been included in the current resource estimate.

The mineralization in the Mayville deposit occurs principally as disseminations of chalcopyrite and pyrrhotite with lesser pentlandite and pyrite hosted in what has been described as an intrusive breccia unit emplaced near the base of the Mayville Complex.

Figure 2. Mayville Long Section (looking north) showing drill hole traces and mineralization block model

A sectional view of the mineralization block model is shown in Figure 3 below.

Figure 3: Representative cross section for the Mayville deposit, looking west, and showing the current Micon block model coded to copper grade and selected length-weighted average drill hole intersections for drill holes captured on this section.

Makwa Deposit

The Makwa deposit is a conventional, basal-contact related, Ni- and Pd-rich disseminated magmatic sulfide deposit. The steep south-dipping and west-plunging Makwa deposit has a minimum strike length of 1.1 km, an average vertical depth of ~350 metres and an average width of 30-50 metres. The Makwa deposit remains open along strike to the east and partially down-dip below its currently defined vertical extent. The deposit was briefly mined from a shallow open pit by a subsidiary of Falconbridge Ltd. in 1974. It was the subject of a standalone Prefeasibility Study completed in 2008 (Micon International) for the mining and production of nickel concentrate for sale to a smelter.

The Micon resource estimate discussed here subdivides the deposit into a central higher-grade zone (HG1) and a flanking lower-grade zone (LG1). The metal tenor in both zones is very similar, such that the Ni (and Pd) grades are strongly correlative with the total amount of sulfide present. Localized high-grade nickel mineralization is present in associated with narrow lenses of net-textured and semi-massive sulphides. A longitudinal section of the deposited is shown in Figure 4 and a sectional view of the mineralization block model is shown in Figure 3 below.

Figure 4. Makwa Long Section (looking north) showing drill hole traces and mineralization block model

Figure 5: Representative cross section, looking west, showing the current Micon block model coded to nickel grade, the HG1 and LG1 zone boundaries, and selected length-weighted interval assays for drill holes captured on this section.

Resource Modeling Methods

The mineral resource estimation (MRE) strategy adopted for the Makwa and Mayville deposits comprises the following sequence:

- Exploratory data analysis/review

- Modelling

- Compositing/Grade Capping/Statistics

- Geostatistics/Variography/Spatial Analysis

- Definition of Block Model and Search Parameters

- Grade Interpolation and Validation

- Determination of Tonnage

- Establishment of Parameters/Prospects for Economic Recovery

- Mineral Resource Definition: parameters; classification

While both the Makwa and Mayville deposits belong to the same deposit class, the former is nickel dominant while the later is copper dominant. Accordingly, the two deposits have been estimated separately.

The bulk of the new resources estimated are constrained by optimized pit shells. In addition, a small underground resource was also estimated by Micon for both Makwa and Mayville.

Qualified Persons Statements

The Grid Metals' MM Project 2024 Mineral Resource Estimate with an effective date of December 31, 2023 was prepared by Messrs. Alan J. San Martin, MAusIMM (CP) and Charley Murahwi, P.Geo., FAusIMM, from Micon International Limited, both of whom are Independent Qualified Persons in accordance with the guidelines of the Canadian Securities Administrators' National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

Dr. Dave Peck, P.Geo., is the Qualified Person for purposes of National Instrument 43-101 and has reviewed and approved the technical content of this release.

References

- Ewert, D., Yassa, A., Armstrong, T., Brown, F., and Puritch, E. 2009. Technical Report and Resource Estimate on the Ore Fault, Galaxy and Page Zones of the Marathon PGM/Gossan Resources JV Bird River Property, Southeast Manitoba. 103 p.

- Houlé, M.G., Lesher, C.M., Sappi, A., Bédard, M., Goutier, J. and Yang, E., 2020. Overview of Ni-Cu-(PGE), Cr-(PGE), and Fe-Ti-V magmatic mineralization in the Superior Province: Insights on metallotects and metal endowment. In: Targeted Geoscience Initiative 5: Advances in the understanding of Canadian Ni-Cu-PGE and Cr ore systems - Examples from the Midcontinent Rift, the Circum-Superior Belt, the Archean Superior Province, and Cordilleran Alaskan-type intrusions. Geological Survey of Canada, Open File 8722, p. 117-139.

About Grid Metals Corp.

Grid Metals is focused on both lithium and copper/nickel projects in the Bird River area, approximately 150 km northeast of Winnipeg Manitoba. The Donner Lake lithium project is a 75% owned property subject to a joint venture agreement. Grid has a lease agreement on the True North mill where it plans to process feed from Donner Lake. Grid also has an MOU with Tantalum Mining Corporation of Canada Limited who operates the nearby producing Tanco Mine. The MM copper/nickel project is a resource-stage project that is undergoing exploration and development work as reported in this Press Release.

All of the Company's southeastern Manitoba projects are located on the Traditional Lands of the Sagkeeng First Nation with whom the Company maintains an Exploration Agreement.

On Behalf of the Board of Grid Metals Corp.

For more information about the Company, please see the Company website at www.gridmetalscorp.com or contact:

Robin Dunbar - President, CEO & Director Telephone: 416-955-4773 Email: rd@gridmetalscorp.com

Brandon Smith - Chief Development Officer - bsmith@gridmetalscorp.com

David Black - Investor Relations Email: info@gridmetalscorp.com

We seek safe harbour. This news release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of the Securities Act (Ontario) (together, "forward-looking statements"). Such forward-looking statements include the Company's closing of the proposed financial transactions, sale of royalty and property interests. the overall economic potential of its properties, the availability of adequate financing and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements expressed or implied by such forward- looking statements to be materially different. Such factors include, among others, risks and uncertainties relating to potential political risk, uncertainty of production and capital costs estimates and the potential for unexpected costs and expenses, physical risks inherent in mining operations, metallurgical risk, currency fluctuations, fluctuations in the price of nickel, cobalt, copper and other metals, completion of economic evaluations, changes in project parameters as plans continue to be refined, the inability or failure to obtain adequate financing on a timely basis, and other risks and uncertainties, including those described in the Company's Management Discussion and Analysis for the most recent financial period and Material Change Reports filed with the Canadian Securities Administrators and available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

SOURCE: Grid Metals Corp.

View the original press release on accesswire.com