VANCOUVER, BC / ACCESSWIRE / May 7, 2024 / Faraday Copper Corp. ("Faraday" or the "Company") (TSX:FDY)(OTCQX:CPPKF) is pleased to announce the results of the Gold Program from the Keel Zone at the Copper Creek project in Arizona, USA. The results support the potential to unlock significant value through the contribution of payable gold in concentrate in future Mineral Resource Estimates ("MRE")1.

Paul Harbidge, President and CEO, commented "The results show that the Keel Zone hosts the largest gold-bearing domain on the property to date. For context, the Keel underground zone represents approximately 60 million tonnes of the 330 million tonnes in the current underground mineral resource. This newly acquired data, together with our recent metallurgical results, supports the potential for the addition of gold in concentrate as a significant source of by-product revenue that would increase the value of Copper Creek."

Highlights

- Doubled the gold assay coverage in the Keel Zone with 1,017 new gold assays, in addition to the 1,062 historical gold assays.

- Examples of intercepts with new gold assays and re-assayed copper from historical core include:

- 103.64 m ("metres") at 1.34% copper and 0.28 grams per tonne ("g/t") gold from 667.51 m in drill hole LM-2;

- 85.35 m at 0.91% copper and 0.11 g/t gold from 652.27 m in drill hole LM-1; and

- 272.19 m at 0.47% copper and 0.05 g/t gold from 921.11 m in drill hole RMK-12-068.

- Gold and copper are correlated on an intercept basis with an overall ratio2 of approximately 1:9 gold (g/t):copper (%) at the Keel Zone.

- Recently completed metallurgical test work supports gold recoveries exceeding 80% to a payable grade in the copper concentrate from the Keel Zone.

- As part of the gold program, copper was re-assayed and the results confirmed historical data, providing additional confidence in the database.

Keel Zone Overview

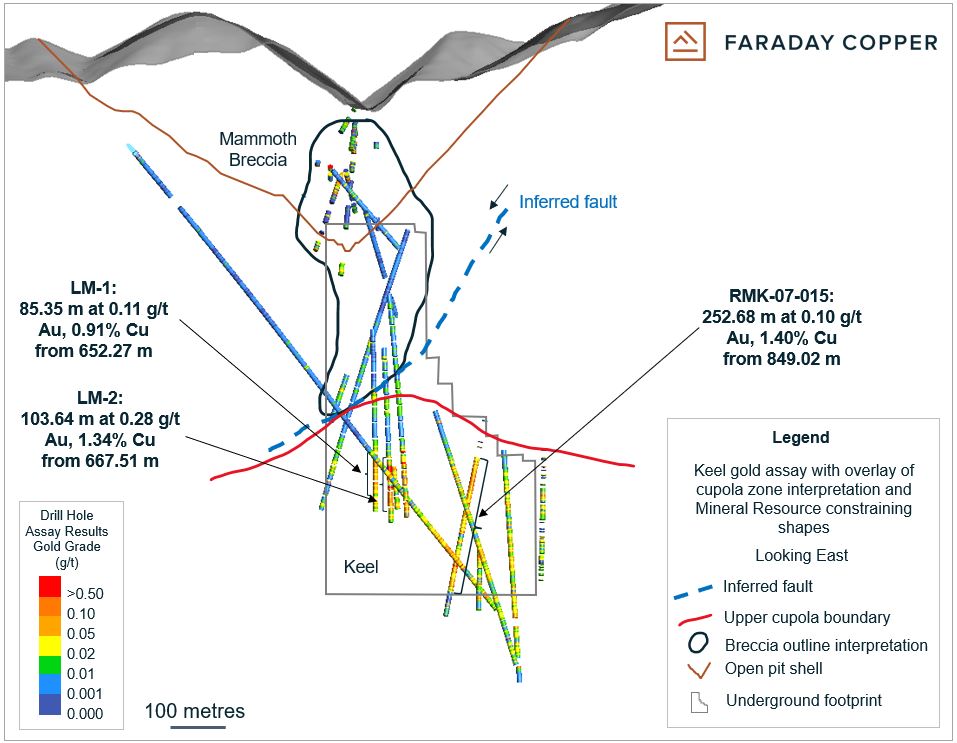

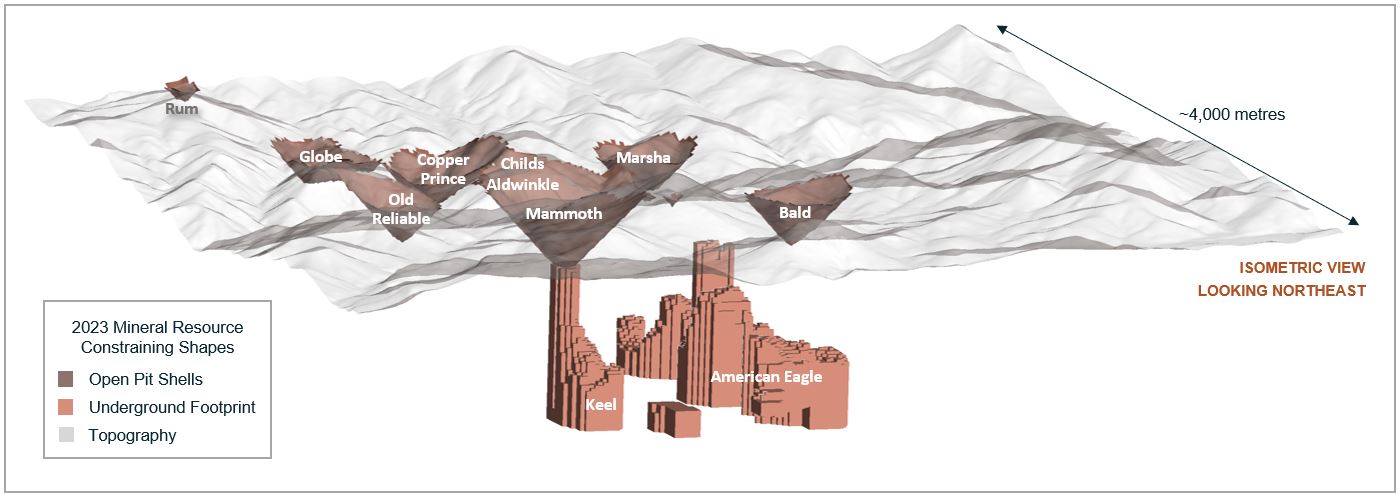

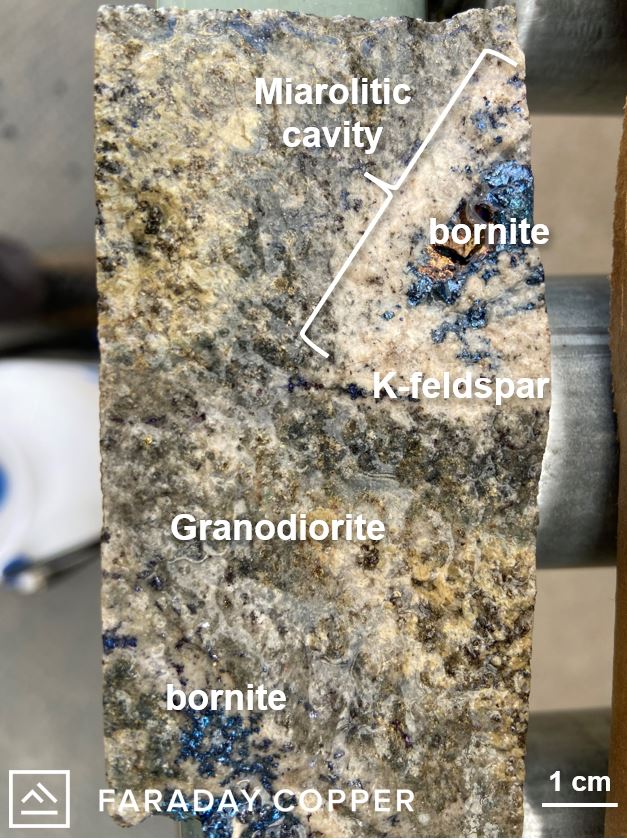

The Keel Zone (Figure 1 and 2) represents approximately 60 million tonnes of the 330 million tonnes of the current underground MRE. The Keel Zone contains several domains of mineralization with the dominant style including bornite and chalcopyrite that occur disseminated and in miarolitic cavities, as well as in porphyry-style veins. This is indicative of a high emplacement temperature near the apex of a magmatic intrusion and this environment is commonly referred to as a cupola zone (Figure 1). In addition, chalcopyrite-rich breccias crosscut the magmatic cupola mineralization. The Keel Zone is located below the Mammoth breccia and together these areas form the most continuous vertical mineralization (over 1,400 m) discovered on the project to date.

Gold mineralization within Keel is zoned, with the greatest enrichment occurring in the magmatic cupola associated with bornite (Figure 3). Metallurgical test work, reported in a news release dated February 26, 2024, on bornite-bearing samples from the Keel Zone suggests that gold recoveries average over 80% and gold has the potential to be payable in a copper concentrate.

Gold Program Overview

Historically, only a small portion of samples analyzed for copper were also analyzed for gold. The Company has been analyzing archived sample material for gold with the aim of increasing data coverage for potential inclusion in future MRE updates. In addition to gold assays, samples have been re-analyzed for copper, silver and molybdenum to further validate historical results. Assay results for Childs Aldwinkle, Copper Prince and the Keel Zone have been released.

Gold and copper results for the Keel Zone are presented in Table 1. Gold values were calculated for a total of 15 drill hole intercepts and the results improve spatial coverage (Figure 1).

Next Steps

Additional zones in the current MRE are being evaluated for gold assay data coverage as the Company intends to include gold in future MRE updates. Further, gold continues to be analyzed as part of the ongoing Phase III drill program which has the following objectives:

- Expanding the MRE;

- Better delineating high-grade, mineralized zones; and

- Reconnaissance drilling on new targets.

The current focus of the Phase III drilling program is on shallow breccia-hosted mineralization at American Eagle. This follows the approval by the Bureau of Land Management of the Company's Notice of Intent, as reported in a news release dated May 2, 2024.

Figure 1: Cross section of the Keel and Mammoth domain with gold intercepts for the Keel Zone

Note: The underground footprint and open pit shell are based on constraints used in the MRE1.

Figure 2: Mineral Resource areas at the Copper Creek project

Figure 3: Example of magmatic cupola-style mineralization at 690.3 m from a core sample from 688.85 m to 691.90 m grading 1.43 g/t gold and 6.03% copper in drill hole LM-2

Table 1: Intercept Values at the Keel Zone

| Drill Hole ID | From | To | Length | Au g/t | Ag g/t | Cu % | Mo % | Cu:Au |

| (m) | (m) | (m) | (g/t) | (g/t) | (%) | (%) | ||

| FCD-22-007 | 1112.00 | 1217.59 | 105.59 | 0.09 | 9.71 | 1.21 | 0.0200 | 13.44 |

| FCD-22-0072 | 1277.10 | 1289.77 | 12.67 | 0.14 | 36.52 | 5.00 | 0.0230 | 35.71 |

| FCD-23-024 | 757.25 | 949.49 | 192.24 | 0.05 | 2.24 | 0.42 | 0.0068 | 8.40 |

| LM-1 | 652.27 | 737.62 | 85.35 | 0.11 | 5.24 | 0.91 | 0.0366 | 8.27 |

| LM-2 | 667.51 | 771.15 | 103.64 | 0.28 | 12.18 | 1.34 | 0.0606 | 4.79 |

| LM-3 | 664.47 | 789.43 | 124.96 | 0.10 | 4.12 | 0.70 | 0.0190 | 7.00 |

| LM-6 | 685.80 | 765.05 | 79.25 | 0.05 | 2.72 | 0.49 | 0.0058 | 9.80 |

| NE-5 | 871.73 | 932.69 | 60.96 | 0.07 | 1.81 | 0.44 | 0.0162 | 6.29 |

| Including | 905.26 | 926.59 | 21.33 | 0.14 | 2.86 | 0.82 | 0.0074 | 5.86 |

| RMK-07-015 | 849.02 | 1101.70 | 252.68 | 0.10 | 9.77 | 1.40 | 0.0335 | 14.00 |

| Including | 868.38 | 907.85 | 39.47 | 0.15 | 9.78 | 1.95 | 0.0494 | 13.00 |

| RMK-08-031 | 904.95 | 914.10 | 9.15 | 0.12 | 4.95 | 0.74 | 0.0263 | 6.17 |

| RMK-11-072 | 816.26 | 895.51 | 79.25 | 0.06 | 2.39 | 0.46 | 0.0108 | 7.67 |

| RMK-12-068 | 921.11 | 1193.30 | 272.19 | 0.05 | 2.58 | 0.47 | 0.0129 | 9.40 |

| RMK-12-069 | 970.18 | 1065.89 | 95.71 | 0.05 | 4.49 | 0.55 | 0.0039 | 11.00 |

| Including | 979.33 | 994.26 | 14.93 | 0.08 | 6.39 | 0.61 | 0.0034 | 7.63 |

| VIX24-22 | 792.94 | 926.59 | 133.65 | 0.02 | 0.64 | 0.33 | 0.0150 | 16.50 |

| Including | 832.11 | 880.87 | 48.76 | 0.03 | 1.01 | 0.36 | 0.0265 | 12.00 |

| And | 594.36 | 615.70 | 21.34 | 0.03 | 3.90 | 1.77 | 0.0072 | 59.00 |

| VIX28-2 | No significant gold intercepts | |||||||

Notes: Copper, silver and molybdenum columns indicate re-assayed metal values. Drill holes FCD-22-007, FCD-23-024 and RMK-07-015 were not re-assayed as part of this program. Mineralization is dominantly bulk porphyry and magmatic and cupola-style and lesser breccia mineralization. Drilled widths are interpreted to be the best available approximation to true widths.

Sampling Methodology, Chain of Custody, Quality Control and Quality Assurance

All sampling was conducted under the supervision of the Company's geologists and the chain of custody from Copper Creek to the independent sample preparation facility, ALS Laboratories in Tucson, AZ, was continuously monitored. The samples were taken from archived pulverized rock material (pulps). Pulps were re-blended and analyzed using industry standard analytical methods including a 4-Acid ICP-MS multielement package and an ICP-AES method for high-grade copper samples. Gold was analyzed on a 30-gram aliquot by fire assay with an ICP-AES finish. A certified reference sample was inserted every 15th to 20th sample. Blanks were inserted every 10th sample. In addition to the internal QA-QC protocol, additional blanks, reference materials and duplicates were inserted by the analytical laboratory according to their procedure. Data verification of the analytical results included a statistical analysis of the standards and blanks that must pass certain parameters for acceptance to ensure accurate and verifiable results.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Faraday's Vice President Exploration, Dr. Thomas Bissig, P. Geo., and Faraday's Vice President, Projects and Evaluations, Zach Allwright, P.Eng., both of whom are considered a Qualified Person under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

Notes

1 The Mineral Resource Estimate is presented in the report titled "Copper Creek Project NI 43-101 Technical Report and Preliminary Economic Assessment" with an effective date of May 3, 2023 (the "Technical Report") available on the Company's website at www.faradaycopper.com and on the Company's SEDAR+ profile at www.sedarplus.ca.

2 The gold:copper ratio for the Keel Zone should not be applied to other mineralized domains. The gold occurrence has not undergone economic assessment and therefore it does not currently qualify as part of a mineral resource. Certain intercepts in holes FCD-22-007 and VIX24-2 with outliers in gold and copper concentrations were not considered for the calculation of this ratio.

About Faraday Copper

Faraday Copper is a Canadian exploration company focused on advancing its flagship copper project in Arizona, USA. The Copper Creek Project is one of the largest undeveloped copper projects in North America with significant district scale exploration potential. The Company is well positioned to deliver on its key milestones and benefits from a management team and board of directors with senior mining company experience and expertise. Faraday trades on the TSX under the symbol "FDY".

For additional information please contact:

Stacey Pavlova, CFA

Vice President, Investor Relations & Communications

Faraday Copper Corp.

E-mail: info@faradaycopper.com

Website: www.faradaycopper.com

To receive news releases by e-mail, please register at www.faradaycopper.com.

Cautionary Note on Forward Looking Statements

Some of the statements in this news release, other than statements of historical fact, are "forward-looking statements" and are based on the opinions and estimates of management as of the date such statements are made and are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual results, level of activity, performance or achievements of Faraday to be materially different from those expressed or implied by such forward-looking statements. Such forward-looking statements and forward-looking information specifically include, but are not limited to, statements concerning the possibility of adding payable gold in future Mineral Resource Estimates, the thesis that precious metals are mineralogically associated with copper within the Copper Creek property and the areas to be included in the review of historical samples for increased assay coverage.

Although Faraday believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements should not be in any way construed as guarantees of future performance and actual results or developments may differ materially. Accordingly, readers should not place undue reliance on forward-looking statements or information.

Factors that could cause actual results to differ materially from those in forward-looking statements include without limitation: market prices for metals; the conclusions of detailed feasibility and technical analyses; lower than expected grades and quantities of mineral resources; receipt of regulatory approval; receipt of shareholder approval; mining rates and recovery rates; significant capital requirements; price volatility in the spot and forward markets for commodities; fluctuations in rates of exchange; taxation; controls, regulations and political or economic developments in the countries in which Faraday does or may carry on business; the speculative nature of mineral exploration and development, competition; loss of key employees; rising costs of labour, supplies, fuel and equipment; actual results of current exploration or reclamation activities; accidents; labour disputes; defective title to mineral claims or property or contests over claims to mineral properties; unexpected delays and costs inherent to consulting and accommodating rights of Indigenous peoples and other groups; risks, uncertainties and unanticipated delays associated with obtaining and maintaining necessary licenses, permits and authorizations and complying with permitting requirements, including those associated with the Copper Creek property; and uncertainties with respect to any future acquisitions by Faraday. In addition, there are risks and hazards associated with the business of mineral exploration, development and mining, including environmental events and hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and the risk of inadequate insurance or inability to obtain insurance to cover these risks as well as "Risk Factors" included in Faraday's disclosure documents filed on and available at www.sedarplus.ca.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such an offer or solicitation in such jurisdiction. This press release is not, and under no circumstances is to be construed as, a prospectus, an offering memorandum, an advertisement or a public offering of securities in Faraday in Canada, the United States or any other jurisdiction. No securities commission or similar authority in Canada or in the United States has reviewed or in any way passed upon this press release, and any representation to the contrary is an offence.

SOURCE: Faraday Copper Corp.

View the original press release on accesswire.com