EQS-News: CPI PROPERTY GROUP

/ Key word(s): ESG/Real Estate

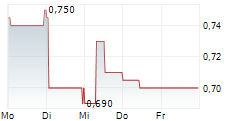

CPI Property Group CPI PROPERTY GROUP - High Demand for Recent Green Bond CPI PROPERTY GROUP ("CPIPG" or the "Company"), a leading European landlord, is pleased to announce the closing of €500 million of 5-year senior unsecured green bonds. More than €3 billion of orders were placed for the green bonds, the strongest-ever response to a bond issue by CPIPG. With a six times oversubscribed orderbook, CPIPG was able to reduce the cost significantly from initial guidance to pricing. The coupon was set at 7%, which is higher than CPIPG's historic cost of debt. However, CPIPG proceeded with the green bonds in order to bolster liquidity and demonstrate market access in support of the Group's credit ratings and capital structure. "Events of past few years have created many opportunities for investors to test, examine and get to know CPIPG," said David Greenbaum, CEO. "We are grateful for the support and remain focused on delivering for all stakeholders." Barclays, Goldman Sachs, Santander, Société Générale, Erste Group, SMBC, Raiffeisen Bank International and UniCredit acted as joint bookrunners on the transaction. CPIPG will allocate an amount equivalent to the net proceeds to fully retire the bridge loans related to the acquisitions of IMMOFINANZ and S IMMO. This application of proceeds meets the eligibility criteria for green bonds under CPIPG's sustainability finance framework. In particular, both IMMOFINANZ and S IMMO have a large number of green-certified buildings which are now part of the Group. The green bonds are listed on the Main Market of the Irish Stock Exchange plc (trading as Euronext Dublin) and are accepted for clearance through Euroclear and Clearstream, Luxembourg. The green bonds, issued under the Company's Euro Medium-Term Note Programme, are rated Baa3 by Moody's and BBB- by Standard & Poor's. The ISIN code for the green bonds is XS2815976126 and the Common Code is 281597612. The base prospectus and final terms for the green bonds, along with the Group's sustainability finance framework, are available at the website of the Company (www.cpipg.com). For further information, please contact: Investor Relations Moritz Mayer Manager, Capital Markets m.mayer@cpipg.com For more on CPI Property Group, visit our website: www.cpipg.com Follow us on X (CPIPG_SA) and LinkedIn 07.05.2024 CET/CEST Dissemination of a Corporate News, transmitted by EQS News - a service of EQS Group AG. |

| Language: | English |

| Company: | CPI PROPERTY GROUP |

| 40, rue de la Vallée | |

| L-2661 Luxembourg | |

| Luxemburg | |

| Phone: | +352 264 767 1 |

| Fax: | +352 264 767 67 |

| E-mail: | contact@cpipg.com |

| Internet: | www.cpipg.com |

| ISIN: | LU0251710041 |

| WKN: | A0JL4D |

| Listed: | Regulated Market in Frankfurt (General Standard); Regulated Unofficial Market in Dusseldorf, Stuttgart |

| EQS News ID: | 1897965 |

| End of News | EQS News Service |

1897965 07.05.2024 CET/CEST

© 2024 EQS Group