Multiple copper-gold targets enhance regional exploration potential

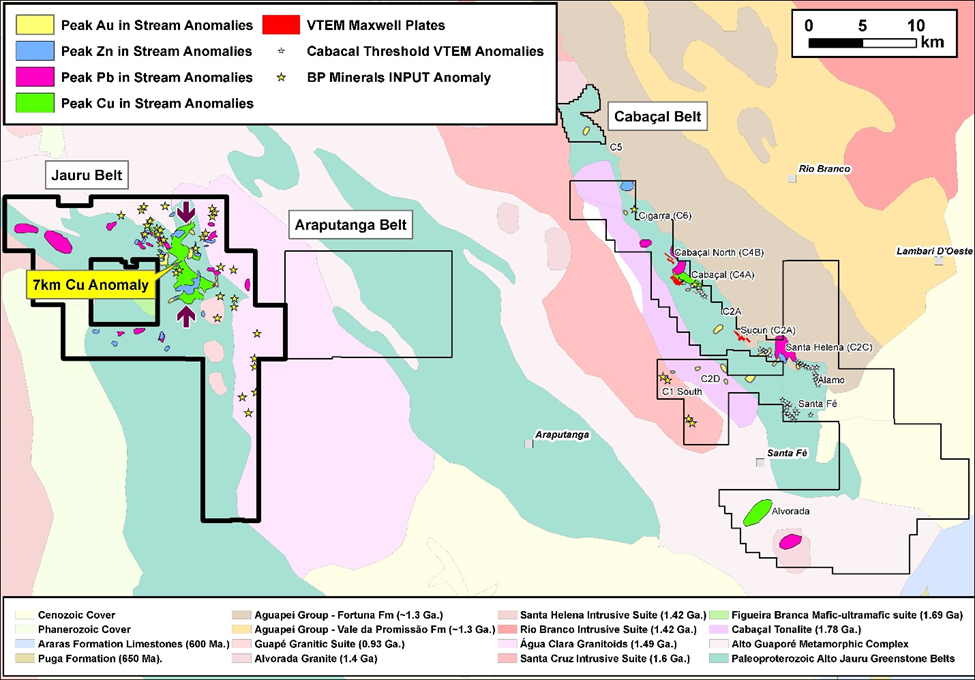

LONDON, UK / ACCESSWIRE / May 14, 2024 / Meridian Mining UK. S (TSX:MNO)(Frankfurt:2MM)(Tradegate:2MM)(OTCQX:MRRDF) ("Meridian" or the "Company") is pleased to report on the initial reviews of the district-scale Jauru copper & gold exploration project1 ("Jauru"), located in Mato Grosso, Brazil. Meridian's exploration licence applications for Jauru ("Figure 1") are located ~45km to the west of the Company's advanced Cabaçal copper-gold-silver VMS project ("Cabaçal"). Jauru was explored by BP Minerals ("BPM") in the 1980's via geochemical and geophysical surveys and reconnaissance drilling, and the belt is geologically analogous to Cabaçal.

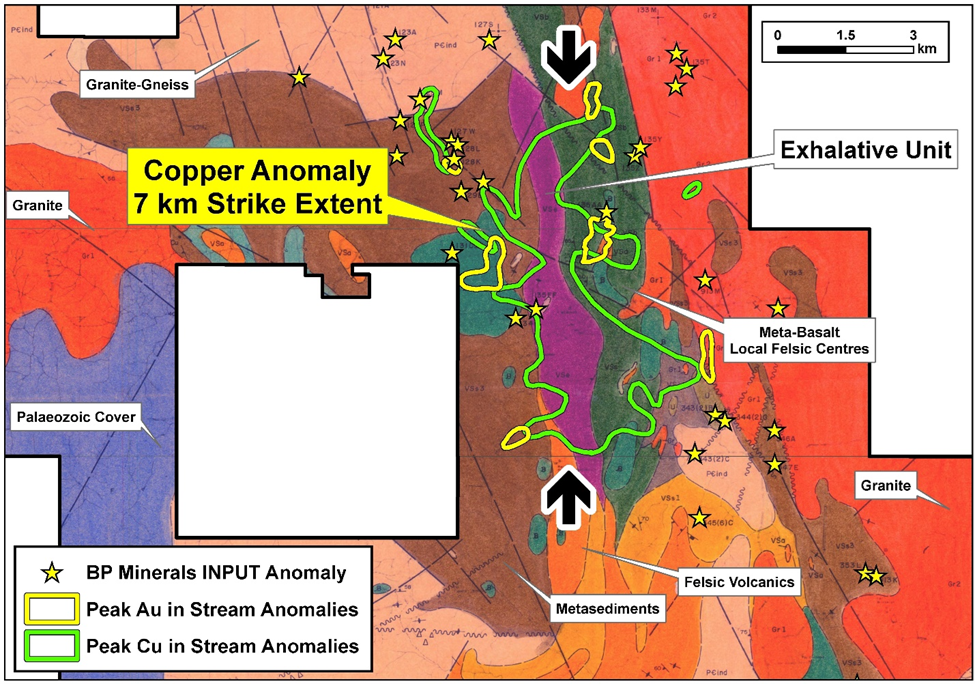

The Company has been progressively and systematically evaluating Jauru's extensive historical data generated by BPM and is highly encouraged by its prospectivity. This review has highlighted a strong 7km copper stream sediment exploration target ("Figure 2"). Jauru's copper and gold geochemical anomalies are equal to or above the threshold values of Cabaçal, when it was at a similar stage of exploration. The strength and the extent of Jauru's anomalies strengthen Meridian's goal of becoming an emerging copper-gold producer via Cabaçal, with further resource growth from Santa Helena, and a pipeline of near mine and regional exploration prospects. Results reported today focus on anomalies observed in the Jauru Belt, with compilation of data ongoing.

Highlights Reported Today

- Meridian highlights strong district-scale copper-gold potential at Jauru exploration project;

- Jauru's copper and gold anomalies equal to or above threshold values of Cabaçal;

- Meridian reports 7km copper in stream anomaly, with superimposed and offset gold anomalies;

- Surface copper anomaly overlies prospective exhalative geological unit, wholly contained in the Company's licence applications;

- Multiple anomalies present in historic aerial magnetic-electromagnetic survey;

- Strong geological similarities apparent between Cabaçal and Jauru greenstone belts; and

- Meridian's emergence as a copper-gold company strengthens with targets defined on an expansive portfolio of development and exploration assets.

Mr. Gilbert Clark, CEO, comments: "Once again, Meridian has been able to leverage off the historical BPM investment in exploration and create highly prospective copper-gold targets for future advancement, this time with the Jauru Belt. Having a 7km copper anomaly already defined with a larger footprint, and equal to or above threshold values than the original stream copper-gold anomaly at Cabaçal, is encouraging, and a solid foundation from which to launch our future exploration in the region. Our primary focus is on executing the Cabaçal mine's near-term development, then initial growth via Santa Helena and the mine corridor. Our ultimate goal is for the Company to be an emerging copper-gold producer and developer with a pipeline of high-quality projects like Jauru."

Jauru District Technical Note

Meridian's Jauru database draws on an intensive phase of "frontier" exploration in the 1980's by BPM when the belt was initially discovered, during which time the BP Minerals regional team grew from a reconnaissance staff of around seventy people to over two hundred ahead of the commissioning of the Cabaçal Mine. BPM drilling was heavily focussed on Cabaçal and Santa Helena, leaving their near mine and regional targets at a reconnaissance stage, after the mine was closed in the early 1990's. This left significant exploration upside. Meridian, with its in-house suite of modern geophysical equipment and local knowledge, can follow on from where BPM left off, and define new drill targets for the future.

Figure 1: Jauru-Cabaçal location map. Data for Araputanga under compilation.

The Jauru portfolio of exploration assets spans positions along a Paleoproterozoic greenstone belt that is considered coeval with the Cabaçal Belt to the east. Geological mapping has been conducted by the state geological survey at 1:100,000 scale, and that of BPM at a more detailed scale again of 1:50,000. The more detailed scale of mapping in the Jauru Belt shows an exhalative unit extending over a strike length of 9km, contained wholly within the Company's licence applications. This unit is structurally truncated to the north against a sequence of undifferentiated granites-gneisses, and to the south, it passes laterally to a sequence of acid metavolcanics. The geological units of the belt have a dominant gentle southerly plunge, and the unit may project further below surface along the southern continuation of the Company's licences.

A strong copper-in-stream anomaly is evident over at least a 7km strike extent over this exhalative unit. Basaltic metavolcanics are developed in the footwall of the exhalative unit to the east, and a metasedimentary unit is present to the west in the hangingwall. The copper-in-stream response increases rapidly from background values over the metavolcanic-sedimentary package, to form a coherent strike-extensive anomaly over the exhalative unit, increasing to peak values of up to 240ppm Cu. For context, peak copper values for the stream anomaly that led to definition of the Cabaçal target were in the order of 34 - 56ppm Cu, and for Santa Helena, 20 - 36ppm Cu.

Figure 2: Jauru Belt geology and key geochemical / geophysical anomalies.

The exhalative position also exhibits more localized elevated responses in other base metals. Zinc-in-stream values are typically greater than 40ppm Zn, up to a peak of 144ppm Zn: twice to 10-fold that of background in bounding lithologies. This compares to peak values at Cabaçal of 44 - 60ppm Zn, and Santa Helena of 41 - 149ppm Zn. Lead-in-stream values are more subdued, with a peak of 21ppm Pb over the exhalative unit, compared to peak values at Cabaçal of 8 - 20ppm Pb, where lead is restricted to the far northern periphery of the deposit, and at Santa Helena of 68 - 90ppm Pb.

Gold anomalism was measured by panning a set volume of channel alluvium (5 litres) and counting the gold grains in the heavy mineral concentrate. Mild anomalies peak at up to 7 gold counts. Values in the Santa Helena - Alamo corridor are typically 1 - 12, peaking at 30 counts, and at Cabaçal 1 - 14 gold counts.

Also of interest are that offset and more focussed discrete gold and base metal anomalies are present in drainage passing over the footwall and hangingwall stratigraphy. Strong copper-in-stream responses extend into the metabasaltic footwall succession, including peak values of 41 - 63ppm Cu. These are spatially located over or down-stream from felsic volcanic units mapped with 400 - 600m strike extents, within the metabasaltic pile. Some of these felsic volcanic centres are also gold-anomalous (7 - 12 counts), and locally zinc anomalous (up to 70ppm Zn). Gold counts in drainage catchments in the hangingwall peak at 10 - 17 counts at a number of discrete sites, whereas satellite copper peaks are in the order of 34 - 49ppm Cu in the hangingwall.

The appearance of the exhalative unit aligned with a transition from mafic to felsic volcanism is a characteristic signature of various VMS camps, where sulphide mounds can develop during a break in volcanism. In some camps, such as Flin Flon, Canada, deposits can also be developed within the predominantly mafic pile, close to more restricted felsic volcanic centres.

In addition to the encouraging geochemical signature aligning with prospective stratigraphy, there are a large number of geophysical anomalies defined through BPM's INPUT aerial magnetic-electromagnetic survey ("Figure 2"). The Jauru Belt contains over 30 anomalies. The digital aerial data has been unfortunately lost, although the spatial position of the anomalies is known from maps. Modern geophysical methods have the ability to penetrate yet further than the 1980's technology, which is considered to provide a good screening for shallower level more conductive positions. INPUT anomalies are developed in the footwall, exhalite, and hangingwall positions.

BP Minerals undertook a limited amount of reconnaissance drilling, and the Company will continue to engage with the ANM and its network of past professions to assess whether further data exists. It is clear though that the greenstone belt is under-explored when compared to similar belts in advanced jurisdictions, where hundreds of holes have been drilled in exploration programs sustained over decades.

The licences are currently in application. Having better identified areas of priority interest, the Company will gradually commence a landholder mapping and engagement program, so environmental licences for exploration can be expediently put into place once the licences are approved for exploration in the future. The Company's objective will be to establish an operational base over the Cabaçal Belt, and progressively expand to district scale exploration and discovery programs in the years ahead.

Jauru's Future Work Programs

Upon licencing and environmental approvals, work programs would involve:

- Deployment of surface geophysical methods:

- Gradient array induced polarization to define near-surface open-pit exploration targets;

- Fixed loop electromagnetic surveys, targeting shallow to deeper massive sulphides;

- Surface geochemical surveys:

- Extension of survey coverage into areas not yet sampled;

- Follow-up reconnaissance soil gold and multi-element geochemical surveys;

- Geological mapping and rock chip sampling / gossan search; and

- Drilling of prioritized anomalies.

About Meridian

Meridian Mining UK S is focused on:

- The development and exploration of the advanced stage Cabaçal VMS gold-copper project;

- Regional scale exploration of the Cabaçal VMS belt; and

- Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

Cabaçal is a gold-copper-silver rich VMS deposit with the potential to be a standalone mine within the 50km VMS belt. Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within deformed metavolcanic-sedimentary rocks. A later-stage gold overprint event has emplaced high-grade gold mineralization.

The Preliminary Economic Assessment technical report (the "PEA Technical Report") dated March 30, 2023, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Preliminary Economic Assessment, Mato Grosso, Brazil" outlines a base case after-tax NPV5 of USD 573 million and 58.4% IRR from a pre-production capital cost of USD 180 million, leading to capital repayment in 10.6 months (assuming metals price scenario of USD 1,650 per ounces of gold, USD 3.59 per pound of copper, and USD 21.35 per ounce of silver). Cabaçal has a low All-in-Sustaining-Cost of USD 671 per ounce gold equivalent for the first five years, driven by high metallurgical recovery, a low life-of-mine strip ratio of 2.1:1, and the low operating cost environment of Brazil (see press release dated March 6, 2023).

The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold, 0.3% copper and 1.4g/t silver and Inferred resources of 10.3 million tonnes at 0.7g/t gold, 0.2% copper & 1.1g/t silver (at a 0.3 g/t gold equivalent cut-off grade), including a higher-grade near-surface zone supporting a starter pit.

Readers are encouraged to read the PEA Technical Report in its entirety. The PEA Technical Report may be found on the Company's website at www.meridianmining.co and under the Company's profile on SEDAR+ at www.sedarplus.ca.

The qualified persons for the PEA Technical Report are: Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering), Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering), Simon Tear (PGeo, EurGeol), Principal Geological Consultant of H&SC, Marcelo Batelochi, (MAusIMM, CP Geo), Geological Consultant of MB Geologia Ltda, Joseph Keane (Mineral Processing Engineer; P.E), of SGS, and Guilherme Gomides Ferreira (Mine Engineer MAIG) of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Mr. Gilbert Clark - CEO and Director

Meridian Mining UK S

Email: info@meridianmining.co

Ph: +1 778 715-6410 (PST)

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

Technical Notes

BP Minerals undertook stream sediment sampling by analyses for Cu, Pb, Zn, and Ni by aqua regia / atomic absorption at their in-house laboratory (Nomos Laboratory, Rio de Janeiro). Field protocols included taking periodic duplicate samples. The "gold counts" referenced in the release is a measure of the number of gold grains visually counted in a pan concentrate from a set volume of channel alluvium (a 5-litre bucket), providing an empirical measure of gold anomalism. Anomalies contoured in diagrams in this release are based on threshold values of =10 gold counts, =32ppm Cu, =65ppm Zn, =17ppm Pb.

Qualified Person

Mr. Erich Marques, B.Sc., MAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, and verified the technical information in this news release.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedarplus.ca. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

1See Meridian news release April 12, 2021

SOURCE: Meridian Mining UK S

View the original press release on accesswire.com