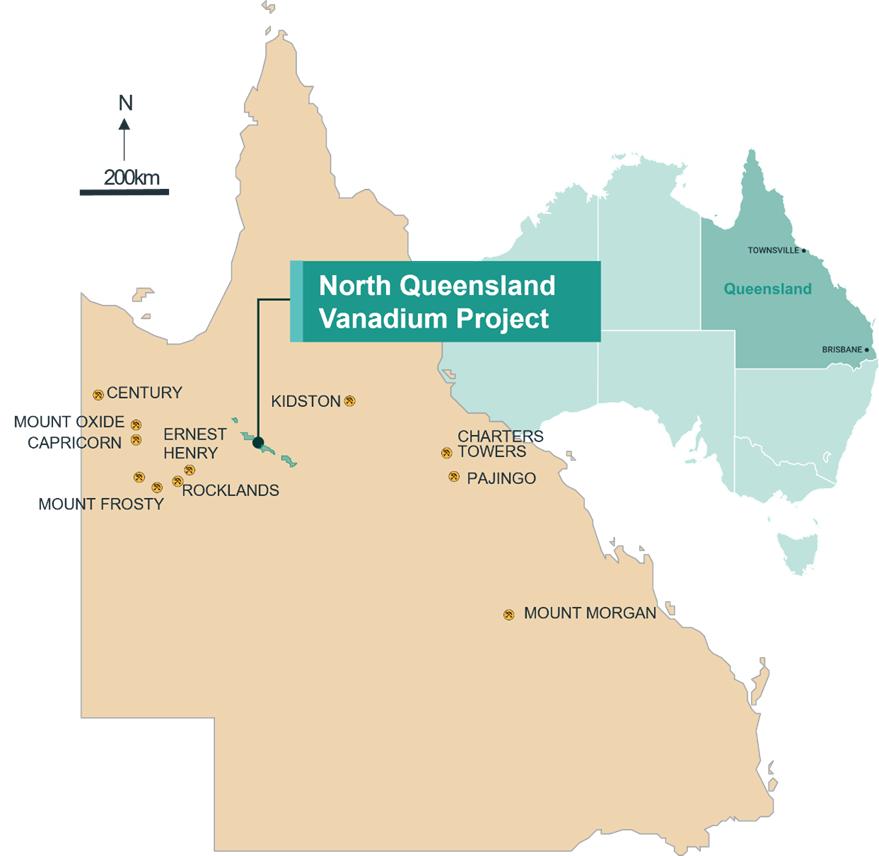

TORONTO, ON / ACCESSWIRE / May 14, 2024 / Velox Energy Materials Inc. (TSXV:VLX) ("Velox" or the "Company") is pleased to report the review and definition of a drill-defined Exploration Target for the Runnymede area in the central tenement area of the North Queensland Vanadium Project ("NQVP") situated within the "Vanadium Hub", approximately 370 km west of the port of Townsville, Queensland, Australia (Figure 1).

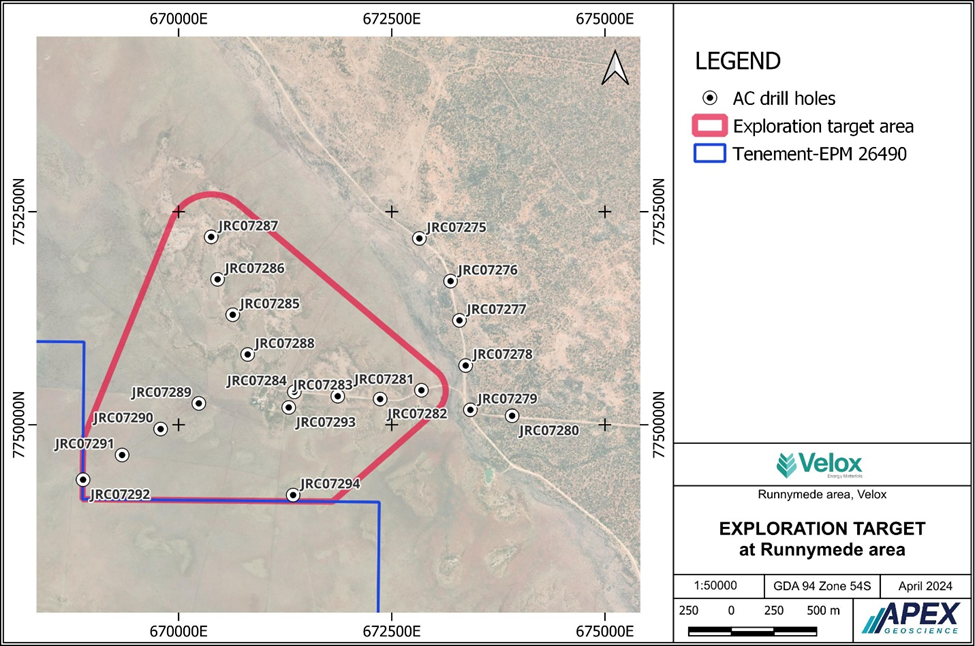

The Runnymede Exploration Target is located approximately 66 km north-west of the township of Richmond and currently measures approximately 4.3 km in length and 3.5 km in width, with an average thickness of 10.70m and an average depth of 3.6m (Figure 2). The Exploration Target remains open to the northwest and north. The Exploration Target was calculated using validated historical drillhole data and hosts a target of 144.30 million tonnes up to 216.46 million tonnes, with an average grade ranging from 0.22 to 0.33 per cent (%) vanadium pentoxide (V2O5) and 147 to 220.8 ppm molybdenum trioxide (MoO3) utilizing a 0.12% V2O5 cut-off (Table 1). The potential quantity and grade are conceptual in nature. There has been insufficient exploration to define a mineral resource at the Runnymede area and it is uncertain if further exploration will result in the target being delineated as a mineral resource.

Velox's President and CEO, Simon Coyle, commented:

"We have already proven there are significant mineral resources in the Cambridge Deposit, and we are currently progressing through the first stages of our metallurgical testwork from large diameter core drilling completed in September 20231. The new Runnymede Exploration Target adds significant upside potential to the existing Flinders River Exploration Target announced on 13 March 2023. This demonstrates the substantial unexplored potential within the 1,246 km2 near surface, oxidised Toolebuc Formation of the NQVP package. It is worth noting that we are also considering other areas covered by historical drilling to expand our Exploration Target inventory.

Vanadium redox flow batteries will soon begin to play an integral role in supporting power grids and bridging the gap of reliable alternative sources of energy. We believe that the NQV Project presents a massive opportunity to make our mark in the ever-evolving battery and energy materials markets."

Table 1- Runnymede Exploration Target Tonnes and Grades

Volume (m3) | Tonnes | V2O5 (%) | MoO3 (ppm) | |||||

Minimum | Maximum | Minimum | Maximum | Minimum | Maximum | Cut-off | Minimum | Maximum |

80,170,000 | 120,250,000 | 144,310,000 | 216,460,000 | 0.22 | 0.33 | 0.12 | 147.2 | 220.8 |

Notes:

The potential quantity and grade presented represent an Exploration Target and are conceptual in nature. There has been insufficient exploration to define a mineral resource at the Runnymede area and it is uncertain if future exploration will result in a target being delineated as a mineral resource. The Target has not been evaluated for reasonable prospects for future economic extraction. Metallurgical work is ongoing and future drill programs are planned for the NQVP.

For the conceptual estimate, the range of elemental V2O5 is provided by multiplying the mean volume, density and vanadium concentration of the Runnymede area Exploration Target by +/- 20%.

- Molybdenum was treated as a by-product of Vanadium.

- Volume and tonnes have been rounded to the nearest 10,000 and grade rounded to two decimal places.

The Exploration Target is based upon a mineralization horizon that was constructed utilizing the results of a 14-hole historic aircore (AC) drill program totaling 320m. The drill program was completed in 2006-2007 by Intermin2 and intersected anomalous vanadium mineralization in the coquina-shale horizons of the Toolebuc Formation. The Toolebuc Formation is a flat-lying, early Cretaceous (Albian ~100 Ma) sedimentary package that consists predominantly of black carbonaceous and bituminous shale and minor siltstone, with limestone lenses and coquinites (mixed limestone and clays). The exploration target was defined based on 20 aircore drillholes situated within NQVP tenement EPM 26490, with the results from 14 holes being used for the calculation. Section by section geological and mineralization interpretation at a 0.12% V2O5 lower cut-off was conducted, and the shapes were block modelled and estimated for V2O5. The mineralisation solid was intersected by a total of 14 drill holes, which have been sampled by 1m samples in their entirety. The mineralization solids contain a total of 150 sampled intervals representing 150m of sample drillhole chips. For the conceptual estimate, the range of elemental V2O5 is provided by multiplying the mean volume, density and vanadium concentration of the Runnymede area Exploration Target by +/- 20%.

The Runnymede Exploration Target is situated 25km north-west of the Company's flagship Cambridge Deposit. The Cambridge Deposit is hosted within the Toolebuc Formation, which is reported to be flat-lying and occurring from 1m below the surface.

Velox has undertaken drilling at the Cambridge Deposit, however has not yet completed any drilling at the Runnymede Exploration Target area. In preparation of the calculation of the Exploration Target, Mr. Nicholls reviewed Intermin Resources Ltd.'s annual technical report and drillhole database. The AC samples were submitted to SGS in Townsville, Queensland, for preparation and shipped to SGS in Perth, Western Australia for analysis. Analysis comprised ICPMS for Ag (ppm) and Mo (ppm), and using ICP Optical Emission Spectrometry for Al (%), Ca (%), Cu (ppm), Mn (ppm), Na (%),P (ppm), S (ppm),Ti (%), V (ppm), and Zn (ppm).

NQVP Resources and Exploration Target Summary

Cambridge Deposit3

Table 2 - Cambridge Mineral Resource Estimate for the NQVP at 0.25 % Vanadium Cut-Off Grade

Cut-Off | Classification | Ore Tonnes (Mt) | V2O5 | V2O5 | MoO3 | MoO3 (ppm) |

0.25 | Indicated | 61.33 | 210,300 | 0.34 | 14,600 | 234.6 |

Inferred | 144.87 | 483,400 | 0.33 | 35,500 | 241.9 |

Notes:

- Indicated and Inferred Mineral Resources are not Mineral Reserves. Mineral resources which are not mineral reserves do not have demonstrated economic viability. There has been insufficient exploration to define the inferred resources tabulated above as an indicated or measured mineral resource, however, it is reasonably expected that the majority of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. There is no guarantee that any part of the mineral resources discussed herein will be converted into a mineral reserve in the future. The estimate of mineral resources may be materially affected by environmental, permitting, legal, marketing or other relevant issues. The mineral resources have been classified according to the Canadian Institute of Mining (CIM) Definition Standards for Mineral Resources and Mineral Reserves (May 2014) and CIM Estimation of Mineral Resources & Mineral Reserves Best Practices Guidelines (2019).

- The Mineral Resource Estimate is constrained in an LG pit optimization utilizing V2O5 at $USD 7.5/lb, Mining at $AUD 2.86/tonne, Processing and G&A at $AUD 7.86/tonne, pit slopes at 35o.

- Differences may occur in totals due to rounding.

- Tonnage estimates are based on a bulk density of 1.8 g/cm3.

Mr. Mike Dufresne, P.Geol., P.Geo. and Mr. Steven Nicholls, M.AIG of APEX Geoscience Ltd. ("APEX"), who are deemed a qualified person as defined by NI 43-101 is responsible for the completion of the updated mineral resource estimation.

Flinders River Exploration Target4

Table 3 - Flinders River Exploration Target*** Tonnes and Grades

Volume (m3) | Tonnes | V2O5 (%) | MoO3 (ppm) | |||||

Minimum | Maximum | Minimum | Maximum | Minimum | Maximum | Cut-off | Minimum | Maximum |

78,990,000 | 118,480,000 | 142,170,000 | 213,260,000 | 0.22 | 0.33 | 0.12 | 192 | 288 |

*The potential quantity and grade presented represent an Exploration Target and are conceptual in nature. There has been insufficient exploration to define a mineral resource at Flinders River and it is uncertain if future exploration will result in a target being delineated as a mineral resource. The Target has not been evaluated for reasonable prospects for future economic extraction. Metallurgical work is ongoing and future drill programs are planned for the NQVP.

** For the conceptual estimate, the range of elemental V2O5 is provided by multiplying the mean volume, density and vanadium concentration of the Flinders River Exploration Target by +/- 20%.

***Molybdenum was treated as a by-product of Vanadium.

****Volume and Tonnes have been rounded to the nearest 10,000 and grade rounded to two decimal places.

1 TSX-V Currie Rose Completes Drilling Program and Commences Environmental Studies at the North Queensland Vanadium Project in Australia, 27th September 2023

2 Intermin Resources - Annual Report EPM15869 Dec 2006 to Dec 2007

3 TSX-V - Currie Rose Announces Updated Mineral Resource Estimate at its North Queensland Vanadium Project 1 November 2022

4 TSX-V - Flinders River-Exploration Target-13-3-23

About Velox Energy Materials

Velox Energy Materials is a publicly traded energy materials company developing and progressing high-value assets in resource and research-friendly jurisdictions. The Company's priority focus is the advanced NQV Project in Queensland, Australia. The NQV Project hosts the Cambridge Deposit with a CIM compliant Indicated Mineral Resource of 61.33 Mt @ 0.34% V2O5 and 234.6 ppm MoO3 along with an Inferred Mineral Resource of 144.87 Mt @ 0.33% V2O5 (cut-off grade of 0.25% V2O5) and 241.9 ppm MoO3 (Dufresne et al., 2022). The Company is targeting shallow, high-grade mineralization that can be developed using low-cost mining and processing options.

The Company additionally owns Kotai Energy and the option to acquire 100% of the intellectual property rights associated with the Solid-State Hydrogen Storage Project from Curtin University in Western Australia. Kotai is focused on the commercialisation of technology that can produce high-pressure hydrogen following transport as an inert powder.

In October 2023, the Company acquired a package of tenements that are prospective for lithium in eastern Quebec.

The Indicated Resource of 61.33 Mt @ 0.34% V2O5 and an Inferred Resource of 144.87 Mt @ 0.33% V2O5 for the Cambridge Deposit was announced in November 2022 (see Currie Rose news release dated November 1, 2022 and the Technical Report by Dufresne et al., 2022).

Please visit our website at www.veloxenergymaterials.com.au for further information.

Approved by the Board of Velox Energy Materials Inc.

Simon Coyle

President & CEO

+1 416-214-7577

Investor Relations Contact

Andrew Rowell

Investor Relations - Australia

M: +61 400 466 226

Email: andrew@whitenoisecomms.com

Qualified Persons

The technical content of this news release has been reviewed and approved by Michael Dufresne, M.Sc., P.Geol., P.Geo., and Steven Nicholls, BA.Sc., M. AIG., both qualified persons as defined by National Instrument 43-101. Mr. Nicholls conducted the most recent property visit in October 2023, compiled the mineralized domains for the mineral resource estimation of the Cambridge Deposit, and calculated the Runnymede area Exploration Target.

Forward Looking Statements

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements that are based on the Company's expectations, estimates and projections regarding its business and the economic environment in which it operates. Statements about the closing of the transaction, expected terms of the transaction, the number of securities of Velox Energy Materials that may be issued in connection with the transaction, and the parties' ability to satisfy closing conditions and receive necessary approvals are all forward-looking information. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. Therefore, actual outcomes and results may differ materially from those expressed in these forward-looking statements and readers should not place undue reliance on such statements. Statements speak only as of the date on which they are made, and the Company undertakes no obligation to update them publicly to reflect new information or the occurrence of future events or circumstances, unless otherwise required to do so by law.

SOURCE: Velox Energy Materials Inc.

View the original press release on accesswire.com