MILPITAS, Calif., May 14, 2024 /PRNewswire/ -- The global semiconductor manufacturing industry in the first quarter of 2024 showed signs of improvement with an uptick in electronic sales, stabilizing inventories and an increase in installed wafer fab capacity, SEMI announced today in its Q1 2024 publication of the Semiconductor Manufacturing Monitor (SMM) Report, prepared in partnership with TechInsights. Stronger industry growth is expected in the second half of the year.

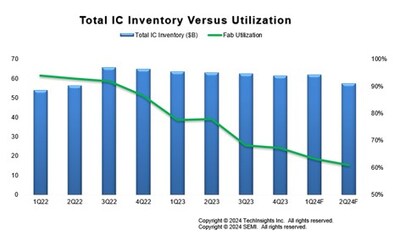

In Q1 2024, electronic sales rose 1% year-over-year (YoY), with Q2 2024 forecast to register a 5% YoY increase. IC sales posted robust 22% YoY growth in Q1 2024 and are expected to surge 21% in Q2 2024 as shipments of high-performance computing (HPC) chips increase and memory pricing continues to improve. IC inventory levels stabilized in Q1 2024 and are expected to improve this quarter.

Installed wafer fab capacity continues to increase and is projected to exceed 40 million wafers per quarter (in 300mm wafer equivalent), rising 1.2% in Q1 2024 with an expected 1.4% uptick in Q2 2024. China continues to log the highest capacity growth among all regions. However, fab utilization rates, particularly for mature nodes, remain a concern with little signs of recovery expected in the first half of 2024. Memory utilization rates were lower than expected in Q1 2024 due to disciplined supply control.

In line with fab utilization trends, semiconductor capital expenditures remain conservative. After falling 17% YoY in Q4 2023, capital expenditures continued to pull back 11% in Q1 2024 before eking out an expected 0.7% gain in Q2 2024. Sequentially in Q2 2024, the trend is turning positive with an expected 8% increase in memory-related capital expenditures as they see slightly stronger growth than non-memory segments.

"Demand in some semiconductor segments is recovering, but the pace of recovery is uneven," said Clark Tseng, Senior Director of Market Intelligence at SEMI. "AI chips and high-bandwidth memory are currently among devices in the highest demand, leading to increased investment and capacity expansion in these areas. However, the impact of AI chips on IC shipment growth remains limited due to their reliance on a small number of key suppliers."

"Semiconductor demand in the first half of 2024 is mixed, with memory and logic rebounding due to surging generative AI demand," said Boris Metodiev, Director of Market Analysis at TechInsights. "However, analog, discrete, and optoelectronics have experienced a slight correction due to the slow recovery of the consumer market coupled with a pullback in demand from the automotive and industrial markets."

"A full-on recovery is likely to take hold in the second half of the year with the projected boost in consumer demand by AI's expansion to the edge," Metodiev said. "Additionally, the automotive and industrial markets are expected to return to growth in the latter part of the year as interest rates fall - providing consumers more purchasing power - and inventory declines."

The Semiconductor Manufacturing Monitor (SMM) report provides end-to-end data on the worldwide semiconductor manufacturing industry. The report highlights key trends based on industry indicators including capital equipment, fab capacity, and semiconductor and electronics sales, and includes a capital equipment market forecast. The SMM report also contains two years of quarterly data and a one-quarter outlook for the semiconductor manufacturing supply chain including leading IDM, fabless, foundry, and OSAT companies. An SMM subscription includes quarterly reports.

Download a sample Semiconductor Manufacturing Monitor report.

For more information on the report or to subscribe, please contact the SEMI Market Intelligence Team at mktstats@semi.org. Details on SEMI market data are available at SEMI Market Data.

About SEMI

SEMI® is the global industry association connecting over 3,000 member companies and 1.5 million professionals worldwide across the semiconductor and electronics design and manufacturing supply chain. We accelerate member collaboration on solutions to top industry challenges through Advocacy, Workforce Development, Sustainability, Supply Chain Management and other programs. Our SEMICON® expositions and events, technology communities, standards and market intelligence help advance our members' business growth and innovations in design, devices, equipment, materials, services and software, enabling smarter, faster, more secure electronics. Visit www.semi.org, contact a regional office, and connect with SEMI on LinkedIn and X to learn more.

Association Contact

Michael Hall/SEMI

Phone: 1.408.943.7988

Email: mhall@semi.org

Photo - https://mma.prnewswire.com/media/2410305/IC_Sales.jpg

Photo - https://mma.prnewswire.com/media/2410306/Total_IC_Inventory_Versus_Utilization.jpg

Logo - https://mma.prnewswire.com/media/469944/Semi_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/key-measures-of-global-semiconductor-manufacturing-industry-strength-improve-in-q1-2024-semi-reports-302143250.html

View original content:https://www.prnewswire.co.uk/news-releases/key-measures-of-global-semiconductor-manufacturing-industry-strength-improve-in-q1-2024-semi-reports-302143250.html