VANCOUVER, BC / ACCESSWIRE / May 15, 2024 / Alta Copper Corp. (TSX:ATCU)(OTCQX:ATCUF)(BVL:ATCU) ("Alta Copper" or "the Company") is pleased to announce attractive economics results from the 2024 Optimized Preliminary Economic Assessment ("2024 PEA") at its 100% owned Cañariaco Project ("Cañariaco" or the "Project"), a world class porphyry copper project, located 700 km northwest of Lima. The 2024 PEA has been prepared by Ausenco Engineering Canada ULC ("Ausenco"), AGP Mining Consultants Inc. ("AGP") and Whittle Consulting Pty. Ltd., ("Whittle"), respectively leading international engineering and mining consultancy firms.

All values contained in this press release are reported in US dollars.

Cañariaco 2024 PEA Highlights

- Robust Economics: Cañariaco 2024 PEA using 8% discount factor and three year trailing average metal prices of US$4.00/pound (lb) copper (Cu), US$1,850/ounce (oz) gold (Au) and US$23.00/ounce (oz) silver (Ag):

- Base-case Pre-tax Net Present Value ("NPV8%") of US$4.1 billion and IRR of 32.4%

- Base-case After-tax NPV8% of US$2.3 billion and Internal Rate of Return ("IRR") of 24.1%

- Significant Upside to Higher Metal Prices - At US$4.50/lb Cu After-tax NPV8% of US$3.2 billion and IRR of 28.9% (See Table 1)

- Highly Leveraged to Copper Price: For every US$0.25/lb Cu increase above US$$4.00 Cu approximately US$425 Million is added to the After-Tax NPV8%

- Life-of mine ("LOM") metal production of 8,026M lb (3,642M tonnes) Cu, 1.67 million oz Au, and 33.2 million oz Ag

- Average annual metal production (Year 1 to 10) of 347M lb (158k tonnes) Cu; 70K oz Au; 1.5 million oz Ag

- Average annual metal production LOM of 294M lb (134K tonnes) Cu; 61K oz Au; 1.2 million oz Ag

- After-tax Average Annual Free Cash Flow (Year 1-10) from Start of Operation: US$538 million

- After-tax Average Annual Free Cash Flow LOM from Start of Operation: US$383 million

- C-1 cost of $1.86/lb copper (net of by-products)

- Total average operating cost of $11.21 per tonne processed

- All In Costs ("AISC") of $1.96/lb copper

- Pre-production capital cost of $2.2 billion based on leased mining equipment and including a contingency allocation of 21% on initial project capital

- Rapid After-tax payback period of 3.1 years from initial production with a 27 year mine life

- One of the lowest capital intensities when compared to other current global copper development projects

The 2024 PEA is preliminary in nature. Current published resources for both of the Cañariaco Norte and Cañariaco Sur deposits (previously reported in News Release dated January 28, 2022) includes Inferred Mineral Resources along with a significant percentage of Measured and Indicated Resources. Inferred Mineral Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves and there is no certainty that the 2024 PEA will be realized. Mineral resources that are not mineral reserves have not demonstrated economic viability.

An independent technical report for the 2024 PEA,prepared in accordance with NI 43-101,will be available under the Company's SEDAR+ profile and website on or before June 7, 2024.

For readers to fully understand the information in this news release, they should read the technical report in its entirety when it is available, including all qualifications, assumptions, exclusions and risks. The technical report is intended to be read in its entirety and sections should not be read or relied upon out of context.

An updated Corporate Presentation will be available on the Company's website at www.altacopper.com

Giulio T. Bonifacio, Executive Chair, commented "We are extremely pleased with our 2024 PEA which is well advanced as we have clearly benefited from several previous engineering studies and a wealth of experience from our external international engineering firms. This PEA will prove of great value as we advance Alta Copper to the next stage. The PEA shows that Cañariaco is clearly a Tier 1 asset that provides a long-life, large-scale copper project producing annual average copper of 158,000 tonnes per year in the first 10 years. The Cañariaco project is economically robust with considerable leverage to increasing copper prices while also possessing considerable upside through resource expansion drilling with numerous high priority drill targets identified to date at Norte, Sur and the undrilled Quebrada Verde porphyry target".

Table 1 - Summary of Economic Results

AFTER-TAX (US$M, Unless Otherwise Stated) | |||||||||

Cu Price (US$/lb) | 3.50 | 3.85 | 4.00 | 4.50 | 5.00 | ||||

Undiscounted After-Tax Cash Flow (LOM) | 5,887 | 7,572 | 8,293 | 10,677 | 13,055 | ||||

Net Present Value (8%) | 1,450 | 2,054 | 2,312 | 3,163 | 4,011 | ||||

IRR (%) | 18.7 | 22.5 | 24.1 | 28.9 | 33.4 | ||||

Average Annual Revenue (US$M) | 1,118 | 1,217 | 1,259 | 1,401 | 1,542 | ||||

Average Annual EBITA | 463 | 561 | 604 | 744 | 885 | ||||

Average Annual Free Cash Flow (Note 3) | 295 | 356 | 383 | 470 | 557 | ||||

Average Annual Free Cash Flow (Year 1-10) (Note 3) | 437 | 508 | 538 | 638 | 739 | ||||

Payback Period (Note 3) | 3.7 | 3.2 | 3.1 | 2.6 | 2.3 | ||||

PRE-TAX (US$M, Unless Otherwise Stated) | |||||||||

Undiscounted Pre-Tax Cash Flow (LOM) | 9,746 | 12,433 | 13,585 | 17,424 | 21,264 | ||||

Net Present Value (8%) | 2,735 | 3,701 | 4,115 | 5,496 | 6,876 | ||||

IRR (%) | 25.3 | 30.3 | 32.4 | 39.0 | 45.1 | ||||

Mill Throughput | 120,000 tpd | ||||||||

Average Annual Cu Production (Year 1 to 10) | 347 million lbs Cu | 158K tonne Cu | ||||||||

Average Annual Cu Production (LOM) | 294 million lbs Cu | 134K tonne Cu | ||||||||

C-1 Cash Costs (net of by-products) $/lb | 1.86 | ||||||||

AISC (Note 5) $/lb | 1.96 | ||||||||

Strip Ratio (Waste to Ore) | 1.33 to 1 | ||||||||

Initial Mine Life (Years) | 27 | ||||||||

Initial Project Capital | 2,160 | ||||||||

Sustaining Capital | 526 | ||||||||

Closure Cost | 216 | ||||||||

Notes

(1) Copper contributes 88% of the net revenue with the balance of 12% from gold silver credits in copper concentrate.

(2) For this analysis Gold is US$1,850/oz and Sliver is US$23/oz and remain constant with only the Copper price changing.

(3) From Commencement of Operations.

(4) Cash Costs consist of mining, processing, site G&A, off-site treatment and refining, transport, and royalties net of by-product credits (Au & Ag).

(5) AISC consists of Cash Costs plus sustaining capital and closure costs.

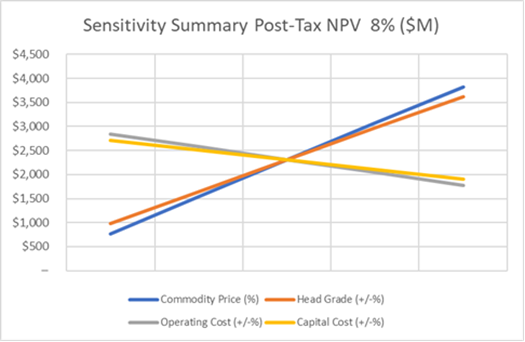

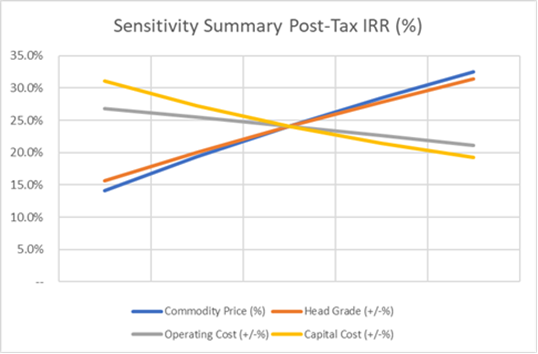

NPV Sensitivities

The sensitivity analysis provides a range of outcomes for the Project when the key parameters vary from their base-case values. The NPV estimate is most sensitive to changes of metal prices, resource grade, overall operating costs and capital costs as illustrated in Figure 1 and 2.

The After-tax NPV ranges from US$2,054 billion to US$4,011 billion as the applied Copper price varies from US$3.85/lb Cu to $5.00/lb Cu.

Figure 1 - Sensitivity Summary Post - Tax NPV 8% ($M)

Figure 2 - Sensitivity Summary Post - Tax IRR (%)

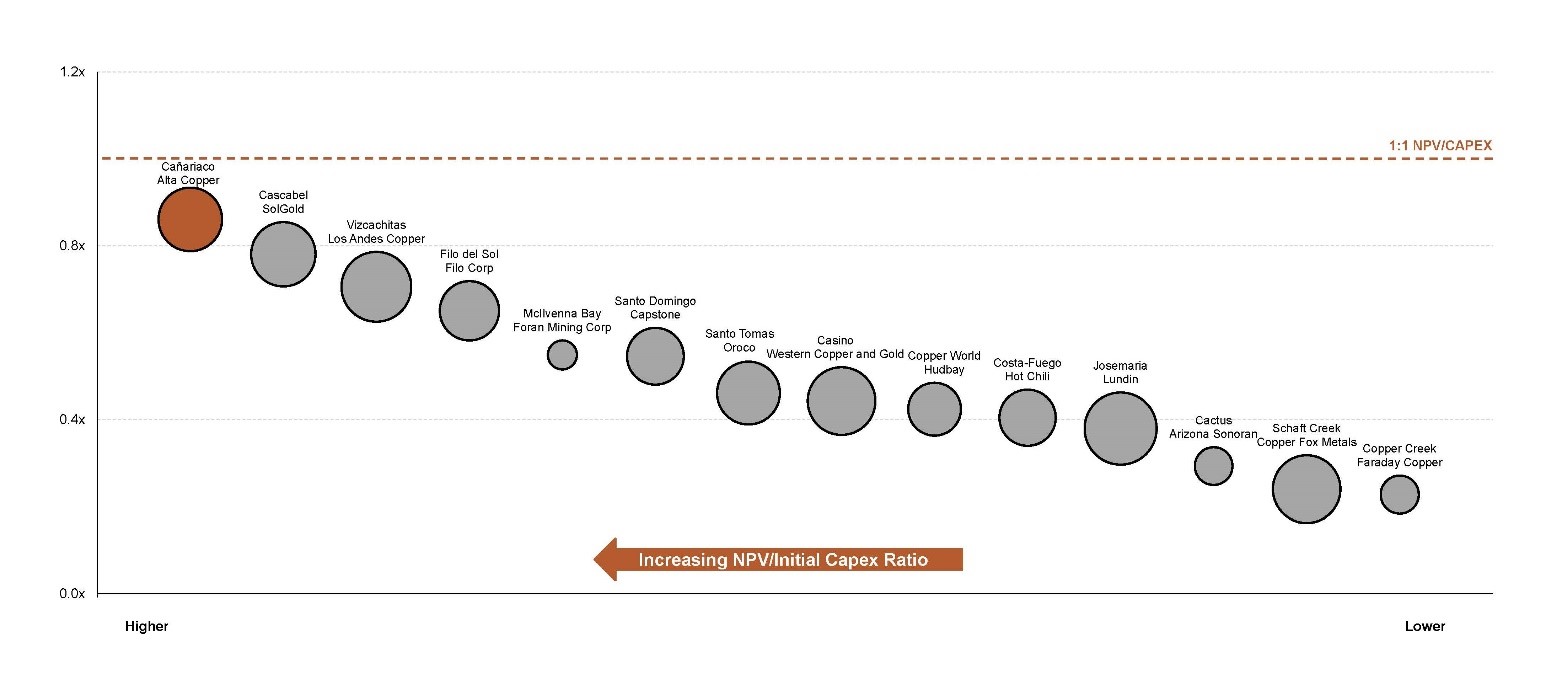

Figure 3 - Cañariaco displays strong economics, generating NPV for lower capital compared to its peers

(After-Tax NPV 8% / Total Capex (US$M) | Bubble size based on annual production)

Source/Notes: FactSet. Technical reports

(1) Copper equivalent production calculated using stated metal prices from each project's latest technical report

Table 2 - Detailed Results

METRIC | Unit of Measure | Year 1-10 | LOM | |

Plant Feed Grade | ||||

Cu | % | 0.41 | 0.35 | |

Au | g/t | 0.08 | 0.07 | |

Ag | g/t | 1.86 | 1.59 | |

Cu Equivalent | % | 0.48 | 0.41 | |

Metal Production | ||||

Cu | Mlb | 3,469 | 8,026 | |

Au | koz | 696 | 1,674 | |

Ag | Koz | 14,978 | 33,219 | |

Average Process Recovery | ||||

Cu | % | 89.2 | 88.2 | |

Au | % | 66.4 | 63.3 | |

Ag | % | 58.5 | 55.3 | |

Physicals | ||||

Total in-situ rock | Kt | 1,040,399 | 2,739,133 | |

Waste rock | Kt | 588,138 | 1,562,925 | |

Plant Feed (all grades) | Kt | 452,262 | 1,176,207 | |

Strip Ratio | w:o | 1.30 | 1.33 | |

Average Annual Production | ||||

Copper | Ktpa | 158 | 134 |

Project Description

The Cañariaco Project is situated within the Province of Ferreñafe, in the Department of Lambayeque, in northwestern Peru, approximately 700 km northwest of Lima, the capital of Peru, and approximately 102 km northeast of the city of Chiclayo. Current access from Chiclayo to the Cañariaco Project is 150 km along a paved road followed by secondary gravel roads.

The project area covers moderate elevations ranging from 2,200 to 3,600 metres ("m") above sea level. The copper deposits are situated on the eastern side of the continental divide and infrastructure will be on the top as well as both western and eastern sides of the divide. The topography varies from steep incised valleys at lower elevations to open grassy highlands at upper elevations. There is sufficient suitable land available within the concessions and close to the mining areas for the process plant, ancillary infrastructure and comingled waste rock and dry stack tailings facility.

The 2024 PEA contemplates that Cañariaco would be mined using conventional open pit mining equipment followed by crushing, SAG/ball mill grinding and flotation recovery of copper, gold and silver to a copper concentrate.

Cañariaco is estimated to have relatively low project capital and operating costs due to proximity to infrastructure and favourable natural setting with key features as follows:

- Large scale mining and processing operation to process 120,000 tpd/43.8 million tpa with a currently planned 27 year mine life;

- Conventional drill and blast mining, large scale electric shovels and haul trucks;

- Conventional crushing, SAG and ball mill grinding followed by flotation recovery of copper, gold and silver to a copper concentrate;

- Application of best practice process tailings management through comingled waste rock and filtered dry stack tailings storage;

- Water resources available in project area exceed project requirements;

- Low Strip Ratio life of mine of 1.33:1;

- Power supply from existing Northern Peru power grid with connection point only 57 kms from the project; and

- Project site located only 24 kms from existing paved highway connecting to the Pan American Highway on the west coast.

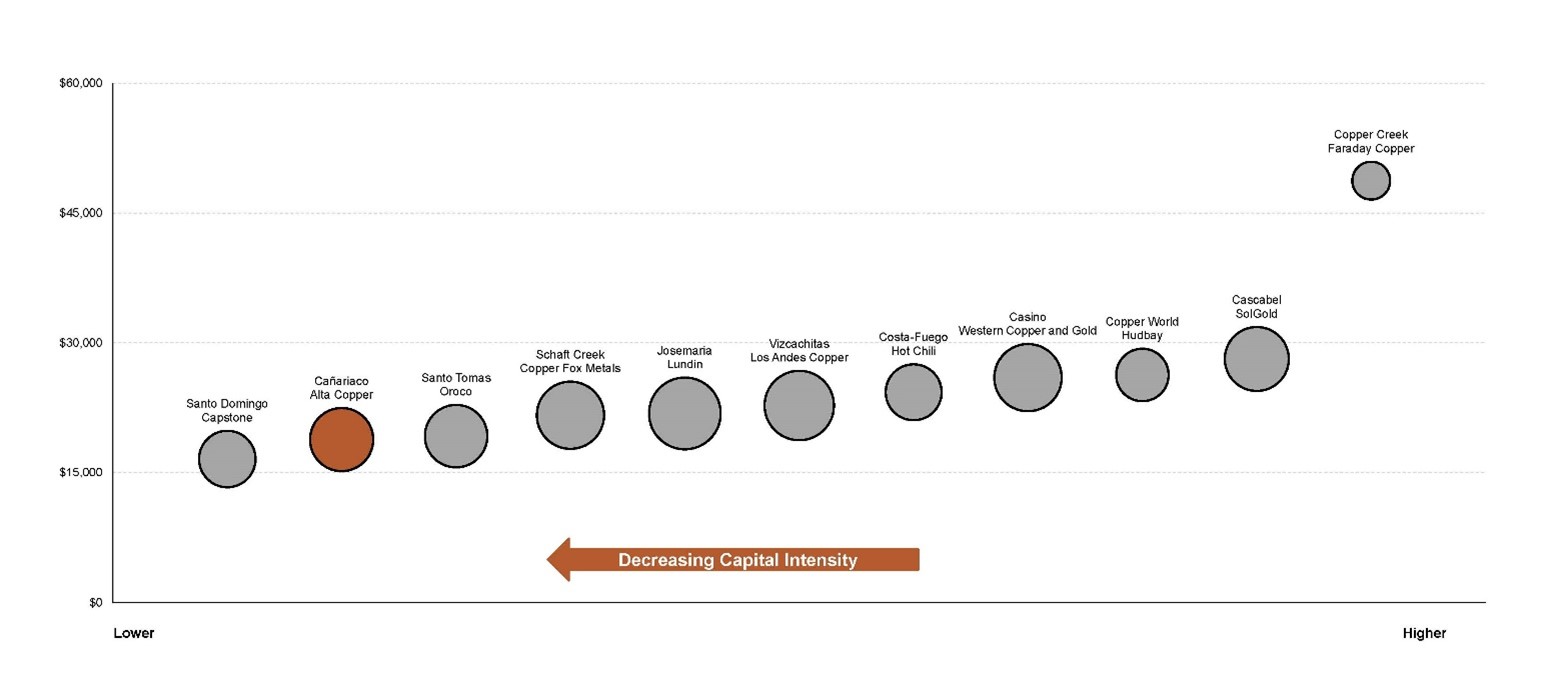

Low Capital Cost Intensity

Importantly, the Cañariaco project has low capital intensity when compared to several other global copper projects currently in the development stage. Key project attributes that reduce the capital cost include the following:

- The mineralized material from Cañariaco Norte and Sur deposits are moderately competent with Axb of 53, and moderately soft rock with an average BWI 12.2 kWh/tonne, which enables high throughput utilizing a single comminution line consisting of one primary crusher, one large SAG mill and two ball mills whereas many projects with comparable throughput require two SAG mills and four ball mills;

- The region receives significant annual rainfall and adequate fresh water is available at site eliminating the need for a desalination plant and pipeline from the coast;

- Relatively close proximity to the national power grid reduces the capital intensity of power supply infrastructure;

- Close proximity to an existing major transportation highway reduces access road construction cost and time;

- Utilization of trucks to transport concentrate along existing highways to the loadout port eliminates the requirement for a concentrate pipeline;

- The project site is in a sparsely populated area and there is no requirement for community relocation; and

- Concentrate loadout through an existing port on the west coast of Peru eliminates need to construct a new loadout facility.

Figure 4 - Cañariaco possesses a strong production profile with low capital intensity (based on average annual copper equivalent production (1)

(Capital Intensity (US$/t) | Bubble size based on annual production)

Source/Notes: Technical reports. Capital intensity equals total capex divided by average annual copper equivalent production. | (1) Copper equivalent production calculated using stated metal prices from each project's latest technical report.

Sustainable and Responsible Mining

The project development concept has utilized best practice technologies and will benefit from several existing external factors which will assist in making Cañariaco a very responsible, desirable and sustainable project.

The application of filtered dry stack tailings combined with comingled waste rock storage maximizes the recycling of process water and significantly reduces freshwater requirements. In addition, this technology eliminates the need for wet tailings storage and a major tailing retainment structure and reduces associated seismic risk.

Electrical power in Northern Peru is generated predominantly by hydro which is the preferred power source from ecological and carbon emissions perspectives.

Electric powered overland belt conveyors, rather than haul trucks, will transport most of the mill feed and waste rock from the mining areas to the plant as well as the comingled waste and dry stack tailings facility thereby reducing fuel consumption and CO2 emissions.

The project is located in a sparsely populated region and at elevations above major agricultural zones.

Capital, Sustaining and Operating Costs

The initial capital, expensed over the first four years of the Project, amounts to $2.2 billion. The sustaining capital over the remainder of LOM amounts to $526 million. Closure costs are estimated at $216 million. The project financial model incorporates a lease strategy for the purchase of the initial mining equipment whereby 20% of the mining fleet cost is capitalized and the remainder is carried as operating cost. Sustaining costs include construction of a crusher at the Sur deposit and related conveyor system to connect with the primary overland conveyor in year 16 prior to the start of mining operations at Sur.

A breakdown of capital cost is presented in the table 3 below:

Table 3 - Capital Cost Summary

Cost Area | Initial Capital | Sustaining | Total | |

Mine | 429 | 193 | 622 | |

Process Plant | 789 | 25 | 814 | |

Site Services and Utilities | 106 | - | 106 | |

Internal Infrastructure | 151 | 216 | 367 | |

External Infrastructure | 42 | - | 42 | |

Total Directs | 1,517 | 434 | 1,951 | |

Common Construction Facilities and Services | 245 | 14 | 259 | |

Owner's Cost | 30 | - | 30 | |

Total Indirects | 275 | 14 | 289 | |

Total Directs and Indirects | 1,792 | - | 1,792 | |

Contingency @ 20.5% | 368 | 78 | 446 | |

TOTAL | 2,160 | 526 | 2,686 | |

Table 4 - Life of Mine Operating Costs Summary

Area | Unit | US$ | Unit | US$ /lb Cu |

On-site Costs | ||||

Mining | $/t milled | 5.68 | lb Cu | 0.83 |

Processing | $/t milled | 4.97 | lb Cu | 0.73 |

Co-mingle Tailings | $/t milled | 0.11 | lb Cu | 0.01 |

General & Administration | $/t milled | 0.45 | lb Cu | 0.07 |

Sub-total Site Costs | $/t milled | 11.21 | lb Cu | 1.64 |

Off-site Costs | ||||

Concentrate Transport | $/t dry concentrate | 172.5 | lb Cu | 0.30 |

Smelting & Refining | $/t dry concentrate | 155.1 | lb Cu | 0.27 |

Sub-total Off-site Costs | $/t dry concentrate | 327.6 | lb Cu | 0.57 |

| Total Cost On/Off Site | lb Cu | 2.21 | ||

Credits (Gold, Silver) | lb Cu | (0.35) | ||

Total Cost | lb Cu | 1.86 | ||

Cost Area | Life-of-Mine Cost (US$M) | Unit Cost (US$/t milled) |

|---|---|---|

Mining | 6,685 | 5.68 |

Process | 5,847 | 4.97 |

Co-Mingle Facility | 116 | 0.11 |

G&A | 532 | 0.45 |

Total | 13,180 | 11.21 |

Social &Environmental

Alta Copper has been active in the Cañariaco area since 2004 and since that time has developed and established a wide range of relationships with a corporate policy of respect, shared involvement and value, mutual benefit and transparency. Communications with the local communities and public authorities at all levels continues to ensure that key stakeholders are aware of the Cañariaco project status and plans, and that the Company responds to community concerns and requests.

Mining

The 2024 PEAis based on open pit mining methods with conventional drilling,blasting and material loading with large electric shovels for excavation and haulage to the primary crusher using large capacity haul trucks. Independent and dedicated high-capacity electric conveyor systems will transport plant feed from the primary crusher to the process plant and waste to the comingled waste and dry stack tailings facility.

Over the life of the Cañariaco mine, two separate deposits: Cañariaco Norte ("Norte") and Cañariaco Sur ("Sur") will be mined in separate pits, with the bulk of the plant feed coming from Norte. Mining will commence in the Norte pit which will provide 100% of the process plant feed until year 16 at which point mining operations will commence at Sur. Years 17 through 25 will see mining taking place in both Norte and Sur with variable mining rates while maintaining total annual production of 43.8 million tonnes. From year 26 through end of mine life all mining will take place in Sur.

The Cañariaco open pit mining operations will have a mine life of 27 years, operating 365 days a year with a life of mine strip ratio of 1.33:1 (including pre-stripping). The mine production plan is based on mining a total of 2.72 billion tonnes of material, comprised of 1.176 billion tonnes of plant feed and 1.548 billion tonnes of waste rock over the life of the mine. Mining operations will supply the process plant at 120,000 tonnes per day or 43.8 million tonnes per annum. During the life of mine operation, annual cash-flow will vary due to annual and forecast variations in head grade, strip ratio and metal recoveries.

The major mining equipment fleet will include nine (9) blast hole drills, five (5) 38 m3 electric shovels, two (2) 33 m3 front end loaders and thirty-eight (38) 290 tonne capacity haul trucks. A fleet of smaller loaders and trucks will be utilized for early mine access development and initial pre-stripping. Electric shovel major maintenance and mobile equipment replacement are carried in the mining costs. The moderate altitude of the Project avoids the need for de-rating of mine haul truck drive systems.

Whittle Consulting's Mine Plan Optimization

A key part of the mining plan development for this 2024 PEA included comprehensive mine plan optimization analysis by Whittle. This analysis includes a very detailed assessment of metal grades, metal prices, metal recoveries, mining and processing costs throughout the deposit, and by applying advanced computational analysis, including by the use of Whittle's proprietary Prober-E software, develops an optimized mining plan to maximize the net economic value of the mining operation. A key aspect of this mine planning strategy is that it brings forward cash flow and optimizes the net present value of the deposit. This approach involves advanced pit phasing techniques and takes advantage of variable mining cutoff grades, plant feed stockpiling and blending strategies during the life of the mine plan.

Metallurgy and Processing

The Cañariaco project comprises two copper-gold-silver porphyry deposits where the main copper species are primarily sulphides, predominantly chalcopyrite with lesser amounts of bornite and chalcocite. The Sur deposit also contains molybdenum however the levels did not warrant recovery for this 2024 PEA. Extensive metallurgical testwork programs on samples from Norte have been completed over previous years, providing an extensive metallurgical database for Norte. Resource development at Sur is at a much earlier stage than Norte and accordingly the metallurgical testwork completed for Sur is preliminary. However, the testwork results received to date from Sur are very good and comparable to the results for Norte confirming the amenability of conventional flotation recovery for both Norte and Sur.

The key metallurgical design parameters applied for process design in the 2024 PEA are as follows:

- Mineralized material competency/hardness: Drop Weight Test Parameter Axb 53 (75th percentile), Bond Ball Mill Work Index 12.2 kWh/tonne (75th percentile), moderately competent and moderately soft

- Grind size P80 for flotation feed: 200 microns

- Metallurgical recoveries (life of mine): Copper 88.2 %, Gold 63%, Silver 53%

- Copper concentrate: 26% Copper, 3.7 g/t Gold, 74 g/t Silver.

Mine haul trucks will transport plant feed material to the crushing station where they will dump the material directly into a large gyratory crusher. From the crusher, plant feed material will be conveyed to a live stockpile ahead of the grinding circuit. Plant feed will be drawn from the stockpile and fed to a single 12.8 m diameter by 8.2 m EGL (Effective Grinding Length) SAG mill. SAG mill discharge will be screened to remove oversize pebbles which will be crushed in pebble crushers and returned to the SAG mill feed. SAG mill screen undersize product will be fed to two parallel 8.5 m diameter by 11.4 m EGL ball mills operating in closed circuit with cyclones to produce floatation feed at 80% minus 200 microns. The floatation circuit will comprise of rougher and cleaner flotation stages, with rougher concentrate regrinding prior to cleaner flotation. Cleaner concentrate will be dewatered using a thickener and pressure filters, then conveyed to the concentrate storage building to await transportation to the port for loadout and shipping to offshore smelters.

Waste and Tailings Handling

The Cañariaco process flowsheet has included Comingled Dry Stack tailing technology for waste rock and tailings placement. This technology is considered as "Best Practice" and is seeing more application within the global mining industry. The technology offers three key benefits:

- increases process water reclaim and recycling;

- eliminates the requirement for wet tailings containment dams and eliminates related seismic risk,

- reduces the size of tailing containment system footprint. Dry stack tailings treatment utilizes pressure filters to dewater process tailings to low moisture content with recovered water recycled to the process. The dry tailings filter cake produced are transported by belt conveyor to the tailings management facility where they can be placed or "stacked" with waste rock as a stable pile within the tailings facility. Combining the dry tailings sands with waste rock within the same pile enhances the overall stability of the pile and eliminates the need for two separate facilities.

Qualified Persons and NI 43-101 Technical Report

The 2024 PEA summarized here for the Cañariaco project was completed by Ausenco Engineering Canada ULC, of Vancouver British Columbia, with mining aspects completed by AGP Mining Consultants Inc.

The findings of the 2024 PEA will be disclosed in a NI 43-101 Technical Report which will be completed and available on SEDAR+ and Alta Copper's website on or before June 7, 2024.

The qualified persons for the 2024 PEA and this News Release are identified below:

Mr. Gordon Zurowski, P.Eng. Principal Mining Engineer at AGP Mining Consultants Inc.and an independent Qualified Person as set forth by NI 43-101, is responsible for mine design and mine capital and operating costs. Mr. Zurowski has reviewed the news release against the technical report.

Mr. Kevin Murray, P.Eng. Principal Process Engineer at Ausenco Engineering Canada ULC and an independent Qualified Person as set forth by NI 43-101, is responsible for the financial model as well as mineral processing and metallurgical resting, recovery methods, and process and infrastructure capital and operating costs. Mr. Murray has reviewed the news release against the technical report.

Mr. Scott Elfen, P.E., Global Lead Geotechnical and Civil Services at Ausenco Engineering Canada ULC and an independent Qualified Person as set forth by NI 43-101, is responsible for the waste management facility and associated capital and operating costs, and the site-wide water management design. Mr. Elfen has reviewed the news release against the technical report.

Mr. James Millard, P.Geo., Director, Strategic Projects at Ausenco Sustainability ULC and an independent Qualified Person as set forth by NI 43-101, is responsible for environmental studies, permitting, and social and community impacts. Mr. Millard has reviewed the news release against the technical report.

Joanne Freeze, P.Geo., President, CEO and Director has reviewed and approved the contents of this release for Alta Copper Corp.

About Ausenco

Ausenco is a global company redefining what's possible. The team is based across 26 offices in 15 countries delivering services worldwide. Combining deep technical expertise with a 30-year track record, Ausenco delivers innovative, value-add consulting studies, project delivery, asset operations and maintenance solutions to the minerals and metals and industrial sectors (www.ausenco.com).

About Whittle

Australia-headquartered Whittle Consulting has a 25-year proven track record helping mining companies worldwide improve NPVs and sustainability for their operations and projects. It is comprised of a group of highly experienced industry experts, who have strong technical backgrounds in a range of disciplines including geology, mining engineering, metallurgy, research, mathematics and computing, finance, operational, financial modeling and analysis, sustainability, and a thorough appreciation of practical, organizational, and contextual reality. Whittle Consulting are comfortable with complexity, not being bound by conventional thinking, and by being willing to challenge existing paradigms and conventional wisdom which can conceal the real potential of mining businesses.

About Alta Copper

Alta Copper is focused on the development of its 100% owned Cañariaco advanced staged copper project. Cañariaco comprises 97 square km of highly prospective land located 102 km northeast of the City of Chiclayo, Peru, which includes the advanced stage Cañariaco Norte deposit, Cañariaco Sur deposit and Quebrada Verde prospect, all within a 4 km NE-SW trend in northern Peru's prolific mining district. Cañariaco is one of the largest copper deposits in the Americas not held by a major.

Cautionary Note Regarding Forward Looking Statements

This press release contains forward-looking information within the meaning of Canadian securities laws ("forward-looking statements"). Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, plans, postulate and similar expressions, or are those, which, by their nature, refer to future events. All statements that are not statements of historical fact are forward-looking statements. Forward-looking statements in this press release include, without limitation: the results of the 2024 PEA, including the projected CapEx, the estimated pre-tax and after-tax NPV and IRR, the estimated mine life and estimated concentrate grades; the potential production from and viability of the Cañariaco Project; the risks and opportunities outlined in the 2024 PEA; the potential tonnage, grades and content of deposits; the extent of mineral resource estimates; and estimated production and operating costs. These forward-looking statements are made as of the date of this press release. Although the Company believes the forward-looking statements in this press release are reasonable, it can give no assurance that the expectations and assumptions in such statements will prove to be correct. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements. Such factors and assumptions include, among others, variations in market conditions; the nature, quality and quantity of any mineral deposits that may be located; metal prices; other prices and costs; currency exchange rates; the Company's ability to obtain any necessary permits, consents or authorizations required for its activities; the Company's ability to access further funding and produce minerals from its properties successfully or profitably, to continue its projected growth, or to be fully able to implement its business strategies. In addition, there are known and unknown risk factors which could cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements.

Known risk factors include risks associated with exploration and project development; the need for additional financing; the calculation of mineral resources; operational risks associated with mining and mineral processing; fluctuations in metal prices; title matters; government regulation; obtaining and renewing necessary licenses and permits; environmental liability and insurance; reliance on key personnel; local community opposition; currency fluctuations; labour disputes; competition; dilution; the volatility of our common share price and volume; future sales of shares by existing shareholders; and other risk factors described in the Company's annual information form and other filings with Canadian securities regulators, which may be viewed at www.sedarplus.ca. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws.

Cautionary Note to US Investors

We advise U.S. investors that this news release uses terms defined in the 2014 edition of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) "CIM Definition Standards on Mineral Resources and Mineral Reserves", as incorporated by reference in Canadian National Instrument 43-101 "Standards of Disclosure for Mineral Projects", for reporting of mineral resource estimates. These Canadian standards, including NI 43-101, differ from the requirements of the United States Securities and Exchange Commission (SEC) as set forth in the mining disclosure rules under Regulation S-K 1300. Regulation S-K 1300 uses the same terminology for mineral resources, but the definitions are not identical to NI 43-101 and CIM Definition Standards. Regulation S-K 1300 uses the term "initial assessment" for an evaluation of potential project economics based on mineral resources. This study type has some similarities to a Preliminary Economic Assessment, but the definition and content requirements of an initial assessment are not identical to the definition and content requirements for a PEA under NI 43-101.

On behalf of the Board of Alta Copper Corp.

"Giulio T. Bonifacio", Executive Chair and Director

For further information please contact:

Giulio T. Bonifacio, Executive Chair and Director

gtbonifacio@altacopper.com

+1 604 318 6760

or

Joanne C. Freeze, President, CEO and Director

jfreeze@altacopper.com

+1 604 512 3359

Email: info@altacopper.com

Website: www.altacopper.com

Twitter: https://twitter.com/Alta_Copper

LinkedIn: https://www.linkedin.com/company/altacopper/

Facebook: https://www.facebook.com/AltaCopperCorp

Instagram: https://www.instagram.com/altacopper/

YouTube: https://www.youtube.com/@AltaCopper

SOURCE: Alta Copper Corp.

View the original press release on accesswire.com