- Significant porphyry copper mineralization over a 2.3 km by 650 m area is largely untested by drilling; gold-enriched skarn mineralization remains open along strike and down-dip in multiple horizons

- 2022 drill results of 1.87% copper and 1.04 g/t gold over 15.27 m from the Copper Castle skarn target and 0.22% copper over 114.38 m from the Hopkins North porphyry target

- Road-accessible and permitted for a large drill program; the Hopper Project lies 22 km north of the Otter Falls hydroelectric generator and only 320 km from the deep sea port of Haines, Alaska

VANCOUVER, BC / ACCESSWIRE / May 16, 2024 / Strategic Metals Ltd. (TSXV:SMD) ("Strategic") reports that it has terminated the Option Agreement (the "Agreement") on the Hopper copper-gold project ("Hopper" or the "Project") with Alpha Copper Corp. (CSE:ALCU). Upon termination, Strategic regains full ownership of the Project, without any underlying royalty interest.

The Project consists of 365 mineral claims covering a 74 km2 area in southern Yukon, within the Traditional Territory of the Champagne and Aishihik First Nations. Exploration targets at Hopper, which covers a copper-gold porphyry and skarn system, are fully permitted and accessible via a network of roads and trails.

Hopper Highlights

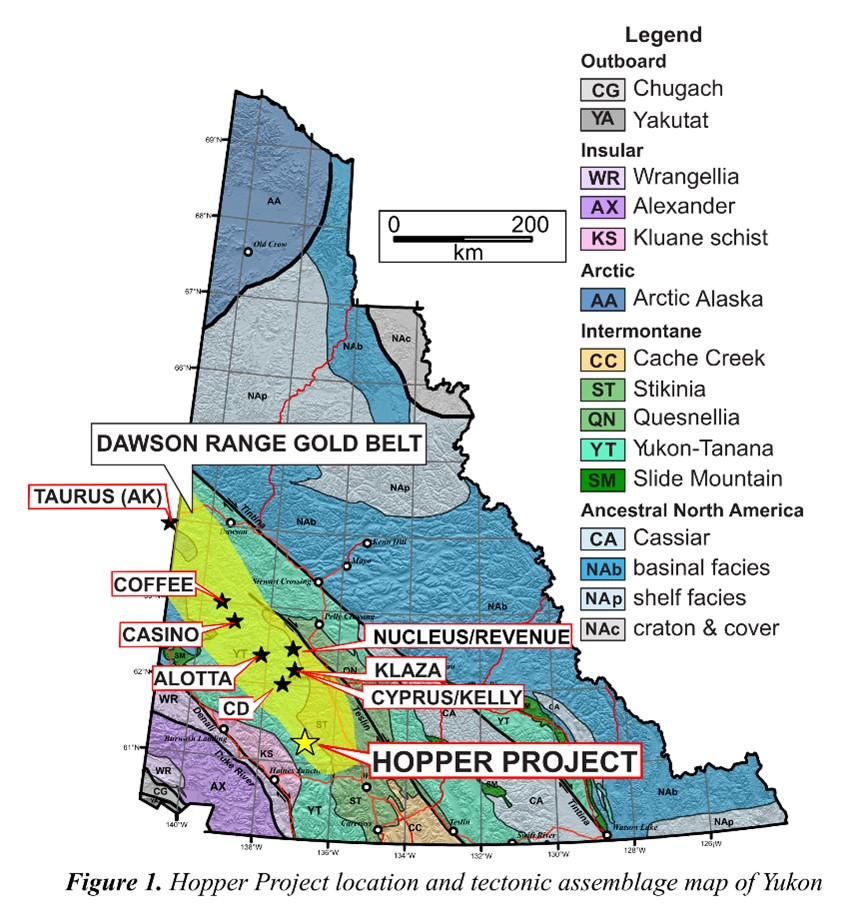

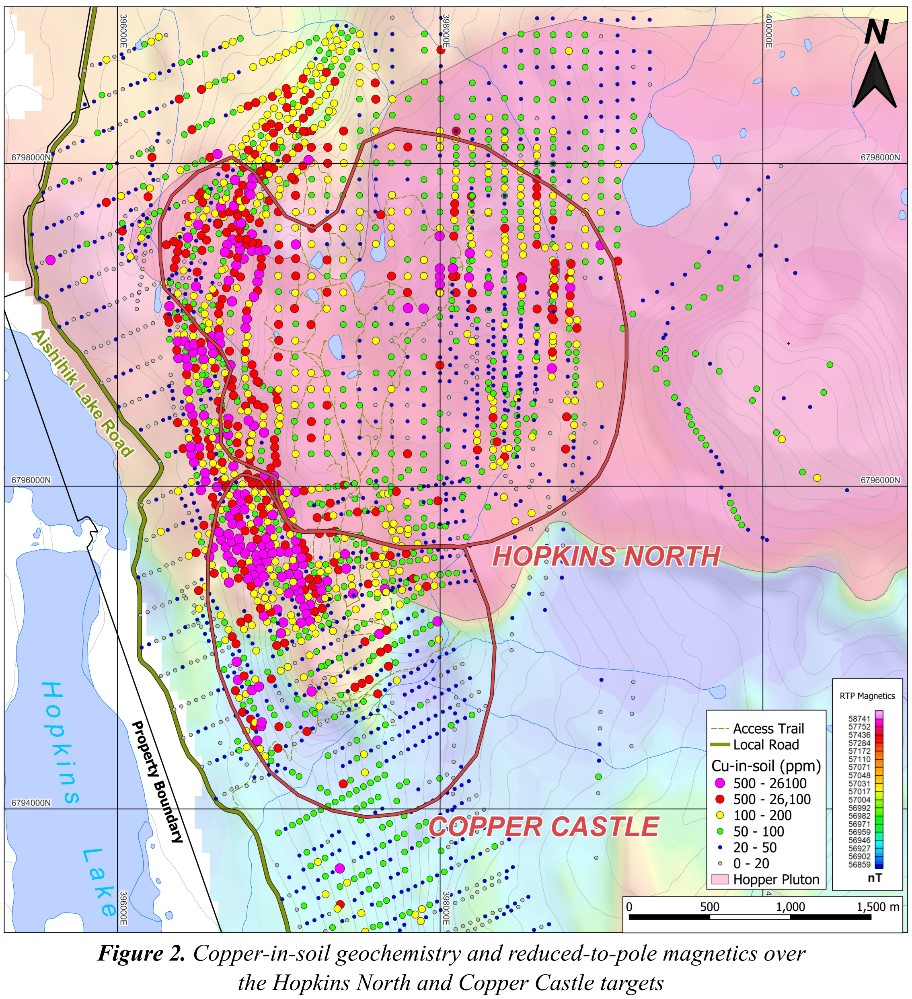

Hopper lies within the Dawson Range Gold Belt, a metallogenic province that hosts several major deposits, including Western Copper and Gold Corporation's Casino porphyry copper-gold deposit, located 190 km to the north-northwest (Figure 1). Mineral occurrences on the property, which collectively make up the Hopkins North porphyry target and the Copper Castle skarn target, are associated with a 4 by 6 km intrusion referred to as the Hopper Pluton (Figure 2). Dating of the pluton has yielded a Late Cretaceous age that is consistent with most mineralization along the belt, including the Casino deposit.

The Copper Castle target covers at least 10, stacked skarn horizons that are partially delineated along a 1,200 m strike length south of the Hopper Pluton. The mineralized horizon are layered throughout a known vertical section approximately 425 m thick. The skarns have been only partially delineated by trenching, percussion and diamond drilling, soil geochemistry and geophysical surveying, and remains open down dip and along strike to the south. Recent drill results from the Copper Castle target include 1.41% copper and 0.532 g/t gold over 22.28 m from HOP21-01 and 1.87% copper and 1.04 g/t gold over 15.27 m from HOP22-03. Additional drill highlights from the Copper Castle target are tabulated below.

| Drill Hole | From (m) | To (m) | Interval* (m) | Cu | Au | Ag | Mo |

| (%) | (g/t) | (g/t) | (ppm) | ||||

| DDH-11-01 | 2.95 | 16.65 | 13.70 | 0.41 | 0.25 | 3.8 | 9 |

| including | 9.69 | 12.02 | 2.33 | 1.24 | 0.87 | 13.0 | 2 |

| and | 125.67 | 142.60 | 16.93 | 0.22 | 1.76 | 1.8 | 1 |

| including | 125.67 | 133.17 | 7.50 | 0.43 | 3.35 | 3.6 | 1 |

| DDH-11-03 | 58.28 | 66.78 | 8.50 | 1.62 | 0.54 | 9.3 | 1 |

| and | 88.28 | 90.70 | 2.42 | 1.87 | 0.64 | 17.7 | 2 |

| and | 130.00 | 132.45 | 2.45 | 0.72 | 0.18 | 6.8 | 3 |

| DDH-11-04 | 57.39 | 62.53 | 5.15 | 0.95 | 0.84 | 5.6 | 2 |

| and | 174.86 | 182.87 | 8.01 | 1.58 | 0.84 | 14.8 | 43 |

| DDH-15-01 | 90.59 | 92.26 | 1.67 | 0.57 | 0.12 | 4.4 | 0 |

| and | 284.29 | 286.94 | 2.65 | 0.95 | 12.25 | 5.5 | 3 |

| DDH-15-02 | 82.07 | 91.09 | 9.02 | 0.24 | 0.12 | 1.6 | 32 |

| and | 113.13 | 128.14 | 15.01 | 0.50 | 0.50 | 1.6 | 4 |

| including | 121.70 | 128.14 | 6.44 | 1.00 | 1.01 | 3.9 | 4 |

| and | 136.60 | 138.60 | 2.00 | 0.70 | 0.14 | 4.4 | 2 |

| and | 150.85 | 151.85 | 1.00 | 0.45 | 1.00 | 2.1 | 6 |

| and | 204.90 | 205.90 | 1.00 | 0.79 | 0.72 | 4.2 | 4 |

| DDH-15-04 | 39.09 | 52.10 | 13.01 | 0.41 | 0.33 | 1.7 | 7 |

| and | 196.97 | 211.40 | 14.43 | 0.60 | 1.11 | 2.9 | 184 |

| including | 202.52 | 207.44 | 4.48 | 1.03 | 2.40 | 4.0 | 253 |

| DDH-15-08° | 336.66 | 337.66 | 1.00 | 0.06 | 43.60 | 1.1 | 53 |

| and | 341.49 | 342.63 | 1.14 | 0.31 | 0.20 | 1.9 | 45 |

| HOP21-01 | 38.60 | 40.75 | 2.15 | 0.38 | 0.14 | 3.4 | 1 |

| and | 55.44 | 77.72 | 22.28 | 1.41 | 0.53 | 11.7 | 2 |

| including | 62.00 | 66.72 | 4.72 | 5.34 | 1.44 | 45.7 | 7 |

| HOP21-03 | 77.00 | 87.96 | 10.96 | 1.37 | 0.49 | 9.6 | 2 |

| including | 83.95 | 87.96 | 4.01 | 2.72 | 1.01 | 20.1 | 4 |

| HOP22-02 | 69.26 | 70.42 | 1.16 | 0.37 | 0.10 | 3.7 | 7 |

| and | 99.40 | 100.69 | 1.29 | 1.27 | 0.71 | 9.9 | 3 |

| and | 107.02 | 123.54 | 16.52 | 0.80 | 0.49 | 6.7 | 77 |

| including | 109.46 | 114.62 | 5.16 | 1.86 | 0.83 | 11.4 | 102 |

| and | 117.37 | 123.54 | 6.17 | 1.04 | 0.56 | 7.4 | 116 |

| and | 137.70 | 141.70 | 4.00 | 0.24 | 0.12 | 2.9 | 251 |

| HOP22-03 | 62.23 | 77.50 | 15.27 | 1.87 | 1.04 | 13.8 | 92 |

| including | 63.85 | 70.00 | 6.15 | 3.93 | 2.20 | 28.8 | 71 |

| and | 113.01 | 114.74 | 1.73 | 0.72 | 0.35 | 5.9 | 28 |

| and | 166.81 | 168.00 | 1.19 | 0.96 | 0.22 | 8.4 | 4 |

| and | 216.98 | 222.50 | 5.52 | 0.24 | 0.09 | 1.7 | 1,392 |

| and | 234.65 | 237.18 | 2.53 | 0.37 | 0.14 | 2.2 | 7 |

*Interval represents the downhole intersection length; true widths are estimated to represent 70% to 100% of the interval, depending on the orientation of each hole

°Re-entered and deepened hole DDH-11-05

The Hopkins North target covers porphyry-type copper-gold mineralization identified within a 650 by 2,300 m area, which is associated with late phases of the Hopper Pluton. Much of this prospective area is heavily vegetated and blanketed by various depths of overburden, and the target is largely untested. Historical chip sampling from trenches at the porphyry target reportedly yielded 0.24% over 45.72 m1. In 2011, a program of very short, widely spaced, vertical reverse-circulation drilling was performed over the overburden covered plateau. Notably, several of the holes bottomed in copper mineralization. In 2015, a single diamond drill hole tested Hopkins North and returned a weighted average grade of 0.17% copper over 162.85 m. A follow-up hole in 2021, collared 320 m to the southeast, yielded 0.22% copper over 114.38 m from surface (HOP21-06). A third hole, HOP22-07, directed at the same target, returned an intercept of 0.12% copper over 214 m. Additional drill highlights from the Hopkins North target are tabulated below.

| Drill Hole | From (m) | To (m) | Interval* (m) | Cu | Au | Ag | Mo |

| (%) | (g/t) | (g/t) | (ppm) | ||||

| PDH-11-19 | 19.81 | 28.96 | 9.15 | 0.36 | 0.01 | 2.3 | N/A |

| PDH-11-23 | 42.67 | 44.19 | 1.52 | 0.33 | 0.01 | 0.7 | N/A |

| PDH-11-39 | 0.00 | EOH | 39.62 | 0.24 | 0.06 | 1.4 | N/A |

| including | 28.96 | EOH | 10.67 | 0.70 | 0.20 | 4.1 | N/A |

| DDH-15-05 | 113.88 | 276.73 | 162.85 | 0.17 | 0.02 | 2.1 | 34 |

| including | 149.74 | 150.74 | 1.00 | 5.00 | 0.26 | 17.1 | 2,730 |

| and including | 275.73 | 276.73 | 1.00 | 2.40 | 0.06 | 17.5 | 61 |

| HOP21-06 | 1.80 | 116.18 | 114.38 | 0.22 | 0.025 | 1.3 | 49 |

| including | 16.50 | 36.39 | 19.89 | 0.27 | 0.043 | 1.1 | 43 |

| and including | 69.98 | 83.67 | 13.69 | 0.40 | 0.032 | 2.6 | 209 |

| and | 178.23 | 187.00 | 8.77 | 0.32 | 0.012 | 2.9 | 27 |

| and | 233.35 | 241.00 | 7.65 | 0.23 | 0.033 | 1.8 | 130 |

| HOP22-07 | 0.00 | 214.00 | 214.00 | 0.12 | 0.013 | 0.9 | 80 |

| including | 0.00 | 58.15 | 58.15 | 0.23 | 0.011 | 1.6 | 90 |

| and | 250.91 | 279.50 | 28.59 | 0.13 | 0.017 | 0.8 | 90 |

| and | 310 | 313.25 | 3.25 | 0.41 | 0.059 | 1.9 | 80 |

*Interval represents the downhole intersection length and true widths are unknown

EOH is End of Hole; N/A is Not Available

Mineralization within the porphyry consists of both vein-controlled and disseminated chalcopyrite, with lesser pyrite, pyrrhotite, magnetite and molybdenite. The best drill intersections to date comprise chlorite-altered monzonite and porphyry dykes, with zones of vein-controlled potassic alteration, indicating proximity to an untested, higher-temperature porphyry centre and the potential to discover stronger copper and gold grades. Several other targets on the property have seen minor work, including a complementary skarn target to Copper Castle on the northern side of the Hopper Pluton.

Technical information in this news release has been approved by Strategic's Vice President Exploration, Jackson Morton, P.Geo., a qualified person as defined under the terms of National Instrument 43-101.

1Trench results at the Hopkins North target are historical in nature and have been compiled from public sources believed to be accurate.

NAD Property Sale

Strategic also announces the sale of its NAD Property to Senoa Gold Corp. a wholly owned subsidiary of Snowline Gold Corp. ("Snowline") for cash consideration of $50,000 and a 2% Net Smelter Return ("NSR") royalty with a buy-down to 1% for 1,000 ounces of gold or cash equivalent. The NAD 1-76 claims are contiguous with the northwestern portion of Snowline's Einerson Project.

About Strategic Metals Ltd.

Strategic is a project generator with 13 royalty interests, 14 projects under option to others, and a portfolio of 82 wholly owned projects that are the product of over 50 years of focussed exploration and research by a team with a track record of major discoveries. Projects available for option, joint venture or sale include drill-confirmed prospects and drill-ready targets with high-grade surface showings and/or geochemical anomalies and geophysical features that resemble those at nearby deposits.

Strategic has a current cash position of approximately $1.8 million and large shareholdings in several active mineral exploration companies including 32.8% of Broden Mining Ltd., 33.4% of GGL Resources Corp., 29.6% of Rockhaven Resources Ltd., 16.2% of Silver Range Resources Ltd and 15.6% of Precipitate Gold Corp. All these companies are engaged in promising exploration projects. Strategic also owns 15 million shares of Terra CO2 Technologies Holdings Inc. ("Terra"), a private Delaware corporation developing a cost-effective alternative to Portland cement, which recently announced a definitive agreement with Asher Materials for an exclusive market license of Terra's first commercial-scale advanced processing facility.

ON BEHALF OF THE BOARD

"W. Douglas Eaton"

President and Chief Executive Officer

For further information concerning Strategic or its various exploration projects please visit our website at www.strategicmetalsltd.com or contact:

Corporate Information

Strategic Metals Ltd.

W. Douglas Eaton

President and C.E.O.

Tel: (604) 688-2568

Investor Inquiries

Richard Drechsler

V.P. Communications

Tel: (604) 687-2522

NA Toll-Free: (888) 688-2522

rdrechsler@strategicmetalsltd.com

http://www.strategicmetalsltd.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward looking statements based on assumptions and judgments of management regarding future events or results that may prove to be inaccurate as a result of exploration and other risk factors beyond its control, and actual results may differ materially from the expected results.

SOURCE: Strategic Metals Ltd.

View the original press release on accesswire.com