SHENZHEN, China, May 17, 2024 /PRNewswire/ -- RLX Technology Inc. ("RLX Technology" or the "Company") (NYSE: RLX), a leading global branded e-vapor company, today announced its unaudited financial results for the first quarter ended March 31, 2024.

First Quarter 2024 Financial Highlights

- Net revenues were RMB551.6 million (US$76.4 million) in the first quarter of 2024, compared with RMB188.9 million in the same period of 2023.

- Gross margin was 25.9% in the first quarter of 2024, compared with 24.2% in the same period of 2023.

- U.S. GAAP net income was RMB132.6 million (US$18.4 million) in the first quarter of 2024, compared with U.S. GAAP net loss of RMB56.3 million in the same period of 2023.

- Non-GAAP net income[1] was RMB207.5 million (US$28.7 million) in the first quarter of 2024, compared with RMB183.6 million in the same period of 2023.

"We started 2024 with a steady first quarter," commented Ms. Ying (Kate) Wang, Co-founder, Chairperson of the Board of Directors, and Chief Executive Officer of RLX Technology. "Our international business is developing positively as we refine our regional strategies. Despite challenges posed by regulatory changes across various regions, we continue to identify opportunities and leverage our core strengths to prudently enter potential markets. Domestically, we are encouraged by the positive impact of China's recent regulatory crackdown on illegal products, but much progress remains to be made. We remain committed to collaborating with regulators and advocating for a well-regulated and healthy e-vapor industry. As a trusted e-vapor brand for adult smokers, we are dedicated to optimizing our product portfolio with premium, compliant, and innovative products that meet our users' needs and drive growth in this evolving industry."

Mr. Chao Lu, Chief Financial Officer of RLX Technology, commented, "In the first quarter, net revenues increased to RMB551.6 million, marking our fifth consecutive quarter of sequential revenue growth. Our gross margin improved by 170 basis points year-over-year to 25.9%, thanks to our supply chain efficiency enhancements. Furthermore, excluding the impact of share-based compensation, our non-GAAP operating profit remained positive, bolstered by an increasing contribution from our international operations, compared to a RMB133.3 million loss recorded in the same quarter last year. With our resilient business model, effective regional strategies, and consistent strong execution, we are confident of sustaining this growth trajectory and delivering sustainable value to our stakeholders."

First Quarter 2024 Financial Results

Net revenues were RMB551.6 million (US$76.4 million) in the first quarter of 2024, compared with RMB188.9 million in the same period of 2023. The increase was primarily due to our international expansion.

Gross profit was RMB142.8 million (US$19.8 million) in the first quarter of 2024, compared with RMB45.7 million in the same period of 2023.

Gross margin was 25.9 % in the first quarter of 2024, compared with 24.2% in the same period of 2023. This improvement was primarily driven by our supply chain efficiency enhancements, partially offset by an increase in inventory provision and an unfavorable shift in the revenue mix.

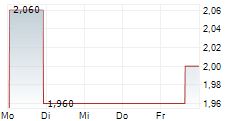

Operating expenses were RMB194.4 million (US$26.9 million) in the first quarter of 2024, compared with RMB418.9 million in the same period of 2023. The decrease was primarily due to a decrease in share-based compensation expenses, from RMB240.0 million in the first quarter of 2023 to RMB74.9 million (US$10.4 million) in the same period of 2024, along with a decrease in salaries and welfare benefits. The changes in share-based compensation expenses were primarily due to the changes in the fair value of the share incentive awards that the Company granted to its employees with the fluctuations of the Company's share price.

Selling expenses were RMB52.9 million (US$7.3 million) in the first quarter of 2024, compared with RMB85.8 million in the same period of 2023, primarily due to a decrease in salaries, welfare benefits and share-based compensation expenses.

General and administrative expenses were RMB110.0 million (US$15.2 million) in the first quarter of 2024, compared with RMB256.5 million in the same period of 2023, mainly driven by a decrease in share-based compensation expenses, salaries, and welfare benefits.

Research and development expenses were RMB31.5 million (US$4.4 million) in the first quarter of 2024, compared with RMB76.7 million in the same period of 2023, mainly driven by a decrease in salaries, welfare benefits and share-based compensation expenses.

Loss from operations was RMB51.6 million (US$7.1 million) in the first quarter of 2024, compared with RMB373.2 million in the same period of 2023.

Income tax expense was RMB16.3 million (US$2.3 million) in the first quarter of 2024, compared with income tax benefit of RMB17.6 million in the same period of 2023.

U.S. GAAP net income was RMB132.6 million (US$18.4 million) in the first quarter of 2024, compared with U.S. GAAP net loss of RMB56.3 million in the same period of 2023.

Non-GAAP net income was RMB207.5 million (US$28.7 million) in the first quarter of 2024, compared with RMB183.6 million in the same period of 2023.

U.S. GAAP basic and diluted net income per American depositary share ("ADS") were RMB0.106 (US$0.015) and RMB0.101 (US$0.014), respectively, in the first quarter of 2024, compared with U.S. GAAP basic and diluted net loss per ADS of RMB0.043, in the same period of 2023.

Non-GAAP basic and diluted net income per ADS[2] were RMB0.166 (US$0.023) and RMB0.159 (US$0.022), respectively, in the first quarter of 2024, compared with non-GAAP basic and diluted net income per ADS of RMB0.139 and RMB0.136, respectively, in the same period of 2023.

Balance Sheet and Cash Flow

As of March 31, 2024, the Company had cash and cash equivalents, restricted cash, short-term bank deposits, net, short-term investments, net, long-term bank deposits, net and long-term investment securities, net of RMB14,681.4 million (US$2,033.3 million), compared with RMB15,138.4 million as of December 31, 2023. In the first quarter of 2024, net cash generated from operating activities was RMB4.0 million (US$0.6 million).

Conference Call

The Company's management will host an earnings conference call at 8:00 AM U.S. Eastern Time on May 17, 2024 (8:00 PM Beijing/Hong Kong Time on May 17, 2024).

Dial-in details for the earnings conference call are as follows:

United States (toll-free): | +1-888-317-6003 |

International: | +1-412-317-6061 |

Hong Kong, China (toll-free): | +800-963-976 |

Hong Kong, China: | +852-5808-1995 |

Mainland China: | 400-120-6115 |

Participant Code: | 5404850 |

Participants should dial in 10 minutes before the scheduled start time and ask to be connected to the call for "RLX Technology Inc." with the Participant Code as set forth above.

Additionally, a live and archived webcast of the conference call will be available on the Company's investor relations website at https://ir.relxtech.com.

A replay of the conference call will be accessible approximately two hours after the conclusion of the call until May 24, 2024, by dialing the following telephone numbers:

United States: | +1-877-344-7529 |

International: | +1-412-317-0088 |

Replay Access Code: | 5345683 |

About RLX Technology Inc.

RLX Technology Inc. (NYSE: RLX) is a leading global branded e-vapor company. The Company leverages its strong in-house technology, product development capabilities and in-depth insights into adult smokers' needs to develop superior e-vapor products.

For more information, please visit: http://ir.relxtech.com.

Non-GAAP Financial Measures

The Company uses non-GAAP net income and non-GAAP basic and diluted net income per ADS, each a non-GAAP financial measure, in evaluating its operating results and for financial and operational decision-making purposes. Non-GAAP net income represents net income excluding share-based compensation expenses. Non-GAAP basic and diluted net income per ADS is computed using non-GAAP net income attributable to RLX Technology Inc. and the same number of ADSs used in U.S. GAAP basic and diluted net income per ADS calculation.

The Company presents these non-GAAP financial measures because they are used by the management to evaluate its operating performance and formulate business plans. The Company believes that they help identify underlying trends in its business that could otherwise be distorted by the effect of certain expenses that are included in net income. The Company also believes that the use of the non-GAAP measures facilitates investors' assessment of its operating performance, as they could provide useful information about its operating results, enhances the overall understanding of its past performance and future prospects and allows for greater visibility with respect to key metrics used by the management in its financial and operational decision making.

The non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial measures have limitations as analytical tools. They should not be considered in isolation or construed as an alternative to net income, basic and diluted net income per ADS or any other measure of performance or as an indicator of its operating performance. Investors are encouraged to review its historical non-GAAP financial measures to the most directly comparable U.S. GAAP measures. The non-GAAP financial measures here may not be comparable to similarly titled measures presented by other companies. Other companies may calculate similarly titled measures differently, limiting their usefulness as comparative measures to our data. The Company encourages investors and others to review its financial information in its entirety and not rely on any single financial measure.

For more information on the non-GAAP financial measures, please see the table captioned "Unaudited Reconciliation of GAAP and non-GAAP Results" set forth at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars at a specified rate solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to U.S. dollars and from U.S. dollars to RMB are made at a rate of RMB7.2203 to US$1.00, the exchange rate on March 29, 2024, set forth in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or U.S. dollar amounts referred could be converted into U.S. dollars or RMB, as the case may be, at any particular rate or at all.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "may," "will," "expect," "anticipate," "aim," "estimate," "intend," "plan," "believe," "is/are likely to," "potential," "continue" and similar statements. Among other things, quotations from management in this announcement, as well as the Company's strategic and operational plans, contain forward- looking statements. The Company may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including but not limited to statements about the Company's beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: the Company's growth strategies; its future business development, results of operations and financial condition; trends and competition in global e-vapor market; changes in its revenues and certain cost or expense items; governmental policies, laws and regulations across various jurisdictions relating to the Company's industry, and general economic and business conditions globally and in China and assumptions underlying or related to any of the foregoing. Further information regarding these risks, uncertainties or factors is included in the Company's filings with the U.S. Securities and Exchange Commission. All information provided in this press release and in the attachments is current as of the date of this press release, and the Company does not undertake any obligation to update such information, except as required under applicable law.

For more information, please contact:

In China:

RLX Technology Inc.

[email protected]

Piacente Financial Communications

[email protected]

In the United States:

Piacente Financial Communications

[email protected]

|

|

RLX TECHNOLOGY INC. | |||

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS | |||

(All amounts in thousands) | |||

As of | |||

December 31, | March 31, | March 31, | |

2023 | 2024 | 2024 | |

RMB | RMB | US$ | |

ASSETS | |||

Current assets: | |||

Cash and cash equivalents | 2,390,298 | 2,322,277 | 321,632 |

Restricted cash | 29,760 | 52,484 | 7,269 |

Short-term bank deposits, net | 2,631,256 | 2,320,529 | 321,390 |

Receivables from online payment platforms | 6,893 | 7,284 | 1,009 |

Short-term investments, net | 3,093,133 | 2,691,275 | 372,737 |

Accounts and notes receivable, net | 60,482 | 113,665 | 15,742 |

Inventories | 144,850 | 99,768 | 13,818 |

Amounts due from related parties | 118,736 | 179,645 | 24,881 |

Prepayments and other current assets, net | 508,435 | 620,771 | 85,976 |

Total current assets | 8,983,843 | 8,407,698 | 1,164,454 |

Non-current assets: | |||

Property, equipment and leasehold improvement, net | 77,358 | 69,973 | 9,691 |

Intangible assets, net | 69,778 | 65,004 | 9,003 |

Long-term investments, net | 8,000 | 8,000 | 1,108 |

Deferred tax assets, net | 58,263 | 58,263 | 8,069 |

Right-of-use assets, net | 52,562 | 47,708 | 6,607 |

Long-term bank deposits, net | 1,757,804 | 1,624,802 | 225,032 |

Long-term investment securities, net | 5,236,109 | 5,669,997 | 785,286 |

Goodwill | 66,506 | 64,136 | 8,883 |

Other non-current assets, net | 4,874 | 11,746 | 1,627 |

Total non-current assets | 7,331,254 | 7,619,629 | 1,055,306 |

Total assets | 16,315,097 | 16,027,327 | 2,219,760 |

LIABILITIES AND SHAREHOLDERS' EQUITY | |||

Current liabilities: | |||

Accounts and notes payable | 266,426 | 213,849 | 29,618 |

Contract liabilities | 49,586 | 15,058 | 2,086 |

Salary and welfare benefits payable | 39,256 | 50,620 | 7,011 |

Taxes payable | 77,164 | 106,658 | 14,772 |

Accrued expenses and other current liabilities | 103,996 | 118,805 | 16,454 |

Amounts due to related parties | 101,927 | 63,141 | 8,745 |

Dividend payable | 881 | - | - |

Lease liabilities - current portion | 29,435 | 31,093 | 4,306 |

Total current liabilities | 668,671 | 599,224 | 82,992 |

Non-current liabilities: | |||

Deferred tax liabilities | 23,591 | 22,584 | 3,128 |

Lease liabilities - non-current portion | 24,419 | 17,968 | 2,489 |

Total non-current liabilities | 48,010 | 40,552 | 5,617 |

Total liabilities | 716,681 | 639,776 | 88,609 |

Shareholders' Equity: | |||

Total RLX Technology Inc. shareholders' equity | 15,609,393 | 15,397,603 | 2,132,543 |

Noncontrolling interests | (10,977) | (10,052) | (1,392) |

Total shareholders' equity | 15,598,416 | 15,387,551 | 2,131,151 |

Total liabilities and shareholders' equity | 16,315,097 | 16,027,327 | 2,219,760 |

RLX TECHNOLOGY INC. | ||||

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF | ||||

(All amounts in thousands, except for number of shares and per share data, or otherwise noted) | ||||

For the three months ended | ||||

March 31, | December 31, | March 31, | March 31, | |

2023 (As adjusted) (a) | 2023 | 2024 | 2024 | |

RMB | RMB | RMB | US$ | |

Net revenues | 188,877 | 520,468 | 551,623 | 76,399 |

Cost of revenues | (78,693) | (327,325) | (327,610) | (45,373) |

Excise tax on products | (64,458) | (69,730) | (81,240) | (11,252) |

Gross profit | 45,726 | 123,413 | 142,773 | 19,774 |

Operating expenses: | ||||

Selling expenses | (85,761) | (37,985) | (52,887) | (7,325) |

General and administrative expenses | (256,504) | (204,030) | (109,954) | (15,228) |

Research and development expenses | (76,682) | (21,904) | (31,540) | (4,368) |

Total operating expenses | (418,947) | (263,919) | (194,381) | (26,921) |

Loss from operations | (373,221) | (140,506) | (51,608) | (7,147) |

Other income: | ||||

Interest income, net | 148,803 | 157,928 | 158,858 | 22,002 |

Investment income | 21,385 | 182,699 | 12,776 | 1,769 |

Others, net | 129,157 | 30,925 | 28,943 | 4,009 |

(Loss)/income before income tax | (73,876) | 231,046 | 148,969 | 20,633 |

Income tax benefit/(expense) | 17,571 | (15,078) | (16,344) | (2,264) |

Net (loss)/income | (56,305) | 215,968 | 132,625 | 18,369 |

Less: net income attributable to noncontrolling interests | 661 | 2,491 | 717 | 99 |

Net (loss)/income attributable to RLX Technology Inc. | (56,966) | 213,477 | 131,908 | 18,270 |

Other comprehensive (loss)/income: | ||||

Foreign currency translation adjustments | (148,096) | (132,470) | 12,706 | 1,760 |

Unrealized income/(loss) on long-term investment securities | 2,873 | (11,288) | (13) | (2) |

Total other comprehensive (loss)/income | (145,223) | (143,758) | 12,693 | 1,758 |

Total comprehensive (loss)/income | (201,528) | 72,210 | 145,318 | 20,127 |

Less: total comprehensive income attributable to | 661 | 2,491 | 730 | 101 |

Total comprehensive (loss)/income attributable to RLX | (202,189) | 69,719 | 144,588 | 20,026 |

Net (loss)/income per ordinary share/ADS | ||||

- Basic | (0.043) | 0.166 | 0.106 | 0.015 |

- Diluted | (0.043) | 0.161 | 0.101 | 0.014 |

Weighted average number of ordinary shares/ADSs | ||||

- Basic | 1,316,798,713 | 1,285,752,182 | 1,249,317,641 | 1,249,317,641 |

- Diluted | 1,316,798,713 | 1,324,466,240 | 1,301,431,007 | 1,301,431,007 |

Note (a): The Company acquired various companies on December 13, 2023, which was accounted for as an under common control transaction in accordance with | ||||

RLX TECHNOLOGY INC. | ||||||

UNAUDITED RECONCILIATION OF GAAP AND NON-GAAP RESULTS | ||||||

(All amounts in thousands, except for number of shares and per share data) | ||||||

For the three months ended | ||||||

March 31, | December 31, | March 31, | March 31, | |||

2023 (As adjusted) (b) | 2023 | 2024 | 2024 | |||

RMB | RMB | RMB | US$ | |||

Net (loss)/income | (56,305) | 215,968 | 132,625 | 18,369 | ||

Add: share-based compensation expenses | ||||||

Selling expenses | 23,955 | 12,128 | 4,603 | 638 | ||

General and administrative expenses | 201,343 | 194,153 | 66,414 | 9,198 | ||

Research and development expenses | 14,654 | 10,335 | 3,881 | 538 | ||

Non-GAAP net income | 183,647 | 432,584 | 207,523 | 28,743 | ||

Net (loss)/income attributable to RLX Technology Inc. | (56,966) | 213,477 | 131,908 | 18,270 | ||

Add: share-based compensation expenses | 239,952 | 216,616 | 74,898 | 10,374 | ||

Non-GAAP net income attributable to RLX Technology Inc. | 182,986 | 430,093 | 206,806 | 28,644 | ||

Non-GAAP net income per ordinary share/ADS | ||||||

- Basic | 0.139 | 0.335 | 0.166 | 0.023 | ||

- Diluted | 0.136 | 0.325 | 0.159 | 0.022 | ||

Weighted average number of ordinary shares/ADSs | ||||||

- Basic | 1,316,798,713 | 1,285,752,182 | 1,249,317,641 | 1,249,317,641 | ||

- Diluted | 1,345,828,279 | 1,324,466,240 | 1,301,431,007 | 1,301,431,007 | ||

Note (b): The Company acquired various companies on December 13, 2023, which was accounted for as an under common control transaction in accordance with | ||||||

RLX TECHNOLOGY INC. | ||||||

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF | ||||||

(All amounts in thousands) | ||||||

For the three months ended | ||||||

March 31, | December 31, | March 31, | March 31, | |||

2023 (As adjusted) (c) | 2023 | 2024 | 2024 | |||

RMB | RMB | RMB | US$ | |||

Net cash (used in)/generated from operating activities | (230,686) | 305,197 | 4,020 | 557 | ||

Net cash generated from investing activities | 381,954 | 310,274 | 420,665 | 58,261 | ||

Net cash generated from/(used in) financing activities | 4,346 | (791,905) | (472,885) | (65,495) | ||

Effect of foreign exchange rate changes on cash, cash equivalents and | 10,409 | (18,544) | 2,903 | 404 | ||

Net increase/(decrease) in cash and cash equivalents and restricted cash | 166,023 | (194,978) | (45,297) | (6,273) | ||

Cash, cash equivalents and restricted cash at the beginning of the period | 1,289,086 | 2,615,036 | 2,420,058 | 335,174 | ||

Cash, cash equivalents and restricted cash at the end of the period | 1,455,109 | 2,420,058 | 2,374,761 | 328,901 | ||

Note (c): The Company acquired various companies on December 13, 2023, which was accounted for as an under common control transaction in accordance with | ||||||

SOURCE RLX Technology Inc.