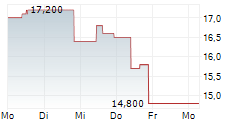

BUENOS AIRES, Argentina, May 22, 2024 /PRNewswire/ -- Banco BBVA Argentina S.A (NYSE; BYMA; MAE: BBAR; LATIBEX: XBBAR) ("BBVA Argentina" or "BBVA" or "the Bank") announced today its consolidated results for the first quarter (1Q24), ended on March 31, 2024.

As of January 1, 2020, the Bank started to inform its inflation adjusted results pursuant to IAS 29 reporting. To facilitate comparison, figures of comparable quarters of 2023 and 2024 have been updated according to IAS 29 reporting to reflect the accumulated effect of inflation adjustment for each period up to March 31, 2024.

1Q24 Highlights

- BBVA Argentina's inflation adjusted net income in 1Q24 was $34.2 billion, 53.7% lower than the $73.7 billion reported on the fourth quarter of 2023 (4Q23), and 41.4% lower than the $58.3 billion reported on the first quarter of 2023 (1Q23).

- In 1Q24, BBVA Argentina posted an inflation adjusted average return on assets (ROAA) of 1.6% and an inflation adjusted average return on equity (ROAE) of 6.6%.

- Operating income in 1Q24 was $631.2 billion, 12.9% lower than the $724.7 billion recorded in 4Q23 and 106.6% over the $305.5 billion recorded in 1Q23.

- In terms of activity, total consolidated financing to the private sector in 1Q24 totaled $2.7 trillion, falling 12.7% in real terms compared to 4Q23, and 21.9% compared to 1Q23. In the quarter, the variation was mainly driven by a decline in credit cards by 17.9%, in discounted instruments by 27.1% and in other loans by 19.7%. This was offset by an increase in prefinancing and financing of exports by 26.0%. BBVA's consolidated market share of private sector loans reached 10.08% as of 1Q24.

- Total consolidated deposits in 1Q24 totaled $4.8 trillion, decreasing 13.5% in real terms during the quarter, and 21.7% YoY. Quarterly decrease was mainly explained by a fall by 25.3% and 8.1% in savings and checking accounts respectively. The Bank's consolidated market share of private deposits reached 7.37% as of 1Q24.

- As of 1Q24, the non-performing loan ratio (NPL) reached 1.23%, with a 173.77% coverage ratio.

- The accumulated efficiency ratio in 1Q24 was 65.4%, deteriorating compared to 4Q23's 58.6%, and to 1Q23's 62.4%.

- As of 1Q24, BBVA Argentina reached a regulatory capital ratio of 35.6%, entailing a $1.4 trillion or 336.0% excess over minimum regulatory requirement. Tier I ratio was 35.6%.

- Total liquid assets represented 91.9% of the Bank's total deposits as of 1Q24.

click here

click here

To access the full reportEnglish version - Spanish version

click here

About BBVA Argentina

BBVA Argentina (NYSE; BYMA; MAE: BBAR; LATIBEX: XBBAR) is a subsidiary of the BBVA Group, the main shareholder since 1996. In Argentina, it is one of the leading private financial institutions since 1886. Nationwide, BBVA Argentina offers retail and corporate banking to a broad customer base, including: individuals, SME's, and large-sized companies.

BBVA Argentina's purpose is to bring the age of opportunities to everyone, based on our customers' real needs, providing the best solutions, and helping them make the best financial decisions through an easy and convenient experience. The institution relies on solid values: "The customer comes first, We think big and We are one team". At the same time, its responsible banking model aspires to achieve a more inclusive and sustainable society.

Investor Relations Contact

Carmen Morillo Arroyo

Chief Financial Officer

Inés Lanusse

Investor Relations Officer

Belén Fourcade

Investor Relations

[email protected]

ir.bbva.com.ar

SOURCE Banco BBVA Argentina S.A.