Metallic pulp assays from winter 2024 drilling program, MOU with Novamera Inc.

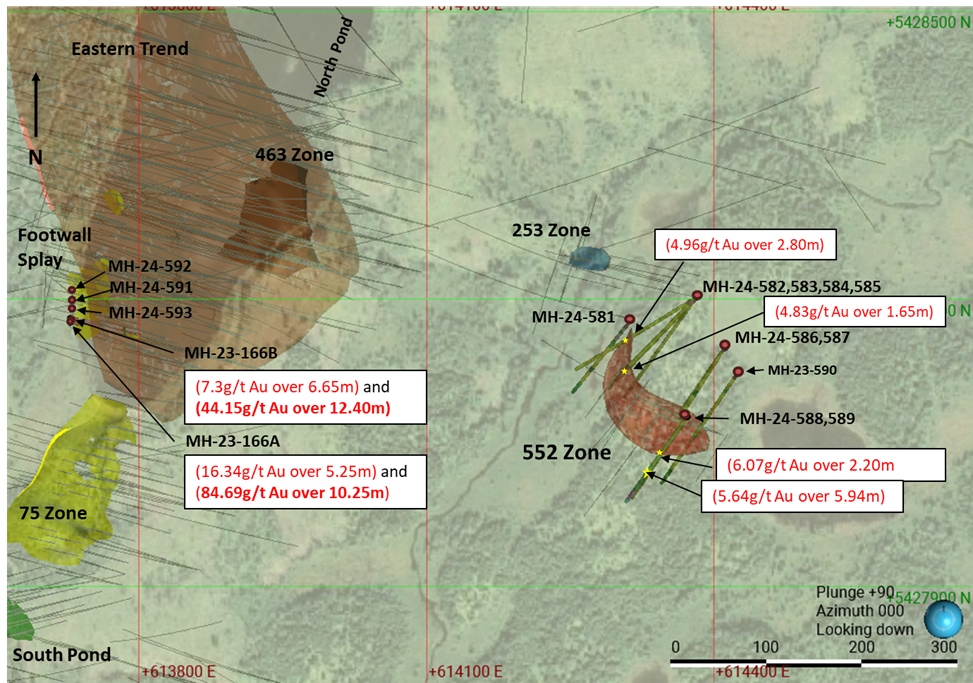

ST. JOHN'S, NL / ACCESSWIRE / May 23, 2024 / Sokoman Minerals Corp. (TSXV:SIC)(OTCQB:SICNF) ("Sokoman" or the "Company") is pleased to report metallic pulp gold assay results from winter drilling at the 552 Zone, as well as assays from a section of the Footwall Splay. These drill holes were targeted as a possible bulk sample location, linked to the recently signed Memorandum of Understanding (MOU) with Novamera Inc. ("Novamera"). The MOU is focused on modeling the near-surface portion of the Footwall Splay Zone for a possible bulk sample using Novamera's proprietary drilling and bulk sampling technology.

Footwall Splay

Drilling confirmed strong, near-surface gold values, including 10.25 m at 84.69 g/t Au from 53.90 m downhole in MH-23-166A, in the down-plunge portion of the Zone.

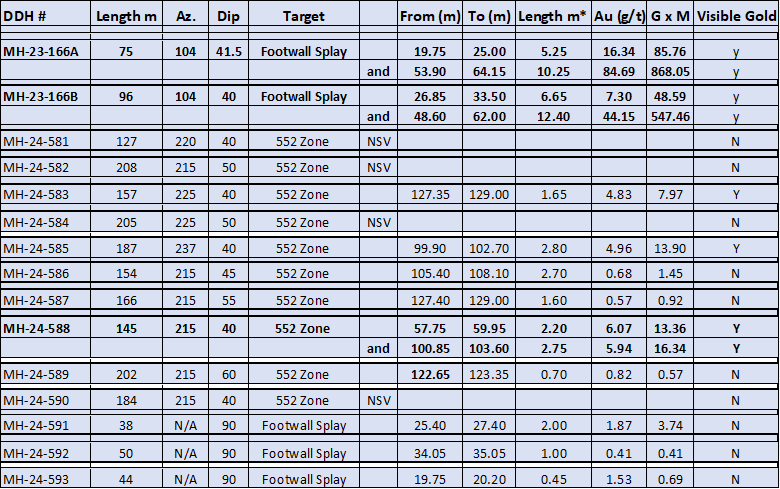

Highlight Drill Results - Moosehead Project - Footwall Splay / 552 Zone

*Core length - true widths are estimated to be approximately 90% of the core length

552 Zone

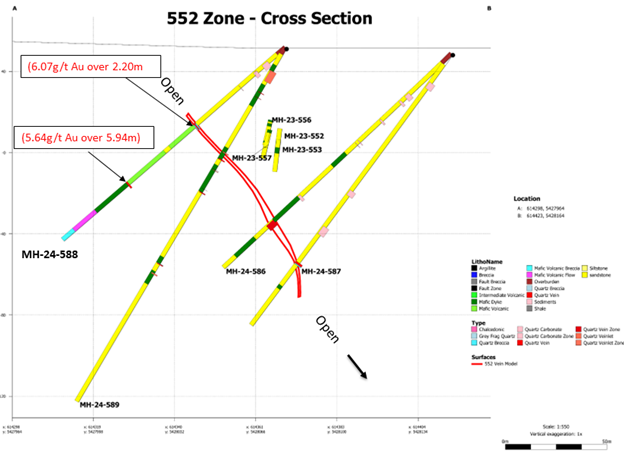

Ten drill holes gave mixed results although most intersected the 552 structure. The highest grades were in quartz veining - MH-24-588 - 2.20 m / 6.07 g/t Au at 57.75 m downhole and 2.75 m at 5.94 g/t Au at 100.85 m downhole, with the second intersection the first visible gold (VG) found in deformed mafic volcanics on the property (see the section for the location of the new vein in proximity to the previously modeled 552 vein). The intersection in the volcanics highlights additional prospective areas in the easternmost, underexplored, portion of the Moosehead property. The 552 zone carries VG-bearing quartz veins on both the east and west margins. Drilling will continue after the spring break up in approximately three to four weeks.

Novamera Inc.

Novamera's guidance tool provides a high-resolution 3-D model of the quartz veins by detecting veins up to 4 m off hole in all directions. As part of the initial setup process, Novamera requested the drilling of two holes (MH-23-166A and B) from an area of the Footwall Splay, which was surveyed by Novamera to calibrate their guidance tool. The holes were drilled proximal to MH-23-166, selected as the test area based on a high-grade intersection at the bedrock surface - 5.10 m of 15.51 g/t Au at 9 m downhole). Novamera used the two new holes and the original hole for calibration. A mineralization model, being developed, will include surveying of additional holes later this spring.

The bulk sample method being considered is a "surgical" mining method in which a large (1-2 m) diameter drill bit is used to recover the high-grade, VG-bearing quartz veins, greatly reducing the environmental impact and decreasing the time required for permitting.

The permitting process will begin when the 3D modeling and extraction plan is completed in the coming months. The holes were assayed for grade control at Eastern Analytical in Springdale, Newfoundland and Labrador.

Timothy Froude, P. Geo., President and CEO of Sokoman Minerals, states, "We are pleased to announce the MOU with Novamera as part of our efforts to advance the Moosehead gold project. The results of the initial work have confirmed the area for a bulk sample by demonstrating strong gold grades in the Footwall Splay. The MOU is not a commitment for a bulk sample; rather, it is a process to determine if a bulk sample can be taken efficiently and cost-effectively. There is no obligation on Sokoman's part to complete all the stages as defined in its MOU with Novamera."

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman is one of the largest landholders in Newfoundland, in Canada's newest and rapidly emerging gold districts.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. The agreement provides for Piedmont to earn up to 62.5% of the Killick Lithium Project (formerly Golden Hope project) by funding up to $12 million in exploration expenses and issuing $10 million common shares in three stages. The Killick Lithium Project has been transferred to Killick Lithium Inc. (Killick), a 100%-owned subsidiary of Vinland Lithium Inc. (Vinland). Newly created Vinland has received $2 million in financing from Piedmont for a 19.9% interest, with the balance of ownership between Sokoman and Benton. Sokoman and Benton will continue to operate the exploration efforts at Killick through the earn-in stages. Sokoman and Benton will retain a royalty of 2% NSR on future production. Piedmont will have exclusive marketing rights for the promotion and sale of any lithium products produced from the project on a life-of-mine basis, and the right of first refusal on 100% offtake rights to the lithium concentrates.

Projects optioned with optionee fully vested:

- East Alder Project optioned to Canterra Minerals Inc (SIC retains 850,000 shares of CTM plus 1% NSR)

- Startrek Project optioned to Thunder Gold (SIC retains 1,750,000 shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

SOURCE: Sokoman Minerals Corp

View the original press release on accesswire.com