- Imports from Moscow will cease 90 days after bill is enacted

- Uranium prices held steady around increases gained during late 2023 rally

- Canada major contributor to projected 11%+ growth in uranium production in 2024?

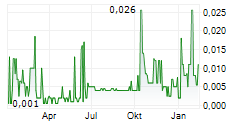

Vancouver, British Columbia, May 24, 2024 (GLOBE NEWSWIRE) -- MegaWatt Lithium and Battery Metals Corp. (CSE:MEGA) (FSE: WR20) (OTCQB: WALRF) (the "Company", "MegaWatt Metals" or "MegaWatt") provides additional commentary on America's May 14, 2024 ban on Russian imports of enriched uranium, the primary fuel used in nuclear power plants. The bipartisan bill will ban uranium imports from Moscow beginning 90 days after its enactment. Despite the pending need for America to shift its uranium supply, uranium prices continued to hold the increases gained during the late 2023 rally, possibly due to the forecast that global uranium production will grow by over 11% in 2024, with most of that increase coming from America's largest uranium suppliers: Kazakhstan and Canada.[1]

Please click to view image

?Data Source BusinessInsider.com May 21, 2024

America's dependence on imported Russian uranium dates back to a 1993 nuclear disarmament program soon after the end of the Cold War. Currently, Russian enriched uranium supplies roughly 20% of America's nuclear fuel. US companies pay roughly $1 billion per year to Rosatom, Russia's state nuclear power conglomerate. The US National Security Council (NSC), however, stated that America's reliance on Russia for low-enriched uranium to support US nuclear reactors is not in the nation's security or economic interests.

To help offset imports from Russia, the bill also frees up $2.7 billion that was passed in previous legislation to build out America's domestic uranium processing industry. Establishing domestic supply chain solutions for uranium is especially important due to US President Joe Biden having set the goal of America achieving 100% clean electricity by 2035. Reaching that ambitious goal would require significant electricity generation from nuclear reactors, which currently generate more than 50% of America's emissions-free electricity.[2] Toward that end, the US recently announced plans to triple their nuclear power capacity by 2050.[3]

MegaWatt's CEO, Casey Forward, commented, "We are understandably in support of America's ban on Russian uranium imports, both as a uranium exploration company and as citizens of a Western nation that values energy independence and geopolitical sovereignty. Fortunately, at the same time that Russian imports are being taken out of the equation, global uranium production is expected to grow by over 11% this year. While we're excited that Canada is among the 2 countries where most of that increased uranium production will come from, we're not surprised. Most of Canada's uranium resources are in high-grade deposits with some being 100X the world average, and over 85% of Canada's uranium production is exported.[4] The ban on Russian imports is yet another long-term driver supporting the uranium sector that we expect to benefit from while advancing MegaWatt's focus on becoming a domestic, clean-energy minerals supplier."

For Additional Information

Investors can learn more about the Company, our team and latest news at https://megawattmetals.com.

Facebook, X (Twitter), Instagram, LinkedIn, YouTube

About MegaWatt Lithium and Battery Metals Corp.

MegaWatt is a British Columbia based company involved in the acquisition and exploration of mineral properties.

MegaWatt has acquired a 100% interest in a company that holds a 100% interest (subject to a 1.5% NSR) in the Benedict Mountains Uranium Property, consisting of 2 mineral licenses covering an area of approximately 350 hectares in the Central Mineral Belt on the east coast of Labrador, Canada, approximately 200 km NE of Goose Bay (see press release dated April 1, 2024).

MegaWatt holds a 100% undivided interest (subject to a 1.5% NSR) on all base, rare earth elements and precious metals, in the Cobalt Hill Property, consisting of 8 mineral claims covering an area of approximately 1,727.43 hectares located in the Trail Creek Mining Division in the Province of British Columbia, Canada.

Additionally, the Company has acquired a 100% interest in a company that indirectly holds a 100% interest (subject to a 2% NSR) in the Tyr Silver Project (see press release dated October 15, 2020).

MegaWatt holds a 100% interest (subject to a 2% NSR) in and to the Route 381 Lithium Property, comprised of 40 mineral claims located in James Bay Territory, north of Matagami in the Province of Quebec, covering 2,126 hectares (see press release dated February 3, 2021), and a 100% interest in 229 additional mineral exploration claims prospective for lithium, also in the James Bay area of Quebec covering an area of 12,116 hectares or 121 square kms.

On Behalf of the Board of Directors,

MegaWatt Lithium and Battery Metals Corp.

Casey Forward, CEO

1055 West Georgia Street, Suite 1500

Vancouver, BC, Canada

V7X 1M5

For Further Information Please Contact:

Kelvin Lee, Chief Financial Officer

kelvin@megawattmetals.com, (236) 521-6500

Sources:

1.https://www.morningstar.com/news/globe-newswire/9066905/global-uranium-mining-output-expected-to-rise-117-in-2024-due-to-kazakh-and-canadian-growth

2.https://www.washingtonpost.com/business/2024/05/13/russian-uranium-imports-ban/

3.https://tradingeconomics.com/commodity/uranium

4.https://world-nuclear.org/information-library/country-profiles/countries-a-f/canada-uranium.aspx

The CSE does not accept responsibility for the adequacy or accuracy of this release.

This press release includes "forward-looking information" that is subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company. These forward-looking statements or information may relate to the Company's business plans, the exploration plans of the Company and the timing thereof, and other factors or information. Such statements represent the Company's current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules and regulations.