NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE U.S.

WHITE ROCK, BC / ACCESSWIRE / May 29, 2024 / TDG Gold Corp (TSXV:TDG) (the "Company" or "TDG") is pleased to announce that the size of its non-brokered private placement previously reported on February 22 , April 04 , April 11 , May 03 , and May 06, 2024 (the "Offering") has been increased to gross proceeds of $2,200,000, up from the previously announced gross proceeds of up to $2,000,000. The Offering is expected to close in early June and the final tranche will include charity flow-through units of the Company (the "Charity FT Units") at a price of $0.20 per Charity FT Unit.

Mets Program

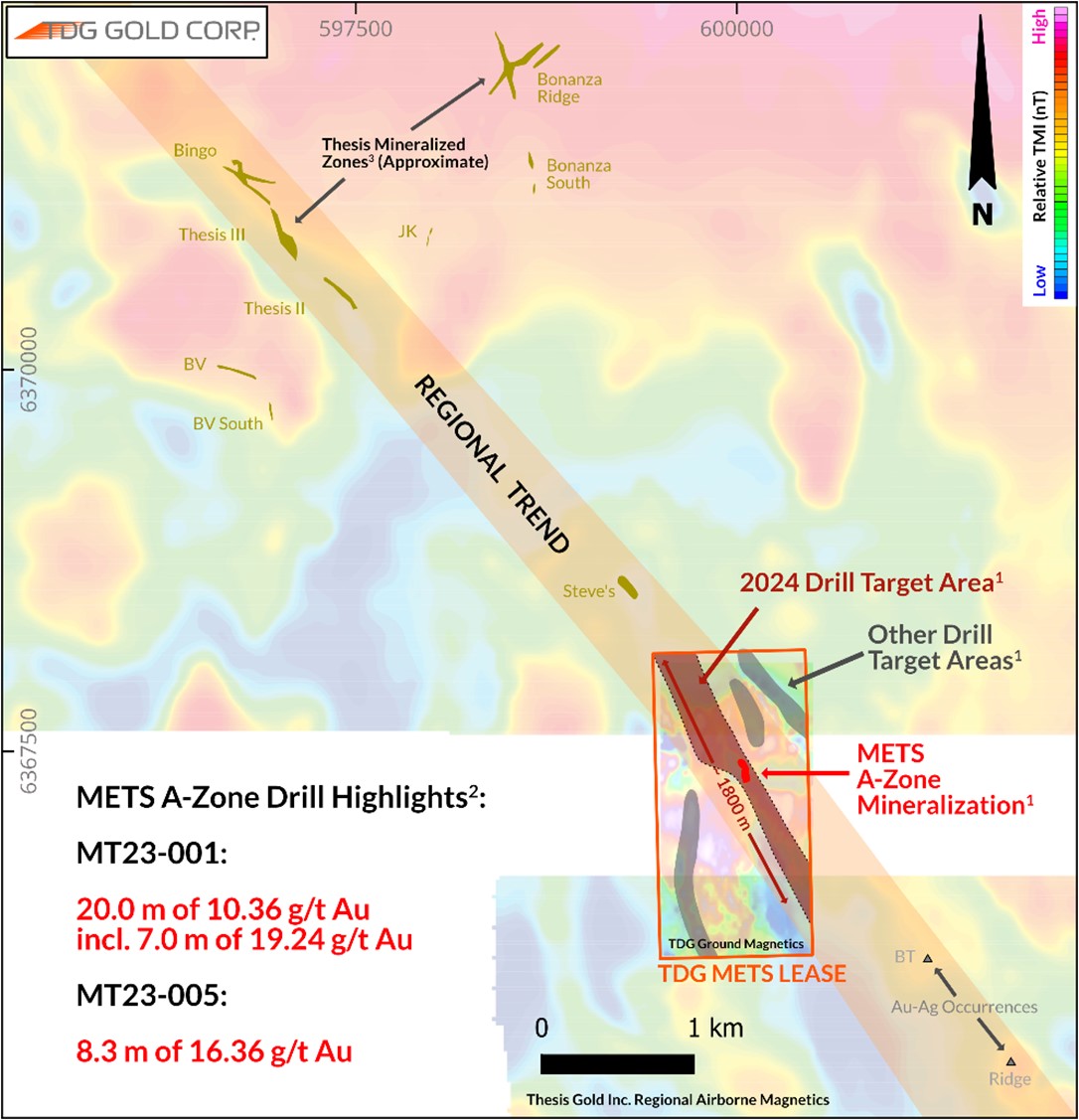

TDG intends to use the net proceeds of the Offering for continued exploration on its mineral properties in the Toodoggone mining district and for general working capital. Potential exploration plans for 2024 include prospect drilling on TDG's 100% owned Mets mining lease which is part of an identified, road-connected, mineralized trend in the Toodoggone ( Figure 1 ).

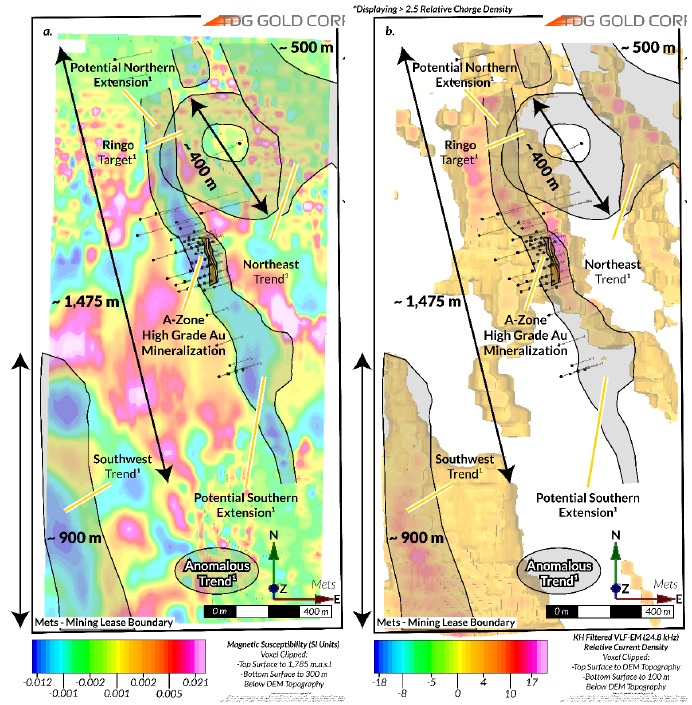

In 2023, TDG's diamond drill program intersected multiple intervals of high-grade gold ("Au") from near surface in the Mets A-Zone including 20.0 metres ("m") grading 10.4 grams per tonne ("g/t") Au from 19.0 m depth and 8.3 m grading 16.4 g/t Au from 50.5 m depth (Final Results 2 , Table 1 ). Modern geophysics conducted by TDG has identified multiple additional targets 1 on Mets that merit drilling ( Figure 2 ) within this mineralized corridor.

Figure 1 - Mets Drill Target Areas 1: Relative Total Magnetic Intensity ("TMI") displaying TDG ground magnetics and Thesis Gold airborne magnetics 3 , superimposed.

Fletcher Morgan, TDG's CEO, commented: "The opportunity for additional high-grade, near surface ounces of free-gold at Mets could be transformative for TDG, given our existing infrastructure including our mill, permits and tailings storage facility. Last year we completed high-resolution geophysics demonstrating the potential extension of anomalies to the south and north of the high-grade Mets A Zone, and two new parallel target zones. Our goal is for further exploration success similar to the mineralization in the A-Zone at Mets."

Table 1. Final Assay results from Mets A-Zone 2023 Drilling 2 .

Drillhole | From (m) | To (m) | Interval (m) | Au (g/t) 2 | Ag (g/t) 2 |

MT23-001 | 19.0 | 39.0 | 20.0 | 10.36 | 1 |

incl. | 24.0 | 31.0 | 7.0 | 19.24 | 1 |

MT23-002 | 45.0 | 53.6 | 8.6 | 5.09 | 2 |

MT23-003 | 71.0 | 80.2 | 9.2 | 9.18 | 2 |

incl. | 75.4 | 80.2 | 4.8 | 15.29 | 3 |

MT23-004 | 17.5 | 22.5 | 5.0 | 5.59 | 2 |

MT23-005 | 50.5 | 58.8 | 8.3 | 16.36 | 4 |

Notes:

- Intervals are core-length weighted. True width is estimated on average between 70-90 % of core length; core recovery is estimated to be, on average, > 90 %, whereas core recovery is an average of > 80 % through the mineralized composites stated in the Table.

- Composite results were built using 3.0 g/t Au cut-off, although there may be intervals within the composite below 3.0 g/t Au.

- Calculated composites are truncated to significant 2 decimal places for Au and the nearest integer for Ag.

- Calculated composites may not sum due to rounding.

- These results supersede any previously published preliminary assay results and are considered final.

Steven Kramar, TDG's VP Exploration, commented: "In 2023, we confirmed the historical high-grade gold at the Mets A-Zone with modern drilling, and used the latest technology in post-processing geophysical data to outline additional priority targets across the Mets mining lease. We are excited to prospect drill our targets as we endeavor to expand the strike length, add additional dimensionality to the mineralized zone and uncover new parallel zones."

Mets Exploration Target

The mineralization in the A-Zone at Mets is comprised of free-gold hosted in a quartz-barite breccia(s) at or near the disrupted lithological contact between volcanic cycles. Historically, ~350 m of underground development work was completed around the A-Zone which is defined as ~150 m of strike and was the focus of ~8,800 m of historical diamond drilling reporting near surface high-grade Au.

In 2022, TDG received and compiled the historical archive of exploration and development work undertaken at Mets between 1986-92, including original assay certificates (third party), underground development schematics, historical mine calculations and progress reports.

In 2023, TDG conducted a 5-drillhole program to confirm historical grades and an extensive geophysical survey. The geophysics included a Very Low Frequency Electromagnetics ("VLF-EM") technique, in addition to magnetics, and expanded the previous surveyed area to the boundaries of the mining lease. With detailed post-processing of the geophysical data and interpretation of the drill data, TDG confirmed targets 1 on strike and contiguous with the A-Zone (news releases Jan 08 and Jan 15, 2024 ) and identified new targets 1 in potential parallel trends (news release Jan 22, 2024 ) . In October 2022, the Mets mining lease was extended for an additional 30 years to April 2053.

Figure 2 - 3D View of Mets Mining Lease & Potential Target Areas 1 displaying (a) magnetic susceptibility voxel model (left) and (b) VLF-EM 24.8 kHz, Karous-Hjelt filtered voxel model (right).

The Offering

The securities issued in connection with the Offering will be subject to a four-month and a day hold period. The Offering is subject to certain conditions including, but not limited to, the receipt of all necessary regulatory and other approvals including the approval of the TSX Venture Exchange. Finder's fees will be payable from the proceeds of the Offering.

Caution to US Investors

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

About TDG Gold Corp.

TDG is a major mineral tenure holder in the historical Toodoggone Production Corridor of north-central British Columbia, Canada, with over 23,000 hectares of brownfield and greenfield exploration opportunities under direct ownership. TDG's flagship projects are the former producing, high-grade gold-silver Shasta and Baker mines, which produced intermittently between 1981-2012, and the historical high-grade gold Mets developed prospect, all of which are road accessible, and combined have over 65,000 m of historical drilling. The projects have been advanced through compilation of historical data, new geological mapping, geochemical and geophysical surveys and, at Shasta, 13,250 m of modern HQ drill testing of the known mineralization occurrences and their potential extensions. In May 2023, TDG published an updated Mineral Resource Estimate for Shasta (news release May 01, 2023 ) which remains open at depth and along strike. In January 2023, TDG defined a larger exploration target area adjacent to Shasta ('Greater Shasta-Newberry'; news release Jan 25, 2023 ). In Fall 2023, TDG published the first modern drill results from the Mets mining lease (news releases Sep 07, 2023 , Sep 11, 2023 and Nov 28, 2023 ). In early 2024, TDG identified new copper-gold target areas over an expanded footprint covering ~53 sq.km known as the 'Baker Complex' (news release Feb 28, 2024 ).

Qualified Person

The technical content of this news release has been reviewed and approved Steven Kramar, MSc., P.Geo., Vice President, Exploration for TDG Gold Corp., a qualified person as defined by National Instrument 43-101.

1 Mineral Exploration/Exploration Target Area(s): TDG is a mineral exploration focused company and the Company's Projects are in the mineral exploration stage only. The degree of risk increases substantially where an issuer's properties are in the mineral exploration stage as opposed to the development or operational stage. Exploration targets and/or Exploration zones and/or Exploration areas are speculative and there is no certainty that any future work or evaluation will lead to the definition of a mineral resource.

2 2023 Drillcore Assay: Drillcore samples for the Mets 2023 drill program were handled via rigorous chain of custody, including sample collection, processing, and delivery to the MSA laboratory in Langley, B.C. The drillcore was logged, photographed, and sampled at TDG's Baker Mine site and processed by geologists and technicians. Quality assurance and control ("QAQC") materials were inserted into the sampling sequence during geological sample selection. The drillcore was selected for sampling and placed in zip-tied polyurethane bags, then in security-sealed rice bags before being delivered directly by TDG staff from the Baker Mine site to the MSA facility in Langley, B.C. Samples were prepared and analyzed following procedures: CRU-240,SPL-415,PPU-510 for sample preparation, FAS-221 for Au and IMS-230 for Ag and trace elements. Overlimit concentrations (> 20 ppm Au) of precious metals reported in the FAS-221 analysis were reanalyzed (where applicable) by MSC-550. Information about methodology can be found on the MSA Labs website, in the analytical guide.

3 Adjacent Mineral Properties: This information is third party public material about adjacent properties to the Mets project on which TDG does not have the right to explore or mine. Investors are cautioned that mineralization on adjacent properties is not necessarily indicative of mineralization that may be hosted on the Mets project. References to active mines or other mineral projects is for illustration purposes only. There can be no assurances that TDG will achieve comparable results.

ON BEHALF OF THE BOARD

Fletcher Morgan

Chief Executive Officer

For further information contact:

TDG Gold Corp.,

Telephone: +1.604.536.2711

Email: info@tdggold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements that are based on the Company's current expectations and estimates. Forward-looking statements are frequently characterized by words such as "plan", "project", "intend", "anticipate", "esti mate", "trend", "identify", "merit", "opportunity", "transform", "demonstrate", "confirm", "expand", "potential" and variants of these words and other similar words or statements that certain events or conditions "may" or "will" occur. Forward looking statements in this press release include: statements regarding the closing of the Offering and the amount of funds to be raised by the Company; the anticipated closing date; the final acceptance of the TSX Venture Exchange; the planned use of proceeds of the Offering; the plans for and results of drilling at Met; whether or not geophysical anomalies and the new targets are related to mineralization and whether such mineralization, if located, will be of economic significance; whether mineralization identified by Thesis' ground has any relationship to that at Mets and whether there is in fact a regional trend of mineralization in this area. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward- looking statements. Such factors include, among others: the state of the equity financing markets in Canada and other jurisdictions; the receipt of regulatory approvals; fluctuations in metals prices, the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans to continue to be refined; possible variations in ore grade or recovery rates; accidents, labour disputes and other risks of the mining industry; and delays in obtaining governmental approvals or financing. There may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

SOURCE: TDG Gold Corp.

View the original press release on accesswire.com