Highest Revenue Quarter in Company History Includes YOY Adjusted EBITDA* Improvement of 36%

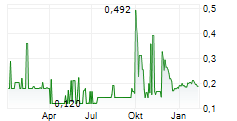

TORONTO, MUMBAI, India and LOS ANGELES, May 30, 2024 /PRNewswire/ - QYOU Media Inc., (TSXV: QYOU) (OTCQB: QYOUF) a company operating in India and the United States producing and distributing content created by social media stars and digital content creators, is reporting financial results for the quarter ended March 31, 2024. Highlights include as follows:

- Record Revenue: The company recorded quarterly revenue of $8,227,089 representing the highest quarterly revenue mark in corporate history. This was driven by strong results for QYOU USA, along with the beginning of revenue contribution from the direct-to-consumer gaming business in India. Revenue on a YOY basis increased by $1,180,640 or 17%.

- Improved Adjusted EBITDA*: For the three months ended March 31, 2024 compared to same period prior year, Adjusted EBITDA improved by $276,654 or 36% driven by QYOU USA's strong revenue growth and a meaningful return on strategic investment in the gaming segment, digital channels, workforce and new relationships in the social media space.

- Improved Net Loss: For the three months ended March 31, 2024, net loss improved by $146,854 or 10% compared to the same period prior year, most significantly driven by strong revenue growth offset by an increase in workforce and other operating expenses associated with building the gaming segment and new relationships in the social media space.

- Improved Cash Balance: The Company concluded the three months ended March 31, 2024 with cash of $1,615,481 (2023 - $736,713). Cash used in operating activities for the three months ended March 31, 2024 was $110,108 compared to $1,897,153 in the three months ended December 31, 2023. The decrease in cash used in operating activities is primarily due to the increase in collection of trade receivables.

QYOU Media CEO and Co-Founder, Curt Marvis commented, "Q1 2024 marked a powerful rebound for our business particularly driven by the strong performance of our QYOU USA business unit along with the early contributions coming from our India based gaming business. It is obviously very gratifying to see us reach an all time quarterly revenue record while also improving our Adjusted EBITDA results. This year we will continue to be focused on optimizing the value of each of our business units and assets to drive consistent and predictable growth in the future."

*Note on Adjusted EBITDA:To supplement our consolidated financial statements, which are prepared and presented in accordance with International Financial Reporting Standards ("IFRS"), we present Earnings Before Interest Tax Depreciation and Amortization ("Adjusted EBITDA") which is a non-IFRS financial measure. The presentation of non-IFRS financial measurement are not intended to be considered in isolation from, or as a substitute for, or superior to, operating loss or net income (loss) or any other performance measures derived in accordance with IFRS or as an alternative to net cash provided by operating activities or any other measures of cash flows or liquidity.

We define earnings before interest, taxes, depreciation and amortization ("Adjusted EBITDA") as revenue minus operating expenses excluding non-cash and or non-recurring operating expenses of stock-based compensation, marketing credits, depreciation and amortization (interest and taxes are not included in the Company's operating expenses). Adjusted EBITDA is used as an internal measure to evaluate the performance of our operating segments. We believe that information about this non-IFRS financial measure assists investors by allowing them to evaluate changes in operating results of our business separate from non-operational factors that affect operating income (loss) and net income (loss), thus providing insights into both operations and other factors that affect reported results. A limitation of the use of Adjusted EBITDA as a performance measure is that it does not reflect the periodic costs of certain amortizing assets used in generating revenue in our business. Furthermore, this measure may vary among companies; thus Adjusted EBITDA as presented herein may not be comparable to similarly titled measures of other companies.

In compliance with the TSX Venture Exchange's policies, QYOU Media Inc. announces that it previously engaged the services of ICP Securities Inc. ("ICP") to provide 'market making' services for a monthly service fee of $7,500 per month. The services began on February 1, 2024 and ended on April 30, 2024. ICP is at arm's length to the Company and does not currently have any interest, directly or indirectly, in the Company or its securities.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of applicable securities laws. Words such as "expects', "anticipates" and "intends" or similar expressions are intended to identify forward-looking statements. The forward-looking statements contained herein may include, but are not limited to, information concerning the completion of future investments, the approval of the Exchange of the investments, the approval of the Reserve Bank of India of future investments, the expected use of proceeds from the investment, and statements relating to the business and future activities of QYOU. These forward-looking statements are based on QYOU's current projections and expectations about future events and other factors management believes are appropriate. Although QYOU believes that the assumptions underlying these forward-looking statements are reasonable, they may prove to be incorrect, and readers cannot be assured that the offering and the closing thereof will be consistent with these forward-looking statements. Actual results could differ materially from those projected in the forward-looking statements as a result of numerous factors, including certain risk factors, many of which are beyond QYOU's control. Additional risks and uncertainties regarding QYOU are described in its publicly-available disclosure documents, filed by QYOU on SEDAR (www.sedar.com) except as updated herein. The forward-looking statements contained in this news release represent QYOU's expectations as of the date of this news release, or as of the date they are otherwise stated to be made, and subsequent events may cause these expectations to change. QYOU undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

About QYOU MediaOne of the fastest growing creator-media companies, QYOU Media operates in India and the United States producing, distributing and monetizing content created by social media influencers and digital content stars. In India, under our flagship brand, The Q and on connected TV, via channels Q Kahaniyan, Q GameX, Q Comedistaan & Sadhguru TV, QToonz and RDCMovies we curate, produce and distribute premium content across television networks, VOD and OTT platforms, mobile phones, smart TV's and app-based platforms. In addition, QYOU has numerous additional content destinations, apps and gaming platforms engaging over 125 million Indian households weekly. Our influencer marketing company, Chtrbox, has been a pioneer in India's creator economy, leveraging data to connect brands to the right social media influencers. QGamesMela is a recently launched casual gaming business leveraging access to the large audience enjoyed by Q India products. In the United States, we power major film studios, game publishers and brands to create content and market via creators and influencers. Founded and created by industry veterans from Lionsgate, MTV, Disney and Sony, QYOU Media's millennial and Gen Z-focused content reaches more than one billion consumers around the world every month. Experience our work at www.qyoumedia.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE QYOU Media Inc.