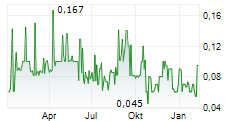

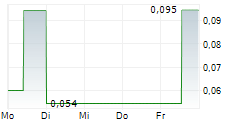

VANCOUVER, BC, May 14, 2024 /CNW/ - Africa Energy Corp. (TSX Venture: AFE) (Nasdaq First North: AEC) ("Africa Energy" or the "Company"), an oil and gas exploration company, announces corporate update and financial and operating results for the three months ended March 31, 2024.

FINANCIAL AND OPERATIONAL UPDATE

The Company's financial results for the three months ended March 31, 2024, have been negatively impacted by a US$23.1 million non-cash loss on revaluation of our investment in Block 11B/12B, which was due to changes in base assumptions for discount rates applied in the discounted cash flow model for valuing our interest in Block 11B/12B.

On April 25, 2024, the National Council of Provinces approved the Upstream Petroleum Resources Development Bill ("UPRDB"), which will now be tabled for presidential assent. Once presidential assent of the UPRDB is obtained, the industry will have more certainty and clarity, which is expected to drive investment in South Africa.

As part of South Africa's commitment to the Paris Climate Agreement, it must diversify energy mix, reducing its reliance on ageing coal fired power plants. In an effort to fulfill this commitment, the Department of Mineral Resources and Energy announced the draft Gas Master Plan ("GMP") in April 2024 and the Integrated Resource Plan 2023 ("IRP 2023") in January 2024, both designed to balance demand and supply of energy, including the use of natural gas, until 2050 as the country transitions its energy mix accordingly and provides the country with reliable base load generation capacity while ensuring compliance with emission reduction plans. IRP 2023 is a two phased approach to dealing with the electricity crisis, with phase one focusing on power system requirements up to 2030 and phase two focusing on long-term energy mix pathways to guide long-term policy choices. Phase two of IRP 2023 identifies the need to roll out dispatchable power including gas to provide security of power supply to South Africa and references more than 7 gigawatts of new gas-to-power requirements. The Company believes the program for phase two with associated transmission network upgrades needs to begin earlier if energy supply security is the objective of the IRP 2023.

The use of indigenous gas, potentially including the discovered resources from Block 11B/12B as identified in IRP 2023 and the draft GMP, will be part of the solution to South Africa's energy crisis and will have positive implications for the South African economy. In addition, the government of South Africa has committed to the unbundling of the government-owned electricity supplier into separate entities; Transmission, Generation and Distribution, creating an entity focused on expansion of the electricity grid, which is critical to allow future tie-in of potential gas-to-power projects.

OUTLOOK

The Block 11B/12B joint venture has applied for the Production Right and is contemplating an early production system ("EPS") for a phased development of the Paddavissie Fairway. The EPS would provide first gas and condensate production from the Luiperd discovery and would accelerate the Block 11B/12B development timeline by utilizing nearby infrastructure on the adjacent block in order to supply natural gas to customers in Mossel Bay for the conversion of natural gas to power and/or liquid petroleum products. The EPS would significantly decrease the capital expenditures required to reach first production on Block 11B/12B. The Company expects that a full development of the Paddavissie Fairway would follow the EPS as the gas market expands in South Africa. We are encouraged by the 2D and 3D seismic data that has identified additional prospectivity in the Paddavissie Fairway and to the east, confirming the large exploration upside remaining across the block.

HIGHLIGHTS

- The Company incurred a US$23.1 million non-cash loss on revaluation of its financial asset during the first quarter of 2024. The non-cash loss on revaluation of the financial asset relates to the Company's investment in Block 11B/12B and was due to changes in base assumptions for discount rate.

- The joint venture partnership submitted an application for a Production Right on September 7, 2022. As part of the Production Right application process, the Block 11B/12B joint venture also submitted a draft Environmental and Social Impact Assessment ("ESIA"). At the request of the Operator, the final ESIA deadline has been extended and is due August 30, 2024. The approval of the Production Right application will not occur until after the final ESIA has been submitted by the Block 11B/12B joint venture.

- At March 31, 2024, the Company had US$1.6 million in cash.

FINANCIAL INFORMATION

(Unaudited; thousands of US dollars, except per share amounts)

| Three Months | Three Months | ||

| Ended | Ended | ||

| March 31, | March 31, | ||

| 2024 | 2023 | ||

| Operating expenses | 23,832 | 2,193 | |

| Net loss | (24,087) | (2,286) | |

| Net loss per share (basic and diluted) | (0.02) | (0.00) | |

| Weighted average number of shares outstanding (basic and diluted) | 1,407,812 | 1,407,812 | |

| Number of shares outstanding | 1,407,812 | 1,407,812 | |

| Cash flows provided by (used in) operations | (216) | (931) | |

| Cash flows provided by (used in) investing | (173) | (3,192) | |

| Cash flows provided by (used in) financing | 315 | - | |

| Total change in cash and cash equivalents | (86) | (4,137) | |

| Change in share capital | - | - | |

| Change in contributed surplus | 375 | 1,099 | |

| Change in deficit | 24,087 | 2,286 | |

| Total change in equity | (23,712) | (1,187) | |

| March 31, | December 31, | ||

| 2024 | 2023 | ||

| Cash and cash equivalents | 1,622 | 1,708 | |

| Total assets | 115,843 | 138,833 | |

| Total liabilities | 7,709 | 6,987 | |

| Total equity attributable to common shareholders | 108,134 | 131,846 | |

| Net working capital | (5,973) | 1,671 | |

The financial information in this table was selected from the Company's unaudited condensed interim consolidated financial statements for the three months ended March 31, 2024 (the "Financial Statements"), which are available on SEDAR at www.sedar.com and the Company's website at www.africaenergycorp.com.

EARNINGS TREND AND FINANCIAL POSITION

(Unaudited; US dollars)

The Company recorded $23.8 million of operating expenses for the three months ended March 31, 2024, compared to $2.2 million for the same period in 2023. The Company recorded a $23.1 million non-cash loss on revaluation of the financial asset during the first quarter of 2024. The non-cash loss on revaluation of the financial asset relates to the Company's investment in Block 11B/12B and was due to changes in base assumptions for discount rate.

At March 31, 2024, the Company had cash of $1.6 million and working capital deficiency of $6.0 million compared to cash and working capital of $1.7 million at December 31, 2023. The reduction in working capital since December 31, 2023, can be mainly attributed to the amount due on the promissory note becoming a current liability, as it is due March 31, 2025. On December 19, 2022, the Company entered into a promissory note for $5.0 million. On November 7, 2023, amendments were made to increase the total amount available under the promissory note to $8.3 million, with a maturity date of March 31, 2025. At March 31, 2024, the Company had $2.0 million remaining available on the promissory note.

CORPORATE UPDATE

Africa Energy's Board of Directors has agreed that Robert Nicolella, the Company's Chief Executive Officer, be appointed as a Board nominee for election to the board as an executive director at the Annual General and Special Meeting on June 20, 2024.

NEXT EARNINGS REPORT RELEASE

The Company plans to report its results for the six months ended June 30, 2024, on August 13, 2024.

Important information

This is information that Africa Energy is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication through the agency of the contact persons set out above on May 14, 2024, at 5:30 p.m. ET.

The Company's certified advisor on Nasdaq First North Growth Market is Aktieinvest FK AB, +46 739 49 62 50, rutger.ahlerup@aktieinvest.se.

Forward looking statements

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or the Company's future performance, business prospects and opportunities, which are based on assumptions of management.

The use of any of the words "will", "expected", "planned" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company's current belief or assumptions as to the outcome and timing of certain future events. These forward-looking statements involve risks and uncertainties relating to, among other things, changes in oil prices, results of exploration and development activities, including results, timing and costs of seismic, drilling and development related activity in the Company's area of operations and, uninsured risks, regulatory changes, defects in title, availability of funds required to participate in the exploration activities, or of financing on reasonable terms, availability of materials and equipment on satisfactory terms, outcome of commercial negotiations with government and other regulatory authorities, timeliness of government or other regulatory approvals, actual performance of facilities, availability of third party service providers, equipment and processes relative to specifications and expectations and unanticipated environmental impacts on operations. Actual future results may differ materially. Various assumptions or factors are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information. Those assumptions and factors are based on information currently available to the Company. The forward-looking information contained in this release is made as of the date hereof and the Company is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward-looking information. The foregoing statements expressly qualify any forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

View PDF version

For further information, please contact:

Jeromie Kufflick

Chief Financial Officer

+1 (587) 333-6489

info@africaenergycorp.com

www.africaenergycorp.com

About Africa Energy Corp.

Africa Energy Corp. is a Canadian oil and gas exploration company focused on South Africa. The Company is listed in Toronto on TSX Venture Exchange (ticker "AFE") and in Stockholm on Nasdaq First North Growth Market (ticker "AEC").