Toronto, Ontario--(Newsfile Corp. - June 3, 2024) - SPARQ Systems Inc. (TSXV: SPRQ) (OTCQB: SPRQF) ("SPARQ" or the "Company") is pleased to announce it has completed the first tranche of its brokered private placement (the "Offering") of common shares in the capital of the Company ("Common Shares") previously announced in its press release dated May 6, 2024.

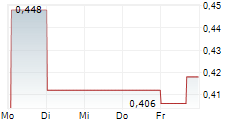

The first tranche was completed on May 31, 2024 and consisted of the issuance of an aggregate of 11,938,746 Common Shares at a price of $0.40 per Common Share for aggregate gross proceeds of $4,775,498. The net proceeds of the Offering are intended to be used for working capital and general corporate purposes.

The Company is also pleased to announce that, due to strong investor demand, it has upsized the total potential size of the Offering from $5.0 million to up to $12.5 million. In addition to the subscriptions closed in the first tranche of the Offering, the Company has received additional firm commitments to purchase up to 18,950,975 Common Shares for aggregate gross proceeds of approximately $7,580,390. The Company expects to close the second tranche of the Offering on or about June 7, 2024.

Praveen Jain, CEO said: "We are very pleased to upsize and close the first tranche of this financing and are grateful for the support from both existing and new investors. This financing will allow SPARQ to continue to advance the rollout of our partnership with Jio Things and to continue evolving and innovating our unique micro-inverter technology."

Pursuant to Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions ("MI 61-101"), the Offering constituted a "related party transaction" as insiders of the Company subscribed for an aggregate of 3,750,000 Common Shares in the first tranche. The Company is relying on exemptions from the formal valuation and minority approval requirements of MI 61-101. The Company did not file a material change report more than 21 days before the expected closing of the Offering as the details of the related parties' participation in the Offering had not been settled.

The securities issued in connection with the Offering are subject to a statutory hold period of four months and one day from the date of issuance in accordance with applicable securities legislation.

The securities referred to in this news release have not been, nor will they be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), and may not be offered or sold within the United States or to, or for the account or benefit of, "U.S. persons" (as defined in Regulation S under the U.S. Securities Act) absent registration or an applicable exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. This press release shall not constitute an offer to sell or the solicitation of any offer to buy, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Pollitt & Co. Inc. (the "Agent") was engaged as the sole agent and bookrunner for the Offering to offer the Common Shares for sale on a best efforts agency basis. In connection with the closing of the first tranche of the Offering, the Agent received: (i) a cash commission of $239,212; and (ii) common share purchase warrants entitling the Agent to purchase up to 361,442 Common Shares at a price of $0.40 per Common Share for a period of two years from the closing of the Offering.

Shares for Debt

The Company also announces that it intends to issue an aggregate of 1,775,640 Common Shares at a deemed issuance price of $0.40 per Common Share to settle in full $710,256 owing to certain arm's length parties pursuant to outstanding unsecured loans (the "Debt Settlement"). The board of directors and management of the Company believe that the proposed Debt Settlement is in the best interests of the Company as it allows the Company to preserve its funds for operations. The Debt Settlement is subject to the acceptance of the TSX Venture Exchange and execution of applicable settlement documents with the holders of the loans. The Common Shares issued pursuant to the Debt Settlement will be subject to a statutory four month and one day hold period.

ABOUT SPARQ

SPARQ designs and manufactures next generation single-phase microinverters for residential and commercial solar electric applications. SPARQ has developed a proprietary PV solution called the Quad; the Quad inverter optimizes four PV modules with a single microinverter, simplifying design and installation, and lowering cost for solar power installations when compared to existing market offerings.

SPARQ's head office is located at 945 Princess Street, Kingston, Ontario, K7L 0E9.

Cautionary Note

Certain statements contained in this press release constitute "forward-looking statements". All statements other than statements of historical fact contained in this press release, including, without limitation, the Offering and the Debt Settlement and any statements preceded by, followed by or that include the words "believe", "expect", "aim", "intend", "plan", "continue", "will", "may", "would", "anticipate", "estimate", "forecast", "predict", "project", "seek", "should" or similar expressions or the negative thereof, are forward-looking statements. These statements are not historical facts but instead represent only the Company's expectations, estimates and projections regarding future events. These statements are not guarantees of future performance and involve assumptions, risks and uncertainties that are difficult to predict. Therefore, actual results may differ materially from what is expressed, implied or forecasted in such forward-looking statements.

Additional factors that could cause actual results, performance or achievements to differ materially include, but are not limited to the risk factors discussed in the Company's management's discussion and analysis for the financial year ended December 31, 2023. Further, there is no assurance that the Company will be able to successfully complete the remaining portion of the Offering beyond the completion of the first tranche or complete the Debt Settlement. Management provides forward-looking statements because it believes they provide useful information to investors when considering their investment objectives and cautions investors not to place undue reliance on forward-looking information. Consequently, all of the forward-looking statements made in this press release are qualified by these cautionary statements and other cautionary statements or factors contained herein, and there can be no assurance that the actual results or developments will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, the Company. These forward-looking statements are made as of the date of this press release and the Company assumes no obligation to update or revise them to reflect subsequent information, events or circumstances or otherwise, except as required by law.

Neither the TSXV nor its regulation services provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

For more information, please contact:

SPARQ Systems Inc.

Dr. Praveen Jain

Chief Executive Officer

Email: pjain@sparqsys.com

Tel: 343.477.1158

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR DISSEMINATION IN THE

UNITED STATES

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/211422

SOURCE: SPARQ Systems Inc.