AUBURN HILLS, Mich.--(BUSINESS WIRE)--SPAR Group, Inc. (NASDAQ: SGRP) (the "Corporation"), a provider of merchandising, marketing and distribution services, announced today that based on the unanimous approval of the Board and a Special Committee of Independent Directors formed to evaluate strategic alternatives, the Corporation has entered into a letter of intent ("LOI"), which is non-binding, in all respects, other than a defined term of exclusivity and certain legal terms, with Highwire Capital ("Highwire").

Highwire has offered to acquire the Corporation in a merger transaction for consideration of $58.0 million or $2.50 per share, payable in cash, subject to certain adjustments, and the negotiation and execution of a definitive merger agreement, including the satisfaction of any conditions in such an agreement.

"The Board believes that agreement to this proposal is the best way to secure the recent value created and deliver a meaningful return to our shareholders," said Jim Gillis, Chairman of the Board. "Upon completing a thorough process and analysis over the last 18+ months, we considered a number of alternatives. Working with management, we began a process to dispose of the joint ventures, bring cash back into the business and focus on the U.S. and Canada. This strategy energized the stock and provided us an opportunity to capture value for our shareholders in this LOI."

Other factors that were considered by the Board included:

- Advice and counsel from Lincoln International, a financial advisor, having discussed the potential value of the Corporation and alternatives with more than 165 parties

- Output of a thorough and exhaustive process evaluating alternatives to create maximum shareholder value

- Review of multiple offers for the business that were materially lower in value than the current offer

- Analysis of the volume and historical stock price performance in unlocking shareholder value

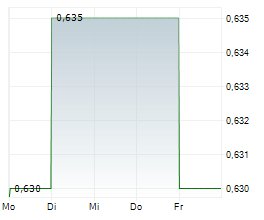

- Recognition that the stock is highly volatile closing from $.97 to $2.97 over the last 90 trading days

The $2.50 proposed merger consideration represents a 19% premium over the 20-day average [closing] price per share of $2.10 and approximately a 107% premium to the average closing price of the last 12 months of $1.21. In addition, the Board and Special Committee expect to receive and review a fairness opinion from its financial advisor prior to the execution of any definitive agreements.

"The proposed merger with Highwire Capital will maximize value to our stockholders and enable us to continue our growth while offering innovation and more value to our clients. Highwire is expected to retain the SPAR executive team. Our commitment to clients and service is unchanged and our passion for results is unwavering," said Mike Matacunas, CEO and president, SPAR Group.

"This is an exciting opportunity to leverage SPAR's tenured industry expertise with transformative innovation - a hallmark of Highwire's founding ethos," said Rob Wilson, CEO of Highwire Capital.

The letter of intent does not provide for any agreement to consummate the proposed acquisition or any other transaction, or the requirement of participation in any negotiations toward any definitive agreement by either party therein, and no such obligation or agreement will be deemed to exist unless and until a definitive agreement has been executed, which definitive agreement may contain terms materially different from those proposed in the letter of intent. The proposed acquisition will be subject to satisfactory completion of due diligence by Highwire, the approval by a majority of the Corporation's shares of common stock at a special meeting, the receipt of any necessary regulatory approvals and completion of any further closing conditions.

Neither this press release nor the letter of intent is an offer to purchase any securities, a solicitation of proxies or a request or recommendation for any stockholder to vote on or consent to the proposed transaction, and the Corporation's stockholders should not submit any proxy, vote or consent at this time. The Corporation will prepare and distribute a proxy statement or information statement, as appropriate, to its stockholders regarding the proposed transaction in compliance with SEC rules if the parties enter into a definitive agreement.

Lincoln International LLC is serving as the Corporation's financial advisors and Foley & Lardner LLP is serving as the Corporation's legal advisers. Ferguson Braswell Fraser Kubasta P.C. is acting as Highwire's legal advisers.

About Highwire Capital

Highwire Capital transforms middle-market businesses by integrating innovative technologies with traditional operating models. By driving efficiency and fostering industry advancements, Highwire revitalizes established entities into leading platforms for disruption and growth. For more information, please visit Highwire's website at http://www.highwire.capital.

About SPAR Group, Inc.

SPAR Group is an innovative services company offering comprehensive merchandising, marketing and distribution solutions to retailers and brands. We provide the resources and analytics that improve brand experiences and transform retail spaces. We offer a unique combination of scale and flexibility with a passion for client results that separates us from the competition. For more information, please visit the SPAR Group's website at http://www.sparinc.com.

Forward Looking Statements

This Press Release (this "Press Release") contains "forward-looking statements" within the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, made by, or respecting, the Company. "Forward-looking statements" are defined in Section 27A of the Securities Act and Section 21E of the Securities Exchange Act and other applicable Securities Laws.

All statements (other than those that are purely historical) are forward-looking statements. Words such as "may," "will," "expect," "intend," "believe," "estimate," "anticipate," "continue," "plan," "project," or the negative of these terms or other similar expressions also identify forward-looking statements. Forward-looking statements made by the Corporation in this Press Release may include (without limitation) statements regarding: risks, uncertainties, cautions, circumstances and other factors ("Risks"). Those Risks include (without limitation): the impact of the news of the Proposed Acquisition or developments in it; the uncertainty of completion of mutually acceptable definitive documentation, approval by the Corporation's stockholders and satisfaction of other closing conditions respecting the Proposed Acquisition; the impact of the Corporation's continued strategic review process, or any resulting action or inaction, should the Proposed Acquisition not occur; the impact of selling certain of the Corporation's subsidiaries or any resulting impact on revenues, earnings or cash; the impact of adding new directors or new finance team members; the potential negative effects of any stock repurchase and/or payment; the potential continuing negative effects of the COVID pandemic on the Company's business; the Corporation's potential non-compliance with applicable Nasdaq director independence, bid price or other rules; the Company's cash flow or financial condition; and plans, intentions, expectations, guidance or other information respecting the pursuit or achievement of the Company's corporate objectives.

You should carefully review and consider the Company's forward-looking statements (including Risks and other cautions and uncertainties) and other information made, contained or noted in or incorporated by reference into this Press Release, but you should not place undue reliance on any of them. The results, actions, levels of activity, performance, achievements or condition of the Company (including its affiliates, assets, business, clients, capital, cash flow, credit, expenses, financial condition, foreign exchange, income, liabilities, liquidity, locations, marketing, operations, performance, prospects, revenues, sales, strategies, taxation or other achievement, results, Risks, trends or condition) and other events and circumstances planned, intended, anticipated, estimated or otherwise expected by the Company (collectively, " Expectations"), and our forward-looking statements (including all Risks) and other information reflect the Company's current views about future events and circumstances. Although the Company believes those Expectations and views are reasonable, the results, actions, levels of activity, performance, achievements or condition of the Company or other events and circumstances may differ materially from our Expectations and views, and they cannot be assured or guaranteed by the Company, since they are subject to Risks and other assumptions, changes in circumstances and unpredictable events (many of which are beyond the Company's control). In addition, new Risks arise from time to time, and it is impossible for the Company to predict these matters or how they may arise or affect the Company. Accordingly, the Company cannot assure you that its Expectations will be achieved in whole or in part, that it has identified all potential Risks, or that it can successfully avoid or mitigate such Risks in whole or in part, any of which could be significant and materially adverse to the Company and the value of your investment in the Company's common stock.

These forward-looking statements reflect the Company's Expectations, views, Risks and assumptions only as of the date of this Press Release, and the Company does not intend, assume any obligation, or promise to publicly update or revise any forward-looking statements (including any Risks or Expectations) or other information (in whole or in part), whether as a result of new information, new or worsening Risks or uncertainties, changed circumstances, future events, recognition, or otherwise.

Contacts

Media:

Ronald Margulis

RAM Communications

908-272-3930

ron@rampr.com

Investor Relations:

Sandy Martin

Three Part Advisors

214-616-2207

smartin@threepa.com