VANCOUVER, BC / ACCESSWIRE / June 10, 2024 / Troy Minerals Inc. ("Troy" or the "Company") (CSE:TROY)(OTCQB:TROYF)(FSE:VJ3) announces that it has signed a binding letter of intent dated June 6, 2024 with CBGB Ventures Corp. ("CBGB") to acquire 100% of the issued and outstanding shares of CBGB (the "Transaction"). CBGB is a privately held company incorporated in British Columbia that holds interest in two high purity silica projects: the Table Mountain Silica Project near Golden, B.C., and the Tsagaan Zalaa Silica Project in Mongolia.

Through the Transaction, Troy would acquire two highly prospective high purity silica assets, further diversifying and strengthening its critical mineral asset portfolio. The Company anticipates an aggressive campaign of exploration and development across both properties, subject to completion of the Transaction.

Silica, a vital component in everyday products including microchips and emerging green technologies, particularly solar photovoltaics (PV), continues to grow in demand and has become of particular concern to European and North American governments as world tensions rise and China, currently the leader in the production of silicon, continues to exert its influence world-wide leading to concerns of potential restriction of supplies.

Rana Vig, CEO of Troy Minerals stated, "We are thrilled to integrate these high-quality silica assets into our portfolio, as they align seamlessly with our strategy to diversify and reinforce our holdings in critical minerals. With a robust financial position and zero debt, Troy is poised for an active second half of the year as we gear up for accelerated exploration and development activities across our diverse project portfolio. From our imminent follow up drill program at our Lac Jacque REE project in Quebec, to the commencement of our maiden drill program on our highly prospective vanadium-titanium project in Wyoming, to this strategic acquisition of silica assets, we are well positioned and committed to driving rapid progress and creating substantial returns for our shareholders.

With the permitting of silica projects being significantly simpler than traditional mines, the synergy of these efforts will position Troy as an emerging leader in the critical minerals market. The near-term prospect of production and the objective to become a cash-flowing mining company sets up Troy Minerals for the ability to self-fund exploration activities using non-dilutive capital for future growth."

Project Highlights

Table Mountain Silica Project, B.C.

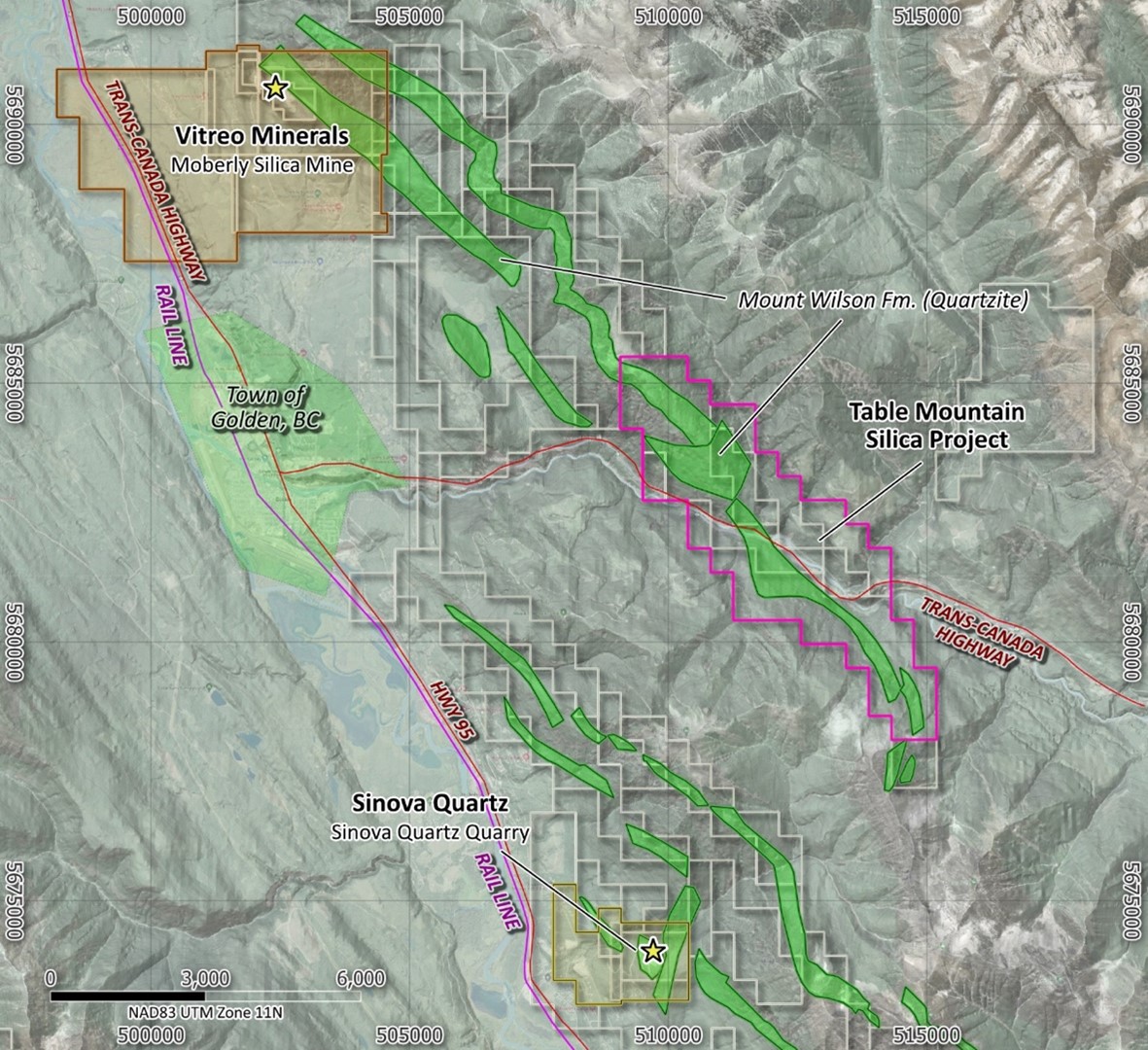

- 1,698 hectares (4,196 acres) located 4 km east of the town of Golden, B.C., and 6 km from the Canadian Pacific Railway Golden Rail Yard with easy year-round access. (Figure 1)

- High-purity quartzite of the Mount Wilson Formation with up to 10 km of regionally mapped strike length on the property and up to 300 to 1,400 metres apparent width at surface.

- 2017 sampling in the northern area of the property conducted by Patriot Battery Metals Inc (TSX:PMET) (formerly 92 Resources Corp), the former owner of the Table Mountain Silica Project area, encountered up to 99.74% SiO2 from grab samples taken over an area of 700 x 600 metres. (1) *

- 2023 surface sampling in the centre of the property yielded up to 99.24% SiO2 with an average of 98.62% SiO2 from 9 grab samples taken across a traverse of over 180 metres of apparent thickness. *

- On the same lithological unit and close to both the Sinova Quartz quarry (6 km to SW) and Moberly Silica Mine (7.5 km to NW).

- The nearby Sinova Quartz quarry will export silica to supply its own silicon plant in Tennessee, USA. Sinova's chairman, Sir Mick Davis (former executive of Billiton and founder of the industry giant Xstrata plc, later bought by Glencore), is also CEO of Vision Blue Resources, a clean energy-focused natural resource investor, which made a $125-million investment into Sinova in 2021. (2)(3)

- Ability to tap into the North American push for securing critical minerals. Over $1.4 billion in the US has been allocated to silica uses, including a $150-million investment by Sinova Global into the construction of a state-of-the-art silicon metal production facility in Tiptonville, Tennessee now underway, in addition to US federal government renewable energy incentives. (4)(5)

- Quick to cashflow potential.

Figure 1. Table Mountain Silica Project Map

Tsagaan Zalaa Silica Project, Mongolia

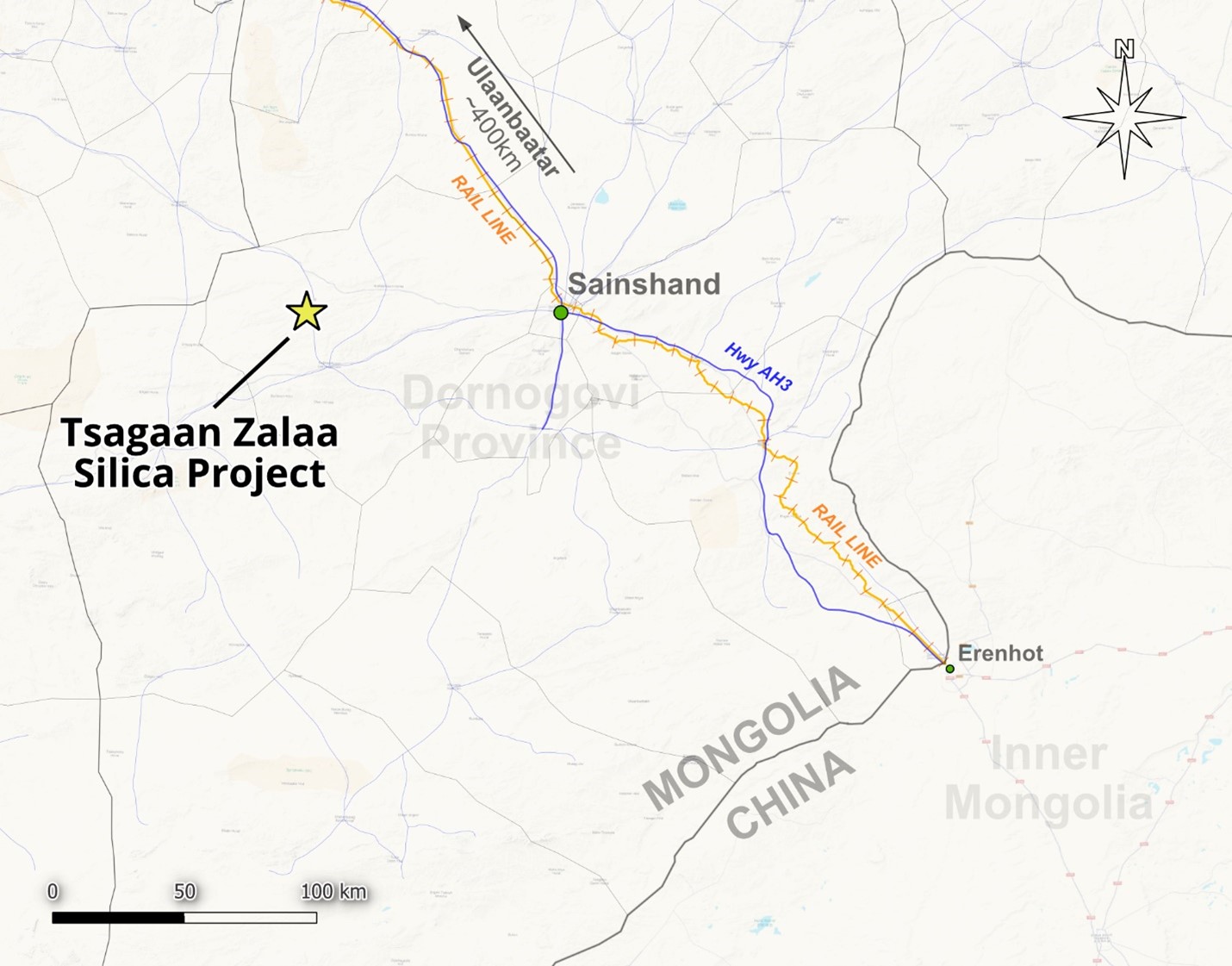

- 1,670 hectares (4,127 acres) located near a Japanese high purity silica quarry and refiner producing and directly exporting high purity silica to Japan. (Figure 2)

- Close to Chinese border and potential offtakers, currently with signed LOI for offtake from Chinese buyer. (Figure 3)

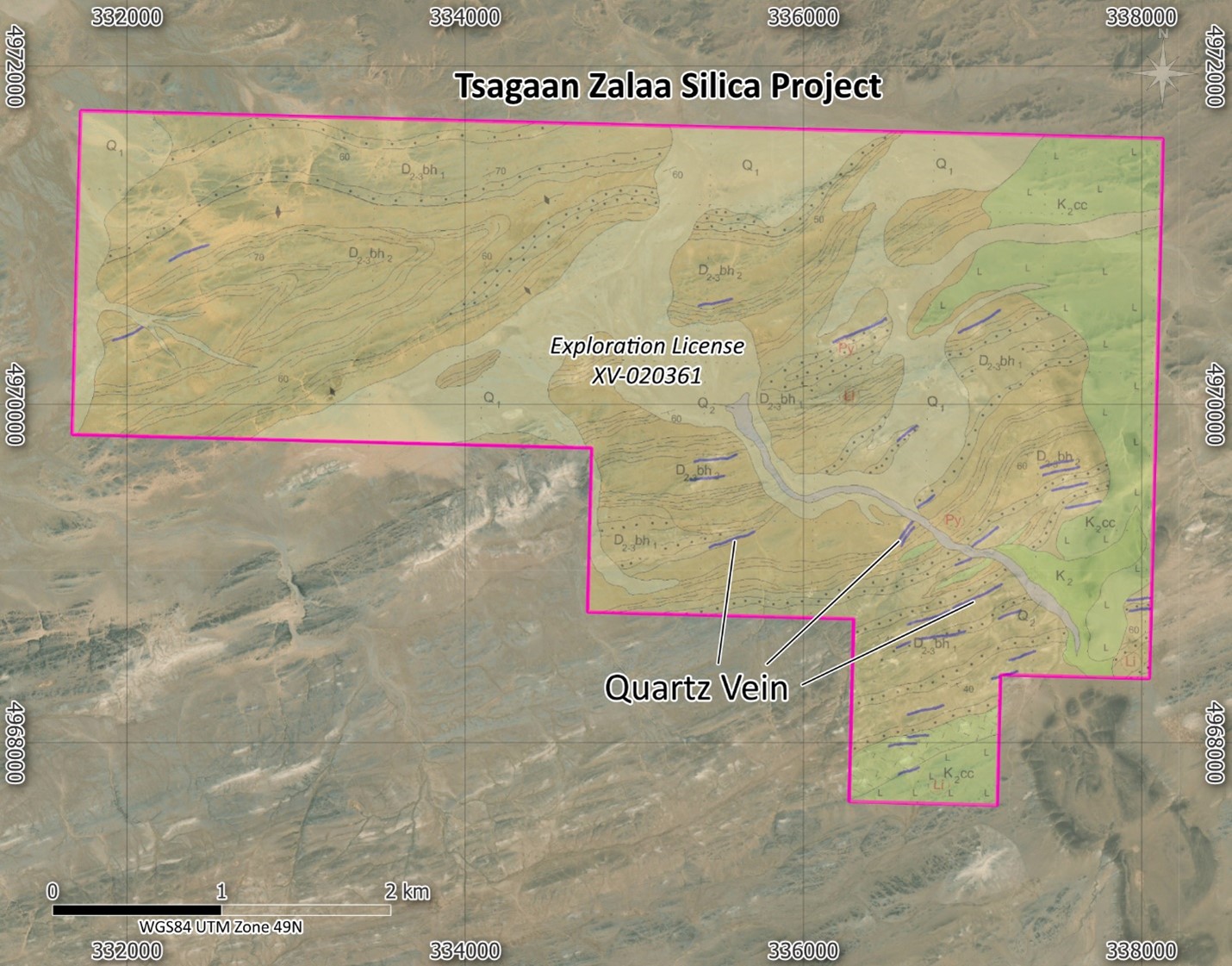

- Massive high-purity quartz veins up to 10 metres in width hosted by Upper-Middle Devonian sediments.

- Successful initial drilling, with final phase of drilling expected by summer 2024. Subsequent objectives remain of establishing resource, mine plan, and mining license application, subject to drilling results.

- 10-tonne bulk sample sent to Chinese offtaker reported 99.98% SiO2 purity after beneficiation with run of mine material.

- Quick to production potential, targeting Q2 2025.

Figure 2. Tsagaan Zalaa Silica Project Map

Figure 3. Tsagaan Zalaa Silica Project Regional Map

To support the execution of the Company's plans, Troy will engage Mine Plus Group (mineplusgroup.com), a leading mining consultancy based in Europe that has been involved in international mining ventures valued at over $2 billion. The Mine Plus team provides management services across the entire mining lifecycle - from exploration and engineering to operations and mergers and acquisitions. Mine Plus has expertise in exploration, geology, mining engineering, metallurgy, and processing engineering, enabling Troy to confidently explore, develop, and operate all the projects in the Company's diverse multi regional portfolio.

Mine Plus's breadth of experience includes projects in Mongolia and Canada, where they have a proven track record in developing mining projects with companies such as Skeena Resources and three additional private mining companies, as well as other high purity silica projects in B.C. in close proximity to the Table Mountain Silica Project. Mine Plus also has provided services to West Red Lake Gold, Tara Resources, and Calipuy Resources, in addition to numerous other private and public companies.

Transaction Terms

The Transaction is currently contemplated to proceed by way of share purchase, share exchange, amalgamation or other similar type of transaction, pursuant to which shareholders of CBGB will exchange all of their shares of CBGB in consideration for a total of 6,488,303 common shares and 6,488,303 special warrants of the Company (the "Consideration Securities").

All shares are subject to voluntary hold and escrow provisions, as detailed below, with 50% of the total shares being issued on the Company achieving key milestones, including production.

The Consideration Securities issued to certain shareholders (the "Restricted Shareholders") will be subject to a voluntary hold period, such that half of such Consideration Shares (842,161) will be restricted for a period of 6 months from the closing date, and a further half (842,161) of such Consideration Shares will be restricted for a period of 12 months from the closing date. The Consideration Securities issued to the CBGB shareholders, other than the Restricted Shareholders (4,803,981), will be subject to escrow and released as follows: 10% of the escrowed shares will be released 6 months after the closing date and 15% of the escrowed shares will be released every 6 months thereafter.

The special warrants of the Company will automatically convert into common shares of the Company as follows:

| a. | 1,601,328 special warrants held by CBGB shareholders, excluding the Restricted Shareholders, will automatically convert into 1,601,328 common shares of the Company on that date which is 30 days of the earlier of the date of Table Mountain Project attaining a mineral resource of 5,000,000 tonnes as supported by a technical report prepared for the Company pursuant to National Instrument 43-101 and upon commencing commercial production. | |

| b. | a further 1,601,327 special warrants held by CBGB Shareholders, excluding the Restricted Shareholders, will automatically convert into 1,601,327 common shares of the Company on that date which is 30 days of the date of the Table Mountain Project commencing commercial production. | |

| c. | a further 1,601,327 special warrants held by CBGB Shareholders, excluding the Restricted Shareholders, and 1,684,321 special warrants held by the Restricted Shareholders, will automatically convert into a total of 3,285,648 common shares of the Company on that date which is 30 days of the Tsagaan Zalaa Project commencing commercial production. |

Upon completion of the Transaction, CBGB will have the right to nominate a director to the board of directors of the Company for a period of 24 months or upon commencement of commercial production at either of the Table Mountain Project or the Tsagaan Zalaa Project.

The final structure of the Transaction will be determined by the parties based on corporate, tax, securities and other legal considerations. The closing of the Transaction is subject to CSE approval, the parties negotiating and executing definitive documentation, the satisfactory completion of due diligence by the Company and the receipt of all other necessary consents and approvals, among other conditions that are typical for a transaction of this nature.

Additional Technical Details on the Table Mountain Silica Project, B.C.

The property is underlain by thick sequences of extremely pure quartzite of the Ordovician Mount Wilson Formation, occurring as north-northwest striking, usually steeply east-dipping thrust panels.

Locally, quartzite of the Mount Wilson Formation occurs as friable sandstone, grading deeper to well cemented quartzite. One structurally repeated exposure of Mount Wilson quartzite occurs on the property, parallel to multiple structurally repeated exposures, one of which hosts the Moberly Silica Mine (7.5 kilometres northwest), which previously produced up to 150,000 tonnes of silica sand annually, while another hosts the Sinova Quartz silica quarry (6 kilometres southwest), both of which exhibit economic grade silica greater than 99.6% SiO2 purity. (6)(7)

The quartzite can be described as frosty white, sedimentary quartzite with a clastic texture containing fine, well-rounded polished grains 1/8- 1/4 mm in diameter. Very competent bonding allows breaking to occur through the quartz grains.

The silica-hosting formation on the property measures up to 10 kilometres in strike length with a regionally mapped surface exposure ranging from 300 to 1,400 metres apparent width at surface.

Additional Technical Details on the Tsagaan Zalaa Silica Project, Mongolia

Mineralization at the property consists of almost pure, monomineralic quartz veins. Vein deposits are formed through a variety of processes, including hydrothermal activity, metamorphism, and weathering. The minerals that make up vein deposits are typically deposited from hydrothermal fluids that have migrated through the rock depth.

At the Tsagaan Zalaa Project, quartz veins up to 5 metres in width are exposed at surface throughout the project area. The veins trend ENE, broadly parallel with the overall structural trend of the area though appear to cut and post-date regional folding.

During September 2022, seven trenches totalling 152 m in length were completed over six veins on the Tsagaan Zalaa Project. The trenches were 1-4 metres deep and a total of 344 m3 of material was excavated and grades up to 99.81% SiO2 were reported on the 47 samples that averaged 97.80% SiO2. *

Initial drilling of 400 metres was conducted from July to November 2023 but was cut short due to the onset of winter. The results will be compiled along with the second phase drilling expected to begin shortly after the closing of the transaction, which will form the mining license submission.

A 10-tonne bulk sample was sold to a Chinese offtaker at US$200 per tonne for testing. The offtaker reported 99.98% SiO2 purity from run of mine material and has requested further material.

* Cautionary Note

The reader is cautioned that grab samples are selective by nature and may not represent the true grade or style of mineralization across the property.

Sources

- https://apps.nrs.gov.bc.ca/pub/aris/Report/37402.pdf/

- https://sinovaglobal.com/about/leadership-team/

- https://sinovaglobal.com/news/us125m-investment-by-sir-mick-davis-vision-blue-resources/

- https://sinovaglobal.com/news/tennessee-governor-lee-announces-silicon-metal-manufacturing-facility-in-tennessee/

- https://sinovaglobal.com/news/groundbreaking-starts-construction-of-the-tennessee-silicon-metal-plant/

- https://minfile.gov.bc.ca/Summary.aspx?minfilno=082N++001

- https://minfile.gov.bc.ca/Summary.aspx?minfilno=082N++043

Qualified Person (QP) Statement

Technical information in this news release has been reviewed and approved by Case Lewis, P.Geo a "Qualified Person" as defined under NI 43-101 Standards of Disclosure for Mineral Projects and a director of the Table Mountain Project vendor.

ON BEHALF OF THE BOARD,

Rana Vig | President and Director Telephone: 604-218-4766 rana@ranavig.com

The Canadian Securities Exchange has not reviewed this press release and does not accept responsibility for the adequacy or accuracy of this news release.

Forward-looking Statements

Certain information contained herein constitutes "forward-looking information" under Canadian securities legislation. Forward-looking information includes, but is not limited to, the Transaction and the completion of the Transaction on the terms and timing described herein. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "will" or variations of such words and phrases or statements that certain actions, events or results "will" occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are from those expressed or implied by such forward-looking statements or forward-looking information subject to known and unknown risks, uncertainties and other factors that may cause the actual results to be materially different, including receipt of all necessary regulatory approvals. Although management of the Company have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.

SOURCE: Troy Minerals Inc.

View the original press release on accesswire.com