Vénissieux, 10 June 2024

BOOSTHEAT (ALBOO), a French industrial and software player in energy efficiency, announces the successful completion of the test program for its new hybrid compressor, marking a significant milestone in the development of innovative energy solutions to reduce environmental impact. This major technological breakthrough, which has already prompted discussions with industrial partners for the exploitation and integration of this technology in the biogas and biomethane sectors, opens a new chapter in the company's history. BOOSTHEAT will now seek to monetize its strategic asset and is radically evolving its organization in this new context.

I DISRUPTIVE TECHNOLOGY FOR INDUSTRIAL AND ENVIRONMENTAL CHALLENGES

Under the impetus of HBR Investment Group, BOOSTHEAT has been engaged in an ambitious development program, serving the acceleration of the ecological transition, since the beginning of 2023. This research work, which has mobilized teams for over 1 year, has resulted in the development of the first hybrid compressor meeting 3 criteria:

- Versatility: Highlighting the distinct advantages of hybrid compression, which take full advantage of the combination of thermal and electrical energy for optimum efficiency.

- Scalability: Develop an innovative compression architecture that enables the creation of products with varied capacities, ranging from 50 to 250 kW, thus meeting the market's diversified needs.

- Performance: Significantly increase the performance of BOOSTHEAT's existing compressors, reinforcing its leading position in the field of gas-fired or waste-heat heat pumps.

BOOSTHEAT has now finalized an ambitious test program focused on the validation of the different operating modes (Stirling Heat Pump / micro-cogeneration / Hybrid Heat Pump), illustrating the advantages of each for industry and future uses of the technology.

The completion of BOOSTHEAT's hybrid compressor test program symbolizes a major achievement, perfectly meeting the ambitious strategic objectives set by the management team and confirming the strengths of BOOSTHEAT's patented technology.

I A STRATEGIC ASSET TO BE VALUED

To make the most of this strategic asset, BOOSTHEAT has chosen to approach industrial players likely to acquire and exploit the hybrid compressor to bring it to industrial scale.

For the record, BOOSTHEAT has already received 2 letters of interest from recognized players in the biogas and biomethane production sector, ideally positioned to benefit from this technology, and hopes to attract interest from industrial players in the compression and HVAC fields, such as manufacturers of heating and cooling equipment.

BOOSTHEAT is committed to the same strategy for its new ImpliciX software solution, which enables industrial companies to optimize product performance and maintenance operations. This pilot solution has already led to the signature of a letter of interest from Proxipel, an industrial player specializing in the processing and valorization of biomass, for the integration of ImpliciX in their future generations of pellet machines.

I ADAPT THE ORGANIZATION TO PRESERVE RESOURCES

To ensure the financial visibility needed to implement this asset enhancement strategy, BOOSTHEAT has decided to implement a drastic cost-cutting plan and has the reaffirmed support of its financial partners. To focus its financial resources on issues directly linked to the implementation of this asset enhancement strategy, BOOSTHEAT has decided to stop all other operating expenses, cut around 10 positions and terminate non-essential contracts. The aim is to reduce cash consumption linked to operations and investments from an average of €375.000 per month in 2023 to an average of around €100.000 per month from the 2nd half of 2024.

At the same time, BOOSTHEAT is working closely with its partners and with the renewed support of HBR Investment Group to clear its liabilities, particularly the bank debts from the safeguard plan still outstanding representing a nominal value of €5.6 million. For the record, HBR Investment Group has already acquired the €8.0 million bond debt during the observation period and has undertaken not to seek cash repayment of these receivables. This drastic cost-cutting plan, combined with the support of HBR Investment Group and the maximum residual financing capacity of €22.8 million through the bond financing line, should enable the company to continue as a going concern.

Emilien Benhard, BOOSTHEAT's Director of Operations, says: "I'm very proud of the work we've accomplished in record time to make available to energy performance professionals two unrivalled innovative solutions, our hybrid compressor and our software suite. I'd like to extend my warmest thanks to all those who made this success possible and hope that tomorrow we'll see a bit of "BOOSTHEAT inside" in the future products of the energy revolution."

Hugo BRUGIERE, CEO of BOOSTHEAT, added: "HBR Investment Group has fully played its role as reference investor to make possible the tremendous work done by all the teams led by Emilien over the last few months. Now it's time to capitalize on this intense work by finding partners with the capacity to integrate these revolutions into large-scale industrial solutions. At the same time, the Board of Directors is considering the best options for the Company's future."

* * *

Find out more about BOOSTHEAT at

www.boostheat-group.com

ABOUT BOOSTHEAT

Founded in 2011, BOOSTHEAT is a player in the energy efficiency sector. The company's mission is to accelerate the energy transition by integrating its technology into energy-intensive applications. BOOSTHEAT has designed and developed a thermal compressor protected by 7 families of patents, enabling significant optimization of energy consumption to move towards a reasonable and appropriate use of resources.

BOOSTHEAT is listed on Euronext Growth in Paris (ISIN: FR001400IAM7).

I CONTACTS

ACTUS finance & communication - Jérôme FABREGUETTES LEIB

Investor Relations

Tel.: +33 1 53 67 36 78 / boostheat@actus.fr

ACTUS finance & communication - Anne-Charlotte DUDICOURT

Press Relations

Tel.: +33 1 53 67 36 32 / acdudicourt@actus.fr

Warning:

BOOSTHEAT has set up an NRS financing arrangement with Impact Tech Turnaround Opportunities (ITTO), which, after receiving the shares resulting from the redemption or exercise of these instruments, will not remain a shareholder in the company.

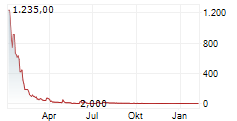

The shares resulting from the redemption or exercise of the above-mentioned securities will generally be sold on the market at very short notice, which may create strong downward pressure on the share price.

Shareholders may suffer a loss of their invested capital due to a significant decrease in the company's share value, as well as significant dilution due to the large number of securities issued to Impact Tech Turnaround Opportunities (ITTO).

Investors are urged to exercise extreme caution before deciding to invest in the securities of a listed company that carries out such dilutive financing operations, particularly when they are carried out in succession. The company wishes to point out that this is not the first dilutive financing transaction it has undertaken.

- SECURITY MASTER Key: nGdwY5uXZm+bmJ2dZMplaZVsnGaVx5TKamWXnGppZ8vHmZ1kxW2TnJqbZnFnl2lo

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-86242-alboo_cp_succes_essais_next-step_veng.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free