Catcha Shareholders Approved the Previously Announced Business Combination at the Extraordinary General Meeting held June 12, 2024

Crown and Catcha Expects to Close the Transaction on or before June 28th, 2024, upon Satisfaction or Waiver of All Closing Conditions and Commence Trading for the Combined Company

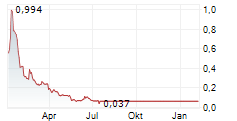

SINGAPORE & OSLO, NORWAY, June 12, 2024 (GLOBE NEWSWIRE) -- Catcha Investment Corp ("Catcha") (NYSE American: CHAA), a publicly traded special purpose acquisition company, today announced that shareholders of record as of January 16, 2024 approved the previously proposed business combination with Crown LNG Holdings AS ("Crown"), a leading provider of LNG liquefaction and regasification terminal technologies for harsh weather locations.

The full results of the vote will be included in a Current Report on Form 8-K to be filed by Catcha with the U.S. Securities and Exchange Commission.

In line with this approval, Catcha and Crown have also agreed to extend the deadline under the Business Combination Agreement until June 28th, 2024, on or before which the business combination is expected to close, and the combined company's ordinary shares and warrants are expected to commence trading on the Nasdaq Capital Market (under the new ticker symbols "CGBS" and "CGBSW" respectively) thereafter.

About Crown LNG Holdings AS

Crown LNG Holdings AS is a leading provider of offshore LNG liquefaction and regasification terminal infrastructure solutions for harsh weather locations, which represent a significant addressable market for bottom-fixed, gravity based liquefaction and regasification plants, as well as associated green hydrogen, ammonia and power projects. Through this approach, Crown aims to provide lower carbon sources of energy securely to under-served markets across the globe. Visit www.crownlng.com/investors for more information.

About Catcha Investment Corp

Catcha Investment Corp (NYSE American: CHAA) is a blank check company, also commonly referred to as a special purpose acquisition company, or SPAC, formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses or entities. Catcha is led by Chief Executive Officer Patrick Grove and President Luke Elliott, and is sponsored by Catcha Group, one of the earliest and most established new economy-focused investment groups in Southeast Asia and Australia.

Important Information and Where to Find It

In connection with the Business Combination, Crown filed the Registration Statement with the SEC, which includes a proxy statement/prospectus to be distributed to holders of ordinary shares of Catcha in connection with Catcha's solicitation of proxies for the vote by Catcha's shareholders with respect to the Business Combination and other matters as may be described in the Registration Statement, as well as a prospectus relating to the offer of securities to be issued to Crown equity holders in connection with the Business Combination. The Registration Statement has been declared effective by the SEC and Catcha is mailing a definitive proxy statement/prospectus and other relevant documents to its shareholders. The Registration Statement includes information regarding the persons who may, under the SEC rules, be deemed participants in the solicitation of proxies to Catcha's shareholders in connection with the Business Combination. Catcha and Crown LNG Holdings Limited have filed and will file other documents regarding the Business Combination with the SEC. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF CATCHA AND CROWN ARE URGED TO READ THE REGISTRATION STATEMENT, THE DEFINITIVE PROXY STATEMENT/PROSPECTUS CONTAINED THEREIN, AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE BUSINESS COMBINATION AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE BUSINESS COMBINATION.

Investors and security holders will be able to obtain copies of the Registration Statement, the definitive proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Catcha or Crown LNG Holdings Limited, without charge, once available, at the SEC's web site at www.sec.gov. In addition, the documents filed by Catcha may be obtained free of charge from Catcha by directing a request to: Catcha Investment Corp, 3 Raffles Place #06-01, Bharat Building, Singapore 048617, Attention: Patrick Grove.

Participants in the Solicitation of Proxies

Catcha and its directors and executive officers may be deemed participants in the solicitation of proxies from Catcha's shareholders with respect to the Business Combination. A list of the names of those directors and executive officers and a description of their interests in Catcha is contained in the registration statement on Form S-1, as amended, which was initially filed by Catcha with the SEC on January 25, 2021 and is available free of charge at the SEC's web site at www.sec.gov, or by directing a request to Catcha Investment Corp, 3 Raffles Place #06-01, Bharat Building, Singapore 048617, Attention: Patrick Grove. Additional information regarding the interests of such participants may be obtained by reading the Registration Statement, the definitive proxy statement/prospectus and other relevant documents filed with the SEC when they become available.

Crown's directors and executive officers may also be deemed to be participants in the solicitation of proxies from Catcha's shareholders in connection with the Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the Business Combination may be obtained by reading the Registration Statement, the definitive proxy statement/prospectus and other relevant documents filed with the SEC when they become available.

No Offer or Solicitation

This press release is for informational purposes only and shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination described herein. This press release shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Forward-Looking Statements

Certain statements in this press release may be considered forward-looking statements within the meaning of the federal securities laws with respect to the Business Combination. These forward-looking statements include, without limitation, statements regarding the benefits of the Business Combination; expectations with respect to the future performance of the combined company following the Business Combination; the anticipated satisfaction or waiver of the closing conditions to the Business Combination and the anticipated timing of the completion of the Business Combination. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expect", "intend", "will", "estimate", "anticipate", "believe", "predict", "potential" or "continue", or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. Although these forward-looking statements are based upon estimates and assumptions that Catcha and Crown believe are reasonable they are inherently uncertain and such estimates and assumptions may prove to be incorrect. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (1) the risk that the Business Combination may not be completed in a timely manner or at all; (2) the potential failure to obtain an extension of the deadline by which to complete the Business Combination; (3) the occurrence of any event, change or other circumstances that could give rise to the termination of Business Combination Agreement; (4) the outcome of any legal proceedings that may be instituted against Catcha, Crown, the combined company or others; (5) the inability to complete the Business Combination due to the failure to obtain approval of the shareholders of Catcha or to satisfy or waiver other conditions to closing; (6) changes to the proposed structure of the Business Combination that may be required or appropriate as a result of applicable laws or regulations; (7) the inability to maintain the listing of Catcha's securities on NYSE American prior to the Business Combination; (8) the inability to meet stock exchange listing standards following the consummation of the Business Combination; (9) the risk that the Business Combination disrupts current plans and operations of Catcha or Crown as a result of the announcement and consummation of the Business Combination; (10) the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (11) costs related to the Business Combination; (12) changes in applicable laws or regulations; (13) the possibility that Catcha, Crown or the combined company may be adversely affected by other economic, business, and/or competitive factors; (14) Crown's estimates of expenses and profitability and underlying assumptions with respect to shareholder redemptions and purchase price and other adjustments; and (15) other risks and uncertainties set forth in the sections entitled "Risk Factors" and "Cautionary Note Regarding Forward-Looking Statements" in Catcha's registration statement on Form S-1, as amended, which was initially filed with the SEC on January 25, 2021, in its Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on April 24, 2023 and its subsequent Quarterly Reports on Form 10-Q, the Registration Statement, the proxy statement/prospectus contained therein, and any other documents filed (or to be filed) from time to time by Catcha with the SEC. The foregoing list of factors is not exhaustive. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date hereof. Unless required by law, none of Catcha or Crown undertakes any duty to update these forward-looking statements.

Investor Contacts

Caldwell Bailey

ICR, Inc.

CrownLNGIR@icrinc.com

Media Contacts

Zach Gorin

ICR, Inc.

CrownLNGPR@icrinc.com