REYKJAVIK, ICELAND / ACCESSWIRE / June 19, 2024 / Ubique Minerals Limited (CSE:UBQ)(FRA:2UM) and GreenBank Capital Inc. (CSE:GBC)(OTC PINK:GRNBF)(FRA:2TL) have signed a non-binding term sheet with Clientque Investments Pty Ltd ("CIP") for the acquisition of 100% ownership of MJR Mining and Exploration (PTY) Ltd ("MJR"), which owns the Stanhove mining tailings dump in Johannesburg. The acquisition will be executed on a 50/50 basis, with GreenBank acting as the funding partner and Ubique as the operating partner.

Key Transaction Details:

Ubique Minerals Limited ("Ubique") and GreenBank Capital Inc. ("Greenbank") will each acquire 50% ownership from Clientque Investments Pty Ltd, securing the Stanhove mining tailings dump in Johannesburg. The transaction includes a cash payment of CAD $846,103, the issuance of two convertible debentures of CAD $500,000 each by GreenBank and Ubique with an interest rate of 6% for 36 months, and an additional cash payment of CAD $1,538,309 after the production of the first 5,000 ounces of gold, totaling CAD $3,384,341. The transaction involves the buyers acquiring MJR Mining and Exploration (PTY) Ltd, which owns the tailings dump.

The non-binding term sheet was signed on June 13, 2024. The Share Sale Agreement (SSA) is to be provided within 60 days by August 12, 2024, and the signing and exchange of contracts are expected to occur within 90 days by September 11, 2024.

The completion of the transaction is subject to regulatory approvals, delivery of the deed of the land, issuance of mining permits, technical due diligence and other customary conditions. Completion is expected within five business days following the satisfaction or waiver of these conditions.

Ubique Minerals Limited will act as the operator, responsible for managing the mining and processing operations of the Stanhove tailings dump. GreenBank Capital Inc. will handle the financial aspects of the project, including funding and the sales of the extracted gold.

About the Stanhove Mining Tailings Dump

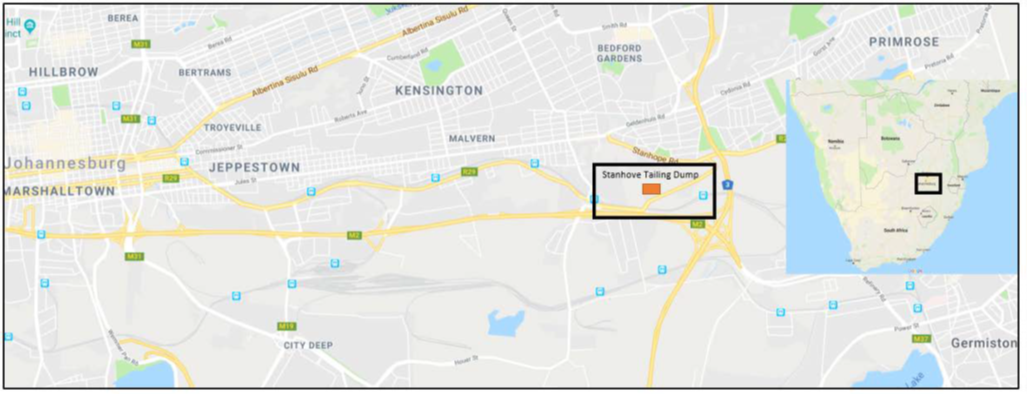

The Stanhove tailings dump is located east of Johannesburg, South Africa, within the area known locally as the East Rand gold basin and was accumulated after mining and processing gold ore from within the Witwatersrand gold mining district. The Witwatersrand basin comprises a sequence of very old, Archean, sedimentary rocks with the gold hosted in a quartz pebble conglomerate. The dominant mineral in the rock hosting the original ore is predominantly quartz with minor pyrite with which the gold is associated. Initial processing involved crushing and grinding the rock to liberate the gold by various processes, depending on the historical period, with the resulting waste being accumulated in tailings piles, of which the Stanhove pile is one. The earliest recovery processes were less efficient and therefore the waste tailings still contained significant quantities of gold. Drill sampling of the Stanhove tailings pile has identified gold values ranging upwards from <0.3g/t Au to >1.3g/t Au with increasing depth in the pile. It is typical of these old dumps for the earliest material mined to have accumulated at the bottom of the tailings pile and to have the highest grades in the basal layer. The Stanhove tailings pile of dry, ground-up rock covers an area of approximately 270 x 170 metres and reaches a maximum height of 20 metres, although most of it is less than half that height according to information provided by the vendors.

The company holds a non-compliant technical report about the project. Prior to final closing of the documentation of the agreement Greenbank and Ubique will undertake technical due diligence to verify the technical aspects of the project.

Figure 1Aerial photo of the tailings site

Figure 2location of the tailings site

Vilhjalmur Thor Vilhjalmsson, CEO of both GreenBank and Ubique, commented, "This acquisition represents a strategic step for both GreenBank and Ubique in expanding our mining assets and leveraging the potential of the Stanhove tailings dump. As partners, GreenBank will provide the necessary funding and handle the sales of gold, while Ubique will manage the operations, ensuring a balanced and effective approach. We are confident that this investment will yield significant returns for our shareholders."

On behalf of the board of directors,

Vilhjalmur Thor Vilhjalmsson

CEO and Chairman

About Ubique Minerals Limited

Ubique Minerals Limited is an exploration company listed on the CSE (CSE:UBQ) and Frankfurt (FRA:2UM) focused on exploration of its Daniel's Harbour zinc property in Newfoundland and is also engaged in exploration in Namibia, Africa along with actively searching for other projects around the world. Ubique became a publicly listed company in September 2018. Ubique has an experienced management group with a record of multiple discoveries of deposits worldwide and owns an extensive and exclusive database of historic exploration results from the Daniel's Harbour area.

About GreenBank

GreenBank is a business-transformation firm, which aims to nurture early stage and growth companies to their full potential. Through modern approaches to the provisions of consultancy services, GreenBank takes a stake in companies it hopes to nurture and gives the opportunity to the founders and executives of those companies to benefit from the years of collective experience of the GreenBank management team.

The team are based in Reykjavík, London and Toronto and work diligently across borders to ensure that businesses in the GreenBank portfolio reach their core objectives. The businesses the Company typically works with are start-ups or early-stage and include mining and mineral exploration companies. From this emergent state, GreenBank aims to quickly implement strong business practices by, where possible and required, deploying operations, communications, data strategy and financial expertise.

Whether a business desires to become a successful private company, list publicly, or is seeking a profitable exit, GreenBank tries to add value at every stage as a strategic partner. GreenBank is listed on the Canadian Securities Exchange, under the symbol "GBC", and on the OTC markets (OTCMKTS: GRNBF) as well as the Frankfurt Boerse (FRA: 2TL).

Dr. Gerald Harper, P.Geo.(NL), director of Ubique, is the qualified person as defined by NI 43-101 responsible for the technical data presented herein and has reviewed and approved this release.

For more information on Ubique please contact see www.ubiqueminerals.com or contact vilhjalmur@jvcapital.co.uk

Forward-Looking Information: This press release may include forward-looking information within the meaning of Canadian securities legislation, concerning the business and trading in the common stock of Ubique Minerals Limited., the raising of additional capital and the future development of the business. The forward-looking information is based on certain key expectations and assumptions made by the company's management. Although the company believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because Ubique can give no assurance that they will prove to be correct. These forward-looking statements are made as of the date of this press release and Ubique disclaims any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Ubique Minerals Limited

View the original press release on accesswire.com