TORONTO, June 25, 2024 (GLOBE NEWSWIRE) -- G2 Goldfields Inc. ("G2" or the "Company") (TSX: GTWO; OTCQX: GUYGF) is pleased to provide an update on the ongoing exploration program at the Company's 27,719-acre OKO-AREMU gold project. G2 recently announced an updated Mineral Resource Estimate ("MRE") for the OKO-Aremu project comprised of 922,000 ounces of gold ("Indicated") and 1,099,000 ounces of gold ("Inferred") [press release dated April 03, 2024].

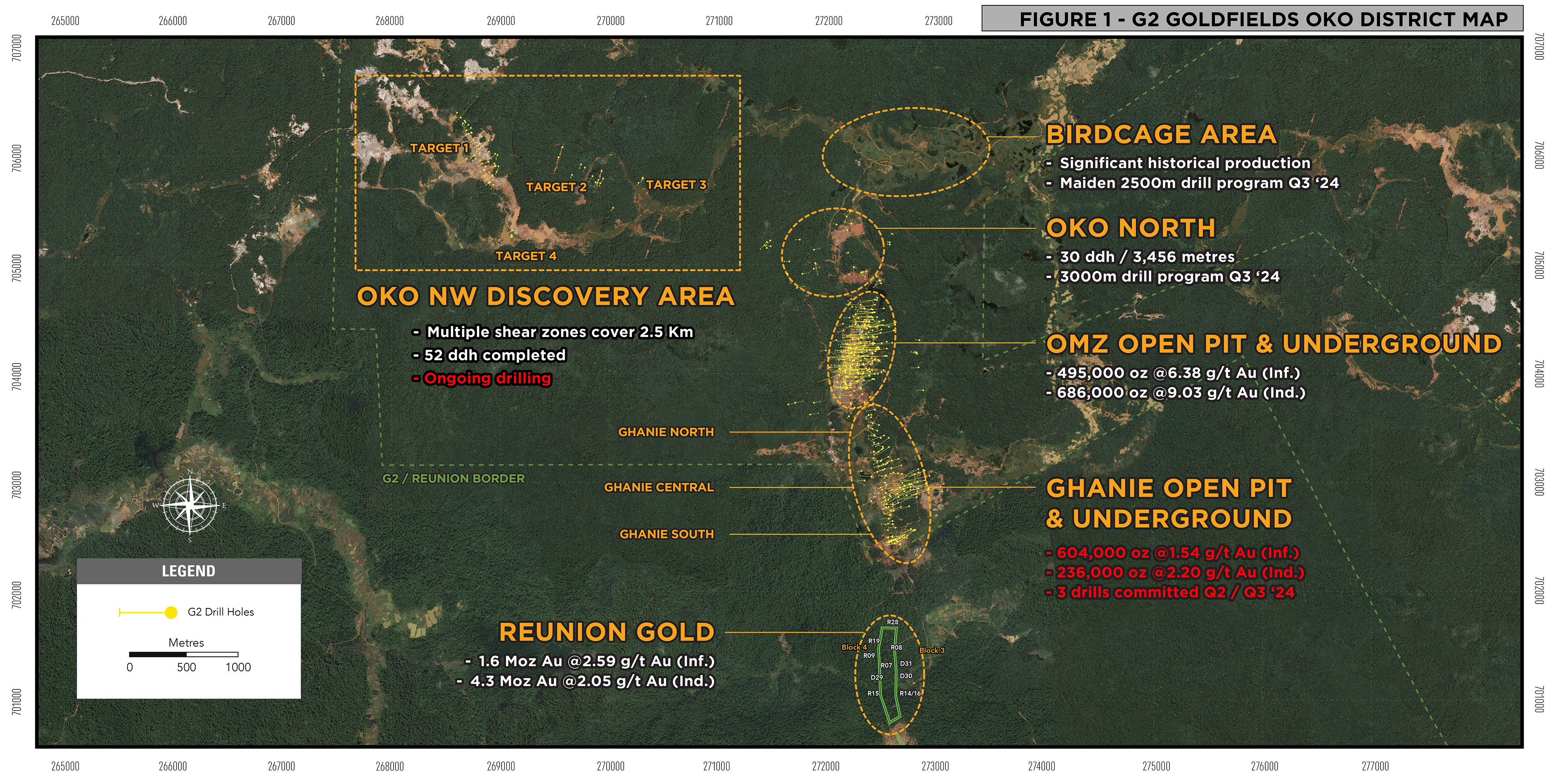

Figure 1

G2's OKO gold resource lies along a prominent 2.5 km long north-south structure which is defined by the high grade OMZ resource to the north [688,000 ounces Au @ 9.03 g/t Au (Indicated) and 495,000 ounces Au at 6.38 g/t Au (Inferred)] and the Ghanie open pit and underground resource to the south. G2 is currently drilling the southern half of the structure, where results demonstrate significant potential for the expansion of the established resource.

Assays from thirteen diamond drill holes (totaling 4,205 m) are included in this release (a complete table can be viewed here). Highlights of the latest drill results are reported in Table 1.

TABLE 1

| HOLE ID | FROM | TO | INT. (M) | AU G/T |

| GDD-113 | 161.0 | 181.5 | 20.5 | 2.7 |

| GDD-115 | 206.9 | 259.2 | 52.3 | 2.1 |

| GDD-117 | 628.0 | 638.0 | 10.0 | 9.7 |

| GDD-120 | 357.5 | 376.5 | 19.0 | 2.8 |

| AND | 550.0 | 563.5 | 13.5 | 3.5 |

The intercepts reported are down-hole widths. True widths are estimated between 75% and 85% of reported down-hole widths. Gold grades are uncapped.

Diamond drilling continues to significantly expand the mineralized envelope at the 1.2 km long Ghanie Zone, with both near-surface and deeper drill holes intersecting gold mineralization. Dan Noone, G2 CEO, stated, "These results continue to demonstrate that the OKO-Aremu district is still very much in the discovery phase. G2 is currently growing its resource by drilling two discoveries, NW Oko and Ghanie, simultaneously, whilst advancing numerous greenfields targets. We look forward to continuing to add further value for our shareholders." G2 intends to provide an updated mineral resource estimate, the Company's third, in early Q1 2025.

Discussion of Drilling Results

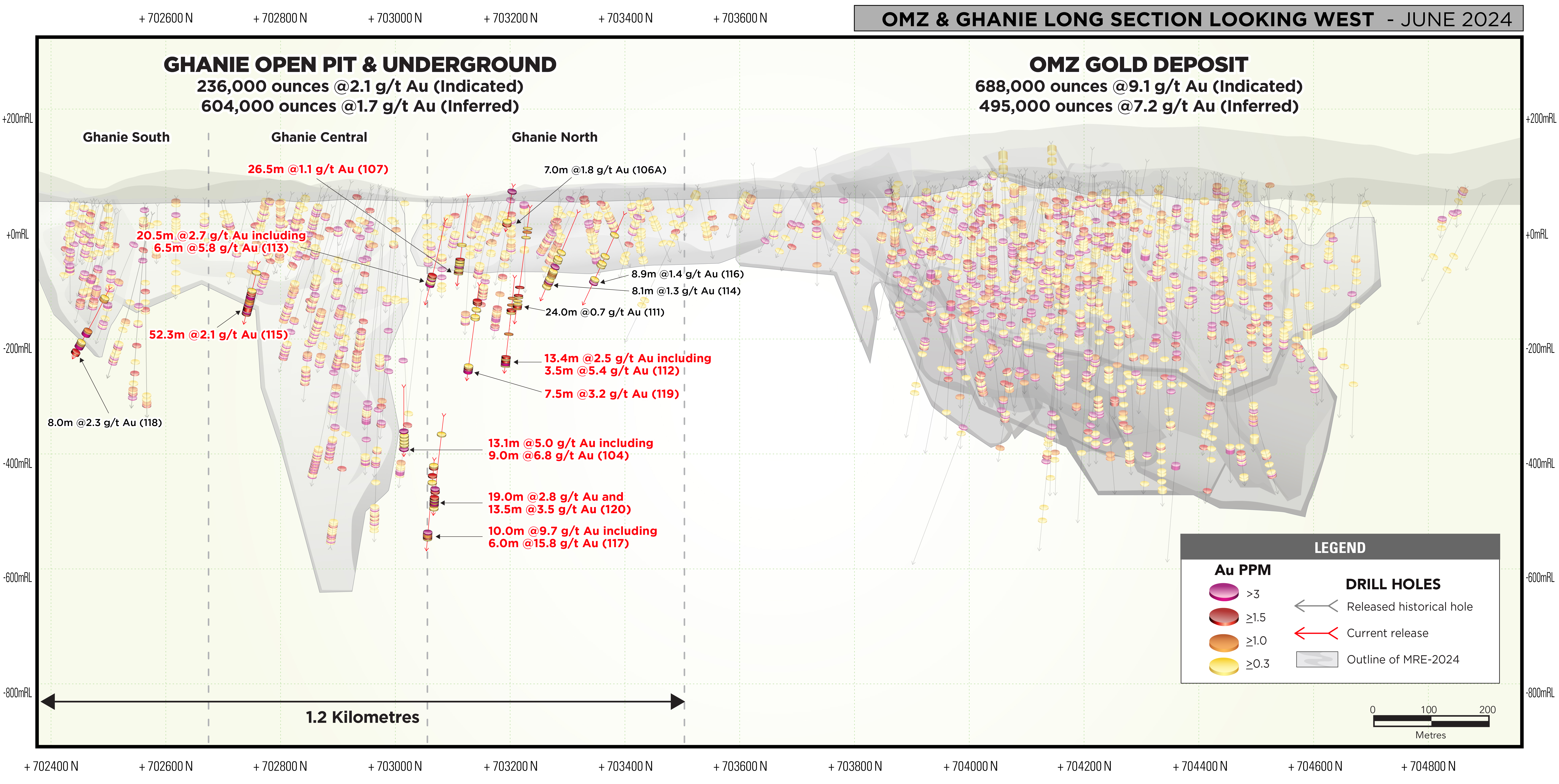

Figure 2

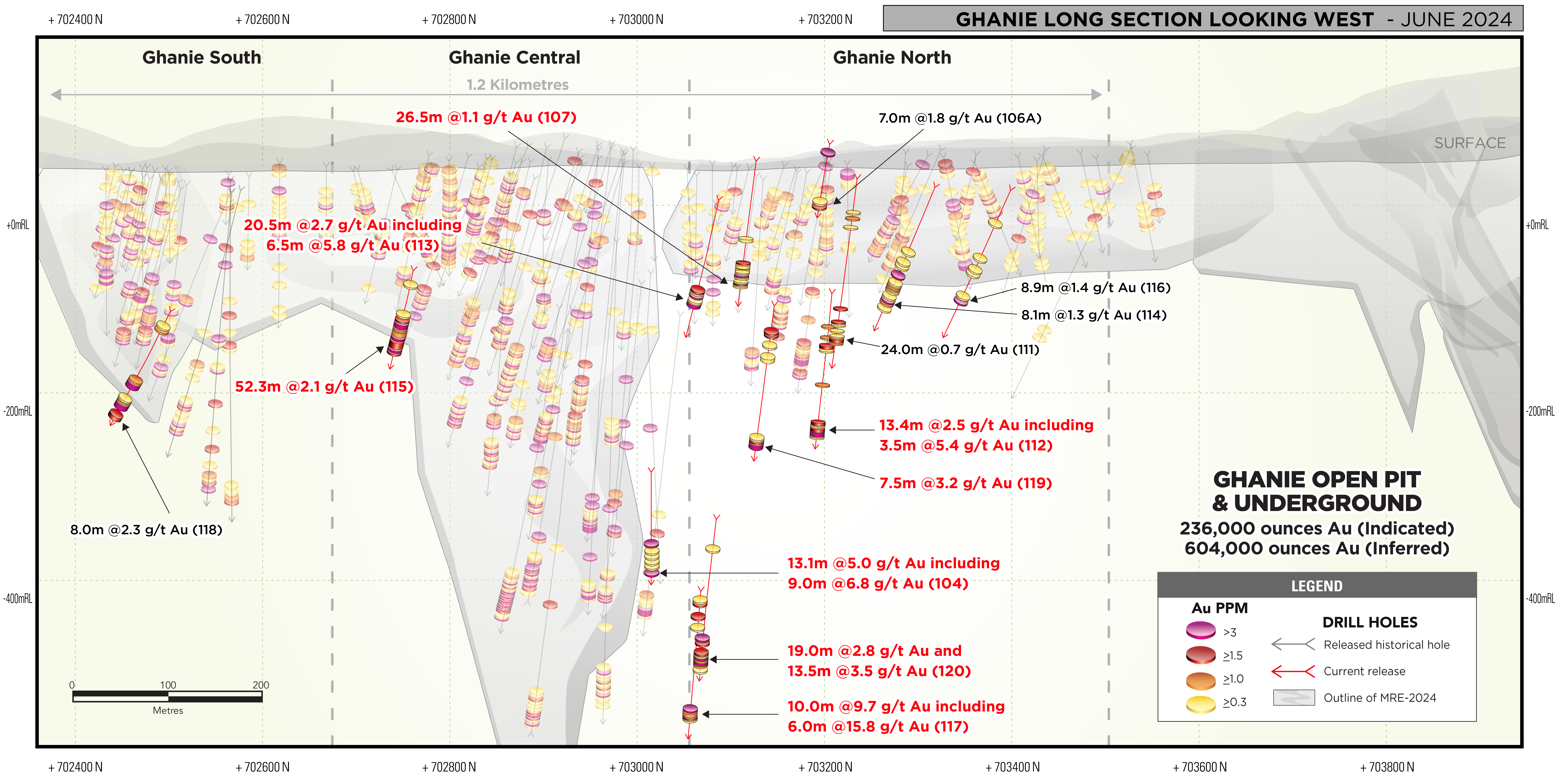

Figure 3

The current drilling at Ghanie is designed to test the continuity of gold mineralisation in the space between the South, Central and North zones. In drilling down plunge (45 degrees to the northeast) of previous high-grade intercepts, it has become apparent that the Ghanie Zone is a relatively continuous zone of mineralisation. Ghanie Central was extended 60m along strike to the south, notably, GDD-115 returned 2.1 g/t Au over 52.3m. Holes GDD- 112 (2.5 g/t Au over 13.4m), GDD-113: (2.7 g/t Au over 20.5m) and GDD-119 (3.2 g/t Au over 7.5m) have provided further evidence of mineralization to the north of the central area.

Additionally, current results demonstrate a significant extension of gold mineralization to depth. Hole GDD-117 intercepted 9.7 g/t Au over 10m (from 628m) making GDD-117 the deepest hole drilled in the Ghanie Zone to date. GDD-104 (5 g/t Au over 13.1m) and two intercepts in GDD-120, 2.8 g/t Au over 19m and 3.5 g/t Au over 13.5m, respectively, added 125m of strike to the north and further tested the continuity of high-grade zones in Ghanie Central. Gold mineralization in the Ghanie area remains open along strike and down plunge.

QA/QC

Drill core is logged and sampled in a secure core storage facility located on the OKO project site, Guyana. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to MSALABS Guyana, in Georgetown, Guyana, which is an accredited mineral analysis laboratory, for analysis. Samples from sections of core with obvious gold mineralisation are analysed for total gold using an industry-standard 500g metallic screen fire assay (MSALABS method MSC 550). All other samples are analysed for gold using standard Fire Assay-AA with atomic absorption finish (MSALABS method; FAS-121). Samples returning over 10.0 g/t gold are analysed utilizing standard fire assay gravimetric methods (MSALABS method; FAS-425). Certified gold reference standards, blanks, and field duplicates are routinely inserted into the sample stream, as part of G2 Goldfields' quality control/quality assurance program (QAQC). No QA/QC issues were noted with the results reported herein.

About G2 Goldfields Inc.

The G2 Goldfields team is comprised of professionals who have been directly responsible for the discovery of millions of ounces of gold in Guyana as well as the financing and development of the Aurora Gold Mine, Guyana's largest gold mine [RPA, 43-101, Technical Report on the Aurora Gold Mine, March 31, 2020].

Anglo Gold Ashanti ("AGA"), the fourth largest gold producer in the world, recently made a substantial investment in the Company. At the close of the Subscription, AGA (NYSE: AU) owned approximately 11.7% of G2's issued and outstanding Shares [see press release dated January 19, 2024].

In April 2024, G2 announced an Updated Mineral Resource Estimate ("MRE") for the Oko property in Guyana [see press release dated April 03, 2024]. Highlights of the Updated MRE include:

Total combined open pit and underground Resource for the Oko Main Zone (OMZ):

- 495,000 oz. Au - Inferred contained within 2,413,000 tonnes @ 6.38 g/t Au

- 686,000 oz. Au - Indicated contained within 2,368,000 tonnes @ 9.03 g/t Au

Total combined open pit and underground Resource for the Ghanie Zone:

- 604,000 oz. Au - Inferred contained within 12,216,000 tonnes @ 1.54 g/t Au

- 236,000 oz. Au - Indicated contained within 3,344,000 tonnes @ 2.20 g/t Au

The MRE was prepared by Micon International Limited with an effective date of March 27, 2024. Significantly, the updated mineral resources lie within 500 meters of surface. The Oko district has been a prolific alluvial goldfield since its initial discovery in the 1870's, and modern exploration techniques continue to reveal the considerable potential of the district.

All scientific and technical information in this news release has been reviewed and approved by Dan Noone (CEO of G2 Goldfields Inc.), a "qualified person" within the meaning of National Instrument 43-101. Mr. Noone (B.Sc. Geology, MBA) is a Fellow of the Australian Institute of Geoscientists.

Additional information about the Company is available on SEDAR (www.sedar.com) and the Company's website (www.g2goldfields.com).

For further information, please contact:

Dan Noone CEO

+1 416.628.5904

news@g2goldfields.com

Forward-Looking Statements

This news release contains certain forward-looking information and statements within the meaning of applicable securities laws. The use of any of the words "expect", "anticipate", "continue", "estimate", "may", "might", "will", "project", "should", "believe", "plans", "intends" and similar expressions are intended to identify forward-looking information and/or statements. Forward- looking statements and/or information are based on a number of material factors, expectations and/or assumptions of G2 Goldfields which have been used to develop such statements and/or information, but which may prove to be incorrect. Although G2 Goldfields believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements as G2 Goldfields can give no assurance that such expectations will prove to be correct. In addition to other factors and assumptions which may be identified herein assumptions have been made regarding, among other things: results from planned exploration and drilling activities; future plans for operational expenditures; the accuracy of the interpretations of exploration and drilling activity results; availability of financing to fund current and future plans and expenditures; the impact of increasing competition; the general stability of the economic and political environment in which G2 Goldfields has property interests; the general continuance of current industry conditions; the timely receipt of any required regulatory approvals; the ability of G2 Goldfields to obtain qualified staff, equipment and/or services in a timely and cost efficient manner; the ability of the operator of each project in which G2 Goldfields has property interests to operate in a safe, efficient and/or effective manner and to fulfill its respective obligations and current plans; future commodity prices; currency, exchange and/or interest rates; and the regulatory framework regarding royalties, taxes and/or environmental matters in the jurisdictions in which G2 Goldfields has property interests. The forward-looking information and statements included in this news release are not guarantees of future performance and should not be unduly relied upon. Such information and/or statements, including the assumptions made in respect thereof, involve known and unknown risks, uncertainties and other factors that may cause actual results and/or events to differ materially from those anticipated in such forward-looking information and/or statements including, without limitation: risks associated with the uncertainty of exploration results and estimates, currency fluctuations, the uncertainty of conducting operations under a foreign regime, exploration risk, the uncertainty of obtaining all applicable regulatory approvals, the availability of labour and/or equipment, the fluctuating prices of commodities, the availability of financing and dependence on the management personnel of the Corporation, other participants in the property areas and/or certain other risks detailed from time-to-time in G2 Goldfields public disclosure documents (including, without limitation, those risks identified in this news release and G2 Goldfields current management's discussion and analysis). Furthermore, the forward-looking statements contained in this news release are made as at the date of this news release and the Corporation does not undertake any obligations to publicly update and/or revise any of the included forward-looking statements, whether as a result of additional information, future events and/or otherwise, except as may be required by applicable securities laws.

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy and / or accuracy of this release.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/0cb0216e-3946-455c-9b5d-b14f0241df50

https://www.globenewswire.com/NewsRoom/AttachmentNg/d744a729-8875-4108-a1c9-0141b97a47de

https://www.globenewswire.com/NewsRoom/AttachmentNg/1c539056-b0db-449e-b7ac-4f9598a50b38