VANCOUVER, BC / ACCESSWIRE / June 25, 2024 / Amarc Resources Ltd. ("Amarc" or the "Company") (TSXV:AHR)(OTCQB:AXREF) is pleased to announce that it has recommenced drilling at its 100% owned DUKE porphyry copper-gold ("Cu-Au") district ("DUKE District" or "District") in British Columbia ("BC"). The current drill program follows the 2024 winter delineation drilling of the DUKE Deposit. The initial focus of this summers drilling is the SVEA Cu-Au Deposit Target and the new JO porphyry Cu-Au discovery identified by the Company's comprehensive surveys across the prospective 722 km2 District. Ground and airborne geophysical surveys are also currently underway with up to 30 crew members onsite.

The Svea Deposit Target shares many attributes with some of the premier deposits and occurrences within the prolific Babine Porphyry Cu-Au Region (the "Babine"). Svea is defined by a 7 km2 Induced Polarization chargeability ("IP") anomaly indicating a large sulphide mineralized system. Widespread and strong Cu-Au-Mo-in-soil geochemical anomalies and favorable biotite-feldspar porphyry ("BFP") intrusive rocks are co-incident with the IP chargeability anomaly. In addition, results from short historical drill holes[1] suggest excellent potential for important Cu-Au mineralization, for example, DDH 69-3 returned 0.36% Cu and 0.18 g/t Au over 23.7 m (see Amarc release January 19, 2024). Another new target, the JO discovery is characterized by coincident IP chargeability and magnetic geophysical anomalies. Initial grab sampling of outcrop within the target returned 0.18% Cu, 0.52 g/t Au, 16 g/t Ag and 55 ppm Mo (see Amarc release April 16, 2024).

Boliden Mineral Canada Ltd. ("Boliden"), under the DUKE District Mineral Property Earn-in Agreement is continuing its earn-in during 2024 with a further $10 million of budgeted expenditures (see Amarc release December 13, 2023). Amarc continues as project operator.

"The Amarc team is excited to be back on the ground commencing the summer drilling program at Svea and JO and plans to complete twelve holes between these Targets," said Amarc President and CEO Diane Nicolson. "In addition to current exploration drilling on the Svea and JO, nine drill holes were completed during the winter drilling at the DUKE Deposit. These drill holes further defined the Cu-Mo mineralization in the central portion of the DUKE Deposit as well as identifying potentially important volumes of mineralization to the south and north of the main Deposit which remain to be fully drill delineated."

[1] Copper assays for nine 1969 Texas Gulf drilling are from copies of original drill logs, accessed at https://propertyfile.gov.bc.ca/showDocument.aspx?docno=830869 (BC Ministry of Energy, Mines and Petroleum Resources ("BC MEMPR") Property File Document 830869), and for gold in from Carter, 1992, Geological and Geochemical Report, Sampling of Diamond Drill Cores and Soil Sampling, on the Trail Mineral Claim, 31 pages, BC MEMPR Assessment Report 22719. Assay summaries are available for some of these historical drill holes, but much of the assay data, along with drill logs, is not available. These results are historical in nature and at the time of this release have not been verified by Amarc or its Qualified Person, as the drill core, and original sample material are not available, however, the Company intends to verify this information through drilling during its summer 2024 campaign.

DUKE Deposit Drill Results and Key Implications

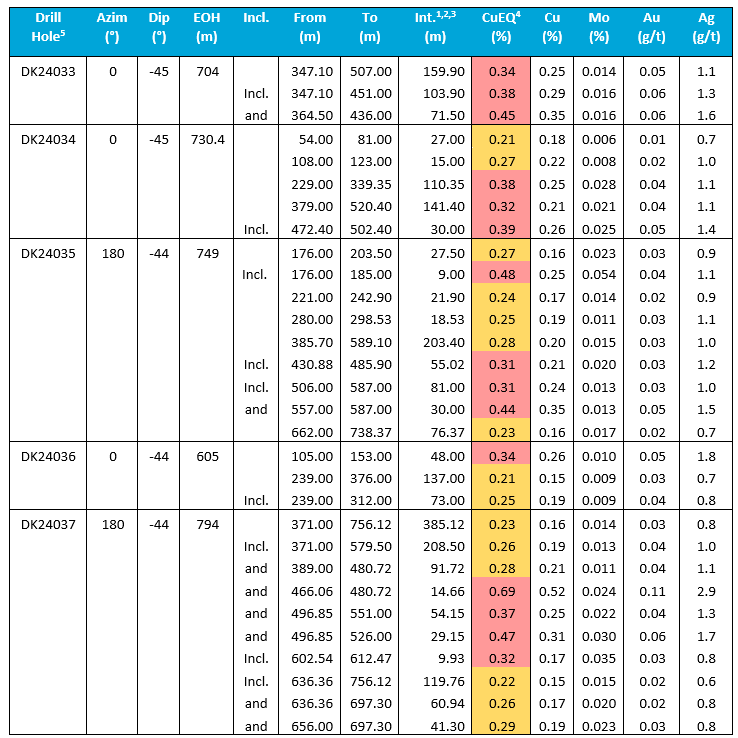

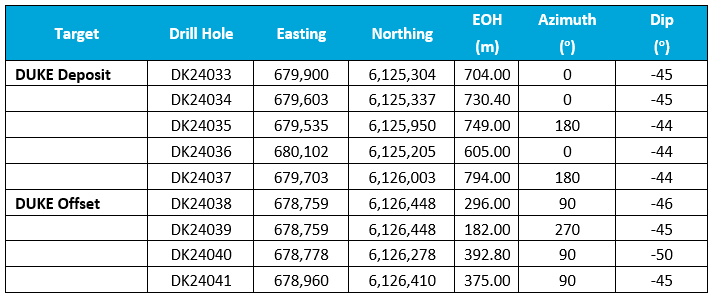

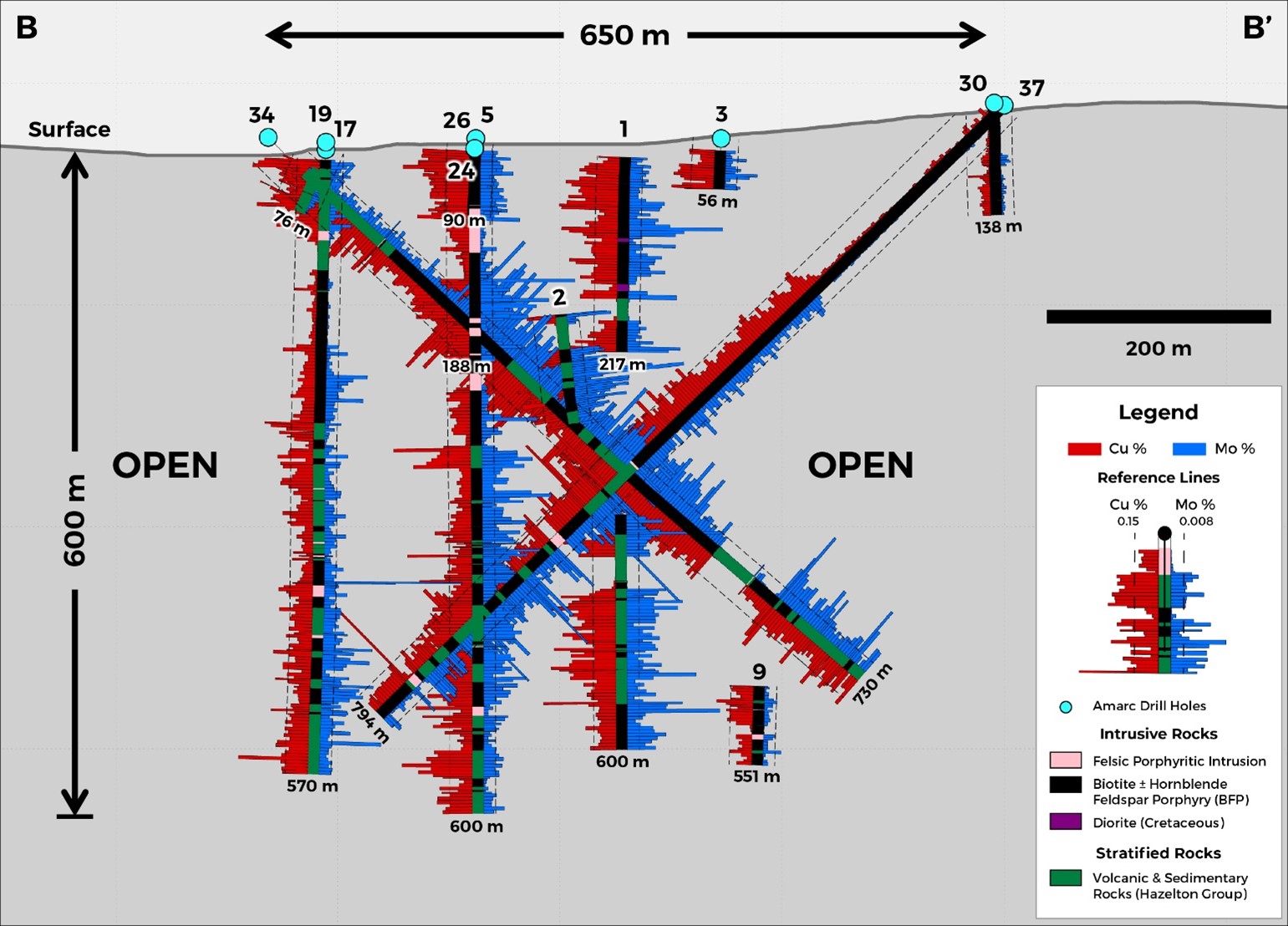

During the winter of 2024, two rigs continued with delineation drilling of the DUKE Cu-Mo Deposit and testing the DUKE Offset (Figure 1). Nine core holes were drilled, totalling some 4,828.2 m. Assay data and drill hole information are provided in Tables 1, 2 and 3. Seven of the 9 drill holes intersected Cu-Mo mineralization above an approximate grade of 0.15% CuEQ* over widths of 104 m to 385 m (Tables 1 and 2).

Highlights from the 2024 winter drilling at the DUKE Deposit include:

- 71 m of 0.45% CuEQ* (0.35% Cu, 0.016% Mo, 0.06 g/t Au, 1.6 g/t Ag) and 104 m of 0.38% CuEQ (0.29% Cu, 0.016% Mo, 0.06 g/t Au, 1.3 g/t Ag) in hole DK24033

- 110 m of 0.38% CuEQ (0.25% Cu, 0.028% Mo, 0.04 g/t Au, 1.1 g/t Ag) and 30 m of 0.39% CuEQ (0.26% Cu, 0.025% Mo, 0.05 g/t Au, 1.4 g/t Ag) in hole DK24034

- 30 m of 0.44% CuEQ (0.35% Cu, 0.013% Mo, 0.05 g/t Au, 1.5 g/t Ag) within 203 m of 0.28% CuEQ (0.2% Cu, 0.015% Mo, 0.03 g/t Au, 1.0 g/t Ag) in hole DK24035

- 48 m of 0.34% CuEQ (0.26% Cu, 0.010% Mo, 0.05 g/t Au, 1.8 g/t Ag) in hole DK24036

- 15 m of 0.69% CuEQ (0.52% Cu, 0.024% Mo, 0.11 g/t Au, 1.9 g/t Ag) and 29 m of 0.47% CuEQ (0.31% Cu, 0.030% Mo, 0.06 g/t Au, 1.7 g/t Ag) within 208 m of 0.26% CuEQ (0.19% Cu, 0.013% Mo, 0.04 g/t Au and 1.0 g/t Ag) in hole DK24037

The 2024 ongoing DUKE Deposit delineation drilling results complement those returned from the 2022-2023 drilling program which included:

- 183 m of 0.43% CuEQ* (0.31% Cu, 0.019% Mo, 0.07 g/t Au,1.5 g/t Ag) in hole DK22009**

- 217 m of 0.45% CuEQ (0.33% Cu, 0.018% Mo, 0.08 g/t Au, 1.5 g/t Ag) in hole DK22010**

- 30 m of 0.47% CuEQ (0.36 % Cu, 0.015% Mo, 0.06 g/t Au, 3.2 g/t Ag) in hole DK23012**

- 30 m of 0.43% CuEQ (0.31% Cu, 0.014% Mo, 0.09 g/t Au, 1.6 g/t Ag), and 33 m of 0.44% CuEQ (0.20% Cu, 0.053% Mo, 0.06 g/t Au, 1.3 g/t Ag) in hole DK23015**

- 82 m of 0.41% CuEQ (0.30% Cu, 0.017% Mo, 0.06 g/t Au, 1.1 g/t Ag) in hole DK23022**

- 36 m of 0.47% CuEQ (0.34% Cu, 0.024% Mo, 0.06 g/t Au, 1.5 g/t Ag) in hole DK23024**

- 33 m of 0.40% CuEQ (0.30% Cu, 0.017% Mo, 0.05 g/t Au, 1.5 g/t Ag) in hole DK23026**

* Copper equivalent (CuEQ) calculations use metal prices of: Cu US$4/lb, Mo US$15/lb, Au US$1,800/oz and Ag US$24/oz and conceptual recoveries of: Cu 85%, Mo 82%, Au 72% and 67% Ag.

** Holes DK22009 to DK23026 were previously reported in Amarc releases dated January 26, 2023, February 15, 2023 and June 15, 2023.

Figure 1: On-going Delineation Drilling Continues to Expand DUKE Deposit

A new and positive structural element, the South Graben Fault ("SGF") was recognized principally from the results of drill hole DK24036. The SGF, like many other mineralized corridors in the Babine, likely has a spatial relationship to the development of significant Cu-Mo mineralized zones. Notably, recognition of the SGF indicates the possibility to expand the DUKE Deposit over a potential strike length of 700 m. A few short historical holes drilled in the 1970's cut the shallowest portions of this targeted volume. In most cases the holes were well mineralized, for example, 70-02 returned 113 m of 0.38% CuEQ (0.29% Cu, 0.012% Mo 0.06 g/t Au, 1.1 g/t Ag) including 12 m of 0.51% CuEQ (0.41% Cu, 0.010% Mo, 0.09 g/t Au, 1.6 g/t Ag) (see Amarc DUKE Project 2020 Technical Report available on the website at https://amarcresources.com/projects/duke-project/technical-report).

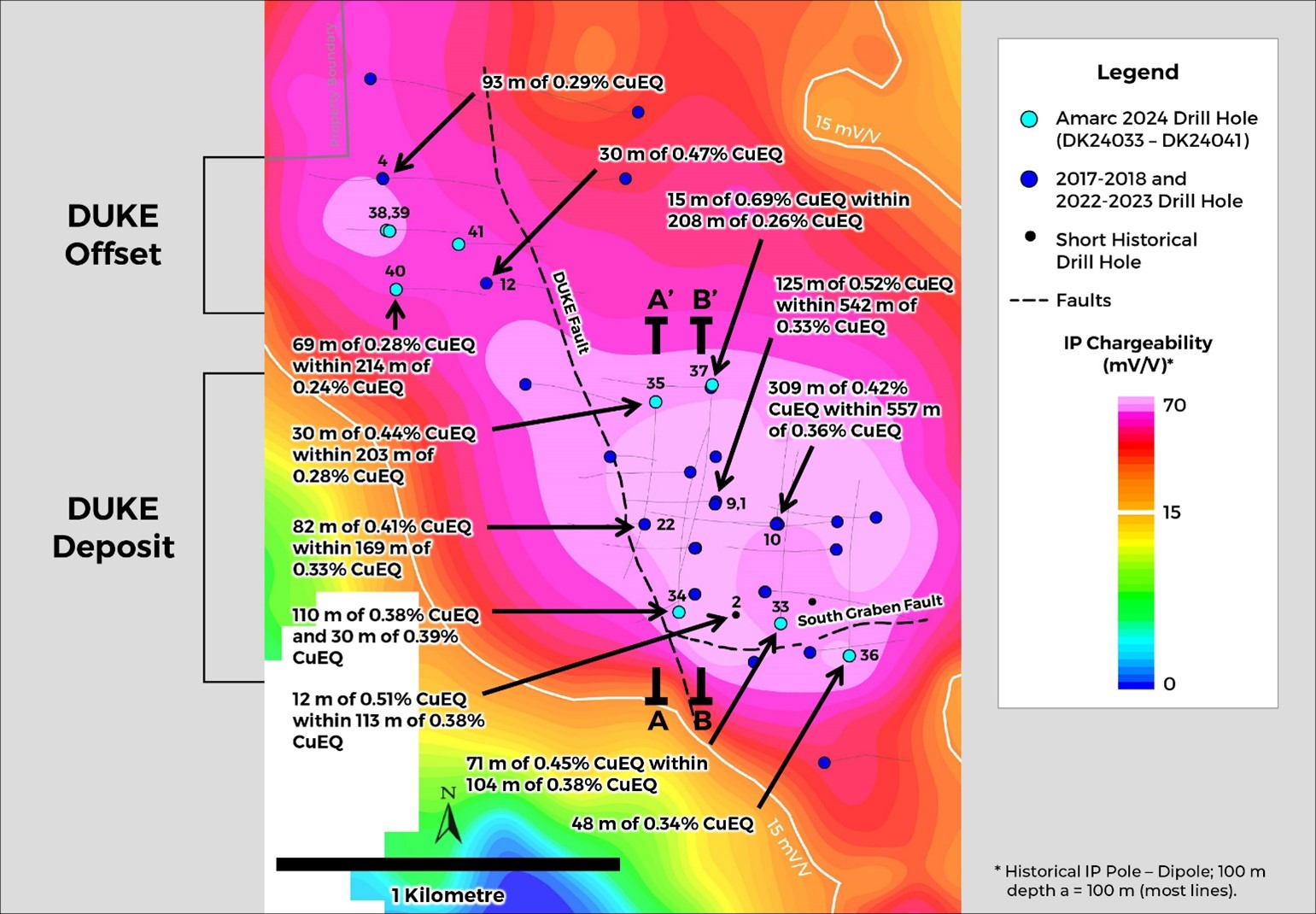

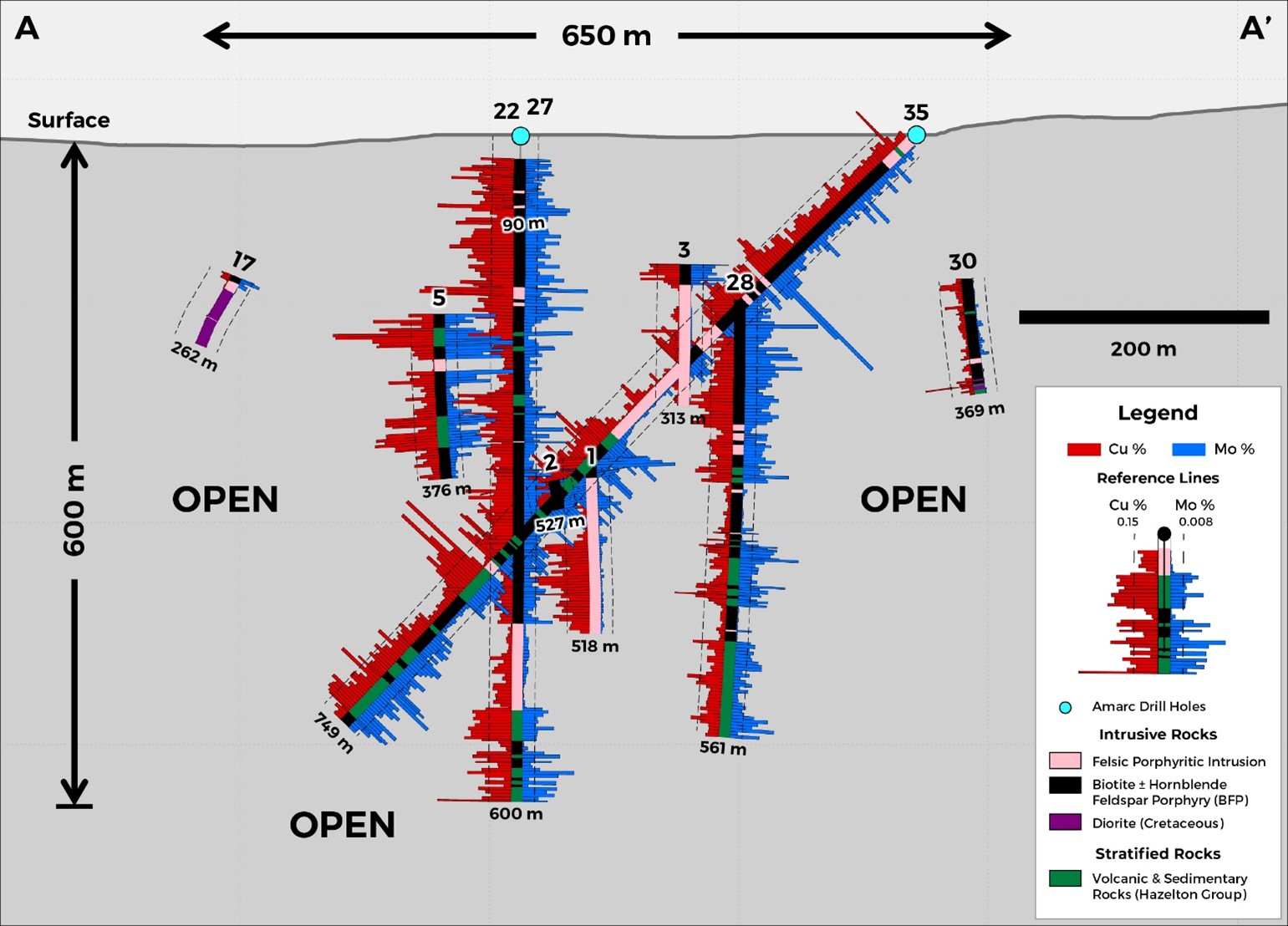

Using orientated core drilling and changing drilling orientations to along north-south sections (from previous east-west sections) (Figures 1, 2 and 3) has provided valuable information for the modelling of the Deposit. This knowledge is also being applied to the drill testing of deposit targets in the DUKE District.

Figure 2: Significant Volumes of Cu-Mo-Ag-Au Mineralization Being Drill Delineated at the DUKE Deposit, Section A-A'

Figure 3: DUKE Deposit Remains Open to Expansion, Section B-B'

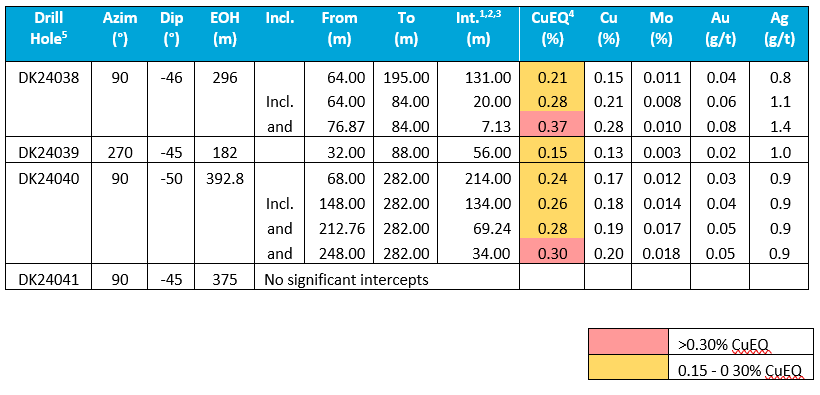

DUKE Offset Drill Results

Drill holes DK24038 and DK24040 returned important Cu-Mo intercepts (Figure 1, Table 2) and with a previously reported intercept in DK18004 (see Amarc release June 12, 2018), are outlining a newly recognized volume of mineralized rock to the west of the DUKE Fault which represents a portion of the DUKE Deposit that was displaced some 450 to 500 m northwards (Figure 1). The initial drilling suggests that this new target has a strike length of approximately 500 m and an estimated true width of around 120 m. It remains to be fully drill delineated.

Importantly, the new accurate determination of the displacement along the DUKE Fault permits targeting - for the first time - the location of the fault-offset portion of the Cu-Mo-Au mineralization intersected in hole DK 17001 (see Amarc release see Amarc release June 12, 2018). The last 93.5 m of this drill hole cut 0.31% CuEQ (0.23% Cu, 0.001% Mo, 2.7 g/t Ag, 0.12 g/t Au), including a significant Au intersection of 0.68 g/t Au over 9 m from 509 to 518.5 m at the bottom of the hole.

Table 1: DUKE Deposit 2024 Assay Results

Table 2: DUKE Deposit Offset Drill Holes

Notes:

- Widths reported are drill widths, such that true thicknesses are unknown.

- All assay intervals represent length-weighted averages.

- Some figures may not sum exactly due to rounding.

- Copper equivalent (CuEQ) calculations use metal process prices of: Cu US$4/lb, Au US$1800/oz., Ag US$24/oz. and Mo US$15/lb and conceptual recoveries of: Cu 85%, Mo 82%, Au 72% and 67% Ag. Conversion of metals to an equivalent copper grade based on these metal prices is relative to the copper price per unit mass factored by conceptual recoveries for those metals normalized to the conceptualized copper recovery. The metal equivalencies for each metal are added to the copper grade. The general formula for this is: CuEQ% = Cu% + ((Au g/t * (Au recovery / Cu recovery) * (Au $ per oz./31.1034768 / Cu $ per lb. * 22.04623)) + ((Ag g/t * (Ag recovery / Cu recovery) * (Ag $ per oz./ 31.1034768 / Cu $ per lb. * 22.04623)) + ((Mo% * (Mo recovery / Cu recovery) * (Mo $ per lb.) / Cu $ per lb.)).

- The collar locations in UTM NAD83, Zone 9N coordinates for drill holes are listed in Table 3.

Corporate

In other news Amarc regrets to report that Dr. Paul Johnston has had to step down as VP Exploration for personal reasons. The Company thanks Dr. Johnston for his contributions and wishes him well.

About Amarc Resources Ltd.

Amarc is a mineral exploration and development company with an experienced and successful management team focused on developing a new generation of long-life, high-value porphyry Cu-Au mines in BC. By combining high-demand projects with dynamic management, Amarc has created a solid platform to create value from its exploration and development-stage assets.

Amarc is advancing its 100%-owned IKE, DUKE and JOY porphyry Cu±Au Districts located in different prolific porphyry regions of southern, central and northern BC, respectively. Each District represents significant potential for the development of multiple and important-scale, porphyry Cu±Au deposits. Importantly, each of the three districts are located in proximity to industrial infrastructure - including power, highways and rail.

Freeport-McMoRan Mineral Properties Canada Inc. ("Freeport"), a wholly owned subsidiary of Freeport-McMoRan Inc. at JOY and Boliden Mineral Canada Ltd. ("Boliden"), an entity within the Boliden Group of companies at DUKE, can earn up to a 70% interest in each District through staged investments of $110 million and $90 million, respectively. Together this provides Amarc with potentially up to $200 million in non-share dilutive staged funding for these Districts. In addition, Amarc intends to solo drill the higher grade Empress Deposit in the IKE District allocating funds from its successful 2023 financing. Amarc is the operator of all programs.

Amarc is associated with HDI, a diversified, global mining company with a 35-year history of porphyry Cu deposit discovery and development success. Previous and current HDI projects include some of BC's and the world's most important porphyry deposits - such as Pebble, Mount Milligan, Southern Star, Kemess South, Kemess North, Gibraltar, Prosperity, Xietongmen, Newtongmen, Florence, Casino, Sisson, Maggie, IKE, PINE and DUKE. From its head office in Vancouver, Canada, HDI applies its unique strengths and capabilities to acquire, develop, operate and monetize mineral projects.

Amarc works closely with local governments, Indigenous groups and stakeholders in order to advance its mineral projects responsibly, and in a manner that contributes to sustainable community and economic development. We pursue early and meaningful engagement to ensure our mineral exploration and development activities are well coordinated and broadly supported, address local priorities and concerns, and optimize opportunities for collaboration. In particular, we seek to establish mutually beneficial partnerships with Indigenous groups within whose traditional territories our projects are located, through the provision of jobs, training programs, contract opportunities, capacity funding agreements and sponsorship of community events. All Amarc work programs are carefully planned to achieve high levels of environmental and social performance.

Qualified Person

Mark Rebagliati, P.Geo, a Qualified Person ("QP") as defined by National Instrument 43-101, has reviewed and approved all technical and scientific information related to the Duke Project contained in this news release. Mr. Rebagliati is not independent of the Company.

Quality Assurance/Quality Control Program

Amarc drilled NQv (48.1mm) size core in the winter of 2024. All drill core was logged, photographed, and cut in half with a diamond saw. Half core samples from the DUKE drilling were sent to ALS Canada Ltd., Kamloops, Canada, for preparation and to North Vancouver, Canada for analysis. Surface rock samples from the 2023 program were sent to either Kamloops or North Vancouver for preparation and were also analyzed in North Vancouver. Both facilities are ISO/IEC 17025:2017 accredited. At the laboratory, samples were dried, crushed to 70% passing -2mm, and a 250 g split pulverized to better than 85% passing 75 microns. Samples were analyzed for Au by fire assay fusion of a 30 g sub-sample with an ICP-AES finish, and for 60 elements including Cu, Mo and Ag by a four-acid digestion, multi-element ICP-MS package. As part of a comprehensive Quality Assurance/Quality Control ("QAQC") program, Amarc control samples were inserted in each analytical batch of the core samples at the following rates: standards one in 20 regular samples, in-line replicates one in 20 regular samples and one coarse blank per hole. For surface rock samples, at least one standard was inserted in each analytical batch. The control sample results were then checked to ensure proper QAQC.

For further details on Amarc Resources Ltd., please visit the Company's website at www.amarcresources.com or contact Dr. Diane Nicolson, President and CEO, at (604) 684-6365 or within North America at 1-800-667-2114, or Kin Communications, at (604) 684-6730, Email: AHR@kincommunications.com.

ON BEHALF OF THE BOARD OF DIRECTORS OF AMARC RESOURCES LTD.

Dr. Diane Nicolson

President and CEO

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking and other Cautionary Information

This news release includes certain statements that may be deemed "forward-looking statements". All such statements, other than statements of historical facts that address exploration plans and plans for enhanced relationships are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Assumptions used by the Company to develop forward-looking statements include the following: Amarc's projects will obtain all required environmental and other permits and all land use and other licenses, studies and exploration of Amarc's projects will continue to be positive, and no geological or technical problems will occur. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, potential environmental issues or liabilities associated with exploration, development and mining activities, exploitation and exploration successes, continuity of mineralization, uncertainties related to the ability to obtain necessary permits, licenses and tenure and delays due to third party opposition, changes in and the effect of government policies regarding mining and natural resource exploration and exploitation, exploration and development of properties located within Aboriginal groups asserted territories may affect or be perceived to affect asserted aboriginal rights and title, which may cause permitting delays or opposition by Aboriginal groups, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. For more information on Amarc Resources Ltd., investors should review Amarc's annual Form 20-F filing with the United States Securities and Exchange Commission at www.sec.gov and its home jurisdiction filings that are available at www.sedarplus.ca.

Table 3: 2024 Drill Hole Information

Figure 1: On-going Delineation Drilling Continues to Expand DUKE Deposit

Figure 2: Significant Volumes of Cu-Mo-Ag-Au Mineralization Being Drill Delineated at the DUKE Deposit, Section A-A'

Figure 3: DUKE Deposit Remains Open to Expansion, Section B-B'

SOURCE: Amarc Resources Ltd.

View the original press release on accesswire.com