NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR INDIRECTLY, IN OR INTO, THE UNITED STATES OF AMERICA, AUSTRALIA, BELARUS, CANADA, HONG KONG, JAPAN, NEW ZEALAND, RUSSIA, SINGAPORE, SOUTH AFRICA, SOUTH KOREA, SWITZERLAND OR ANY OTHER JURISDICTION IN WHICH THE RELEASE, DISTRIBUTION OR PUBLICATION WOULD BE UNLAWFUL OR REQUIRE REGISTRATION OR ANY OTHER MEASURE.

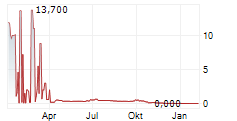

LUND, SWEDEN / ACCESSWIRE / June 25, 2024 / The board of directors of Alligator Bioscience AB (publ) (STO:ATORX) ("Alligator" or the "Company") has today resolved on a directed issue of convertibles to Fenja Capital II A/S ("Fenja") raising gross proceeds of SEK 12 million (the "Convertibles"). Furthermore, the Company has also entered into an agreement with Fenja for a loan facility of up to SEK 68 million (the "Loan Facility" and together with the Convertibles, the "Financing"). The transaction provides Alligator with financial and strategic flexibility, with the full Financing extending the cash runway into the first quarter of 2025.

Reasons and motives for the Financing

The Financing consists of a first tranche of SEK 50 million, of which SEK 12 million are Convertibles and SEK 38 million is a loan under the Loan Facility, and a second tranche for the remaining SEK 30 million as a loan under the Loan Facility. This second tranche is available provided that the total Financing does not exceed 10.00 percent of the Company's market capitalization at the time the second tranche is drawn. The Convertibles entail a potential maximum dilution of the current number of ordinary shares of approximately 1.07 percent. The Financing shall be repaid at the latest on March 25, 2025.

With the currently available cash and the full SEK 80 million Financing, Alligator has a cash runway into the first quarter of 2025, covering the finalization of the OPTIMIZE-1 study, the continued Phase 3 preparation for mitazalimab in first-line metastatic pancreatic cancer, and the continued development of its earlier stage immuno-oncology pipeline.

"Alligator is heading toward several potentially transformative value inflection points during the next six to 12 months, primarily driven by the outstanding clinical performance of our lead asset mitazalimab in the OPTIMIZE-1 Phase 2 trial. This liquidity injection provides Alligator with time and maneuverability, placing us in a position of strength in the ongoing business development process to secure the right commercial partner to progress mitazalimab into Phase 3 development and on to market, and to deliver the best possible deal for the Company and our shareholders." says Søren Bregenholt, CEO of Alligator.

Terms of the Convertibles

The board of directors has today, pursuant to the authorization granted by the annual general meeting on May 7, 2024, resolved on a directed issue of convertibles. The aggregate nominal value of the Convertibles amounts to SEK 12 million. Fenja has the right to request conversion of the Convertibles into ordinary shares at a conversion price of SEK 1.47 per share, which corresponds to 125 percent of the volume weighted average price for the Company's shares during the period of ten trading days up to and including June 24, 2024. Conversion can be requested as from the date of registration of the Convertibles with the Swedish Companies Registration Office up to and including March 25, 2025, and any request for conversion has to be for an amount of at least SEK 4 million.

The Convertibles accrue interest at an annual rate of STIBOR 3M (fixed as of the date of disbursement of the Convertibles) plus 10.00 percent. The interest is due for payment at the final maturity date of the Convertibles. Unless previously converted, the Convertibles shall be repaid at the latest on March 25, 2025.

Terms of the Loan Facility

The Loan Facility entered into with Fenja amounts to a total of up to SEK 68 million, divided into two tranches of SEK 38 million and SEK 30 million respectively. The first tranche is disbursed in connection with the signing of the Loan Facility and the second tranche can be drawn by the Company from the date of the signing of the Loan Facility and up until September 25, 2024, at the latest. The Company's right to draw the second tranche is conditional upon the total amount outstanding under the Convertibles plus the Loan Facility (after disbursement of the second tranche) does not exceed 10.00 percent of the Company's market capitalization at the time of the draw down request. The loans drawn under the Loan Facility accrue interest at an annual rate of STIBOR 3M (for both tranches, fixed as of the disbursement of the first tranche) plus 10.00 percent. Until the second tranche is disbursed or cancelled, an interest corresponding to STIBOR 3M accrues on the undisbursed second tranche. The loans mature on March 25, 2025, and the interest is due for payment at the final maturity date. To the extent the Company would execute new issues of shares while the Convertibles and loans under the Loan Facility are outstanding, the Company shall, with certain exemptions, use the net-proceeds from such new issues to repay the outstanding amounts under the Convertibles and the Loan Facility.

In connection with the Financing, the Company will pay an arrangement fee to Fenja of SEK 4 million, which will be deducted from the first tranche under the Loan Facility.

Reasons for deviation from the shareholders' preferential rights etc.

The issue of the Convertibles constitutes and integrated part of the Financing. The purpose of the Financing and the reason for the deviation from the shareholders' preferential rights in relation to the issue of the Convertibles is the need for ongoing working capital as well as enabling the Company to finalize the OPTIMIZE-1 study, continue Phase 3 preparation for mitazalimab in first-line metastatic pancreatic cancer, and continue development of the Company's earlier stage immuno-oncology pipeline. The Company has weighed the advantages and disadvantages of a rights issue and concluded that a rights issue (i) would be significantly more time-consuming, which may risk that the Company misses out on potential growth opportunities, (ii) would lead to significantly higher costs for the Company, mainly attributable to the procurement of an underwriting consortium and legal costs, (iii) would expose the Company to higher market volatility, especially given the current market conditions, and (iv) would most likely have to be carried out at a lower issue price and result in a higher dilution, which would have been to the detriment of all shareholders. Furthermore, the Convertibles contribute to improving the Company's capital structure and risk level by providing the Company with financing with increased flexibility compared to a customary new issue of shares.

In this respect, the board of directors has particularly considered the importance of being able to carry out the raising of capital in a way that ensures that the Company obtains sufficient working capital at a proportionate cost.

In view of the above and after careful consideration, it is the board of directors' assessment that the Financing is the most favorable financing alternative for the Company, and in the interest of both the shareholders and the Company, and therefore also justifies a deviation from the main rule of the shareholders' preferential rights.

The conversion price as well as the other terms for the Financing has been established through a negotiation at arm's length between the Company and Fenja. In connection herewith, the board of directors has taken into account general market conditions to raise capital, whereby the terms and conditions for the Financing in an overall assessment are deemed to be in accordance with market conditions.

Share capital, shares and dilution

Provided that all Convertibles are converted into shares, the share capital will increase with SEK 6,530.6120 from SEK 607,191.2688 to SEK 613,721.8808 through the issue of 8,163,265 ordinary shares, resulting in that the total number of shares increases from 758,989,086 to 767,152,351, whereof 766,202,501 are ordinary shares and 949,850 are series C shares. Thus, the Convertibles entails a potential maximum dilution of the ordinary shares of approximately 1.07 percent.

Advisors

Setterwalls Advokatbyrå AB acts as legal advisor to the Company in connection with the Financing.

For further information, please contact:

Søren Bregenholt, CEO

E-mail: soren.bregenholt@alligatorbioscience.com

Phone: +46 (0) 46 540 82 00

This information is information that Alligator Bioscience is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2024-06-25 20:30 CEST.

About Alligator Bioscience

Alligator Bioscience AB is a clinical-stage biotechnology company developing tumor-directed immuno-oncology antibody drugs. Alligator's portfolio includes several promising drug candidates, with the CD40 agonist mitazalimab as its key asset. Furthermore, Alligator is co-developing ALG.APV-527 with Aptevo Therapeutics Inc., several undisclosed molecules based on its proprietary technology platform, Neo-X-Prime, and novel drug candidates based on the RUBY bispecific platform with Orion Corporation. Out-licensed programs include AC101/HLX22, in Phase 2 development, by Shanghai Henlius Biotech Inc. and an undisclosed target to Biotheus Inc.

Alligator Bioscience's shares are listed on Nasdaq Stockholm (ATORX) and is headquartered in Lund, Sweden.

For more information, please visit alligatorbioscience.com.

IMPORTANT INFORMATION

Publication, announcement or distribution of this press release may, in certain jurisdictions, be subject to restrictions by law and persons in the jurisdictions where this press release has been published or distributed should inform themselves of and follow such legal restrictions. The recipient of this press release is responsible for using this press release, and the information contained herein, in accordance with applicable rules in each jurisdiction. This press release does not constitute an offer, or a solicitation of any offer, to buy or subscribe for any securities in the Company in any jurisdiction, neither from the Company nor from anyone else.

This press release is not a prospectus for the purposes of Regulation (EG) 2017/1129 (the "Prospectus Regulation") and has not been approved by any regulatory authority in any jurisdiction. The Company has not authorized any offer to the public of securities in any member state of the EEA and no prospectus has been or will be prepared in connection with the Convertibles. In any EEA Member State, this communication is only addressed to and is only directed at "qualified investors" in that Member State within the meaning of the Prospectus Regulation.

This press release does not constitute or form part of an offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein may not be sold in the United States absent registration or an exemption from registration under the US Securities Act of 1933, as amended (the "Securities Act"), and may not be offered or sold within the United States absent registration or an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. There is no intention to register any securities referred to herein in the United States or to make a public offering of the securities in the United States. The information in this press release may not be announced, published, copied, reproduced or distributed, directly or indirectly, in whole or in part, within or into the United States of America, Australia, Belarus, Canada, Hong Kong, Japan, New Zeeland, Russia, Singapore, South Africa, South Korea, Switzerland or in any other jurisdiction where such announcement, publication or distribution of the information would not comply with applicable laws and regulations or where such actions are subject to legal restrictions or would require additional registration or other measures than what is required under Swedish law. Actions taken in violation of this instruction may constitute a crime against applicable securities laws and regulations.

In the United Kingdom, this document and any other materials in relation to the securities described herein is only being distributed to, and is only directed at, and any investment or investment activity to which this document relates is available only to, and will be engaged in only with, "qualified investors" who are (i) persons having professional experience in matters relating to investments who fall within the definition of "investment professionals" in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order"); or (ii) high net worth entities falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as "relevant persons"). In the United Kingdom, any investment or investment activity to which this communication relates is available only to, and will be engaged in only with, relevant persons. Persons who are not relevant persons should not take any action on the basis of this press release and should not act or rely on it. This press release does not constitute a recommendation concerning any investor's decision regarding the Convertibles. Each investor or potential investor should conduct his, her or its own investigation, analysis and evaluation of the business and information described in this press release and any publicly available information. The price and value of the securities can decrease as well as increase. Achieved results do not provide guidance for future results.

Forward-looking statements

This press release contains forward-looking statements that reflect the Company's intentions, assessments, or current expectations about and targets for the Company's future results of operations, financial condition, development, liquidity, performance, prospects, anticipated growth, strategies and opportunities and the markets in which the Company operates. Forward-looking statements are statements that are not historical facts and may be identified by the fact that they contain words such as "believe", "expect", "anticipate", "intend", "may", "plan", "estimate", "will", "should", "could", "aim" or "might", or, in each case, their negative, or similar expressions. The forward-looking statements in this press release are based upon various assumptions, many of which are based, in turn, upon further assumptions. Even if the Company believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurances that they will materialize or prove to be correct. Because these statements are based on assumptions or estimates and are subject to risks and uncertainties, the actual results or outcome could differ materially from those set out in the forward-looking statements, which are a result of many factors. Such risks, uncertainties, contingencies and other important factors could cause actual events to differ materially from the expectations expressed or implied in this release by such forward-looking statements. The Company does not guarantee that the assumptions underlying the forward-looking statements in this press release are free from errors nor does it accept any responsibility for the future accuracy of the opinions expressed in this press release or any obligation to update or revise the statements in this press release to reflect subsequent events. Readers of this press release should not place undue reliance on the forward-looking statements in this press release. The information, opinions and forward-looking statements contained in this press release speak only as of its date and are subject to change without notice. Neither the Company nor anyone else does undertake any obligation to review, update, confirm or to release publicly any revisions to any forward-looking statements to reflect events that occur or circumstances that arise in relation to the content of this press release.

Attachments

Alligator Bioscience announces financing of up to SEK 80 million extending cash runway to Q1 2025

SOURCE: Alligator Bioscience

View the original press release on accesswire.com