$11.00 Offer Represents $0.75 Per Share Increase in Offer Price to May 7, 2024 Tender Offer

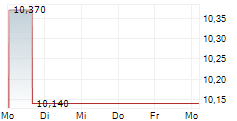

NEW YORK, June 26, 2024 /PRNewswire/ -- Bellevue Capital Partners, LLC ("Bellevue") announced today that it has increased the purchase price of its previously announced tender offer to purchase up to 125,000 shares of American Strategic Investment Co. (NYSE: NYC) ("ASIC") common stock from the previous purchase price of $10.25 to an increased purchase price of $11.00 per share (the "Tender Offer"). The Tender Offer will close on July 5, 2024.

Bellevue is making this offer at a 90% premium to the May 3, 2024 closing price because of its continued confidence in ASIC 's portfolio and underlying assets. Bellevue further believes in the previously announced expanded investment strategy that ASIC is pursuing and in the long-term value of ASIC 's common stock. The 90% premium to the May 3, 2024 closing stock price reflects Bellevue's belief in the long-term performance of ASIC and its portfolio of assets.

The Tender Offer is being made upon, and is subject to, the terms and conditions set forth in the Offer to Purchase and the related Letter of Transmittal. The Tender Offer will expire at 5:00 PM, New York City time, on July 5, 2024, unless extended or earlier terminated by Bellevue (the "Expiration Date"). Tenders of common stock may be withdrawn at any time at or prior to 5:00 PM, New York City time, on July 5, 2024, but may not be withdrawn thereafter except in certain limited circumstances where additional withdrawal rights are required by law.

About Bellevue Capital Partners, LLC

Bellevue is a leading, diversified investment, asset management and operating platform and the sole member of AR Global Investments, LLC, the parent company to the advisor and property manager of ASIC.

SOURCE Bellevue Capital Partners, LLC