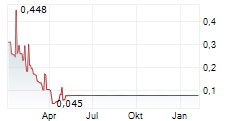

VANCOUVER, British Columbia, July 02, 2024 (GLOBE NEWSWIRE) -- Blender Bites Limited (the "Company", "Blender Bites" or "Blender"), (CSE: BITE, FWB: JL4, WKN: A3DMEJ), announces its unaudited financial results for the three months and six months ended April 30, 2024. All dollar figures are stated in Canadian dollars, unless otherwise indicated.

Financial Highlights for the Three Months Ended April 30, 2024:

- Revenue Growth: Total revenues increased to $1,468,321, up from $217,461 in the comparable period last year, marking an increase of $1,250,860 or 575%.

- Gross Margin Improvement: The gross margin rose to $411,186, compared to $12,249 for the same period last year, an increase of 3,257%.

- Expense Reduction: Total expenses were $960,426, down from $2,208,544 in the comparable period, a reduction of $1,248,118 or 56%, including non-cash depreciation expenses of $2,311.

- Loss Reduction: Comprehensive loss decreased to $475,764, compared to $2,193,131 for the same period last year, reducing the loss by $1,717,367 or 78%.

Financial Highlights for the Six Months Ended April 30, 2024

- Revenue Growth: Total revenues increased to $2,041,989, up from $656,771 in the comparable period last year, marking an increase of $1,385,218 or 211%.

- Gross Margin Improvement: The gross margin rose to $554,595, compared to $138,206 for the same period last year, an increase of 301%.

- Expense Reduction: Total expenses were $1,723,842, down from $2,805,286 in the comparable period, a reduction of $1,081,444 or 39%, including non-cash depreciation expenses of $4,442 and a recovery of ($352,403) for share-based compensation.

- Loss Reduction: Comprehensive loss decreased to $1,095,771, compared to $2,663,916 for the same period last year, reducing the loss by $1,568,145 or 59%. The net loss includes a net $308,625 of non-cash expenditure recoveries.

Outlook for 2024:

On April 18, 2024, the Company announced that a leading U.S. grocery retailer has listed four Blender Bites SKUs, including both 1-STEP Smoothie & Frappé Innovations, in 123 of its stores. The grocer, with over 430 stores across the U.S. Further to this development, on June 18, 2024, Blender Bites announced that it had expanded its distribution at Walmart Canada, adding over 100 stores. The Company expects increased sales, including from retailers mentioned above, leading into summer, as smoothies tend to be more popular during the warmer months and believes this expansion can boost Blender Bites' market presence and sales performance. Therefore, the Company anticipates a favourable third quarter of fiscal 2024, driven by distribution gains, marketing efforts and improved unit metrics.

"Our second quarter results are driven by our multi-award winning products as well as by the incredible amount of hard work our team has put in the past year. Blender Bites has grown tremendously fast in the US market and helped to re-define the frozen fruit category in North America," stated founder and CEO of Blender Bites, Chelsie Hodge. "Our financial results show significant growth, but I know that this is just the beginning for our innovative and disruptive brand. We are continuing to pursue and win highly competitive shelf space but also working tirelessly at improving unit metrics and velocities, ensuring we're driving the most value to our shareholders. With a strong quarter behind us, I look forward to providing regular updates on many other developments which further solidify our success in the marketplace."

Management's Discussion and Analysis and Condensed Interim Consolidated Financial Statements and the notes thereto for the fiscal period ended April 30, 2024 can be obtained from Blender Bites' corporate website at www.blenderbites.ca and under Blender Bites' SEDAR profile at www.sedarplus.ca.

ABOUT BLENDER BITES

Blender Bites is a multi- award-winning Canadian company involved in the development and marketing of a line of premium frozen beverage products with a focus on functionality. Blender Bites was founded in 2017 and quickly became a leader in the "easy smoothie" category in North America. With a focus on better-for-you ingredients and convenience, the Company is proud to be pre-portioned without the use of any inner plastic packaging. Blender Bites products are certified organic, non-GMO, gluten free, dairy free and soy free and contain functional ingredients such as whole food vitamins, collagen, and probiotics. Blender Bites 1-Step Smoothies and 1-Step Frappes are distributed in 5000 stores across North America in leading retailers such as Walmart, Albertsons, Safeway, HEB, Loblaws and Sobeys.

On behalf of the Board of Directors,

Blender Bites Limited

Chelsie Hodge, Chief Executive Officer

Email - chelsie@blenderbites.com

Telephone - 236-521-0626

For further information, contact Blender IR Team at:

Email - investors@blenderbites.com

Telephone - 1-888-997-2055

Media Contact - teamblenderbites@jonesworks.com

CAUTIONARY DISCLAIMER STATEMENT

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. To the extent any forward-looking information in this news release constitutes "financial outlooks" or "future-oriented financial information" within the meaning of applicable Canadian securities laws, the reader is cautioned not to place undue reliance on such information. Forward-looking statements are necessarily based upon several estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward looking statements. Such factors include, but are not limited to general business, economic, competitive, political, and social uncertainties, and uncertain capital markets. Readers are cautioned that actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. In this news release, forward-looking statements include, among other things, statements relating to potential future growth, future financial performance and increased sales in the summer months. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.