VANCOUVER, BC / ACCESSWIRE / July 3, 2024 / South Pacific Metals Corp. (TSXV:SPMC)(FSE:6J00) ("SPMC" or the "Company"), an emerging gold-copper exploration company operating in the heart of Papua New Guinea's proven production corridors, is pleased to announce it has launched a systematic and aggressive exploration program to evaluate its 3,000 square kilometre (km2) portfolio of four gold-copper projects. Generative exploration programs at Anga, Osena, Kili Teke and May River Projects will focus on achieving near-term discoveries and identifying additional growth opportunities.

Highlights:

Boots-on-the-Ground Exploration in the Mineral-Rich Kainantu District: Design of surface sampling, mapping and prospecting programs is currently underway for both the Anga and Osena Projects, located in the Kainantu Gold District and mantling K92's tenements that host their producing Kainantu Gold Mine;

Surface Sampling Analysis at Osena: Submission of 550 surface soil, rock and trench samples collected at the Ontenu porphyry copper-gold prospect in fall 2023 (under previous management) for assaying;

Kili Teke Porphyry Copper-Gold Deposit Expansion: Desktop analysis of comprehensive datasets (geochemical, geophysical, geological and drilling) to identify near-resource targets for possible deposit expansion; and

May River Target Evaluation: Comprehensive desktop review and re-interpretation of extensive historic and modern datasets (geochemical, geophysics, geological, and drilling) is underway to target large-scale porphyry copper-gold and epithermal gold vein systems proximal to the Frieda River Deposit.

Four Projects Covering 3,000 km² Across the Most Well-Endowed Metal Province in the World

"With new management and our experienced in-country team in place, the Company is streamlined and laser-focused on the tremendous exploration potential of all four projects," stated Michael Murphy, Executive Chairman & CEO. "Having recently traveled to Papua New Guinea for a series of site reviews and stakeholder meetings with government officials and community members, it's clear that each of our assets has the potential to demonstrate generational importance. Our strategy is to advance these projects methodically and ethically, so that we have clear, near-term visibility into the true size of the exploration opportunity."

Anga Project

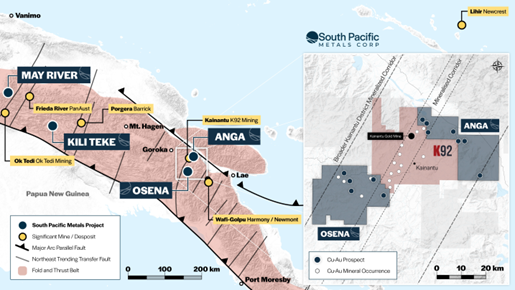

Comprised of 461 km² of exploration licenses in the highly mineralized and prospective Kainantu District, the Anga Project is located immediately northeast of and adjacent to K92's operating Kainantu Gold Mine, known for its gold, copper and silver outputs (see Figure 1). Anga's southwestern project boundary is approximately 3 km from where K92 is currently completing exploration drilling on the Arakompa lode-gold vein system, where multiple wide and high-grade gold zones have been intercepted (see K92 news release dated June 10, 2024, and February 21, 2024).

Surface sampling and mapping work completed by the Company in 2022 (then under Kainantu Resources Ltd.), including preliminary geological mapping, surface sampling (rock and soil) and geophysical surveying (airborne magnetotellurics), indicates that Anga hosts similar geology, surface geochemical signatures (Au-Te-Bi) and geophysical signatures to that observed to be associated with mineralized gold veins at K92. Project data is being re-evaluated under new management and with a better understanding of regional mineralization styles to prioritize regions and complete new exploration work programs.

Osena Project

Covering 626 km² of strategic ground, the Osena Project is located southwest of and adjacent to K92's tenements that host the Kainantu Gold Mine (see Figure 1). Priority prospects include Ontenu, a porphyry copper-gold and epithermal gold system with exposed porphyritic diorite intrusive phases hosting chalcocite, covellite and bornite, located within a highly mineralized corridor that extends more than 40 km northeast across the Kainantu District.

While new surface sampling activity is planned to kick-off later in the year, the Company can confirm that 550 surface soil, rock and trench samples were collected in September 2023 (under previous management) were securely and properly stored since that time, but never sent for assaying. These have now been forwarded on for assaying to Intertek Laboratory in Lae, Papua New Guinea. Results, anticipated to be available in Q3 2024, will aid in determining priority areas to drill test for subsurface porphyry copper-gold and epithermal gold mineralization.

Kili Teke Project

The Kili Teke Porphyry Copper-Gold Complex, situated within a 252 km² exploration licence in Enga Province, represents a substantial asset located 20 km northwest of the Mt. Kare gold deposit and 40 km west of Barrick's newly re-started Porgera Gold Mine (see Figure 1). The Project hosts an Inferred Mineral Resource of 237 Mt at 0.6% CuEq (0.34% Cu, 0.24 g/t Au, and 168 ppm Mo) totaling 802 kt Cu, 1.81 Moz Au, and 40 kt Mo.1 Although drilling extends to depths of 1,000 m, the mineral resource does not include drilling below 650 m depth, nor does it include all high-grade skarn drill intercepts. Skarn intercepts can be very high-grade, for example hole KTD0025 intercepted 7.8 m of 13.3% Cu, 11.75 g/t Au and 21.07 g/t Ag within 54 m of 2.1% Cu, 1.82 g/t Au and 3.87 g/t Ag (from 878 m depth down hole).

Through a preliminary review of the Project's data, the Company has identified multiple avenues to possibly optimize and expand the mineral resource, including identifying near-resource copper-gold drill targets. The Company will commence a comprehensive desktop analysis of the Project's extensive technical dataset, which includes regional airborne magnetics and radiometrics, multi-element geochemical and assay data from surface rocks, soils and drill core, and drill core photos to complete the targeting exercise.

May River Project

The May River Project spans 1,697 km² of exploration licenses in East Sepik Province, immediately west of and adjacent to the tier-1 Frieda River Cu-Au Project, one of the world's largest undeveloped copper-gold projects having 26 Blbs contained Cu and 20 Moz contained Au.2 The Project hosts several compelling porphyry Cu-Au and epithermal Au-Ag prospects, including the Mountain Gate porphyry Cu-Au and the Skiraisa epithermal Au targets, within host rock and structural setting identical to that hosting the Frieda River deposit. May River also hosts a 7 km north-northwest trending Cu-Au mineralized corridor within which occurs with two drill-confirmed high-sulfidation gold occurrences.

As part of the 2024 exploration program, the Company will complete a comprehensive desktop review of all historical and modern geological, geochemical and structural data across the entirety of the Project. The primary goals are to identify where to drill known prospects such as Mountain Gate and Skiraisa, and to identify new large-scale porphyry Cu-Au systems similar to that at nearby Frieda River.

"Our proximity to existing, successful producers like K92 Mining and others are an added plus," Mr. Murphy continued. "Relationships matter and it's beneficial to be in a position to visit and trade notes with the neighbours. Results from on-the-ground exploration programs and desktop reviews will be used to refine drill targets and identify new ones. Anga and Osena remain our top priority projects as we zero-in on targeting possible extensions of structures hosting lode-gold veins from the nearby K92 project."

1Please refer to the 2022 N.I. 43-101 Technical Report for the Kili Teke Project, by Kainantu Resources Ltd., with an effective date of 18 November 2022.

2Please refer to PanAust 2018 Updated Feasibility Study for the Frieda River Project.

Qualified Person

The scientific and technical information disclosed in this release has been reviewed and approved by Darren Holden, Ph.D., FAusIMM, a "Qualified Person" as defined under the Canadian Institute of Mining National Instrument 43-101, 2014 Standards of Disclosure for Mineral Projects. Dr. Holden is a technical advisor to the Company.

The 2022 N.I. 43-101 Technical Report for the Kili Teke Cu-Au Project, Papua New Guinea, was prepared by Graeme J. Fleming, MAIG, an Independent "Qualified Person" as defined under the Canadian Institute of Mining National Instrument 43-101, 2014 Standards of Disclosure for Mineral Projects.

About South Pacific Metals Corp.

South Pacific Metals Corp ("SPMC") is an emerging gold-copper exploration company operating in the heart of Papua New Guinea's proven gold and copper production corridors. With an expansive 3,000 km² land package and four transformative gold-copper projects contiguous with major producers K92 Mining, PanAust and neighbouring Barrick Gold, new leadership and experienced in-country teams are prioritizing thoughtful and rigorous technical programs focused on boots-on-the-ground exploration to prioritize discovery across its portfolio projects: Anga, Osena, Kili Teke and May River.

Immediately flanking K92's active drilling and gold producing operations to the northeast and southwest, SPMC's Anga and Osena Projects are located within the high-grade Kainantu Gold District - each having the potential to host similar-style lode-gold and porphyry copper-gold mineralization as that present within K92's tenements. Kili Teke is an advanced exploration project situated only 40 km from the world-class Porgera Gold Mine and hosts an existing Inferred Mineral Resource with multiple opportunities for expansion and further discovery. The May River Project is located adjacent to the world-renowned Frieda River copper-gold project, with historical drilling indicating potential for a significant, untapped-gold mineralized system. SPMC common shares are listed on the TSX Venture Exchange (TSX.V: SPMC) and Frankfurt Stock Exchange (FSE: 6J00).

For further information please contact:

Michael Murphy, Executive Chairman and CEO

South Pacific Metals Corp.

Tel: +1 604-428-6128

Email: info@southpacificmetals.ca

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer and Forward-Looking Information

Statements contained in this release that are not historical facts are forward-looking statements that involve various risks and uncertainty affecting the business of SPMC. In making the forward-looking statements, SPMC has applied certain assumptions that are based on information available to the Company, including SPMC's strategic plan for the near and mid-term. There is no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements may involve various risks and uncertainty affecting the business of the Company. These forward-looking statements can generally be identified as such because of the context of the statements, including such words as "believes", "anticipates", "expects", "plans", "may", "estimates", or words of a similar nature. Forward-looking statements or information in this news release relate to, among other things: formulation of plans for drill testing; and the success related to any future exploration or development programs. These forward-looking statements and information reflect the Company's current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic, regulatory or other unforeseen uncertainties and contingencies. These assumptions include, without limitation: success of the Company's projects, prices for metals remaining as estimated, currency exchange rates remaining as estimated, availability of funds for the Company's projects, capital, decommissioning and reclamation estimates, prices for energy inputs, labour, materials, supplies and services (including transportation), no labour-related disruptions, no unplanned delays or interruptions in scheduled construction and production, all necessary permits, licenses and regulatory approvals are received in a timely manner, and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive. The Company cautions the reader that forward-looking statements and information involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements or information contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Accordingly, readers should not place undue reliance on forward-looking information. Such factors include, without limitation: fluctuations in gold prices, fluctuations in prices for energy inputs, labour, materials, supplies and services (including transportation), fluctuations in currency markets (such as the Canadian dollar versus the U.S. dollar), operational risks and hazards inherent with the business of mineral exploration, inadequate insurance, or inability to obtain insurance, to cover these risks and hazards, the Company's ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner, changes in laws, regulations and government practices, including environmental, export and import laws and regulations, legal restrictions relating to mineral exploration, increased competition in the mining industry for equipment and qualified personnel, the availability of additional capital, title matters and the additional risks identified in the Company's filings with Canadian securities regulators on SEDAR+ (available at www.sedarplus.ca). Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described, or intended. Investors are cautioned against undue reliance on forward-looking statements or information. These forward-looking statements are made as of the date hereof and, except as required under applicable securities legislation, the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property.

SOURCE: South Pacific Metals Corp.

View the original press release on accesswire.com