Vancouver, British Columbia, July 03, 2024 (GLOBE NEWSWIRE) -- Terra Balcanica Resources Corp. ("Terra" or the "Company") (CSE:TERA; FRA:UB1), a multi-jurisdictional, polymetallic exploration company focused on supporting the global transition to clean energy, is pleased to announce the signing of the definitive option agreement dated July 2, 2024 ("Agreement") between the Company, Fulcrum Metals Plc. ("Fulcrum", AIM:FMET) and Fulcrum Metals (Canada) Ltd. ("Fulcrum Canada"), a wholly-owned subsidiary of Fulcrum, pursuant to which the Company will obtain a four-year option (the "Option") to acquire a 100% interest in Fulcrum's uranium portfolio of exploration licences (the "Licences") located in northern Saskatchewan, Canada and collectively encompassing 596.71 km2 of highly prospective ground for a uranium discovery.

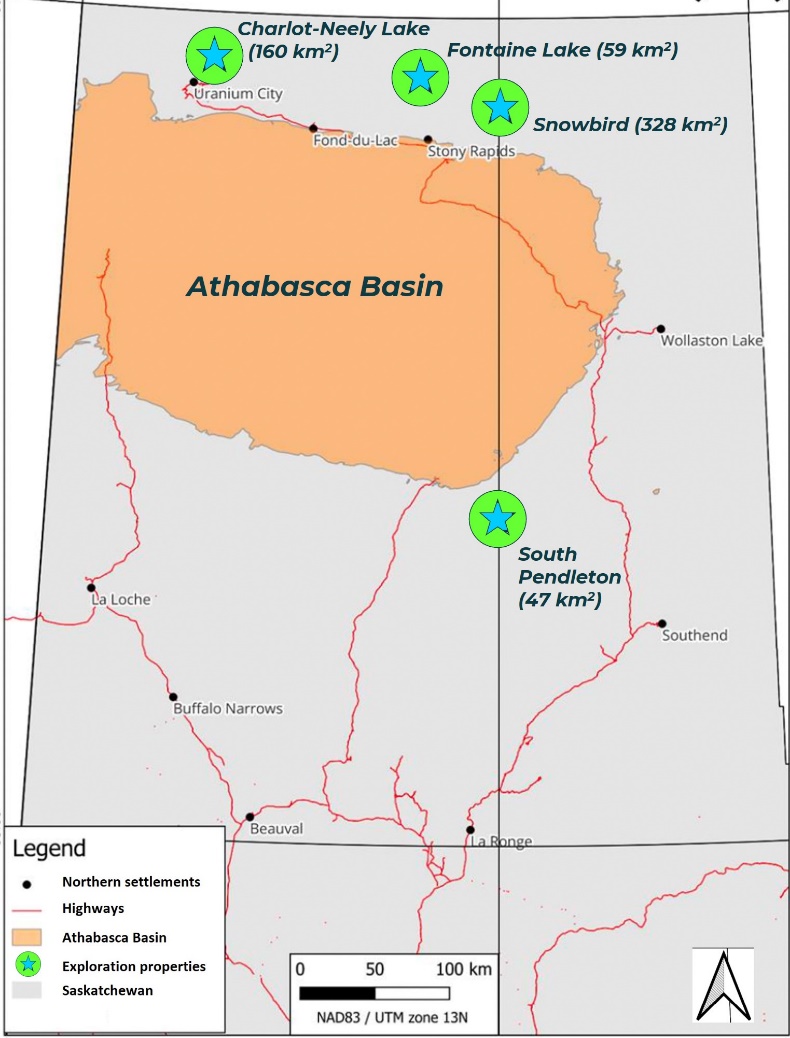

Pursuant to the Agreement, on closing (the "Option Closing Date"), Fulcrum and Fulcrum Canada will grant Terra the Option to acquire a 100% interest in the Licences, comprising Fulcrum's Charlot-Neely Lake, Fontaine Lake, Snowbird, and South Pendleton licence clusters located along northern and southeastern margins of the renowned Athabasca Basin, the supplier of ca. 20% of world's uranium and home to significant uranium deposits.

In consideration for the Option, Terra has paid C$25,000 in cash to Fulcrum to date.

Additionally, Terra may exercise the Option by paying Fulcrum cash according to the schedule below:

- C$50,000 on the first anniversary of the Option Closing Date;

- C$75,000 on the second anniversary of the Option Closing Date;

- C$75,000 on the third anniversary of the Option Closing Date;

- C$75,000 on the fourth anniversary of the Option Closing Date; and

issue Fulcrum Canada common shares of Terra at the 10-day volume weighted average trading price of Terra's shares ending three trading days prior to the date of issuance, subject to the minimum pricing requirements of the Canadian Securities Exchange (the "CSE"), as per the following schedule:

- C$250,000 of Terra shares on the Option Closing Date;

- C$350,000 of Terra shares on the anniversary of the Option Closing Date;

- C$560,000 of Terra shares on the second anniversary of the Option Closing Date;

- C$650,000 of Terra shares on the third anniversary of the Option Closing Date;

- C$1,250,000 of Terra shares on the fourth anniversary of the Option Closing Date; and

Terra will also complete minimum work expenditures totalling C$3,250,000 prior to the fourth anniversary of the Option Agreement.

Upon the exercise of the Option, Terra will grant Fulcrum a 1.0% net smelter returns royalty ("NSR") on all claims with a buy-down option for half of the NSR, being a 0.5% NSR, for the cash payment of C$1,000,000.

Global Energy Metals Corp. ("Global Energy") acted as a finder for this transaction by introducing the parties and facilitating the negotiation of the Agreement. As compensation for Global Energy's services, the Company, Fulcrum Canada and Global Energy entered into a finder's agreement (the "Finder's Fee Agreement"), in which Global Energy will be compensated with 1,198,291 shares of Terra on the Option Closing Date subject to the minimum pricing requirements of the CSE and, upon the exercise of the Option, the Company will grant Global Energy a 0.5% NSR on all of the Licences, subject to a buy-down option of the entire NSR for the cash payment C$500,000.

The Agreement replaces the Letter of Intent between the Company and Fulcrum signed on April 2nd, 2024 (see news release of the Company dated April 3rd, 2024).

The transaction contemplated under the Agreement and the Finder's Fee Agreement are subject to the approval of the CSE.

The common shares of Terra issued under the terms of the Agreement and the Finder's Fee Agreement will be subject to a hold period of four months from the date of issuance in accordance with applicable securities laws in Canada.

Highlights

- 596.71 km2 of land tenure along northern and southeastern edges of the Athabasca Basin, a premium mining district and the leading global source of high-grade uranium with over 70 million lbs of U3O8 produced;

- Surface uranium samples of up to 6.22 % U3O8 at Charlot-Neely and up to 1.44 % U3O8 at Fontaine-Lake licences with anomalous surface radiometric readings of >7,000 cps as well as rare earth element assays;

- A historic (non-43-101 compliant) diamond drill hole intercept of 3.91 g/t Au over 45.8 m from surface at the Charlot-Neely licence;

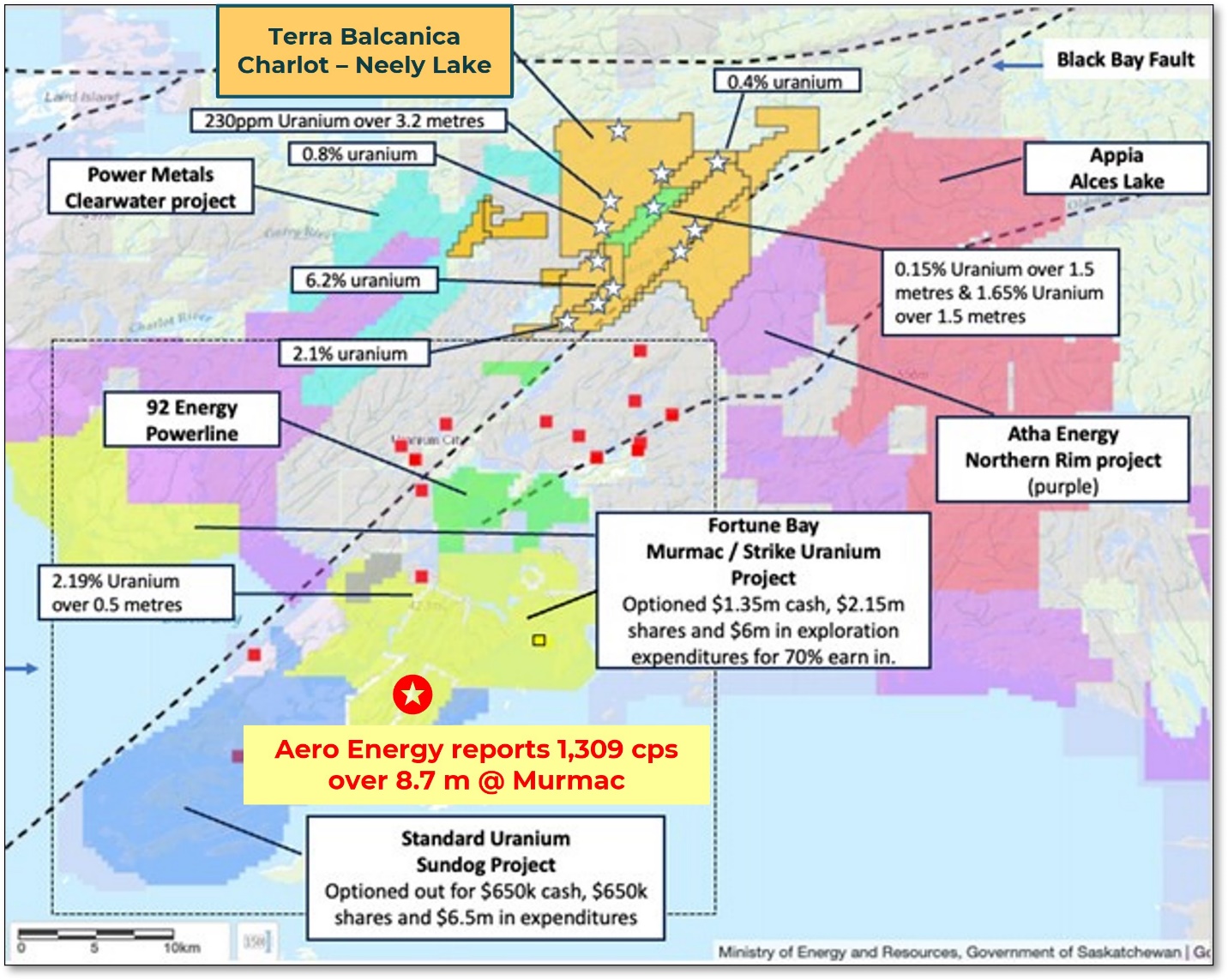

- The recent drill hole intercept of1,309 cps over 8.7 m by Aero Energy and Fortune Bay on the Murmac project (see news release dated June 25th, 2024) is located only 20 km SW of Terra's Charlot-Neely Lake licence and marks the first Beaverlodge District uranium discovery in more than half a century

- Historical work has demonstrated multiple occurrences of uranium mineralization along NE-SW structural corridors such as Black Bay fault, Black Lake shear, and the Snowbird tectonic zone and the many associated fault splays and graphitic conductors;

Terra Balcanica CEO, Dr. Aleksandar Miškovic, commented: "The agreement signed with Fulcrum marks an exciting new chapter in Terra's corporate history as a high-quality target generator and explorer of critically needed commodities. The Company is now exposed to a world-class uranium district that is experiencing a mining renaissance as evidenced by the recent discovery made just 20 km from of our flagship Charlot-Neely licence. With close to 600 km2 of land tenure, we are supremely positioned to take early-mover advantage of opportunities along the entire northern and eastern margins of Athabasca Basin. The optioned portfolio comprises geologically promising ground that has not seen modern surveying nor recent drilling. We are excited to approach it by applying the same level of technical rigor as we did in the Balkans to define drill targets with a high probability of success. In addition to multiple uranium occurrences, the licences feature gold, copper, nickel and cobalt showings. We are fortunate to have inherited a wealth of legacy data from Fulcrum along with the expertise of Mr. Gary Dunn, a veteran of uranium exploration in Saskatchewan. It will be an eventful autumn of prospecting, sampling, and structural mapping together with airborne geophysics to rapidly define drill targets."

Portfolio Overview

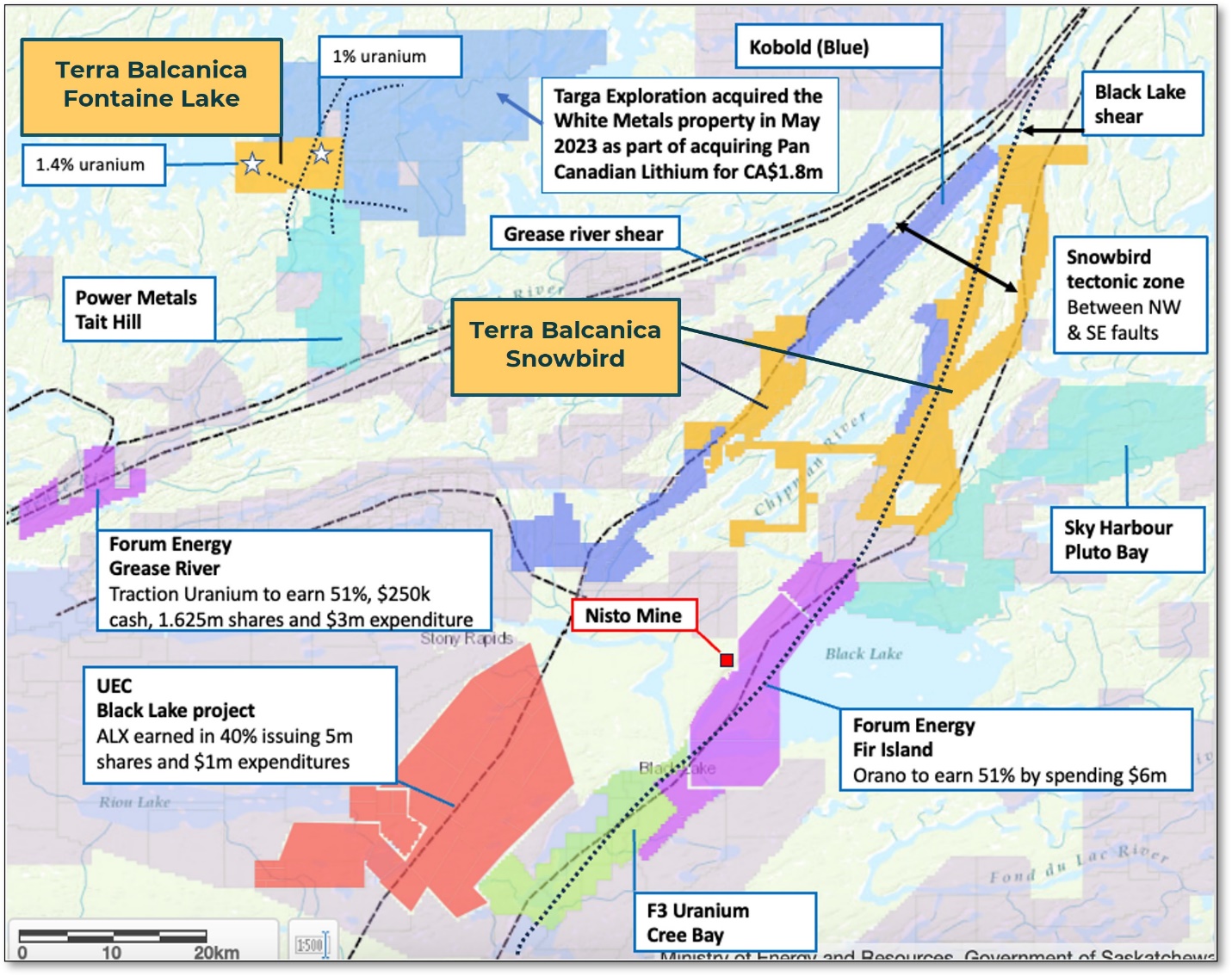

The optioned terrain in norther Saskatchewan is divided into 4 licence clusters targeting the NE-SW structures and associated electromagnetic conductors along strike from historic mines and projects that have attracted significant investment as zones most likely to host basement- and intrusive hosted uranium mineralizations (Figure 1).

Figure 1. Saskatchewan's Athabasca Basin with the optioned licence portfolio .

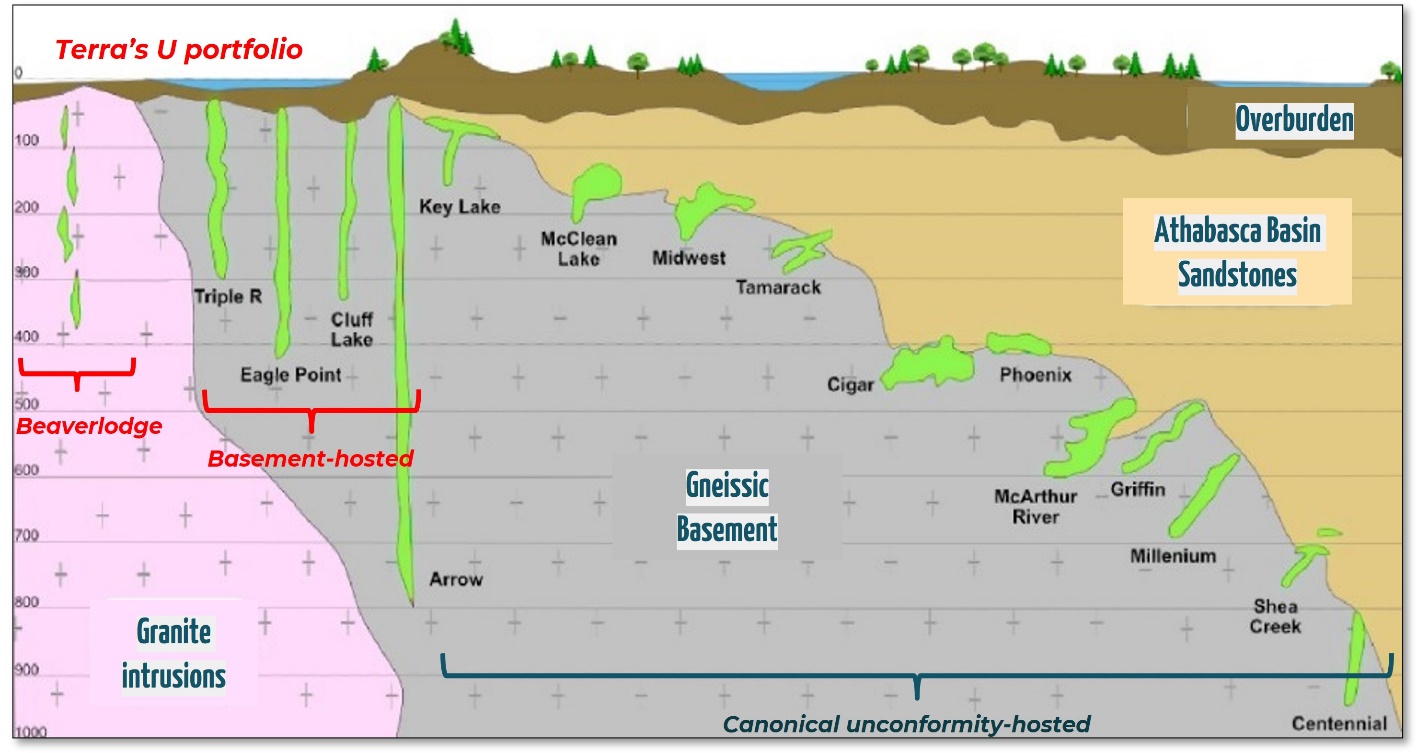

Southeastern margins of the Athabasca Basin are known locations of world-class discoveries such as the Arrow deposit discovered by NexGen Energy Ltd. (4.3 Mt at 0.83% U3O8), and the Triple R deposit (2.7 Mt at 1.94% U3O8) being developed by Fission Uranium Corp. Such sizable accumulations of uranium ore have proved the concept of exploring along fluid bearing structures outside the Basin that have been genetically interpreted to form either the basement or the so-called "Beaverlodge" styles of mineralization (Figure 2).

Figure 2. Three styles of uranium mineralization in northern Saskatchewan on an idealized cross-section of the Athabasca Basin. Terra Balcanica's portfolio focuses on the margins of the Basin where the basement-hosted and so-called "Beaverlodge-style" mineralizations are found as surface expressions of deep-seated feeder dykes and crustal faults .

Terra will focus on this exploration paradigm however, the Company will aim to target major NE-SE trending faults and associated secondary structural corridors along northern margins of the Basin where close to 32,000 tons of U3O8 have been produced in the Beaverlodge District alone.

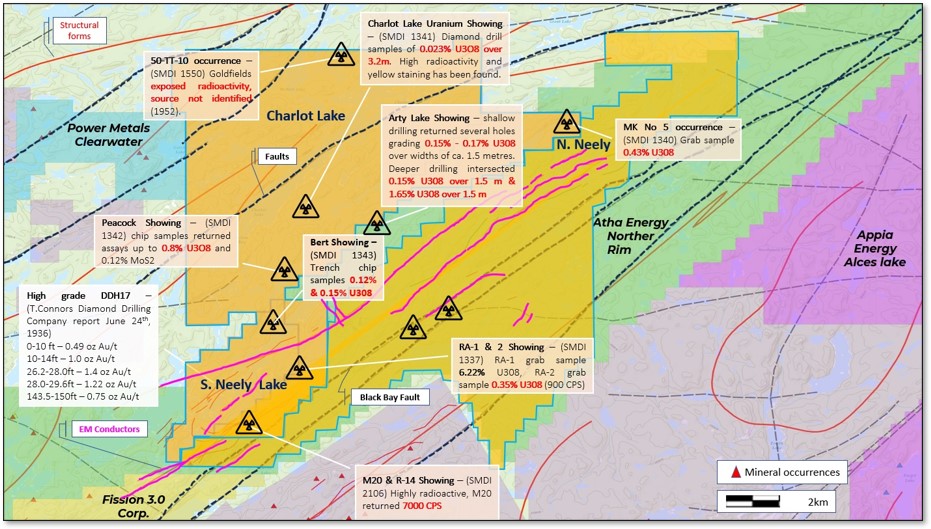

Charlot - Neely Lake

The flagship Charlot-Nely Lake property (Figure 3) covers 163.72 km2 and is located at the heart of the historic Beaverlodge District, 13 km NE of Uranium City. It is found within 10 km radius of the 14 historic mines and uranium ore producers. The licence covers more than 20 km strike length of the major Black Bay Fault with 16 km of previously identified, fault-parallel graphitic conductors. It also hosts significant REE potential given the adjacent Alces REE discovery by Appia with historical samples of over 31% U3O8 and over 16% REE.

Figure 3. Tenure map of the Beaverlodge District along northwestern margin of the Athabasca Basin with Terra's flagship 168 km2 Charlot-Neely Lake property north of centre and 20 km NE along a major structural feature.

The licence benefits from work completed in 2023 which confirmed uranium mineralization on surface of up to 0.55 % U and assays of 0.8% U3O8 confirmed at Peacock showing in 2023, and extensive zones of up to 7,000 cps (counts per second) radioactivity. Historic occurrences are noted of up to 6.22 % U3O8. The first order controls for basement hosted mineralisation are present with large scale structural features, linear conductors that possibly contain graphitic horizons as important reductants and surface uranium anomalism. There is also note of gold drilling intercept of 3.91 g/t Au over 45.8 m from surface (DDH17) which adds additional exploration appeal to the licence (Figure 4).

The Company will focus on high-grade sources of the surficial uranium showings along most radioactive segments of the graphitic conductors as previously untested drill targets.

Figure 4. Charlot-Neely Lake licence cluster encompasses 168 km2 and captures 20 km of the along-strike extent of the Black Bay Fault system with its splays and associated electromagnetic conductors. These graphitic seams serve as favourable redox traps for oxidizing uranium-bearing fluids channelled by deeps seated faults and shears. Multiple anomalously radioactive locations are scattered throughout the tenure .

Fontaine Lake and Snowbird

These licences stretch over 388 km2 and straddle the Grease River Shear Zone, its sub-faults as well as the Snowbird Tectonic Zone (Figure 5). The Black Lake Shear Zone which also transects the Snowbird licence cluster can be traced for 200 km across the Athabasca Basin and is associated with Cameco's Centennial project. Additionally, the Cora and Legs Lake Shear Zones contain multiple airborne radioactivity anomalies that were not followed up on trend. Haymac Mines has recently restarted mining at Nisto Mine which is known for having shipped 500 tons of high-grade ore to Uranium City in the 1950s with one shipment being 106 tons grading 1.6% U3O8. A minimal field program was completed at Fontaine Lake in 2008 with surficial showings of 1% uranium while further work was recommended by CanAlaska Uranium that leaves plenty of discovery potential.

South Pendleton

The South Pendleton property sits upon the Needle Falls Shear Zone and covers 44.76 km2 of terrain along southeastern edge of the Athabasca Basin. It is proximal to Skyharbour Resources' South Falcon project. It features the same basement lithologies as those hosting the prolific Key Lake and Rabbit Lake mines however, several surficial radioactive anomalies and occurrences of uranium mineralization have not been explored yet.

Figure 5. Fontaine Lake and Snowbird licence clusters jointly encompass 388 km2 of terrain along northern and northeastern margins of the Athabasca Basin strategically covering both the Black Lake shear zone and the coupled Grease River and Snowbird Tectonic Zones with their NNE-SSW faults and splays .

Exploration Plan

The Company intends to review cumulative legacy data set by including company assessment reports, historic governmental maps and surveys, extracting findings from research papers, compiling locations of key showings and combining it all into an internally consistent GIS database. Subsequently, Terra will commission a combined, >3,000 line-kilometer, airborne geophysical survey comprising V-TEM Plus electromagnetic and radiometric measurements along a tight, 150-spaced flight grid over all four licence clusters. Data obtained from the geophysics will be combined with the existing GIS database to identify high-priority target zones to follow up by a month and a half of detailed field work including ground radiometrics and lithological sampling in autumn of 2024. Our goal is to immediately generate and rank a dozen drill targets along key structural corridors to be tested in early spring of 2025. Work with the local First Nations to obtain social license to operate and work collaboratively will begin in earnest this summer.

Qualified Person

Dr. Aleksandar Miškovic, P.Geo, is the Company's designated Qualified Person ("QP") for this news release within the meaning of National Instrument 43-101 Standards of Disclosure of Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in this news release as accurate. The QP has not directly verified the data disclosed, including sampling, analytical, and test data underlying the information contained in the press release except to perform a desktop overview of the legacy date provide by Fulcrum.

About the Company

Terra Balcanica is a polymetallic and energy metals exploration company targeting large-scale mineral systems in the Balkans of southeastern Europe and northern Saskatchewan, Canada. The Company has 90% interest in the Viogor-Zanik Project in eastern Bosnia and Herzegovina and owns 100% of the Ceovishte mineral exploration licence in southern Serbia. The Canadian assets comprise a 100% optioned portfolio of uranium-prospective licences at the outskirts of the world-renowned Athabasca basin: Charlot-Neely Lake, Fontaine Lake, Snowbird, and South Pendleton. The Company emphasizes responsible engagement with local communities and stakeholders. It is committed to proactively implementing Good International Industry Practice (GIIP) and sustainable health, safety, and environmental management.

ON BEHALF OF THE BOARD OF DIRECTORS

Terra Balcanica Resources Corp.

"Aleksandar Miškovic"

Aleksandar Miškovic

President and CEO

For the complete information on this news release, please contact Aleksandar Miškovic at amiskovic@terrabresources.com, +1/en/news.

Cautionary Statement

This news release contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively "forward-looking statements"). The use of any of the words "will", "intends" and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Such forward-looking statements should not be unduly relied upon. Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors. The Company believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct. The Company does not undertake to update these forward-looking statements, except as required by law.