Winnipeg, Manitoba--(Newsfile Corp. - July 5, 2024) - Snow Lake Resources Ltd., d/b/a Snow Lake Energy (NASDAQ: LITM) ("Snow Lake" or the "Company") is pleased to provide a corporate update on its portfolio of clean energy mineral projects.

CEO Remarks

"Having assembled a global portfolio of uranium and lithium projects, we feel we have positioned Snow Lake to benefit from both the clean energy transition and the electric vehicle (EV) transition," commented Frank Wheatley, CEO of Snow Lake. He continued: "With exploration crews either in the field, or preparing to mobilize to the field, on our projects, we have high hopes for this exploration season."

Global Portfolio of Clean Energy Projects

Snow Lake's portfolio currently includes the Black Lake Uranium Project in Saskatchewan, the Engo Valley Uranium Project in Namibia, the Shatford Lake Lithium Project and the Snow Lake Lithium Project in Manitoba (See Figure below).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9547/215524_6db208f9d489ea28_001full.jpg

Corporate Strategy

Snow Lake's corporate strategy is to assemble and develop a portfolio of clean energy mineral projects designed to support the clean energy transition and electric vehicle transition. Snow Lake believes that exploring its uranium and lithium projects provide the best opportunity to create shareholder value. Geopolitical events continue to shape both the uranium and lithium markets, with the uranium market showing considerable strength, and the lithium market continuing to show weakness. Given the current state of the uranium and lithium markets, Snow Lake's primary focus over the next year will be to advance the exploration of its two uranium projects, while taking a slower, more careful approach to exploring its two lithium projects.

At the present time, Snow Lake believes the uranium projects provide the best current opportunity to create shareholder value and, during 2024, Snow Lake intends to focus the majority of its exploration efforts and expenditures on its two uranium projects.

Uranium Projects

Snow Lake's two uranium exploration projects are the Engo Valley Uranium Project in Namibia, and the Black Lake Uranium Project in the Athabasca Basin, Saskatchewan, Canada.

Engo Valley Uranium Project

The Engo Valley Uranium Project is located in the Skeleton Coast, in the Opuwo District of the Kunene Region, along the coast of northwest Namibia, approximately 600 kilometers north of Swakopmund, Namibia. Uranium mineralization was discovered in 1973 and exploration was conducted intermittently by Gencor between 1974 and 1980.

The Engo Valley Uranium Project is considered to be a top tier exploration project with historical, non-modern mining code compliant uranium resources, that would benefit from modern exploration techniques and technology for uranium exploration.

Acquisition of 85% Interest in the Engo Valley Uranium Project

Snow Lake and a private British Columbia company have entered into a binding letter of intent, pursuant to which Snow Lake will acquire up to 85% of Namibia Minerals and Investment Holdings (Proprietary) Limited ("NMIH"), a private Namibian company, which in turn is the sole registered and beneficial owner of 100% of the right, title and interest in the Exclusive Prospecting License - 5887 ("EPL-5887") for the Engo Valley Uranium Project. Details of this acquisition are set out in Schedule A attached hereto.

Exclusive Prospecting License 5887

EPL-5887, which covers the Engo Valley Uranium Project, is valid until February 12, 2026, covers an area of 69,530 hectares and authorized NMIH to explore for base and rare metals, industrial minerals, non-nuclear fuel mineral, nuclear fuel minerals, precious metals and precious stones.

2024 Exploration Program

Snow Lake has designed a multi-phase exploration program for 2024 for the Project, which includes:

- analysis of all airborne survey data previously flown by the Namibian Government over the project area, together with all other historical exploration reports and data on the project area on file with the Namibian Ministry of Mines and Energy (now complete);

- topographical survey of the project site (now complete);

- locating all historic drill collars from Gencor's 1970 drilling campaign (now complete);

- radon cup survey of all historical targets, as well as a number of new targets, in order to verify the historical airborne survey data and to confirm both historic and new drill targets (in progress);

- an initial 1,000 - meter reverse circulation drill program to twin the historical drill holes, and to begin an in-fill grid pattern between the historical drill holes (mobilization); and

- downhole radiometrics on each of the new drill holes (pending).

Exploration field crews began mobilizing to site in May 2024 in order to undertake the field portion of Phase 1 of the program. Results from the radon cup survey, the initial phase of drilling, and the downhole gamma logging, will inform a second round of drilling. The two phases of drilling are designed to both test the validity of the various exploration targets and to produce an initial SK-1300 compliant mineral resource estimate.

Namibia

Namibia is ranked as the 5th highest African mining jurisdiction for mining investment according to the Fraser Institute's 2023 annual survey, and was the world's third-largest producer of uranium, accounting for 11% of global production, in 20221. The Husab Uranium Mine and the Rossing Mine are currently the only operating uranium mines in Namibia, with 5 major uranium mines currently in development.

Black Lake Uranium Project

The Black Lake Uranium Project is located in the northeastern Athabasca Basin, Saskatchewan. Uranium mineralization was discovered in 1950 and exploration was conducted intermittently by a number of companies during the 1950's and 1970's. The Black Lake Uranium Project is considered to be an exploration stage project with historical, non-modern mining code compliant uranium resources, that would also benefit from modern exploration techniques and technology for uranium exploration.

Mining Claims

The Black Lake Uranium Project consists of 20 mining claims covering 18,908 hectares and is divided into the following four project areas: Higginson Lake, Charlebois Lake, Fisher Hayes and Spreckley Lake.

Acquisition of a 100% Interest in the Black Lake Uranium Project

Snow Lake has acquired a 100% interest in Global Uranium Acquisition Corp Pty Ltd ("Global"), a private Australian company, which in turn has a mineral property option agreement with Doctors Investment Group Ltd., a private British Columbia company, pursuant to which Global has the sole and exclusive right to earn a 100% undivided interest in the mineral claims comprising the Black Lake Uranium Project. Details of this acquisition are set out in Schedule A attached hereto.

2024 Exploration Program

Given the large amount of historical exploration work undertaken during the 1950's and 1970's on the Black Lake Uranium Project, an initial step will be a compilation and review of all historical exploration data. The first phase of Snow Lake's exploration program for 2024 will include an airborne survey over the entire project area. This will be followed by a suite of ground geophysics to refine the results of the airborne survey, as well as to assist in locating high-value drill targets. A program of diamond drilling will follow the identification of drill targets, with the number and depth of drill holes being dependent on results of the target identification phase. Based upon successful drilling, the objective of the work program would be to have an initial SK-1300 compliant mineral resource estimate completed prior to the end of 2024.

Saskatchewan, Canada

Saskatchewan was the second-largest global producer of uranium in 2022 and accounted for 15% of the world's primary uranium production2, and was ranked as the 3rd overall jurisdiction for mining investment according to the Fraser Institute's 2023 annual survey3. Saskatchewan also hosts the world's largest, highest grade uranium deposits, and is the source of almost a quarter of the world's uranium supply for electrical generation.4

Uranium Market

The only significant commercial use for U3O8 is as a fuel for nuclear power plants for the generation of electricity5. Nuclear energy underpins the three major global trends of: 1) electrification; 2) decarbonization; and 3) energy security. Global demand for electricity is estimated to grow by approximately 50% by 2040, and is accompanied by calls to triple global nuclear capacity by 20506. Nuclear energy provides clean, non-CO2 emissions, and low-cost energy, with greater generating capacity per footprint than other fuel sources.

Geopolitical Events

Geopolitical events continue to shape the global uranium market, including the ongoing Russian invasion of Ukraine, political instability in Niger, and the United States passing a series of laws banning the importation of Russian uranium and facilitating American nuclear energy leadership. These events continue to influence and drive the global energy mix and policy, with renewed focus on nuclear power as a means of ensuring energy security.

United States - Legislation to Enhance Energy Security

In the past two months, the United States has passed two significant pieces of legislation designed to advance clean energy, enhance energy security and independence, and to revive an aging nuclear energy industry at home and bolster cutting-edge technologies abroad.

The Prohibiting Russian Uranium Imports Act

On May 13, 2024, President Biden signed into law The Prohibiting Russian Uranium Imports Act (the "Import Ban"), a move which the White House has called "a national security priority". The Import Ban bans the import of enriched uranium produced in Russia or by Russian entities, and is designed to enhance the United States' energy security by reducing its dependence on Russia for nuclear fuels. It also unlocks funding to support domestic uranium production. Russia is currently the largest foreign supplier of enriched uranium to the United States, according to US Energy Department data.

The ADVANCE Act

On June 18, 2024, the United States Senate passed the Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy (ADVANCE) Act (the "Nuclear Energy Law"), which is designed to reestablish the United States as the global leader in nuclear energy in the twenty-first century. The Nuclear Energy Law strengthens the United States' energy security, as well as expanding nuclear power as a clean, reliable power source designed to remain a major part of the United States future energy mix, meeting their climate goals and ensuring their energy independence.

Nuclear Power's Critical Role in the Energy Transition

Nuclear power plays a critical role in the energy transition, as it is widely stated that there is no path to net zero carbon without nuclear power. At COP 28, a total of 22 countries agreed to target tripling nuclear capacity by 2050 as countries focus on energy security and affordability. Nuclear power programs continue to expand, with 440 operating reactors in 31 countries, and with 60 reactors under construction in 18 countries7.

Uranium Supply, Demand and Pricing

Supply: Geopolitical events continue to disrupt the global uranium supply chain. A combination of low prices over the past decade, underinvestment in uranium projects and nuclear power, mine closures, challenges in re-starting idled uranium mines, and the COVID19 pandemic, have all contributed to a reduction in the global supply of uranium. More recently, uranium producers, developers, and physical uranium holding companies have continued to buy physical uranium, putting further strain on the uranium supply chain.

Demand: Demand for uranium is being driven by the increasing focus on nuclear power as a component part of net zero, a policy shift to include nuclear power as clean energy, and the number of nuclear reactors in operation and under construction.

As noted above, with 440 operating reactors in 31 countries, and with 60 reactors under construction in 18 countries, total uncovered uranium requirements are more than 500 million pounds through 2030. The World Nuclear Association's Nuclear Fuel Report (2023)8 shows a 28% increase in uranium demand over 2023 - 2030, with a 51% increase in uranium demand for the decade 2031 - 2040, providing plenty of scope for growth in nuclear capacity in a world focused on carbon emissions. Demand for uranium is forecast to outstrip uranium supply over the next decade.

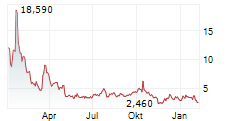

Prices: As a result, prices of uranium have recovered from their lows over the past decade and briefly exceeded USD$100 per pound U3O8 in January 2024, with current prices around USD$85 per pound U3O8.

Positive for Uranium Exploration and Development

Snow Lake is of the view that the combination of supply and demand factors, against the backdrop of the search for solutions to decarbonization and managing global geopolitical risks, is very positive for uranium exploration over the next decade.

Lithium Projects

Snow Lake has two lithium projects, the Shatford Lake Lithium Project, an exploration stage project adjacent to the Tanco lithium mine in Southern Manitoba, and the Snow Lake Lithium Project, an exploration stage project in Northern Manitoba.

Shatford Lake Lithium Project

The Shatford Lake Lithium Project is an exploration stage project located in Southern Manitoba, contiguous to the southern boundary of the Tanco Mine. The region hosts hundreds of individual pegmatite bodies, many of which are classified as complex rare-element Lithium-Cesium-Tantalum ("LCT") pegmatites. Accordingly, the Shatford Lake Lithium Project holds the potential for cesium and tantalum mineralization, in addition to lithium mineralization.

Acquisition of a 90% Interest in the Shatford Lake Lithium Project

Snow Lake has entered into an option agreement with ACME Lithium Inc. ("ACME"), pursuant to which ACME has granted Snow Lake the option to earn up to a 90% undivided interest in the Shatford Lake Lithium Project. Details of the option agreement are set out in Schedule A attached hereto.

The Shatford Lake Lithium Project is comprised of 37 mineral claims located over three project areas - Shatford Lake, Birse Lake, and Cat-Euclid Lake, totaling approximately 17,000 acres. The project is located in the Bird River Greenstone Belt in southeastern Manitoba. Thirty-one (31) of the mineral claims are contiguous to the Tanco mine.

2024 Exploration Program

Snow Lake, together with Critical Discoveries, has designed a four-phase exploration program for 2024. Phase 1 consists of compiling and analyzing all past exploration data generated by ACME Lithium Inc., including all geophysical and geochemical data, as well as past drilling results, in order to identify targets for field work in Phase 2.

Phase 1 has been completed and Phase 2 has been initiated with the Critical Discoveries' exploration field team of 4, consisting of 2 geologists and 2 field technicians. Initial prospecting and mapping will focus on the northwest corner of the Shatford Lake Lithium Project and will then expand to cover the balance of the project.

Initial prospecting activities to date have included the discovery of numerous pegmatites under heavy overburden. Samples have been taken and submitted to the assay lab for analysis.

Depending on assay results, Phase 3 is intended to be a program of up to 2,000 meters of diamond drilling, spread over approximately 10 holes of approximately 200 meters each, dependent upon appropriate drill target identification from Phase 2 of the program. Phase 4 will be compilation and evaluation of all field data, assay results, and drill results from the 2024 exploration program.

Tanco Mine

The Tanco Mine is located on the northwest shore of Bernic Lake, Lac du Bonnet, Manitoba, and is 100% owned and operated by Tantalum Mining Corporation of Canada Ltd. ("Tanco"), a subsidiary of Sinomine (Hong Kong) Rare Metals Resource Co. The Tanco Mine pegmatite orebody was discovered in the late 1920's and the Tanco Mine has been in commercial operation producing lithium in Manitoba for more than 50 years. In addition to lithium concentrate for the lithium battery market, the Tanco Mine produces cesium-based products for the North American market.

Snow Lake Lithium Project

The Snow Lake Lithium Project is a 100% owned exploration stage project located in the Snow Lake region of Northern Manitoba, comprising 122 mineral claims covering 24,515 hectares (approximately 60,577 acres). The Snow Lake region is a historical mining district which currently hosts Hudbay's Lalor mine and Vale's T3 mine.

The Snow Lake Lithium Project consists of two deposits, the Thompson Brothers deposit and the Grass River deposit, which together have a measured, indicated and inferred resource estimate of approximately 8.2 million tonnes grading approximately 1% Li2O.

To date, a total of 26,000 meters of drilling has been completed, of which approximately 20,000 meters included in the current mineral resource estimate, with approximately 6,000 meters of drilling not included.

In July 2023, Snow Lake completed an S-K 1300 Technical Report Summary of Initial Assessment (the "PEA"), which considered a mine plan consisting of underground mining on both deposits, with an initial open pit on the Grass River deposit. Metallurgical testwork has demonstrated that conventional lithium process technologies of dense media separation and floatation will provide robust recoveries.

The PEA contemplated that tailings would ultimately be backfilled underground, with no permanent tailing facility above ground. Together with a smaller operational footprint due to underground mining, and power provided by Manitoba's renewable hydroelectricity, the Snow Lake Lithium Project has strong ESG credentials.

The PEA also looked at the possibility of direct shipping ore ("DSO") as an early cash flow generating opportunity to use revenue from DSO sales to offset initial capital costs to construct the mine and processing facility. Options exist to sell the DSO to a variety of parties, including Sinomine Corporation's world class Tanco Mine (the "Tanco Mine"), a lithium, cesium and tantalum producer since 1969, located east of Winnipeg.

Our Plans for 2024

Due to a number of factors, including warmer than normal winter weather conditions in Northern Manitoba during early 2024, and the current state of the lithium market, Snow Lake did not undertake its planned winter drilling campaign. During 2024, we will complete our second year of environmental baseline data collection. Additional exploration, including additional infill drilling, and drilling of the open extensions of both the Thompson Brothers and Grass River deposits, will not take place during 2024 due the factors described above, and the more detailed description of the current lithium market below.

Manitoba, Canada

Manitoba is a Tier 1 mining jurisdiction and its ranking improved from 14th to 6th overall in the Fraser Institute's 2023 annual survey9. Manitoba is a historic, as well as a current, mining jurisdiction with currently operating gold, nickel and lithium mines.

Lithium Market

The lithium market currently remains depressed. Lithium prices continue to remain low after a stratospheric rise in 2022, followed by a precipitous 80% drop during 2023. Demand for lithium continues to be weak, and a number of major global lithium producers continue to curtail production until the lithium market and lithium prices recover.

When Snow Lake prepared the S-K 1300 Initial Assessment on the Snow Lake Lithium Project in July 2023, the price of lithium concentrate was approximately USD$3,500 per tonne. Recently, prices have hovered around the USD$1,000 to USD$1,200 per tonne. The dramatic drop in lithium concentrate prices has a significant negative effect on the project economics of the Snow Lake Lithium Project.

Project economics are affected by a number of internal and external factors. Internal factors include the size, grade, throughput, cut-off grade, mine plan, infrastructure, permitting and project debt capacity of the project. External factors include the lithium market, lithium prices, supply and demand for lithium, current lithium producers, lithium development projects, and availability of exploration, development and construction financing.

In reviewing the internal factors for the Snow Lake Lithium Project:

a) the scale of the project is relatively small, and it does not enjoy the economies of scale of a larger, higher-grade project;

b) the mineral resource estimate is relatively small, when calculated at historical lithium prices, and would become smaller if calculated at current lithium prices;

c) the grade is relatively low;

d) the project is relatively remote and will require extensive infrastructure to support development and operations, including power, water, highway and rail transportation, at significant cost;

e) the net present value and internal rate of return, at current lithium prices, will be reduced from those at previous lithium prices; and

f) overall project economics at current lithium prices will be reduced to the point where the project will probably not generate a net present value and rate of return that would be attractive to investors, and as such would not support further exploration, development and/or construction financing.

In reviewing the external factors for the Snow Lake Lithium Project:

a) the lithium market is currently depressed and industry experts do not forecast a recovery in the near term;

b) lithium prices suffered an 80% drop in 2023 and have not yet shown any signs of a sustained recovery;

c) In response to these lower prices, some lithium supply has already been curtailed as major global lithium producers have scaled back production until lithium prices recover;

d) lithium demand remains weaker than has been previously forecast, with recovery in demand in the near term to be driven by recovery of growth in the EV market;

e) competition amongst lithium exploration and development companies for projects, personnel and financing is intense; and

f) financing will be provided to those companies whose projects have size, scale, grade, infrastructure, and project economics that are superior to others.

While long term forecasts for lithium demand and lithium prices remains strong over the next decade, there is considerable uncertainty as to when demand and prices will recover. Industry experts feel that recovery in both demand and prices may take a few years.

Competition amongst lithium exploration and development companies, particularly in Canada, is intense and few projects will ultimately proceed through development, permitting, financing, construction and into commercial production. At current lithium prices, only a few, lithium development projects would have the size and scale such that they can be considered economic, and as a result, only a few, will be able to secure the financing necessary to be explored, developed and placed into production.

One of the principal drivers of lithium demand is the electric vehicle (EV) market. While the EV market remains strong in China, uptake of EVs has slowed in North America and major North American OEMs have slowed, curtailed or abandoned EV programs, as the demand for EVs remains lower than has been previously forecast. North American OEMs are continuing to add hybrid vehicles to their product offerings, as the demand for pure EVs remains low. In addition, both North America and Europe are applying tariffs to foreign produced EVs.

As a non-revenue generating company, the Company is dependent upon the capital markets to raise financing to fund its exploration activities. At the present time, given the current state of the lithium market, and the state of the EV transition in North America, there is little investor interest in lithium projects, and hence, little to no ability to raise financing to explore lithium projects.10

As a result of the above, the Company is of the view that the Snow Lake Lithium Project does not have the scale, size, grade or project economics to make it an attractive exploration project at the present time given the current lithium pricing environment. As the Company is not able to generate or create any shareholder value from the further exploration of the Snow Lake Lithium Project at the present time, the Company has come to the conclusion that the Snow Lake Lithium Project is no longer a material asset to the Company.

Further supporting this conclusion is the current positive state of the uranium market, and given the state of the uranium market described above, there is significant investor interest in uranium projects, and ample capital is available to companies exploring and developing prospective uranium projects in friendly jurisdictions.

Accordingly, the focus of the Company has shifted to spend the majority of its time and exploration and evaluation expenditures on its two uranium projects, as these projects hold the potential to create more shareholder value than continuing significant exploration work on its lithium projects at the present time. Limited exploration activities will continue on the Shatford Lake Lithium Project, and environmental baseline data collection will continue on the Snow Lake Lithium Project, during 2024.

The Company has no intention of abandoning the Snow Lake Lithium Project, however, further exploration activities have been limited until such time as the lithium market recovers, lithium prices recover, investor interest in the lithium sector returns, and capital once again becomes available to fund exploration and development of lithium projects.

Appointment of Interim Chief Financial Officer

The Company announces that Keith Li, the Chief Financial Officer of the Company, has resigned as of June 30, 2024 to pursue other opportunities. The Company thanks Mr. Li for his contributions to Snow Lake and wishes him the best in his new endeavours.

Mr. Kyle Nazareth, age 32, has been appointed as Interim Chief Financial Officer of the Company effective July 1, 2024. Mr. Nazareth brings over a decade of experience in managing public companies, advising on capital market transactions, and providing financial stewardship across diverse industries. Mr. Nazareth is currently the Founder and Principal of Nazareth Financial, a role he has held September 2020. Mr. Nazareth joined Branson Corporate Services Ltd. in June 2024 where he is the Chief Financial Officer, a role in which he is also currently serving. Prior to joining Branson Corporate Services Ltd., which provides accounting services to the Company, Mr. Nazareth served as Chief Financial Officer for Danavation Technologies Inc. between May 2022 and September 2023. Between January 2018 and September 2020, Mr. Nazareth served as Manager, Finance at Auxly Cannabis Group Inc. Mr. Nazareth is a Chartered Professional Accountant and has been a member of the Chartered Professional Accountants of Ontario since June 2016. Mr. Nazareth holds a Bachelor of Business Administration from the York University's Schulich School of Business.

There are no arrangements or understandings between Mr. Nazareth and any other persons pursuant to which Mr. Nazareth was appointed as Interim Chief Financial Officer of the Company. In addition, there are no family relationships between Mr. Nazareth and any director or executive officer of the Company, and there are no transactions involving Mr. Nazareth requiring disclosure under Item 404(a) of Regulation S-K.

Clean Energy Opportunities

As Snow Lake continues its transition to a clean energy company, it continues to review North American opportunities in the clean energy space, in an effort to identify additional sources of clean energy that have the potential to be commercialized, that would contribute to net zero, that would complement its current portfolio of uranium and lithium projects, and have the potential to create shareholder value.

About Snow Lake Resources Ltd.

Snow Lake Resources Ltd., d/b/a Snow Lake Energy, is a Canadian clean energy exploration company listed on (NASDAQ: LITM) with a global portfolio of clean energy mineral projects comprised of two uranium projects and two hard rock lithium projects. The Black Lake Uranium Project is an exploration stage project located in the Athabasca Basin, Saskatchewan and the Engo Valley Uranium Project is an exploration stage project located in the Skeleton Coast of Namibia. The Shatford Lake Lithium Project is an exploration stage project located adjacent to the Tanco lithium mine in Southern Manitoba, and the Snow Lake Lithium Project is an exploration stage project located in the Snow Lake region of Northern Manitoba.

The current focus of the Company is advancing the exploration of its two uranium projects to supply the minerals and resources needed for the clean energy transition, while exploration activities on its two lithium projects will remain limited until such time as the lithium market recovers from its current depressed levels. Learn more at www.snowlakelithium.com.

Forward-Looking Statements: This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the "safe harbor" provisions under the Private Securities Litigation Reform Act of 1995 that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements, including without limitation statements with regard to Snow Lake Resources Ltd. We base these forward-looking statements on our expectations and projections about future events, which we derive from the information currently available to us. Forward-looking statements contained in this press release may be identified by the use of words such as "anticipate," "believe," "contemplate," "could," "estimate," "expect," "intend," "seek," "may," "might," "plan," "potential," "predict," "project," "target," "aim," "should," "will," "would," or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Snow Lake Resources Ltd.'s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. Some of these risks and uncertainties are described more fully in the section titled "Risk Factors" in our registration statements and annual reports filed with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Snow Lake Resources Ltd. undertakes no duty to update such information except as required under applicable law.

Contact and Information

Frank Wheatley, CEO

+1 (604) 562-1916

Investor Relations

Investors:

ir@snowlakelithium.com

Website:

www.snowlakeenergy.com

Follow us on Social Media

Twitter:

www.twitter.com/SnowLakeEnergy

LinkedIn:

www.linkedin.com/company/snow-lake-energy

Schedule A

Acquisition Terms and Conditions

- Black Lake Uranium Project

Acquisition of a 100% Interest in the Black Lake Uranium Project

On May 8, 2024, Snow Lake entered into a share purchase agreement to acquire 100% of Global Uranium Acquisition Corp (Pty) Ltd ("Global"), a private Australian company, which in turn, has entered into a mineral property option agreement (the "Option Agreement") with Doctors Investment Group Ltd. ("Doctors"), a private British Columbia company, pursuant to which Global can earn a 100% interest in the Black Lake Uranium Project.

Doctors is currently the sole registered and beneficial owner of 100% of the right, title and interest in the mineral claims comprising the Black Lake Uranium Project.

Snow Lake has agreed to acquire Global in consideration of:

a)Initial Cash Payment: Payment to Global by Snow Lake of the amount of CAD$50,000 in cash, which amount represents the amount paid by Global to Doctors in accordance with Section 3.2 (i) of the Option Agreement (which payment has been made);

b)Initial Issuance of Snow Lake Shares: Allotting and issuing to the shareholders of Global, an aggregate of 1,000,000 fully paid and non-assessable common shares of Snow Lake (the "Initial Snow Lake Shares"); and

c)Milestone Payment of Snow Lake Shares: Allotting and issuing an aggregate of 1,000,000 fully paid and non-assessable common shares of Snow Lake (the "Milestone Snow Lake Shares"), in the event an SK-1300 compliant technical report determines that there is a uranium mineral resource on the Black Lake Uranium Project of a minimum of 10 million pounds U3O8 with a minimum average grade of 500 ppm U3O8 per tonne.

Option Agreement

The Option Agreement provides that Global can earn a 100% interest in the Black Lake Uranium Project as follows:

a)Cash Payments. Payment by Global to Doctors of the following amounts in cash:

i) CAD$50,000 within 2 days of signing the Option Agreement (which amount has been paid);

ii) CAD$150,000 within 30 days of signing the Option Agreement (which amount has been paid);

iii) CAD$250,000 on or before the first anniversary of signing the Option Agreement;

iv) CAD$350,000 on or before the second anniversary of signing the Option Agreement;

v) CAD$400,000 on or before the third anniversary of signing the Option Agreement; and

vi) CAD$600,000 on or before the fourth anniversary of signing the Option Agreement; and

b)Exploration Expenditures. Global incurring the following exploration expenditures on the Black Lake Uranium Project:

i) CAD$500,000 in exploration expenditures on or before the first anniversary of the signing of the Option Agreement;

ii) CAD$500,000 in exploration expenditures on or before the first anniversary of the signing of the Option Agreement; and

iii) CAD$1,000,000 in exploration expenditures on or before the first anniversary of the signing of the Option Agreement.

Global has the right under the Option Agreement to accelerate both cash payments and/or the exploration expenditures prescribed under the Option Agreement.

- Engo Valley Uranium Project

Agreement to Acquire An 85% Interest in the Engo Valley Uranium Project

Snow Lake and a private British Columbia company (the "Vendor") have entered into a binding letter of intent (the "LOI"), as amended, pursuant to which Snow Lake will acquire up to 85% of Namibia Minerals and Investment Holdings (Proprietary) Limited (the "Project Company"), a private Namibian company, which in turn is the sole registered and beneficial owner of 100% of the right, title and interest in the Exclusive Prospecting License - 5887 (the "License") for the Engo Valley Uranium Project, all as more particularly described in Schedule A attached hereto.

Snow Lake will acquire its 85% interest in the Engo Valley Uranium Project in two stages, as follows:

a)First Stage Interest

Snow Lake will acquire an initial 68% interest in the Project Company (the "First Stage Interest"), upon:

- payment to the Vendor, upon execution of the LOI, of the amount of USD$250,000 in cash (which amount has been paid);

- incurring exploration expenditures of a minimum of USD$200,000 (the "First Stage Expenditures") on the Engo Valley Uranium Project on or before July 14, 2024; and

- allotting and issuing to the Vendor, upon execution of a formal share purchase agreement ( the "Share Purchase Agreement"), an aggregate of 2,024,496 fully paid and non-assessable common shares of Snow Lake (the "First Stage Shares").

The First Stage Shares will be issued subject to the satisfactory completion by Snow Lake of due diligence on the Vendor, the Project Company, and the License, from the date of execution of the LOI until July 14, 2024 (the "Due Diligence Period"), and will vest and be released from escrow as follows:

- 50% of the First Stage Shares will vest upon the expiry of the Due Diligence Period; and will be released from escrow upon renewal of the License; and

- 50% of the First Stage Shares will vest upon the expiry of the Due Diligence Period; and will be released from escrow upon the completion of an SK-1300 compliant mineral resource estimate on the Engo Valley Uranium Project.

The First Stage shares will be cancelled by Snow Lake if the escrow conditions are not met within 12 months from the date of signing of the LOI.

b) Second Stage Interest

Snow Lake will acquire an additional 17% undivided interest in the Project Company by (the "Second Stage Interest"), for a total undivided interest of 85% in the Project Company, upon:

- incurring additional exploration expenditures of a minimum of USD$800,000 on the Engo Valley Lithium Project within 12 months of acquiring the First Stage Interest.

Any expenditures incurred by Snow Lake in excess of the minimum expenditures required to acquire the First Stage Interest will be credited or carried forward against the expenditure commitment for the Second Stage Interest.

c)Retention of Interest in the Company

If Snow Lake does not execute the Share Purchase Agreement, then Snow Lake will retain and hold a 10% undivided interest in the Project Company.

d) Milestone Payments

Once Snow Lake has acquired the First Stage Interest and the Second Stage Interest, Snow Lake will make the following milestone payments to the Vendor:

i)Milestone Payment No. 1

Allotting and issuing to the Vendor, an aggregate of 1,030,927 common shares of Snow Lake as fully paid and non-assessable common shares, in the event an SK-1300 compliant technical report determines there is a uranium mineral resource on the Engo Valley Uranium Project of a minimum of 10 million pounds with a minimum average grade of 150 ppm U3O8; and

ii)Milestone Payment No. 2

Allotting and issuing to OG, an aggregate of 1,030,927 common shares of Snow Lake as fully paid and non-assessable common, in the event an SK-1300 compliant technical report determines there is a uranium mineral resource on the Engo Valley Uranium Project of a minimum of 25 million pounds with a minimum average grade of 150 ppm U3O8.

- Shatford Lake Lithium Project

Agreement to Acquire A 90% Interest in the Shatford Lake Lithium Project

Snow Lake has entered into an option agreement with ACME Lithium Inc., pursuant to which Snow Lake has the option to earn up to a 90% undivided interest in the Shatford Lake Lithium Project, and may exercise the Option by paying a total of CAD$500,000 and incurring a total of CAD$1,800,000 in exploration and development expenditures over a two-year period, as follows:

| Date for Completion | Cash Payment | Minimum Exploration and Development Expenditures | Earn In |

| Initial Payment | CAD $20,000 | ||

| Upon Execution | CAD $130,000 | ||

| First Year | CAD $150,000 | CAD $600,000 | 51% |

| Second Year | CAD $200,000 | CAD $1,200,000 | 90% |

Once Snow Lake has earned a 90% undivided interest in the Project, and completed a positive feasibility study, a joint venture (the "Joint Venture") between Snow Lake and ACME will be formed for further development, the detailed market standard terms and conditions of which will be agreed at the time of formation of the Joint Venture.

________________________

1 Fraser Institute. GlobalData's Global Uranium Mining to 2026 Report.

2 World Nuclear Association (WNA) data.

3 Fraser Institute Annual Survey of Mining Companies 2023

4 Government of Saskatchewan

5 Cameco

6 World Nuclear Association

7 World Nuclear Association

8 World Nuclear Association

9 Fraser Institute Annual Survey of Mining Companies 2023

10 Mining Journal - June 28, 2024

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/215524

SOURCE: Snow Lake Resources Ltd