VANCOUVER, BC / ACCESSWIRE / July 9, 2024 / Four Nines Gold Inc. ("Four Nines" or the "Company") (CSE:FNAU)(OTCIQ:FNAUF) is pleased to announce new results for the Company's surface mapping and sampling program for the Hayden Hill Property, with the highest grade to date of 45.4 g/t. The high-grade results are consistent with previous sampling (December 6, 2023) and support the Company's geological team's hypothesis of a high grade low sulfidation model that was not drilled to depth. Surface mapping combined with all available datasets have been used to complete three-dimensional (3D) models, which has refined approved drill targets.

Gold mineralization at Hayden Hill is present in three (3) primary, and two (2) secondary zones within an area of 1.3 square kilometers. The district was explored by several companies throughout the 1980s, Amax Gold gained control of the project in 1988 and mined the deposit from 1991 - 1997, recovering approximately 480,000 ounces of gold. Previous operators did not target structurally controlled high-grade mineralization, as is the Four Nines approach, rather conducted exploration programs assuming that the gold mineralization was disseminated.

Hayden Hill has not been drilled since 1997 and remains one of the few modern open pits in the Western United States unexplored to depth. Four Nines is the first company to apply modern exploration concepts and the low sulfidation epithermal model to the property. Initial surface mapping and sampling was conducted in 2023 with a primary objective to identify and characterize structural feeders that could host high-grade gold-silver mineralization.

Four Nines Gold received approval from Lassen County, California, in 2023, to conduct approximately 10 acres of exploration disturbance.

Highlights:

123 new assays results,

Highest surface gold value is 45.5 grams per metric tonne (g/t),

Twenty (20) samples have values > 10 g/t Au,

Thirty-four (34) samples have values > 5 g/t Au,

Fifty (50) samples have values > 3 g/t Au,

Three-dimensional (3D) modeling of all available datasets indicates high quality drill targets.

David Flint, VP Exploration of Four Nines Gold said "We are extremely pleased with the additional 2024 gold assay results from surface mapping and sampling at our Hayden Hill project. Numerous epithermal veins have been mapped and sampled, plus several significant hydrothermal breccia bodies have also been identified. The gold geochemical results are highly encouraging. The recent results add significantly to our understanding of the distribution and gold values for the Nose epithermal veins and hydrothermal breccias. The 3D gradeshell modeling effort has defined multiple high-quality, high-probability exploration targets that can be executed from the existing approved drill sites".

Surface Program Technical Results

Summary

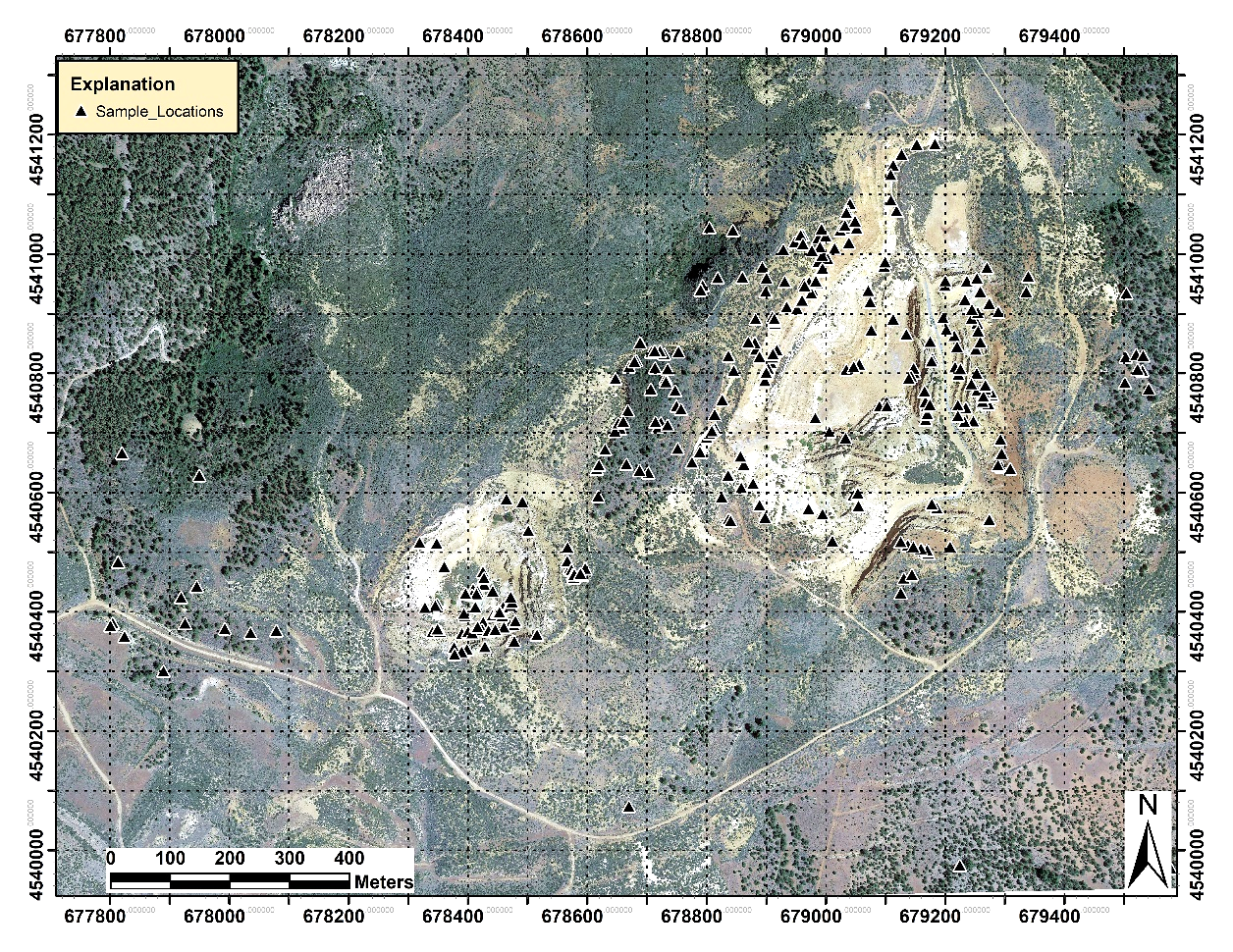

The primary goal of the 2023 field program was to characterize mineralized features that might confirm the geological team's hypothesis of a structurally controlled high-grade epithermal gold mineralization deposit. Pit highwalls, historical trenches and pits, undisturbed outcrops, and areas of subcrop have been mapped and sampled. The Four Nines geological team collected 331 surface selective rock chip grab samples (the "2023 samples", Figure 1) for which 265 assays have been received. The results for the samples assayed in 2023 (the "2023 assays") have been disclosed in a 2023-12-06 press release. This press release discloses the summary results for 123 samples collected in 2023 that have not been previously reported (the "2024 assays").

The highest gold value for the 2024 assays is 45.4 g/t. Seven (7) samples have values > 10 g/t, 12 have values > 5 g/t, 16 have values > 3 g/t, 31 have values > 1 g/t, 38 have values > 0.5 g/t, and 85 have values < 0.5 g/t. Highlight comments for the 2024 sample results include:

The highest gold grade, of 45.4 g/t, was from a sample collected on a northwest trending banded vein in the Nose Zone,

Five (5) of the 7 gold assays > 10 g/t were for samples collected in the Nose Zone, further delineating mineralization associated with the northeast trending Rim Vein and the intersection with northwest trending veins,

Six (6) of the gold grades > 1 g/t were for samples collected in the southeast area of Hayden Hill - requires further mapping and sampling,

One (1) high-grade gold value of 14.15 g/t was for a sample collected in the Juniper Zone,

Two (2) gold grades > 3 g/t were for samples collected from northwest trending veins that cross the west wall of the Lookout Pit,

One (1) sample, with a gold grade of 8.87 g/t, was collected from the West Providence Vein - requires further mapping and sampling, and

A sample, with a gold grade of 24 g/t, was collected from the northern extension of the 214 Vein on the Nose.

The highest gold value for the consolidated 2023 sample set (2023 & 2024 assays), for which assays have been received, is 45.4 g/t. Twenty (20) samples have gold values > 10 g/t, 34 have values > 5 g/t, 50 have values > 3 g/t, 77 have values > 1 g/t, 92 have values > 0.5 g/t, and 173 have values < 0.5 g/t. Follow-up sampling for regions with higher grade initial values will be conducted during the 2024 field season.

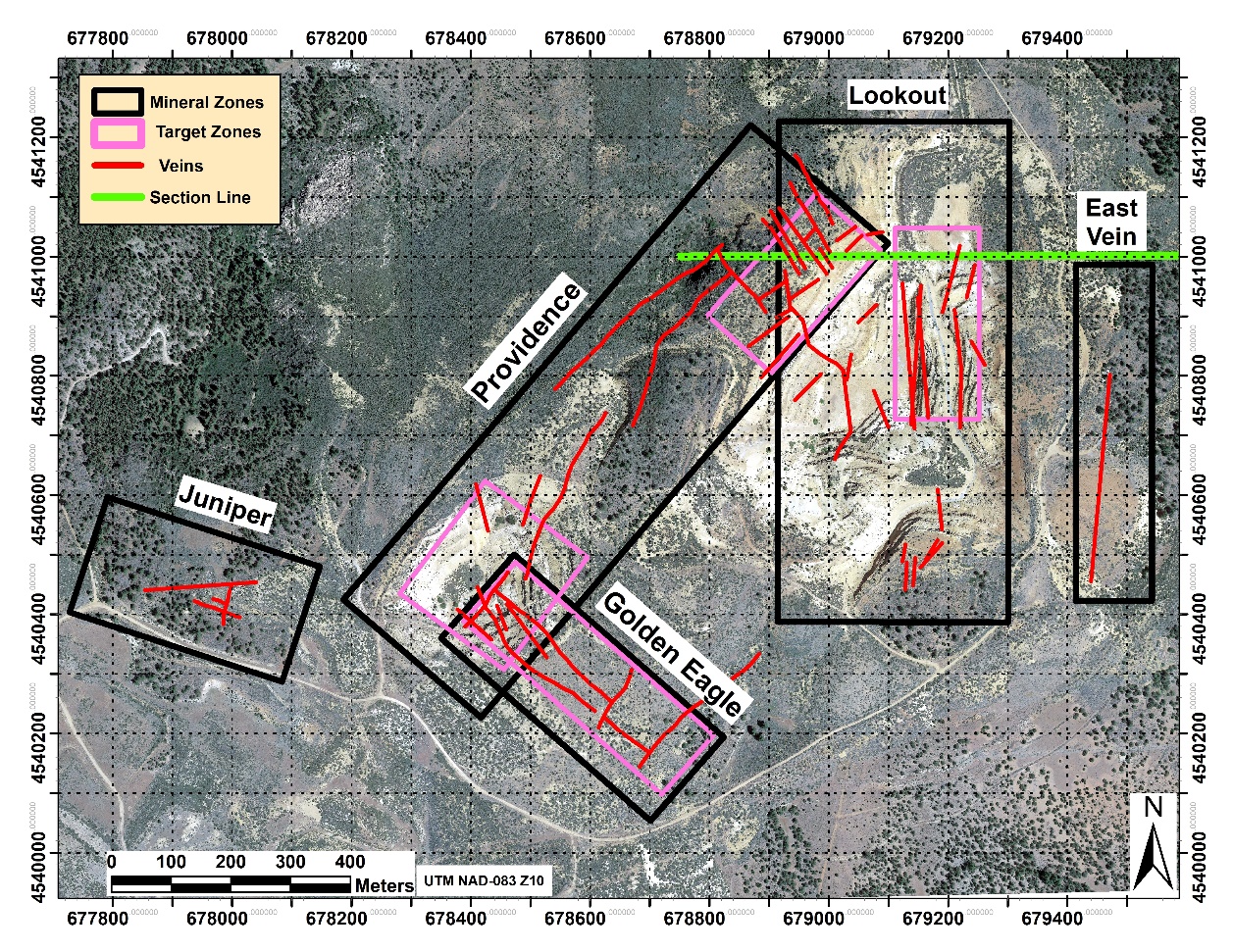

The mapping and assay results continue to verify the Company's geological team's hypothesis of dominant structural orientation, in three primary zones of the property (Figure 2 - the Lookout, Providence, and Golden Eagle zones). Epithermal quartz veins and breccia bodies are located along these high-angle structures and are the targets for the Phase 1 drill program.

The following styles of hydrothermal features, favorable for the presence of epithermal gold-silver mineralization, have been mapped and sampled on the Property:

Multiple banded epithermal veins,

Clast-support hydrothermal breccias (clasts comprise > 50% of the breccia volume),

Matrix-supported hydrothermal breccias, for which the hydrothermal matrix comprises > 50% of the breccia volume. Clasts of previously veined material are common,

Euhedral adularia and quartz replacement of individual calcite crystals is locally present,

Pervasive silicification, that is reported to also include fine-grained adularia, is the most widespread form of hydrothermal alteration present in the Project area.

The surface samples have been analyzed by the ALS Laboratory in Reno Nevada. The samples have been processed according to the following:

Preparation: Prep-31,

Gold assay: Au-AA23 (fire assay with AAS finish); defaults to a 2nd analysis by Au-Grav21 (gravimetric finish) when the concentration from the Au-AA23 assay is > 10 g/t,

Certified reference (CRM) and blank material samples have been inserted into the rock samples submittal at a ratio of 1 standard/10 rock samples,

Chain of custody and security maintained from sample collection through submission to the ALS Laboratory.

Gold assays for the QA/QC samples are: 1) 20 of 21 assays for the gold CRM are within an acceptable range (one sample is 0.01 g/t outside of range), and 2) all blank sample assays are very low (9 of 10 < 0.10 g/t) with the highest value being .017 g/t.

The field program has been conducted under the supervision and direction of David Flint, the Four Nines' VP of Exploration and Qualified Person.

Figure 1: Four Nines Gold Surface Sampling Locations

Figure 2: Hayden Hill Mineral Zones and Epithermal Vein Orientations

Three-Dimensional Modeling Technical Discussion

The Three-Dimensional Modeling summary results have recently been disclosed in the Four Nines Gold Inc. "June 2024" corporate presentation update, which was announced to the public in a 2024-06-11 press release. The information provided below provides additional technical details on the modeling methodology and interpretation of results.

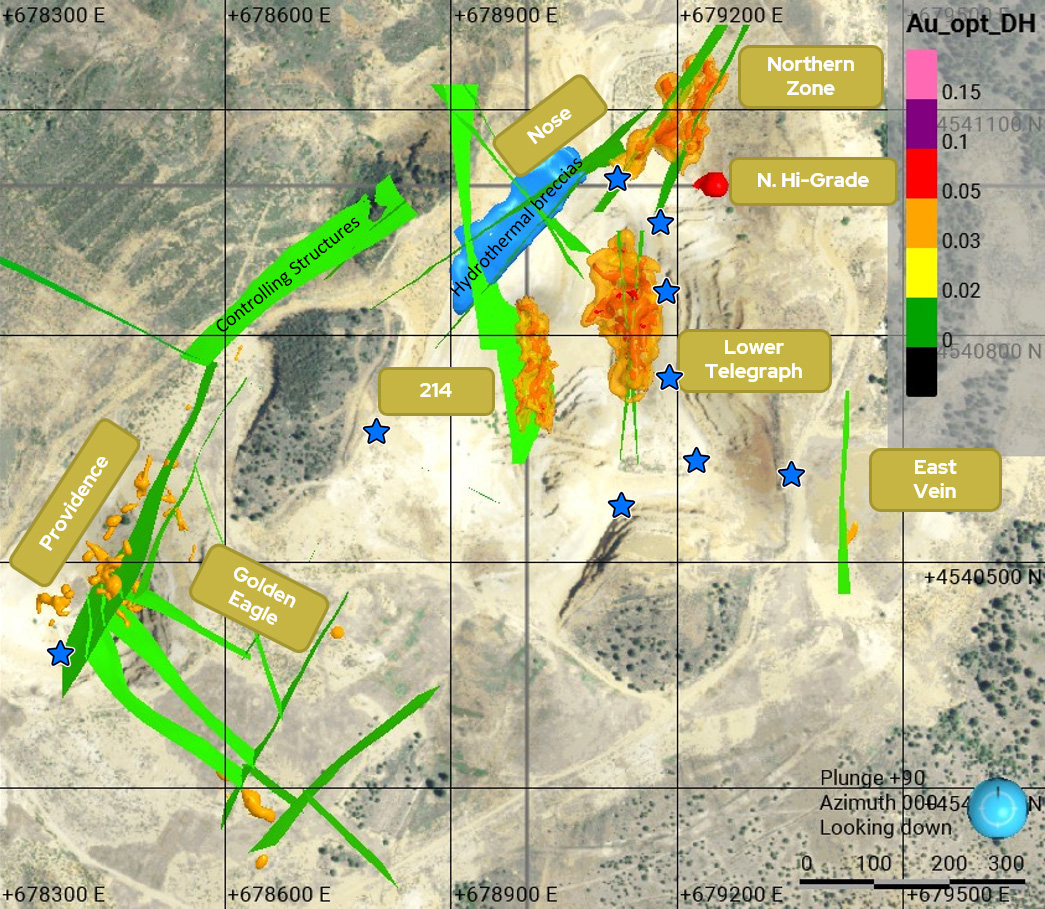

Three-dimensional modeling of the available data sets, utilizing the Leapfrog Software System, was accomplished during the 1st half of 2024. The primary objective of the modeling exercise was to determine if discrete definable 3D zones of gold mineralization are indicated from the historical data, and the possible correlation to mineralized geologic structures defined by the Four Nines geologic team. The following datasets have been analyzed during the modeling exercise:

Historical surface mapping of the pre-mine topography,

Historical exploration drill holes,

Historical blast-hole assay results (7 x 7 x 7 m three-dimensional array of assays), and the

Four Nines 2023 surface mapping and sampling.

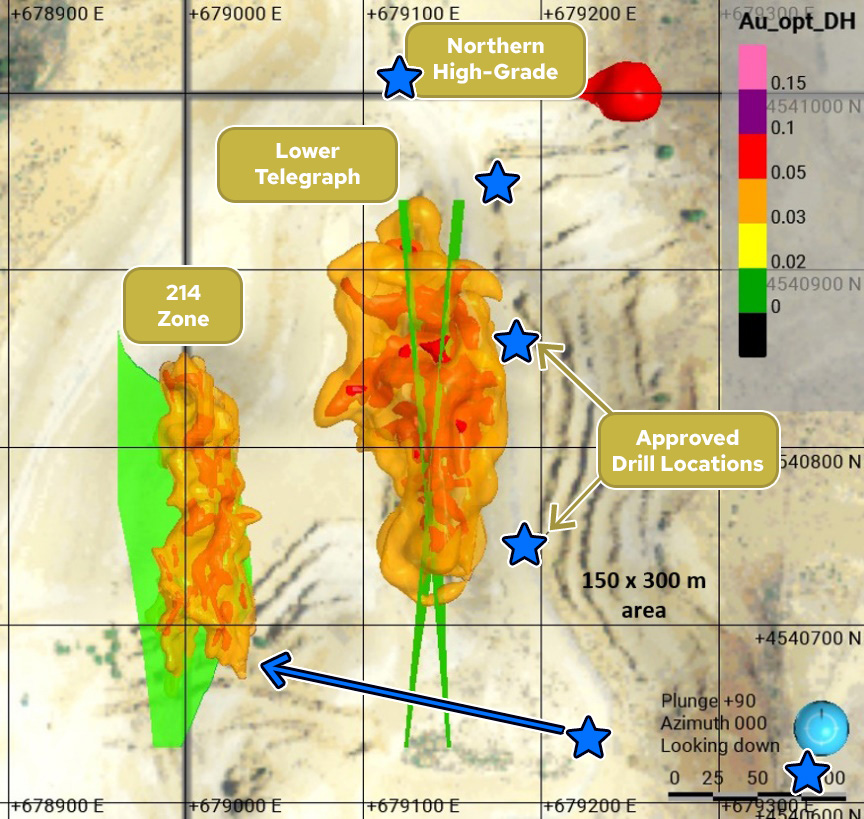

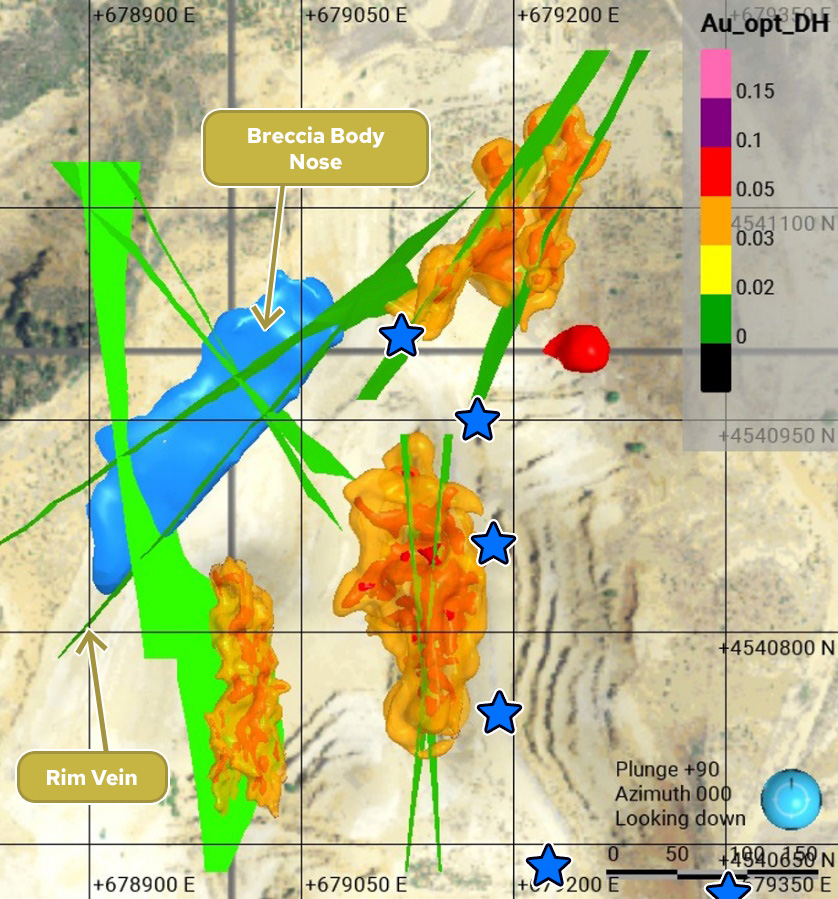

The following were modeled in three-dimension:

Significant epithermal veins and mineralized faults (colored green in Figure 3),

Hydrothermal breccia bodies (colored blue in Figure 3),

Grade shells and a 0.03 troy ounce per short ton (opt) (approximately 1 g/t),

Shells, internal to the 0.03 opt shells, at an enclosing grade of 0.05 opt (colored red in Figure 3),

Geologically indicated targets (locations for which drill data is sparse) and extensions to the data-defined grade shells (colored blue in Figure 3).

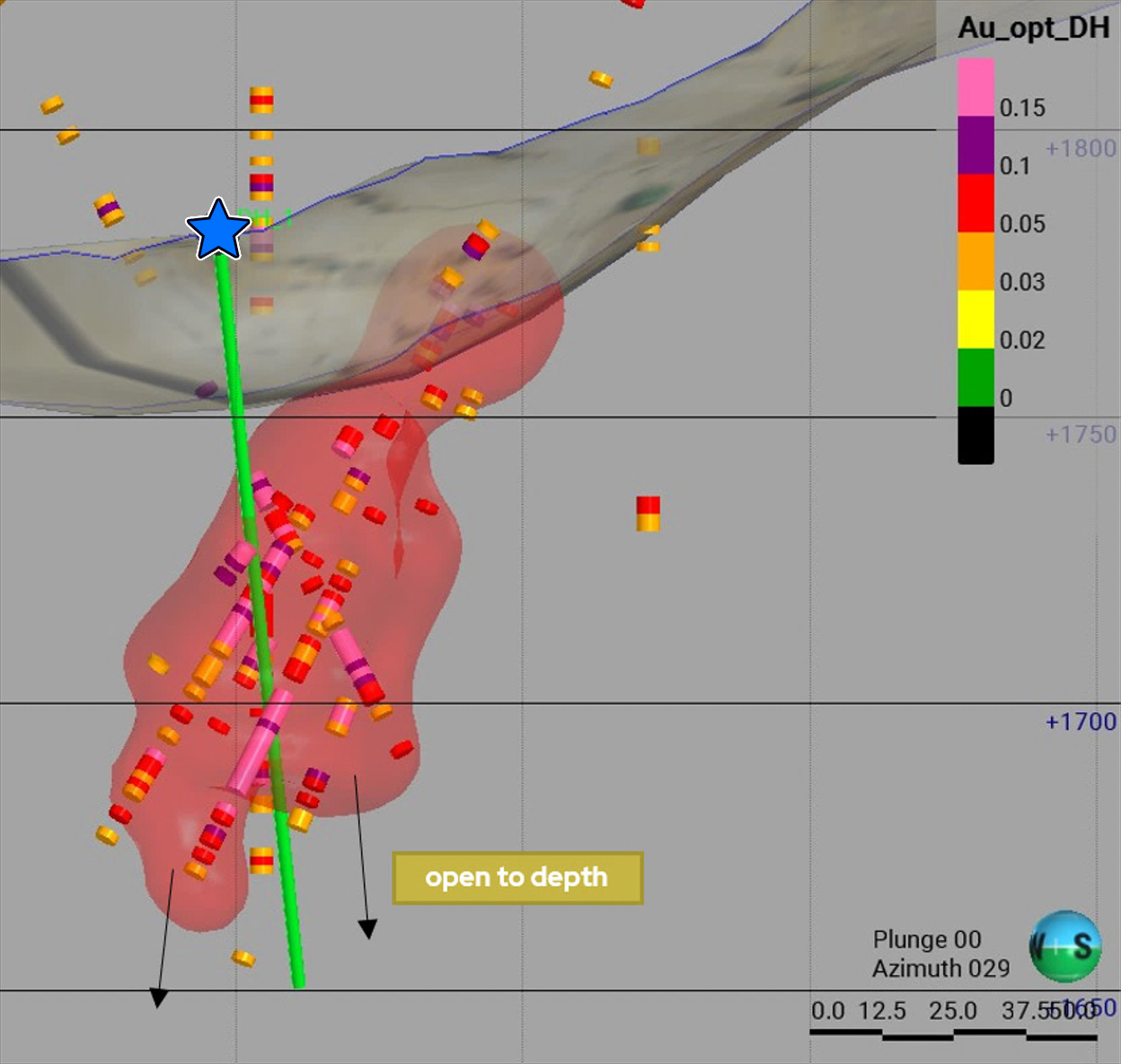

Geologic features were modeled in three-dimension based on the mineralized structures mapped on the present topographic surface. Veins and faults were projected to depth according to the measured strike and dip. Breccia bodies, developed along veins, were projected to depth, sympathetic to the associated vein. Exploration drill data, where available, was utilized to refine the sub-surface geometry of these features. Historical vein mapping was modeled to depth for locations where surface expressions of individual features have been overlain by reclaimed material.

The grade shells have been determined according to the following methodology:

Historical exploration and blast hole, and surface gold values reviewed in plan view,

Polygons that enclosed gold values > 0.03 opt were explicitly drawn,

The analysis was similarly completed on multiple levels, on an approximate 7 meter vertical spacing (the vertical spacing of the production blast-hole data),

Three-dimensional solids were constructed from vertically correlated polygons to establish a discrete mineralized zone,

Multiple definable mineralized zones have been modeled.

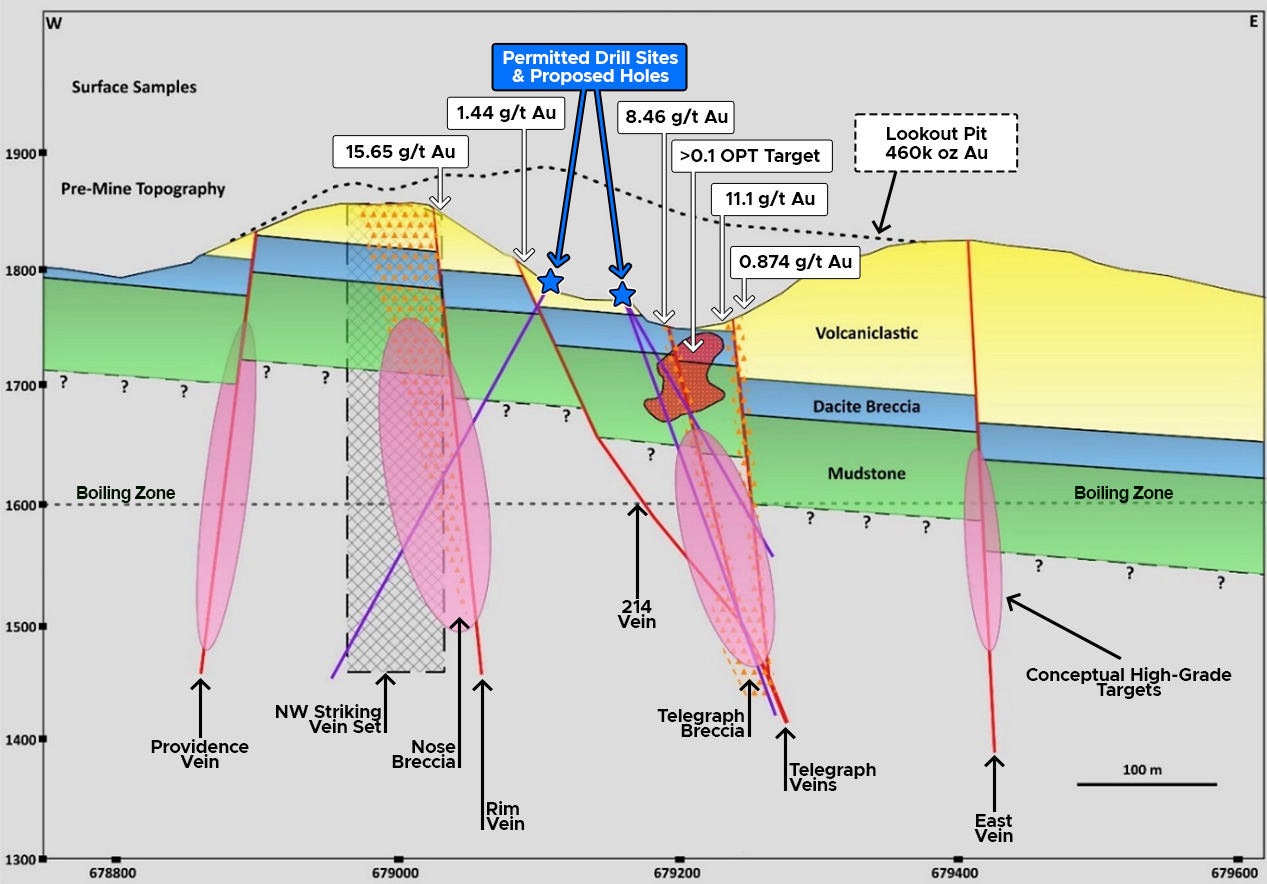

The definition of polygons has been highly influenced by the blast-hole data for the volumes that have been excavated through historical mining. The historical exploration drilling provided the primary data to extend shells beneath the current pit. Mineralized structures that are highly correlated to the shells have been utilized to model geologically indicated extensions to depth. A plan view of these 3D models is shown in Figure 3. The 3D models verify the deep drill targets, as shown in Figure 4.

Readers are cautioned that the historical drill data has not been verified by a Qualified Person, however, is judged to be of sufficient quality to utilize for exploration planning.

Figure 3 Hayden Hill District Breccia, Vein & Gradeshell Models

Figure 4: Schematic Section of Exploration Targets (Section Line from Figure 2 and 5)

Mineral Zones

The following are highlights of the mapping and sampling, and modeling, results for the Hayden Hill primary mineral zones.

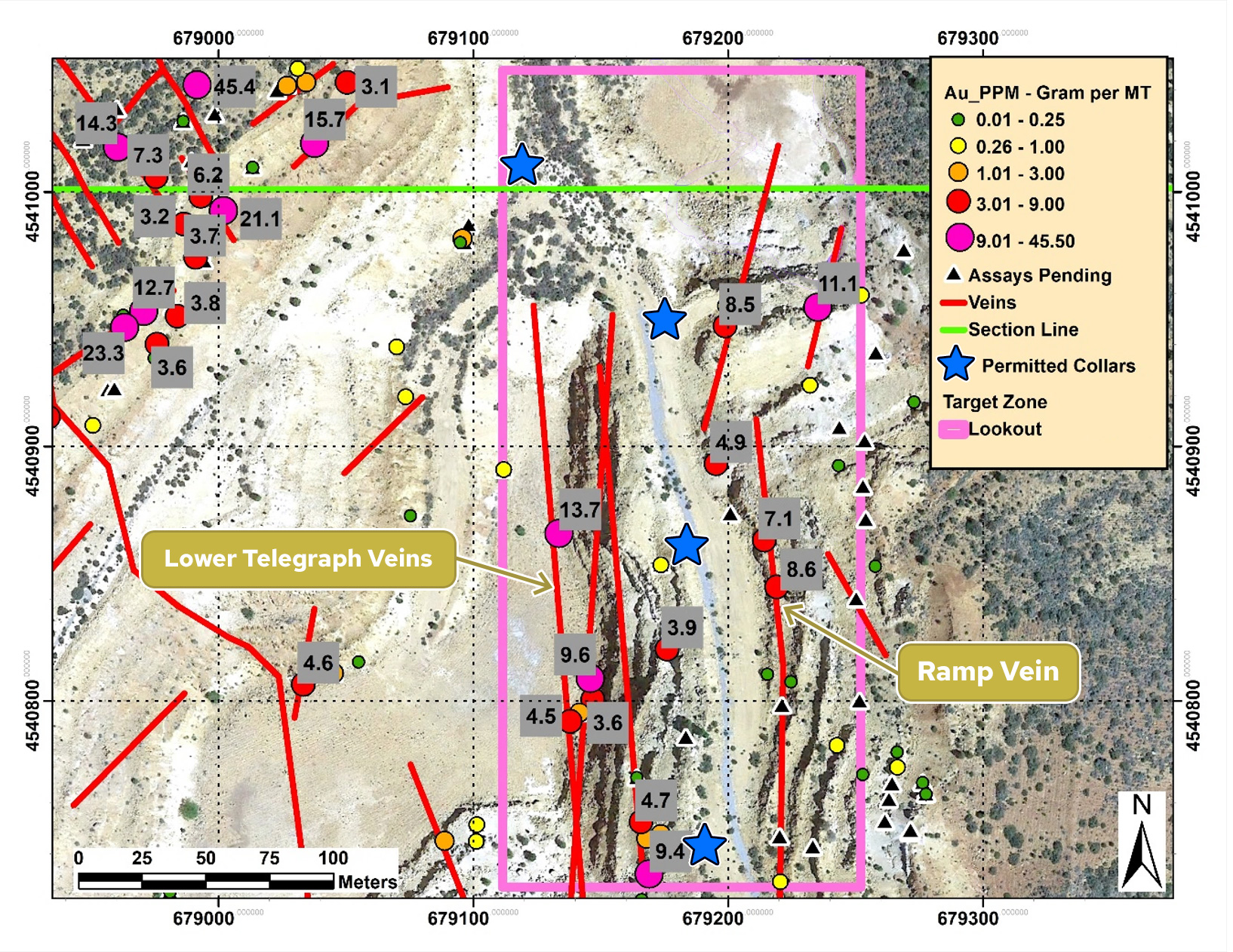

Lookout Zone

Highest gold value of 13.7 g/t,

Consistently high gold grades for the grab samples collected above and below the pit ramp (at 679,200 Easting),

North-south trending epithermal veins (approximately up to 1 meter thick) (Figure 5) post-date the pervasive silicification,

Less common northeast & northwest trending veins are also present (Figure 5),

Four gradeshells (for which 3 are shown on Figure 6) have been modeled in the Lookout Zone. The four shells enclose a large majority of the drill hole assays for the zone above a 0.03 opt grade,

These gradeshells and surface mapping results define high-quality, high-probability drill targets.

Five permitted drill sites (blue stars), for which 4 are displayed on Figures 5 & 6,

Majority of the Amax Gold historical gold production was from the Lookout Pit,

Host rocks include a fine-grained volcaniclastic on higher benches, and a dacite breccia at the lower two benches,

Much of the exposed rock has been pervasively silicified (and reported to be quartz-adularia),

Two veins (of which 1 has an associated hydrothermal breccia) occur at the core of the Lower Telegraph mineral zone (Figure 6, shown in green),

Mineralization associated with the 214 Vein is present in the hangingwall of that structure,

A structural control has yet to be determined for the Northern High-Grade Zone (Figure 7), which has been modeled based on historical exploration drilling,

An additional vein, the "Ramp Vein", has been mapped just east of the mine ramp at the UTM Easting of about 679200 (Figure 5). Two grab samples, with gold grades of 7.1 & 8.6 g/t, have been received on the 1-meter- thick vein: currently insufficient data available to determine a 3D model for the vein.

Figure 5: Lookout Zone - Surface Mapping and Sampling Results

Figure 6: Lookout 3D Grade Shell & Vein Models

Figure 7 North High-Grade Gradeshell

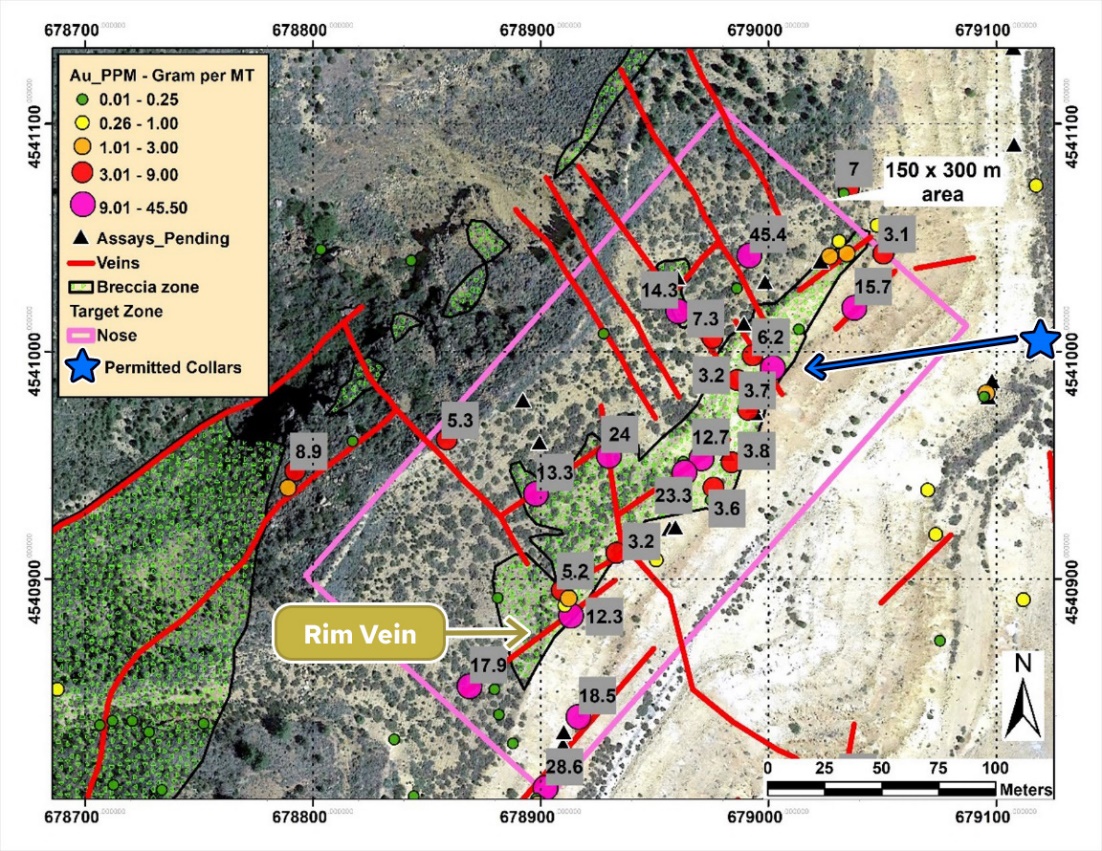

Nose

Highest surface gold grade, sampling a northwest trending banded vein, of 45.4 g/t,

The Nose Zone can be drill-explored, at depth, from a permitted drill station located at the bottom of the Lookout Pit (Figure 8),

Primary northeast trending vein set cut by a swarm of northwest trending veins (Figure 8),

The extent of 214 Vein has been defined to extend across the Nose Zone, with a surface grab sample that assayed 24 g/t gold,

Hydrothermal breccia (poly-lithic) developed along a northeast trending vein, the "Rim Vein" (Figure 9), that is located along the rim of the pit, and at the intersection of northwest trending veins (displayed blue in Figure 10),

The Rim Vein and associated hydrothermal breccia, particularly at intersections with the 214 and northwest trending veins, presents a highly compelling drill target at depth,

Mapped veins and the associated breccia body have been modeled in 3D,

The surface of the Nose Zone is at an approximate elevation of 300 feet (100m) above the Lookout Pit bottom,

Euhedral adularia and quartz replacement of calcite identified at several locations.

Figure 8: Nose - Surface Mapping and Sampling Results

Figure 9: Nose Banded Vein in contact with Hydrothermal Breccia

Figure 10: Nose 3D Hydrothermal Breccia and Vein Models

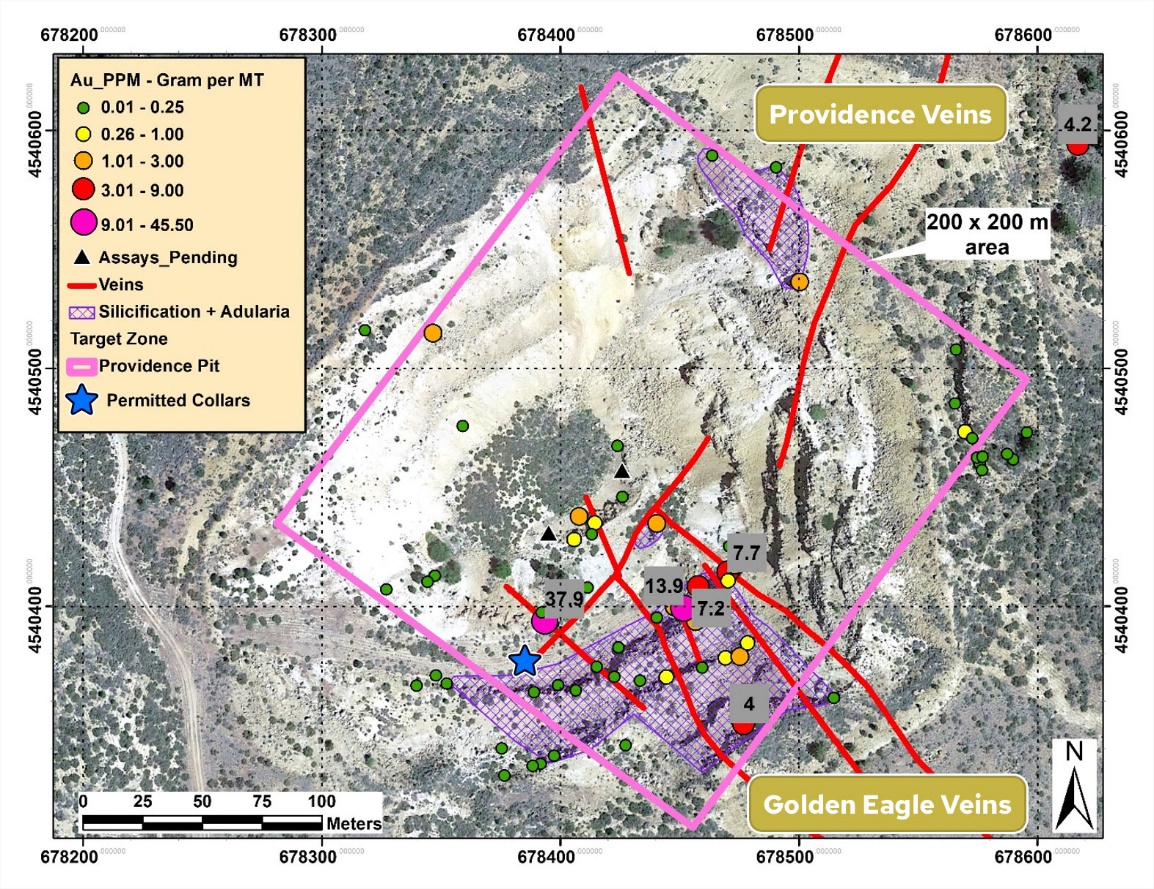

Providence Pit

Highest gold value for the Providence Zone is 37.9 g/t,

The Providence Pit was a site of modest open-pit historical production by Amax Gold,

Most of the Hayden Hill historical underground mine production was from the Golden Eagle northwest trending veins (anecdotally, 12 - 20 feet wide, with grades up to 1 opt),

The Providence veins are primarily oriented to the northeast (Figure 11),

The northwest trending Golden Eagle veins intersect the northeast trending Providence veins within the current pit location,

One (1) approved drill station to explore the zone targeting the intersection of the Providence and Golden Eagle zones,

Additional surface structural mapping is required to guide 3D modeling,

Lithology consists of a fine-grained volcaniclastic, up section, and dacite breccia to depth,

Dacite breccia is pervasively silicified for much of the pit exposures.

Figure 11: Providence Pit - Surface Mapping and Sampling Results

David Flint, MSc, AIPG-CPG, a qualified person as defined in NI 43-101 and a director of the company, has reviewed and approved the technical information in this press release.

About Four Nines Gold Inc.

Four Nines Gold Inc. has the right to acquire 100% of the Hayden Hill Mine from a Kinross Gold USA Inc subsidiary. The Company is exploring and developing the project in mining-friendly Northern California. Hayden Hill is a former producing mine with 99,862.42 meters of drilling in 742 holes and no systematic property exploration since the mine closed in 1997. For more information, please get in touch with the Company at info@fourninesgold.ca or visit our website at www.fourninesgold.ca for project updates and related background information.

ON BEHALF OF THE BOARD OF DIRECTORS

FOUR NINES GOLD INC.

Charles Ross

President

1000 - 409 Granville Street

Vancouver, BC, V6C 1T2

Tel: 604.602.0001

Forward-looking statements

This press release contains forward-looking statements and forward-looking information within the meaning of Canadian securities laws (collectively, "forward-looking statements"). Statements and information that are not historical facts are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "intends", "estimates", "potential", "possible" and similar expressions, or statements that events, conditions or results "will", "may", "could" or "should" occur or be achieved. Forward-looking statements and the assumptions made in respect thereof involve known and unknown risks, uncertainties, and other factors beyond the Company's control. Forward-looking statements in this press release include statements regarding beliefs, plans, expectations, or intentions of the Company. Mineral exploration is highly speculative and characterized by several significant risks, which even a combination of careful evaluation, experience and knowledge may not eliminate. Forward-looking statements in this press release are made as of the date herein. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements in this press release are reasonable, undue reliance should not be placed on such statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information or future events or otherwise, except as may be required by law.

Neither the Canadian Securities Exchange nor its regulation services provider accepts responsibility for the adequacy or accuracy of this news release.

SOURCE: Four Nines Gold Inc.

View the original press release on accesswire.com