- Profit from property management for the period amounted to SEK 3,123m (3,302). Profit from property management attributable to the parent company's shareholders amounted to SEK 2,897m (3,099m), corresponding to a decrease per share by 8% to SEK 2.48 (2.69).

- Long term net asset value amounted to SEK 85.44 per share (91.12).

- Rental income amounted to SEK 6,314m (5,838).

- Profit after tax attributable to the parent company's shareholders amounted to SEK 177m (-918) corresponding to SEK 0.15 per share (-0.80).

Profit from property management for the period amounted to SEK 3,123m (3,302). Profit from property management attributable to the parent company's shareholders amounted to SEK 2,897m (3,099), which corresponds to a decrease per share of 8% to SEK 2.48 (2.69). Profit from property management includes SEK 1,000m (929) in respect of associated companies.

Net profit after tax for the period amounted to SEK 382m (-1,420). Net profit after tax for the period attributable to the parent company's shareholders amounted to SEK 177m (-918), corresponding to SEK 0.15 per share (-0.80). Profit before tax was affected by unrealised changes in value in respect of investment properties of SEK -899m (-4,246), realised changes in value in respect of investment properties of SEK 2m (27), profit from sales of development properties SEK 45m (222), changes in value of interest rate derivatives and option component convertible of SEK -232m (104) and profit from participations in associated companies of SEK -268m (-216).

"The long-term increase of profit from property management is our most important financial metric. The decrease from last year is due to higher interest expenses. Rental income and net operating income are around 8% better compared to last year, and we continue to see a stable demand for residentials and commercial spaces in our different markets," says CEO Erik Selin.

Presentation of Balder's Interim report

On 16 July at 08:45 (CET), Balder's CEO Erik Selin, CFO Ewa Wassberg and IR Jonas Erikson will be hosting an online presentation and telephone conference. The presentation will be held in English, and during the telephone conference there will be an opportunity for representatives from the financial market to ask questions.

Follow the webcast at https://ir.financialhearings.com/fastighets-ab-balder-q2-report-2024.

Please register here to be able to ask questions during the conference call. Once you have registered, you will be sent a phone number and a conference ID.

Questions from the media are referred to Media Relations at press@balder.se.

The recorded presentation and telephone conference will subsequently be made available here.

For further information, please contact:

Erik Selin, CEO, tel. +46 (0)31-10 95 92, erik.selin@balder.se

Ewa Wassberg, CFO, tel. +46 (0)31-351 83 99, ewa.wassberg@balder.se

Jonas Erikson, IR, tel. +46 (0)767-655 088, jonas.erikson@balder.se

This is information that Fastighets AB Balder (publ) is obliged to make public pursuant to the EU Market Abuse Regulation and the Securities Markets Act. The information was submitted for publication, through the agency of the contact persons set out above, at 08.00 CET on July 16, 2024.

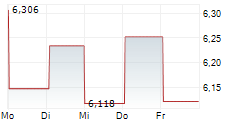

Fastighets AB Balder (publ) is a listed property company that owns, manages and develops residential and commercial properties in Sweden, Denmark, Finland, Norway, Germany and the United Kingdom. The head office is located in Gothenburg. As of 30 June 2024, the property portfolio had a value of SEK 215.5 billion. The Balder share is listed on Nasdaq Stockholm, Large Cap.