Desenio Group AB (publ) ("Desenio") today publishes information on expected financial development in 2024 and 2025 as well as updated medium-term financial targets. The information on expected financial development is shared due to ongoing discussions to enable a long-term sustainable capital structure before Desenio Group's issued bonds of SEK 1.1 billion mature in December 2024.

Expected financial development in 2024

- Net sales are expected to decrease by 5-10% for the full year 2024, compared to 2023.

- The adjusted EBITA margin is expected to be 11-13%.

Expected financial development in 2025

- Net sales growth is expected to amount to 0-5%.

- The adjusted EBITA margin is expected to amount to 11-14%.

The expected financial development above assumes that the same market conditions as in the first half of 2024 remain with similar customer behavior during the relevant periods. All figures refer to the Desenio Group as a whole.

The financial information stated above is indicative and does not constitute a guarantee of future results. Although the financial information reflects Desenio Group's current judgments and expectations, it is subject to material uncertainties and factors, e.g. macroeconomic factors such as inflation levels and general business conditions, future customer behavior, cost of marketing and exchange rates. These uncertainties and factors mean that the actual growth and adjusted EBITA margin may differ materially from those expected.

Updated financial targets

Desenio Group's Board of Directors has today decided on updated medium-term financial targets:

- An organic annual net sales growth of >5%.

- Improve adjusted EBITA margin to >15%.

These financial goals replace previously communicated financial goals of achieving annual organic sales growth of around 30%, potentially further supplemented by impact from add-on acquisitions, and an adjusted EBITA margin of approximately 25% in the medium-term.

Desenio Group's dividend policy remains unchanged. However, no dividend is expected to be distributed in the medium-term and any dividend will be subject to the terms of Desenio Group's dept facilities.

Desenio Group's CEO, Fredrik Palm, and CFO, Anna Ståhle, will present the Group's half-year report 2024 on July 16 at 09:00 and, in connection with this, also comment on the expected financial development and the updated financial targets.

If you wish to participate via webcast please use the link below. Via the webcast you are able to ask written questions.

https://ir.financialhearings.com/desenio-group-q2-report-2024/register

If you wish to participate via teleconference, please register on the link below. After registration you will be provided phone numbers and a conference ID to access the conference. You can ask questions verbally via the teleconference.

https://conference.financialhearings.com/teleconference/?id=50048685

This information is information that Desenio Group is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2024-07-15 17:45 CEST.

For further information, please contact:

Fredrik Palm, CEO, fredrik.palm@deseniogroup.com, +46 70 080 76 37

Anna Ståhle, CFO, anna.stahle@deseniogroup.com, +46 70 922 10 21

Johan Hähnel, Head of IR, johan.hahnel@deseniogroup.com, +46 706 05 63 34

About Desenio Group

Desenio Group is the leading e-commerce company within affordable wall art in Europe, with a growing presence in North America. We offer our customers a unique and curated assortment of about 9,000 designs as well as frames and accessories in 37 countries via 44 local websites and are steadily expanding to new markets.

Desenio Group is well positioned to build upon our dynamic growth model, including our proprietary technical platform, industrialized creative processes and efficient customer acquisition approach.

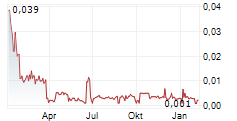

We are headquartered in Stockholm, Sweden, with fulfilment centres in Sweden, Czech Republic and USA. Our share is traded on Nasdaq First North Growth market, under the ticker "DSNO".

Certified Adviser

FNCA Sweden AB is the company's certified adviser.