Highlights:

North Hill Trend Drilling Hits Broad Zone of Mineralization Starting from Surface with a High-Grade Zinc Centre

300-meters East of the Main Zone

JES-24-95, 76.3 meters of 0.2 g/t Au, 1 g/t Ag and 0.4% Zn from 1.5 meters depth

Including, 7.6 meters of 0.2 g/t Au, 3 g/t Ag and 2.8% Zn

And 5.1 meters of 0.8 g/t

Main Zone Eastern Infill Hits Broad Mineralization with Elevated Silver and Zinc

JES-24-94, 24.4 meters of 0.2 g/t Au and 5 g/t Ag from 47.3 meters depth

Including, 1.5 meters of 1.3 g/t Au, 37 g/t Ag, 1.2% Zn and 0.5% Pb

And 1.5 meters of 0.5 g/t Au, 26 g/t Ag and 0.5% Zn

Also 3.1 meters of 0.4 g/t Au, 5 g/t Ag and 0.6% Zn

Five holes Released, All Five Intersect Mineralization

Results Pending for Three (3) Drillholes

CALGARY, AB / ACCESSWIRE / July 16, 2024 / Tocvan Ventures Corp. (the "Company") (CSE:TOC)(OTCQB:TCVNF)(FSE:TV3), is pleased to announce drill results from its 2024 Reverse Circulation (RC) drill program at its road accessible Pilar Gold-Silver project in mine-friendly Sonora, Mexico.

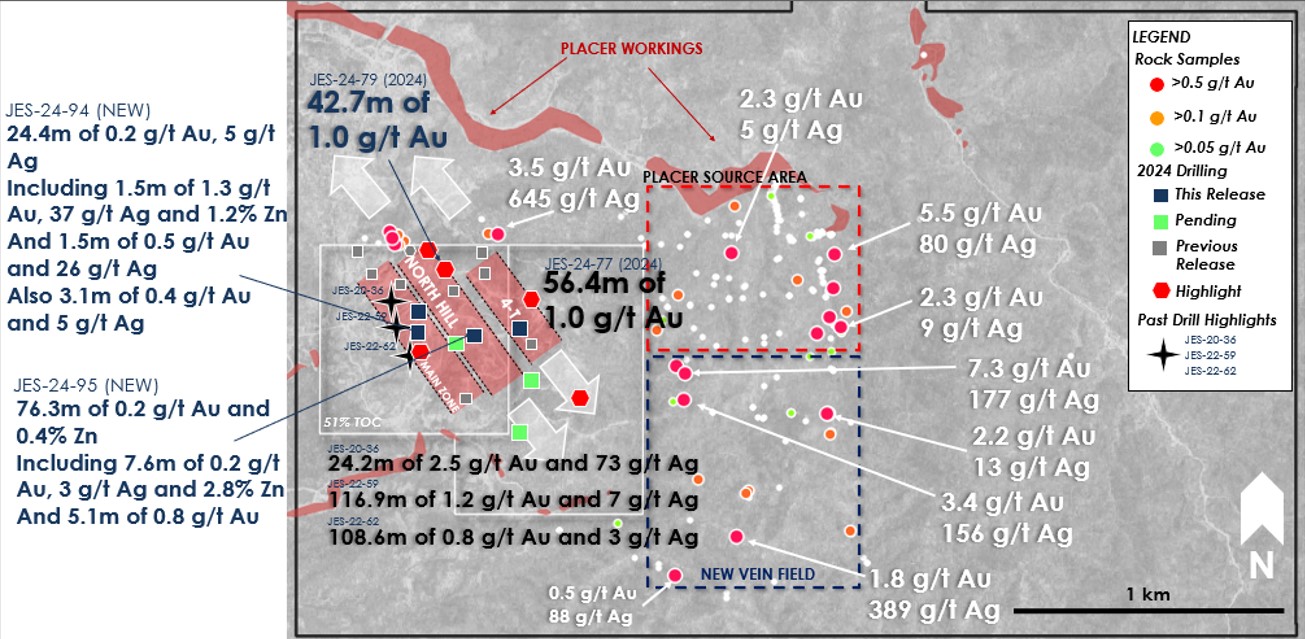

To date, the 2024 drill program has completed 3,268 meters across 26 drill holes. Results for three drill holes are currently pending analysis (green squares on Figure 1).

"Drill results are continuing to show the broad scale of mineralization at Pilar as we push out the edges of the known deposit." commented Brodie Sutherland, CEO. "The infill drilling looks to connect each of the three known trends to date, the results tell us that mineralization does connect across these corridors. Most of the area has never seen detailed drilling and to see mineralization and alteration in all holes showcases the robust system we have. We are also seeing areas with elevated base metals indicating multiple phases of gold and silver deposition, an excellent advantage when expanding and exploring across the greater Pilar area. To date, we have only drilled 2% of the total property area with surface sampling showing much bigger targets are present. A major producer is continuing to show a keen interest in the area conducting detailed review of the greater project area. The results today are supporting the case that we are just scratching the surface of the potential at Pilar. Results for exploration drilling 600 meters south of the Main Zone are still pending and surface work is ongoing. We look forward to updating our shareholders as more results become available."

Figure 1. Summary map of drill highlights and surrounding surface results.

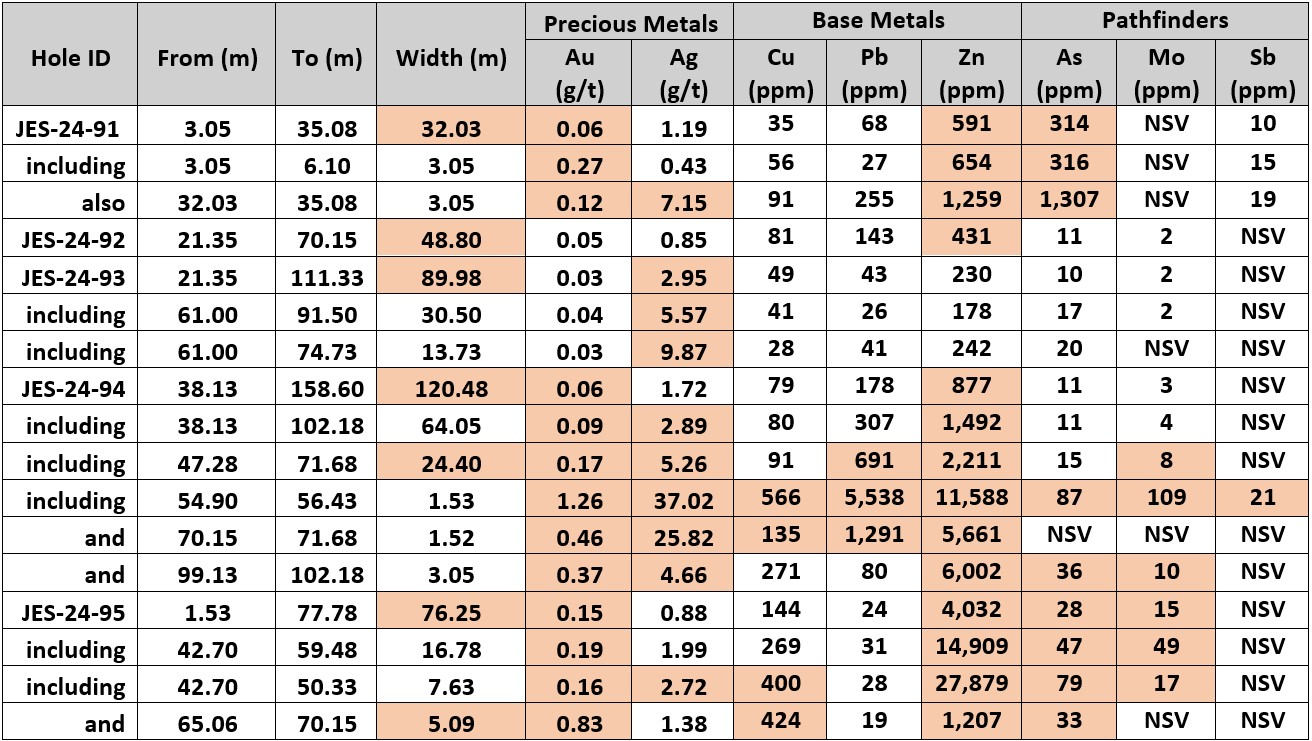

Table 1. Summary of Drill Results Released Today from Pilar Project.

All interval lengths are drilled widths. 10,000 ppm = 1%. Includes Pathfinder Geochemistry.

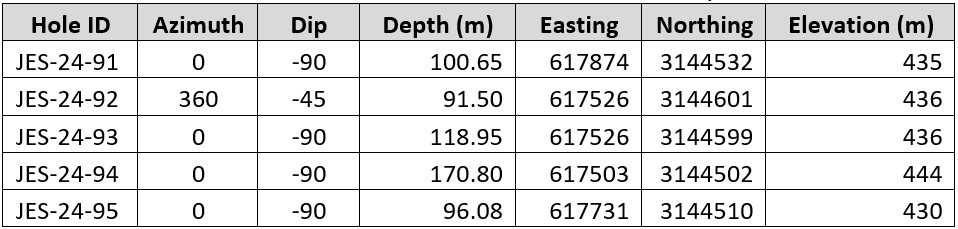

Table 2. Drillhole locations released today.

Results today highlight five infill drill holes on the Main Zone, North Hill and 4-T trends with the primary objective to connect each corridor. Detailed results with pathfinder elements are summarized in Table 1.

Discussion of Results

4-T Trend

JES-24-91

JES-24-91 tested within the 4-T trend along the southwestern edge leading towards the North Hill trend. The hole was vertical, drilled to a depth of 100.7 meters. Moderate zones of mineralization were encountered with elevated zinc and arsenic indicating proximity to higher-grade mineralization. The hole returned 32.0 meters of 591 ppm zinc and 314 ppm arsenic with elevated gold and silver values. As a comparison the bulk sample completed in 2023, returned an average of 400 ppm zinc. Much of the 4-T trend has only seen wide spaced drill testing to date and remains open.

Main Zone East Infill

JES-24-92, JES-24-93 and JES-24-94

Infill holes JES 24-92 and 93 were drilled off the same pad testing the eastern flank of the Main Zone trend to see if the neighboring North Hill trend connects. JES-24-92 was drilled to the north at a 45-degree angle and to depth of 91.5 meters. JES-24-93 was a vertical hole drilled to 119.0 meters. Anomalous silver and zinc values were recorded along with alteration and veining indicative of mineralization within the Main Zone, further evaluation of the eastern flank and its relationship connecting the North Hill Trend is warranted. Infill hole JES-24-94 tested a space along the eastern edge of the Main Zone, a broad anomalous zone of mineralization was recorded along with elevated silver values. JES-24-94 was a vertical hole drilled to a depth of 170.8 meters. A 120.5-meter zone of anomalous gold, silver and zinc was recorded expanding out the eastern side of the Main Zone.

North Hill Trend

JES-24-95

Infill hole JES-24-95 tested the southern extent of the North Hill Trend. Broad anomalous mineralization was recorded with high-grade zinc intervals. The hole was vertical and drilled to a depth of 96.1 meters, with mineralization recorded over 76.3 meters starting at a depth of 1.5 meters. A 16.8-meter zone of higher-grade zinc was recorded, returning 0.2 g/t Au, 2 g/t Ag and 1.5% Zn. A deeper zone of gold mineralization returned 5.1 meters of 0.8 g/t Au. Pathfinder elements arsenic and molybdenite were also elevated across the hole. The hole is located 65-meters south-southeast of JES-22-63 which returned 67.1 meters of 0.2 g/t Au and 4 g/t Ag, including 13.7-meters of 0.6 g/t Au and 13 g/t Ag and 9.2-meters of 0.6 g/t Au, 3 g/t Ag and 0.6% Zn. JES-24-95 is also located 65-meters northwest of JES-22-72 which returned 157.1-meters of 0.1 g/t Au and 4 g/t Ag including 10.7-meters of 0.6 g/t Au, 40 g/t Ag and 1.7% Zn. This area of the trend is developing into a sizable domain with known elevated gold, silver and zinc values.

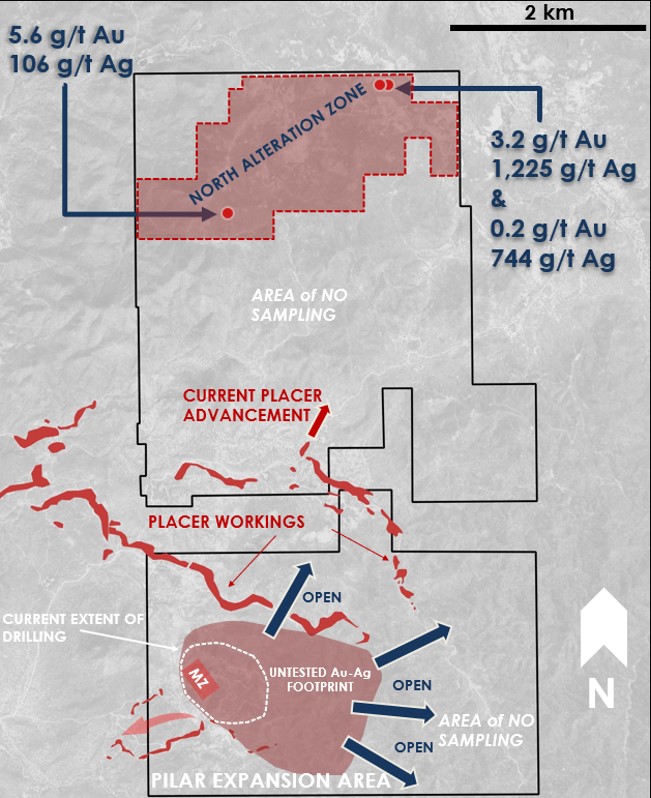

Figure 2. Pilar Project Planview map showing the southern block made up of the Pilar Main Zone and the newly discovered placer source with additional gold-silver mineralization extending to the south. Within the northern block, a large alteration zone that spans 3.3 km by 1.5 km (North Alteration Zone) has returned high-grade gold and silver values in the first few sampling programs across the newly acquired area. The Southern Block remains largely untested with drilling, with an expanding mineralized footprint expanding from ongoing surface sampling.

About the Pilar Property

The Pilar Gold-Silver property has returned some of the regions best drill results. Coupled with encouraging gold and silver recovery results from metallurgical test work, Pilar is primed to be a potential near-term producer. Pilar is interpreted as a structurally controlled low-sulphidation epithermal system hosted in andesite rocks. Initially three primary zones of mineralization were identified on the original property from historic surface work and drilling and are referred to as the Main Zone, North Hill and 4-T. Each trend remains open to the southeast and north and new parallel zones have been discovered. Structural features and zones of mineralization within the structures follow an overall NW-SE trend of mineralization. Mineralization extends along a 1.2-km trend, only half of that trend has been drill tested so far. The Company has now expanded its interest in the area by consolidating 22 square-kilometers of highly prospective ground where it has already made significant surface discoveries.

Pilar Drill Highlights:

2022 Phase III Diamond Drilling Highlights include (all lengths are drilled thicknesses):

116.9m @ 1.2 g/t Au, including 10.2m @ 12 g/t Au and 23 g/t Ag

108.9m @ 0.8 g/t Au, including 9.4m @ 7.6 g/t Au and 5 g/t Ag

63.4m @ 0.6 g/t Au and 11 g/t Ag, including 29.9m @ 0.9 g/t Au and 18 g/t Ag

2021 Phase II RC Drilling Highlights include (all lengths are drilled thicknesses):

39.7m @ 1.0 g/t Au, including 1.5m @ 14.6 g/t Au

47.7m @ 0.7 g/t Au including 3m @ 5.6 g/t Au and 22 g/t Ag

29m @ 0.7 g/t Au

35.1m @ 0.7 g/t Au

2020 Phase I RC Drilling Highlights include (all lengths are drilled thicknesses):

94.6m @ 1.6 g/t Au, including 9.2m @ 10.8 g/t Au and 38 g/t Ag;

41.2m @ 1.1 g/t Au, including 3.1m @ 6.0 g/t Au and 12 g/t Ag ;

24.4m @ 2.5 g/t Au and 73 g/t Ag, including 1.5m @ 33.4 g/t Au and 1,090 g/t Ag

15,000m of Historic Core & RC drilling. Highlights include:

21.0m @ 38.3 g/t Au and 38 g/t Ag

13.0m @ 9.6 g/t Au

9.0m @ 10.2 g/t Au and 46 g/t Ag

61.0m @ 0.8 g/t Au

Pilar Bulk Sample Summary:

62% Recovery of Gold Achieved Over 46-day Leaching Period

Head Grade Calculated at 1.9 g/t Au and 7 g/t Ag; Extracted Grade Calculated at 1.2 g/t Au and 3 g/t Ag

Bulk Sample Only Included Coarse Fraction of Material (+3/4" to +1/8")

Fine Fraction (-1/8") Indicates Rapid Recovery with Agitated Leach

Agitated Bottle Roll Test Returned Rapid and High Recovery Results: 80% Recovery of Gold and 94% Recovery of Silver after Rapid 24-hour Retention Time

Additional Metallurgical Studies:

Gravity Recovery with Agitated Leach Results of Five Composite Samples Returned

95 to 99% Recovery of Gold

73 to 97% Recovery of Silver

Includes the Recovery of 99% Au and 73% Ag from Drill Core Composite at 120-meter depth.

About Tocvan Ventures Corp.

Tocvan is a well-structured exploration and development company. Tocvan was created in order to take advantage of the prolonged downturn in the junior mining exploration sector, by identifying and negotiating interest in opportunities where management feels they can build upon previous success. Tocvan has approximately 51 million shares outstanding and is earning into two exciting opportunities in Sonora, Mexico. The Company has consolidated an attractive land position at its Pilar Gold-Silver Project where it holds 100% interests in over 21 square kilometers of prospective area and a majority ownership (51%) in a one square kilometer area shared with Colibri Resources. The Company also holds 100% interest in the Picacho Gold-Silver project in the Caborca Trend of northern Sonora, a trend host to some of the major gold deposits of the region. Management feels both projects represent tremendous opportunity to create shareholder value.

Quality Assurance / Quality Control

Samples were shipped for sample preparation to ALS Limited in Hermosillo, Sonora, Mexico and for analysis at the ALS laboratory in North Vancouver. The ALS Hermosillo and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Gold was analyzed using 50-gram nominal weight fire assay with atomic absorption spectroscopy finish. Over limits for gold (>10 g/t), were analyzed using fire assay with a gravimetric finish. Silver and other elements were analyzed using a four-acid digestion with an ICP finish. Over limit analyses for silver (>100 g/t) were re-assayed using an ore-grade four-acid digestion with ICP-AES finish. Control samples comprising certified reference samples and blank samples were systematically inserted into the sample stream and analyzed as part of the Company's robust quality assurance / quality control protocol.

Brodie A. Sutherland, CEO for Tocvan Ventures Corp. and a qualified person ("QP") as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

Cautionary Statement Regarding Forward Looking Statements

Neither the Canadian Securities Exchange nor its regulation services provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains "forward-looking information" which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Forward-looking information in this news release includes statements regarding the use of proceeds from the Offering. Such forward-looking information is often, but not always, identified by the use of words and phrases such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others, risks related to the speculative nature of the Company's business, the Company's formative stage of development and the Company's financial position. Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws.

There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

For more information, please contact:

TOCVAN VENTURES CORP.

Brodie A. Sutherland, CEO

820-1130 West Pender St.

Vancouver, BC V6E 4A4

403-829-9877

bsutherland@tocvan.ca

The Howard Group

Jeff Walker

VP Howard Group Inc.

403-221-0915

jeff@howardgroupinc.com

SOURCE: Tocvan Ventures Corp

View the original press release on accesswire.com