Centaurus Energy Announces 2:1 Share Consolidation

Centaurus Energy Announces Shareholders' Meeting

Calgary, Alberta--(Newsfile Corp. - July 16, 2024) - Centaurus Energy Inc. (TSXV: CTA) (OTC Pink: CTARF) ("Centaurus" or the "Company") announces that the TSX Venture Exchange ("TSX-V" or the "Exchange") has issued a temporary trading halt as a normal course of action in connection with the proposed change of business of the Company from a Tier 2 Oil & Gas Issuer to a Tier 2 Investment Issuer (the "Proposed Change of Business"), pursuant to TSX-V Policy 5.2 - Changes of Business and Reverse Takeovers . Trading in the common shares of the Company (the "Common Shares") will remain halted pending the review of the Proposed Change of Business by the TSX-V.

This update aims to refine the Company's transition from oil & gas exploration and production operator, which was the result of the 2023 sale of Madalena Energy Argentina S.R.L., to making strategic investments in physical and digital commodities. With this new listing status, Centaurus may invest directly in physical and digital commodities, undertake corporate transactions, and acquire strategic equity positions.

Common shares of the Company are expected to resume trading upon completion of certain prescribed steps related to the Proposed Change of Business, including the Exchange's preliminary assessment.

The Company will focus on fulfilling the prescribed requirements to obtain the Exchange's conditional approval of the Proposed Change of Business, hold a meeting of its shareholders to obtain, among other things, approval of the Proposed Change of Business (the "Shareholders' Meeting"), and obtain the Exchange's final approval in an expedient manner. Subsequent to the completion of the Proposed Change of Business, and subject to obtaining final approval of the Exchange, the Company will be listed on the TSX-V as a Tier 2 Investment Issuer, aligning the Company with its current business focus in investment in physical and digital commodities.

Mr. David D. Tawil, CEO of Centaurus, commented, "We are excited to complete the final steps in Centaurus' Change of Business, with our primary focus on investment in physical and digital commodities. As an initial matter, and to deploy the proceeds of Centaurus' passive royalty interest from the Coiron Amargo Sur Este petroleum block, located in the Province of Neuquén, Argentina, we will be focused on Ether (ETH), along with staking activities. We find the global acceptance, energy-efficiency, self-deflationary monetary policy, and consistent upgrade of network software of Ether to be persuasive evidence of its superiority as a digital commodity. Ether, as the world's most valuable cryptocurrency of a public blockchain powering "smart contracts" and DApps (Decentralized Applications), serving as the epicenter for DeFi (Decentralized Finance), NFTs (Non-fungible Tokens), and securities tokenization efforts by some of the largest asset management firms globally, is an attractive investment asset. We expect to evaluate and, if appropriate, invest in the cryptocurrency of other Layer 1 blockchains, such as, Solana (SOL), BNB, Avalanche (AVAX), Toncoin (TON), and Cardano (ADA), along with related staking activities. Furthermore, the Company will seek to raise additional capital in connection with these efforts to maximize shareholder value."

Ether[1]

Ether is a digital commodity that is created and transmitted through the operations of the peer-to-peer Ethereum network, a decentralized network of computers that uses cryptographic protocols to operate a public, continuous, uninterrupted and transaction ledger known as a blockchain. The infrastructure is collectively maintained by a decentralized user base.

Ether can be used to pay for goods and services, including computational power on the Ethereum network, or it can be converted to fiat currencies, such as the U.S. dollar, at rates determined on crypto asset trading platforms or in individual end-user-to-end-user transactions.

Ethereum uses blockchain technology to create "smart contracts," allowing users to bind multiple parties to an agreement without an intermediary. The Ethereum network validates and executes smart contracts according to the rules in each contract, facilitating automation of complex and customizable transactions.

Ether is the currency used to pay for the computing resources needed to run applications or programs on the Ethereum platform. Participation and executing transactions on the Ethereum network require Ether. The more computationally expensive an application on the Ethereum platform is, the more Ether that is required to run the application.

Unlike certain other digital assets designed to replace traditional currency, the value of Ether should be driven by the underlying value and functionality of the Ethereum platform. Development on the Ethereum network involves building more complex tools on top of smart contracts, such as DApps and protocols built on top of the Ethereum network that are designed to enhance the scalability of the network by inheriting its security while seeking to provide faster and less costly transactions ("Layer 2 protocols," "rollups," or "sidechains").

The Ethereum network has also been used as a platform for creating new digital assets. Digital assets are built on the Ethereum network and other EVM compatible networks, with such assets representing a significant amount of the total market value of all digital assets.

More recently, the Ethereum network has been used for decentralized finance ("DeFi") or open finance platforms, which seek to democratize access to financial services, such as borrowing, lending, custody, trading, derivatives and insurance, by removing third-party intermediaries. DeFi can allow users to lend and earn interest on their digital assets, exchange one digital asset for another and create derivative digital assets such as stablecoins, which are digital assets pegged to a reserve asset such as fiat currency. Since 2023, between US$40 billion and $100 billion worth of digital assets were locked up as collateral on DeFi platforms on the Ethereum network.

Ether can be thought of as "Digital Oil" because it is consumed by engaging in activity on Ethereum. Ether can also be viewed as "Programmable Money" as the financialization of Ether and other Ethereum assets can occur automatically, without any intermediary or censorship, on the Ethereum blockchain. Furthermore, Ether can be considered a "Yield Bearing Commodity" because it can earn yield in Ether by being pledged, non-custodially, to validators who govern the Ethereum network ("staking"). Finally, Ether can be deemed an "Internet Reserve Currency" as it is the base asset that prices all activity and most digital assets within the $1T+ Ethereum ecosystem and its 50+ connecting blockchains.

Currently, Ethereum is a digital economy that attracts approximately 20 million monthly active users while settling $4 trillion in settlement value and facilitating $5.5 trillion in stablecoin transfers over the last twelve months. Ethereum secures over $91.2 billion in stablecoins, $6.7 billion in tokenized off-chain assets, and $308 billion in digital assets.

Ethereum is a vibrant economic platform that can be considered a "Digital Mall" whose usership has grown approximately 1500%, and revenue has surged at a 161% CAGR since 2019. Over the past year, Ethereum has generated $3.4B in revenue, and this value accrues directly to Ether holders. Because Ether must be purchased to utilize Ethereum, all Ether holders benefit from the demand-driven currency inflows. Additionally, approximately 80% of these revenues in Ether are used to buy back and "burn" circulating ETH to remove it from circulation permanently. This is analogous to irreversible stock buybacks. Over the last six months, 541k of Ether worth $1.58B, 0.4% of all supply, has been removed. Thus, holders of Ether double benefit from Ethereum activity due to both usership-driven Ether purchases and the burning of supply. Ether users can also earn a yield on Ether, in Ether, which amounts to approximately 3.5% per annum. This is done by "staking" Ether to Ethereum network entities called validators to provide them with the necessary collateral bond to run the Ethereum network.

Currently, the majority of activity on Ethereum is financial activity. Decentralized exchanges and banking protocols comprise 49% of Ethereum's revenues, while 20% is accounted for by simple transfers of value. Meanwhile, infrastructure takes up the next largest share, around 19%, which relates to decentralized businesses, and creates software to service decentralized apps. Finally, activities related to social media, gaming and NFTs contributed 11% of Ethereum's revenues. Currently, AI plays a minor role in generating revenue for Ethereum.

The Ethereum network was originally described in a 2013 white paper by Vitalik Buterin, a Russian Canadian computer programmer. The Ethereum network is an open-source project with no official developer or group of developers that controls it.

Name Change

In connection with its Proposed Change of Business and the Consolidation, Centaurus is pleased to announce that, subject to approval by the Exchange and at the Shareholders' Meeting, the Company plans to change its name to "Layer One Inc." and its trading symbol to "LAYR" or such other name and trading symbol as may be determined by Centaurus which are acceptable to the Exchange[2]. The new name and branding are appropriate for the future direction of the Company after updating its listing status from an oil and gas issuer to an investment issuer pursuant to the policies of the TSX Venture Exchange.

The name change was approved by the board of directors of the Company in accordance with the Company's governing corporate legislation, the Business Corporations Act (Alberta), and the Company's constating documents, and it will be submitted to shareholders at the Shareholders' Meeting.

Common share certificates bearing the previous company name "Centaurus Energy Inc.", continue to be valid in the settlement of trades and will only be replaced with certificates bearing the new name upon transfer. The Company is not requesting, and shareholders are not required to exchange their existing share certificates for new certificates bearing the new company name.

With regard to the Company's Name Change, Tawil continued, "'Layer One Inc.' more accurately reflects the focus of our investment activities and will allow market participants to easily identify us as a leading public company focused on investment in liquid digital assets."

Share Consolidation

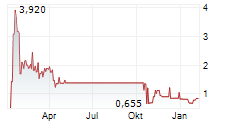

In connection with its Proposed Change of Business, Centaurus is pleased to announce that, subject to approval by the Exchange and at the Shareholders' Meeting, the Company plans to effect a consolidation of all of the issued and outstanding Common Shares on a 2:1 basis (the "Consolidation").

The Consolidation is expected to enhance the liquidity of the Company's common shares, for the benefit of existing and future shareholders. Additionally, the Company may seek to raise additional capital for its investments by issuing equity or equity-linked instruments to investors.

Under the Consolidation, for every two Common Shares held by a shareholder, each shareholder will, as a result of the Consolidation, receive one Common Share after the Consolidation takes effect. There are currently 1,088,070 Common Shares issued and outstanding in the share capital of Centaurus. If the Consolidation is approved and the directors effect the Consolidation on a 2:1 basis, there will be an aggregate of 544,035 Common Shares issued and outstanding in the share capital of Centaurus, subject to rounding.

No fractional Common Shares will be issued in connection with and following completion of the Consolidation. If, as a result of the Consolidation, a shareholder would otherwise be entitled to receive a fraction of a Common Share, an adjustment will be made to the prior whole number of Common Shares and such shareholder will not be entitled to any further consideration.

The Consolidation will not materially affect the percentage ownership in Centaurus of its shareholders even though such ownership will be represented by a smaller number of Common Shares. The Consolidation will merely proportionally reduce the number of Common Shares held by shareholders. Centaurus does not anticipate any impact on the liquidity of the market for the Common Shares and there will be no change to relative voting or equity rights.

Centaurus intends to change its name in conjunction with the Consolidation, as fully described above.

Shareholder Meeting

The Company has not held an annual shareholders' meeting since July 22, 2022 due to the Company's multi-party discussions to exit its Argentina operations, the preoccupation with the sale of Madalena Energy Argentina, securing payment of the PAE ORRI and contemplation and decision of a go-forward strategy for the Company. Furthermore, to reduce the pressure on the Company's liquidity position and to provide maximum value to its shareholders, the Company operates with only one full-time employee, CEO, David D. Tawil.

The Company will call a meeting of its shareholders on or about September 30, 2024 (the "Meeting"), to approve, among other things, the Proposed Change of Business, pursuant to TSX-V Policy 5.2 - Changes of Business and Reverse Takeovers of the Exchange and the name change.

Details of Proposed Change of Business

The Proposed Change of Business is not being conducted in connection with a transaction or financing, and instead is intended to reflect the business of Company moving forward. The Proposed Change of Business is entirely carried out as an arm's length transaction.

The Proposed Change of Business represents the Company's intention to grow and expand its current investment portfolio pursuant to an investment policy adopted by the board of directors of the Company (the "Investment Policy"). A copy of the Investment Policy shall be available to the shareholders of the Company in the management information circular (the "Information Circular") to be distributed to shareholders in advance of the Shareholders Meeting.

Shareholders of the Company are encouraged to read the in-depth summary on the Company's current investment portfolio as well as the digital commodities currently held by the Company in the Information Circular.

Sponsorship, Insiders, Control and Management

Sponsorship of the Proposed Change of Business is required unless an exemption is available or a waiver from this requirement can be obtained in accordance with the policies of the TSX-V. The Company intends to apply for a waiver to the sponsorship requirement under Policy 2.2 of the TSX-V, Sponsorship and Sponsorship Requirements. There is no assurance that a waiver will be granted.

The Company does not expect any change in its insiders nor the persons who, directly or indirectly, control or direct the Company to occur in relation with the Proposed Change of Business.

Reader Advisories

Completion of the Proposed Change of Business is subject to a number of conditions, including but not limited to, Exchange acceptance and if applicable, disinterested shareholder approval. Where applicable, the Proposed Change of Business cannot close until the required shareholder approval is obtained. There can be no assurance that the Proposed Change of Business will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the Information Circular to be prepared in connection with the Proposed Change of Business, any information released or received with respect to the Proposed Change of Business may not be accurate or complete and should not be relied upon. Trading in the securities of the Company should be considered highly speculative.

The TSX-V has in no way passed upon the merits of the Proposed Change of Business and has neither approved nor disapproved the contents of this news release.

About Centaurus Energy

Centaurus is a company focused on investing in Ether and other digital commodities. The Company's shares trade on the TSX-V under the symbol "CTA" and on the OTC Pink Market under the symbol "CTARF".

FOR FURTHER INFORMATION, PLEASE CONTACT:

David Tawil, Chief Executive Officer

email: davidtawil@ctaurus.com

phone: (646) 479-9387

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This press release contains forward-looking statements which with respect to the possible approval of the Proposed Change of Business by the Exchange and the shareholders of the Company, and the implementation of the Proposed Change of Business, if implemented. These forward-looking statements may relate to, among other things, forecasts or expectations regarding business outlook for Centaurus or Ether, the requirements of the Exchange, and may also include other statements that are predictive in nature, or that depend upon or refer to future events or conditions, and can generally be identified by words such as "may", "will", "expects", "anticipates", "intends", "plans", "believes", "estimates", "guidance", or similar expressions. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements.

Events or circumstances may cause actual results to differ materially from those predicted as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of Centaurus. The reader is cautioned not to place undue reliance on any forward-looking information. Although such information is considered reasonable by management at the time of preparation, it may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement. The forward-looking statements contained in this press release are made as of the date of this press release, and Centaurus do not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

[1] All claims relating to Ether in this press release are sourced from Sigel, M., Bush, P. and Zinoviev, D. (2024, June 5). ETH 2030 Price Target and Optimal Portfolio Allocations. VanEck.

[2] New trading symbol subject to review by the TSXV.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/216689

SOURCE: Centaurus Energy Inc