April - June 2024 (compared with April - June 2023)

- Rental income amounted to EUR 30,447 thousand 29,633).

- Net operating income totalled EUR 30,457 thousand (28,050).

- Profit from property management was EUR 10,324 thousand (11,543). Profit from property management, excluding non-recurring items and exchange rate effects, amounted to EUR 11,912 thousand.

- Earnings after tax amounted to EUR 2,226 thousand (3,990), corresponding to EUR 0.03 (0.06) per share.

- Unrealised changes in value affected by EUR -8,338 thousand (-8,258) on properties and by EUR -331 thousand (2,495) on interest rate derivatives.

January - June 2024 (compared with January - June 2023)

- Rental income amounted to EUR 60,966 thousand (59,300).

- Net operating income totalled EUR 58,571 thousand (55,650).

- Profit from property management was EUR 22,553 thousand (23,334). Profit from property management, excluding non-recurring items and exchange rate effects, amounted to EUR 25,665 thousand.

- Earnings after tax amounted to EUR -1,763 thousand (5,957), corresponding to EUR -0.05 (0.09) per share.

- Unrealised changes in value affected by EUR -30,677 thousand (-16,735) on properties and by EUR 3,620 thousand (0) on interest rate derivatives.

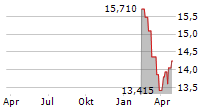

- EPRA NRV amounted to 675,887 TEUR (744,468) corresponding to EUR 11.8 (13.0) per share.

"We continue to operate in accordance with our slogan, "Converting food into yield", generating stable, growing returns by investing in grocery and daily-goods properties".

- Christian Fredrixon, CEO

Key figures 1 | Q2 | Q2 | Jan-jun | Jan-jun |

Market value of properties, EUR million | 1,768 | 1,815 | 1,768 | 1,815 |

NOI, current earnings capacity, EUR million | 114.7 | 111.3 | 114.7 | 111.3 |

Lettable area, thousand sq.m. | 984 | 981 | 984 | 981 |

Proportion grocery and daily goods stores, % | 92.6 | 93.3 | 92.6 | 93.3 |

Number of properties with solar panels | 48 | 44 | 48 | 44 |

Senior debt LTV ratio, % | 50.3 | 50.5 | 50.3 | 50.5 |

Net debt LTV ratio, % | 58.9 | 56.5 | 58.9 | 56.5 |

Debt ratio (net debt/EBITDA), multiple (rolling 12 months) | 9.8 | 10.3 | 9.8 | 10.3 |

Interest coverage ratio, multiple | 2.2 | 2.4 | 2.2 | 2.4 |

1Refer to the full report for alternative performance measures and definitions.

For further information, please contact

Christian Fredrixon, CEO

christian.fredrixon@cibusnordic.com

+46 (0)8 12 439 100

Pia-Lena Olofsson, CFO

pia-lena.olofsson@cibusnordic.com

+46 (0)8 12 439 100

Link to the report archive:

https://www.cibusnordic.com/investors/financial-reports/

About Cibus Nordic Real Estate

Cibus is a real estate company listed on Nasdaq Stockholm Mid Cap. The company's business idea is to acquire, develop and manage high quality properties in the Nordics with daily goods store chains as anchor tenants. The company currently owns more than 450 properties in the Nordics. The main tenants are Kesko, Tokmanni, Coop Sweden, Lidl and S Group.

This information is information that Cibus Nordic Real Estate AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation 596/2014. The information was submitted for publication, through the agency of the contact person set out above, at 08:00 CEST on 17 July 2024.