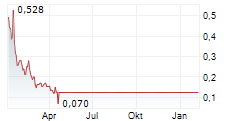

DURHAM, N.C., July 17, 2024 (GLOBE NEWSWIRE) -- Scorpius Holdings, Inc (NYSE American: SCPX) ("Scorpius" or "the Company"), an integrated contract development and manufacturing organization ("CDMO"), today announced that the Company's Board of Directors approved a 1-for-200 reverse stock split (the "Reverse Stock Split") of the Company's common stock (the "Common Stock"), to increase the selling price of the Company's Common Stock in order to regain compliance with the requirements and policies of the NYSE American. However, there can be no assurance that that the Reverse Stock Split will increase the Company's stock price sufficiently in order to meet any requirements and policies of the NYSE American.

The Reverse Stock Split will take legal effect at 11:01 P.M. Eastern Time on July 17, 2024, and the Company's Common Stock will open for trading on the OTC Markets on July 18, 2024, on a post-split basis, under the existing ticker symbol "SCPX" but with new CUSIP number 42237K508.

At Scorpius Holdings, Inc's Annual Meeting of Shareholders (the "Annual Meeting") held on July 15, 2024, the Company's stockholders approved a proposal to amend the Company's certificate of incorporation to effect a reverse stock split of its Common Stock at a ratio of between 1-for-5 to 1-for-200, with the ratio within such range to be determined at the discretion of the Company's Board. Following the Annual Meeting, the Board approved a final split ratio of 1-for-200. Following the Reverse Stock Split, the ownership percentage of each stockholder will remain unchanged, other than with respect to fractional shares.

Additional details regarding the Company's Reverse Stock Split can be found in the Current Report on Form 8-K that the Company will file with the SEC.

Scorpius Holdings, Inc.

Scorpius Holdings, Inc. is an integrated contract development and manufacturing organization (CDMO) focused on rapidly advancing biologic and cell therapy programs to the clinic and beyond. Scorpius offers a broad array of analytical testing, process development, and manufacturing services to pharmaceutical and biotech companies at its state-of-the-art facilities in San Antonio, Texas. With an experienced team and new, purpose-built U.S. facilities, Scorpius is dedicated to transparent collaboration and flexible, high-quality biologics biomanufacturing. For more information, please visit www.scorpiusbiologics.com.

Forward-Looking Statement

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, forward-looking statements can be identified by terminology such as "may," "should," "potential," "continue," "expects," "anticipates," "intends," "plans," "believes," "estimates," and similar expressions, and include statements regarding regaining compliance with the requirements and policies of the NYSE American. Important factors that could cause actual results to differ materially from current expectations include, among others, the ability of the Company to successfully appeal the determination to the Exchange's Listing Qualifications Panel and have its Common Stock remain listed and recommence trading on the NYSE American; the Company's financing needs; its cash balance being sufficient to sustain operations and its ability to raise capital when needed; the Company's ability to leverage fixed costs and achieve long-term profitability; the Company's ability to obtain regulatory approvals or to comply with ongoing regulatory requirements; regulatory limitations relating to the Company's ability to successfully promote its services and compete as a pure- play CDMO; and other factors described in the Company's annual report on Form 10-K for the year ended December 31, 2023, subsequent quarterly reports on Form 10-Qs and any other filings the Company makes with the SEC. The information in this presentation is provided only as of the date presented, and the Company undertakes no obligation to update any forward-looking statements contained in this presentation on account of new information, future events, or otherwise, except as required by law.

Media and Investor Relations Contact

David Waldman

+1 919 289 4017

ir@scorpiusbiologics.com