| LIMONEST, 24 JULY 2024, 5.45 PM |

- CONSOLIDATED REVENUES OF €118.1M

- DEMAND IMPACTED BY AN UNCERTAIN ECONOMIC AND POLITICAL ENVIRONMENT

- SECTOR GROWTH DRIVERS INTACT

Olivier de la Clergerie, LDLC Group CEO, said: "The LDLC Group posted revenues of €118.1m for the first quarter of 2024/2025, down 6.9% compared with the first quarter of 2023/2024. The strained economic environment, combined with political uncertainty in France, is prompting caution and putting pressure on demand from both businesses and consumers, who are inclined to postpone or reduce their investments and consumer spending.

Despite the unfavourable short-term context, the foundations of the high-tech equipment sector remain intact. The Group is therefore pursuing its development strategy, with the aim of becoming the leading retailer for a diversified customer base and capturing new market share. The acquisition of the Rue du Commerce business on 10 July is part of this strategy. It will enable us to strengthen our BtoC positioning, particularly in the consumer segment, and to optimise the Group's profitability.

The renewal cycle for high-tech equipment and innovation, particularly the rise of artificial intelligence, are powerful growth drivers for our markets. The LDLC Group has a solid financial base and is perfectly positioned to seize growth opportunities and outperform the market over the long term."

Q1 CONSOLIDATED REVENUES (1 APRIL TO 30 JUNE) - UNAUDITED

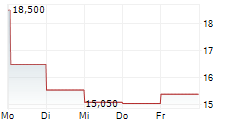

| €m (unaudited) | 2024/2025 | 2023/2024 | Change (%) |

| Q1 revenues | 118.1 | 126.9 | -6.9% |

Corporate data: Q1 2024/2025 revenues amounted to €103.3m

Q1 2024/2025 revenues: €118.1m

Q1 2024/2025 revenues totalled €118.1m, down 6.9% compared to Q1 in the previous year.

The BtoC business posted quarterly revenues of €80.6m, down 4.3% from Q1 2023/2024. Store revenues rose by 7.3%, underlining the merits of the Group's investments to strengthen its regional network and get closer to its customers.

The BtoB business posted revenues of €34.6m for the first quarter of 2024/2025, down 11.7% from €39.2m the previous year. Business continues to be impacted by a difficult macroeconomic climate and an uncertain political environment, prompting businesses to exercise caution and postpone their investments.

Revenues from other businesses decreased 16.9% to €2.9m. Childcare brand L'Armoire de Bébé posted revenues of €1.9m compared to €2.3m in Q1 2023/2024.

RECENT NEWS AND OUTLOOK

Completion of the acquisition of the Rue du Commerce business

On 10 July 2024, the LDLC Group announced the acquisition of the Rue du Commerce business. This transaction perfectly aligns with the LDLC Group's strategy of strengthening its position in the BtoC sector and expanding its customer base, and should enable it to optimise profitability through operating leverage.

For the first six months of 2024, the Rue du Commerce business represented sales of around €45m, generating revenues of around €30m. The business employs around 40 people.

The acquisition price of the business assets amounted to €6m, financed entirely by bank loans.

Outlook

Although the current political and economic environment is having an impact on demand and extending the renewal cycle for high-tech products, the market outlook remains solid, buoyed by the anticipated replacement of equipment purchased during the COVID period and by the development of artificial intelligence, which represents an additional growth driver.

With an extensive chain of 127 stores, renowned customer service, an expanded customer base, and a solid financial foundation, the LDLC Group has significant competitive advantages that will enable it to take full advantage of the next growth cycle, capture new market share, and return to normalised profit margins in the medium term.

Next release:

31 October 2024 after market close, Q2 2024/2025 revenues

GROUP OVERVIEW

The LDLC Group was one of the first to venture into online sales in 1997. As a specialist multi-brand retailer and a major online IT and high-tech equipment retailer, the LDLC Group targets individual customers (BtoC) as well as business customers (BtoB). It operates via 15 retail brands, has 8 e-commerce websites and close to 1,190 employees.

Winner of a number of customer service awards and widely recognised for the efficiency of its integrated logistics platforms, the Group is also developing an extensive chain of brand stores and franchises.

Find all the information you need at www.groupe-ldlc.com

ACTUS

Investor & Media Relations

Hélène de Watteville / Marie-Claude Triquet

hdewatteville@actus.fr - mctriquet@actus.fr

Tel.: + 33 (0)6 10 19 97 04 / + 33 (0)6 84 83 21 82

- SECURITY MASTER Key: yWhylJ1qZW7KyZufYZaYaWlkbptkmWXHmJKdx2Zrl8mZm2+SlG1nm5WbZnFolWZn

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-87011-groupe-ldlc-240724-ca-t1-24-25-gb.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free